Beyond its scale of economic growth, Indonesia offers numerous other, significant advantages to firms that are considering alternative markets in the South Asia region.

Indonesia as a China +1 option

Many businesses are turning to Indonesia as a second Asia investment option for certain types of consumer-related market opportunities such as retail, health, and financial services. Recent global supply chain and trade shocks, as well as higher costs of labor have propelled Indonesia as a viable option for a China+1 strategy. The country boasts an enormous labor pool, growing middle class, and a vast wealth of natural resources.

For investors making long-term commitments and eyeing new growth opportunities, Indonesia may be the most attractive option to complement operations in China. Compared to its ASEAN peers, Indonesia stands out from the rest due to its size and resource wealth. Indonesia projects to become one of the world’s largest economies on the back of a young workforce and rapidly expanding middle class.

Indonesia as a “China plus one” destination offers a strong alternative for dealing with rising costs in China and unpredictable scenarios such as trade shocks. Foreign investors may look at Indonesia to supplement their China operations for its lower-cost inputs, alternate markets, and as a gateway to the ASEAN and South Asia markets.

Strong Free Trade and Double Tax agreements

Free Trade Agreements

As an autonomous market and a member of the Association of Southeast Asian Nations (ASEAN), Indonesia has signed and executed a number of free trade agreements with countries and regions all over the world. This includes the Free Trade Area and the Regional Comprehensive Economic Partnership; two of the largest FTA in the world.

The (ASEAN) Free Trade Area (AFTA) was signed in 1992 with the aim to be a catalyst to help ASEAN become a production base for global markets. Under the agreement, goods originating in ASEAN have applied 0-5 percent tariff rates.

As a member of ASEAN, it is part of the bloc’s free trade area and agreements with Australia, New Zealand, China, Indian, Japan, and South Korea. Indonesia also has a bilateral economic partnership agreement (EPA) with Japan and FTAs with Pakistan and the European Free Trade Association (which consists of Iceland, Liechtenstein, Norway, and Switzerland). Further, Indonesia and Australia ratified the Indonesia-Australia Comprehensive Economic Partnership Agreement on February 10, this year.

The Regional Comprehensive Economic Partnership (RCEP) free trade agreement, signed off on November 15, includes all ten ASEAN countries, along with Australia, China, Japan, New Zealand, and South Korea. It is the world’s largest FTA, covering about 30 percent of global domestic products and nearly one-third of the global population.

Double Tax Avoidance Agreements

In addition to its FTAs, Indonesia has a vast network of double tax agreements (DTAs), totaling 71 jurisdictions. The country has DTAs with Australia, New Zealand, the US, Canada, China, Hong Kong, India, and many EU states, among others.

Double Tax Avoidance Agreements treaties effectively eliminate double taxation by identifying exemptions or reducing the amount of taxes payable in Vietnam.

Competitive Corporate Income Tax rates, Incentives for doing business

The Indonesian government offers numerous investment-related business incentives and is continually making further improvements through reforms and by further upgrading its incentives to maintain the country’s high appeal to foreign investors. Among all investment incentives, tax incentives tend to be one of the most important to foreign investors and one of the most attractive features of the Indonesian business landscape.

Corporate income tax (CIT) incentives are granted investors, to promote investment in sectors or areas that are on par with the national development strategies. There are two main CIT incentives in Indonesia—preferential tax rates (reduced tax rates), and tax holidays (tax exempted for a certain period or the lifetime of the project).

Certain priority sectors for investment offer various tax exemptions. These include industries which the government prioritizes, companies that invest a certain amount in one of the 246 priority business lines will be afforded fiscal and non-fiscal incentives.

Tax incentives are also provided for investments in labor-intensive industries, training programs, and R&D.

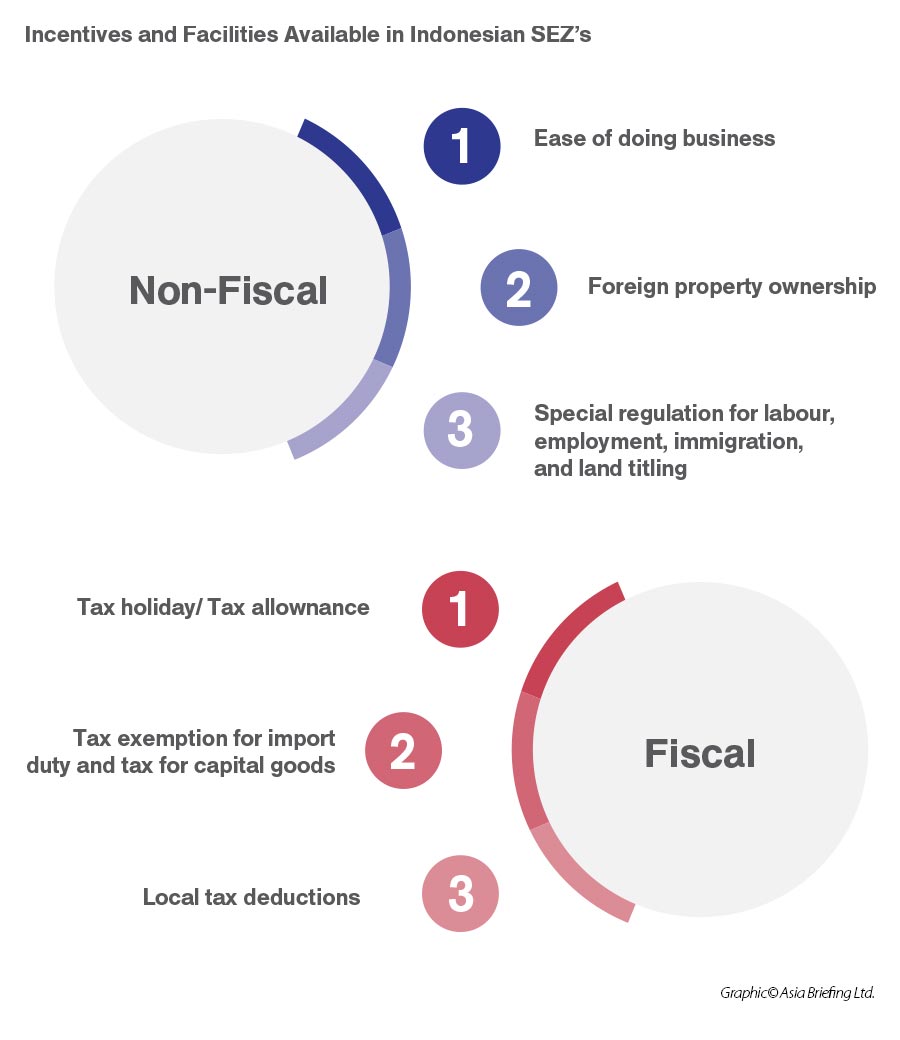

Indonesia aims to make its special economic zones (SEZs) a policy priority to attract foreign investment, boost industrial activity, and promote job creation. This strategy has been further facilitated through various incentive programs available throughout the special economic zones in Indonesia, such as:

- Exemption on corporate income tax

- Corporate income tax allowance

- Exemption on Import and excise duties

- Exemption of VAT and sales tax on luxury goods

Sound economy

Indonesia's economy expanded by 5.03 percent in 2024, showing a slight dip from the 5.05 percent growth recorded in 2023, yet remaining robust relative to other G20 countries. For 2025, the government has slightly lowered its growth projection to a range of 5.1–5.5 percent, down from the previous estimate of 5.3–5.6 percent.

The International Monetary Fund in its World Economic Outlook update projected a 4.8 percent growth for Indonesia's economy and the World Bank also predicts that Indonesia will be one of the six countries that will account for more than half of all global growth by 2025, the others being China, India, Brazil, and South Korea.

Domestic market, large workforce, and improving market liberalization

Indonesia has favorable conditions for labor-intensive manufacturing. Indonesia is the world’s fourth most populous country – with a population of over 272 million – offering foreign investors a vast labor pool. In contrast to China, which is rapidly aging, Indonesia’s demographics skew is young: the country’s median age is 29, and 60 percent of the population is under the age of 40.

Labor costs in Indonesia remain competitive, making it an attractive destination for manufacturing and service-based operations. Wages vary significantly across regions. As of 2025, the highest minimum wage is in the Special Capital Region of Jakarta, set at IDR 5,396,761 (around USD 339.60 per month), while the lowest can be found in Central Java, at IDR 2,169,349 (around USD 136.40). These wage levels are still highly competitive when compared to other major Asian economies, offering cost advantages for labor-intensive industries.

A key driver of Indonesia’s economy is its expanding middle class. In 2024, more than 66 percent of the population either belonged to or were approaching middle-class status, contributing to over 80 percent of national household consumption. Although the number of individuals in the middle class declined slightly from its pre-pandemic peak, the overall spending power remains strong. This consumer segment plays a crucial role in domestic demand, making Indonesia less reliant on external shocks—a factor that helped the country weather both the 2008 financial crisis and the COVID-19 pandemic.

Urbanization is accelerating, with over 59 percent of the population now living in cities and urban areas. This shift is fueling growth in sectors like real estate, infrastructure, retail, and digital services. Furthermore, Indonesia is poised to benefit from a demographic bonus between 2030 and 2040. During this period, the working-age population (15–64 years) is projected to make up around 64 percent of a total population nearing 297 million. This demographic structure offers a unique opportunity to boost productivity and economic output—something regional neighbors like Singapore and Thailand are struggling to maintain due to aging populations.

Indonesia’s regulatory environment has also seen major improvements. The introduction of the Positive Investment List marked a significant shift in policy. Replacing the previous Negative Investment List, this new framework assumes that business sectors are open to 100 percent foreign ownership unless specifically restricted. This liberalization aims to attract more foreign capital and streamline the process of starting and expanding businesses across various sectors.

New emerging sectors – Indonesia’s digital economy

A 2024 report conducted by Google, Temasek Holdings, and Bain & Company concluded that Indonesia’s digital economy is expected to be valued at US$200-360 billion by 2030, largely powered by e-commerce, online travel, ride hailing, and online media.

By 2024, there are 2,300 startups in Indonesia, which is preceded only by the US, India, UK, and Canada. From this large number, five have achieved unicorn status and one is a decacorn.

|

GMV of the Internet Economy of ASEAN-6 (US$ billion) |

||

|

Country |

2024 |

2030 estimation |

|

Indonesia |

90 |

200-360 |

|

Malaysia |

31 |

45-70 |

|

Philippines |

31 |

80-150 |

|

Singapore |

29 |

40-65 |

|

Thailand |

46 |

100-165 |

|

Vietnam |

36 |

90-200 |

|

Source: e-Conomy Report 2024, Google, Temasek Holdings, and Bain & Co |

||

As of February 2024, Indonesia had approximately 221 million internet users, representing a 78.2 percent penetration rate of the total population. The country's digital economy reached a Gross Merchandise Value (GMV) of US$90 billion in 2024, marking a 13 percent increase from the previous year. E-commerce remains the dominant sector, growing by 11 percent to achieve a GMV of US$65 billion in 2024.

Financial technology

Indonesia's fintech sector is among the most dynamic in Southeast Asia. The country is home to approximately 14 startups that have achieved unicorn (valuation over US$1 billion) or decacorn (valuation over US$10 billion) status. Peer-to-peer (P2P) lending has seen significant growth, with total outstanding financing reaching IDR 61.10 trillion (approximately US$3.9 billion) as of February 2024, reflecting a 21.98 percent year-over-year increase.

E-wallets

Electronic money transactions in Indonesia grew by 43.35 percent year-over-year, totaling IDR 835 trillion in 2023, and are projected to increase by 25.77 percent in 2024. E-wallet usage among Indonesians surged to 92 percent in 2023 across all age groups, except those aged 57-75. The country's internet penetration stood at 79.5 percent in 2024, up from 78.1 percent in 2023.

Cloud technology and big data analytics

Indonesia's cloud computing market is experiencing rapid growth, with the market size estimated at USD 2.13 billion in 2024 and projected to reach USD 4.21 billion by 2029, growing at a CAGR of 14.52 percent during the forecast period. This expansion is driven by increased adoption of cloud services across various sectors, including e-commerce, fintech, and digital services.