Indonesia’s government has made the development of the country’s special economic zones (SEZ) a priority policy with the aim of attracting over US$50 billion in foreign investment over the next decade, particularly for SEZ-oriented manufacturing.

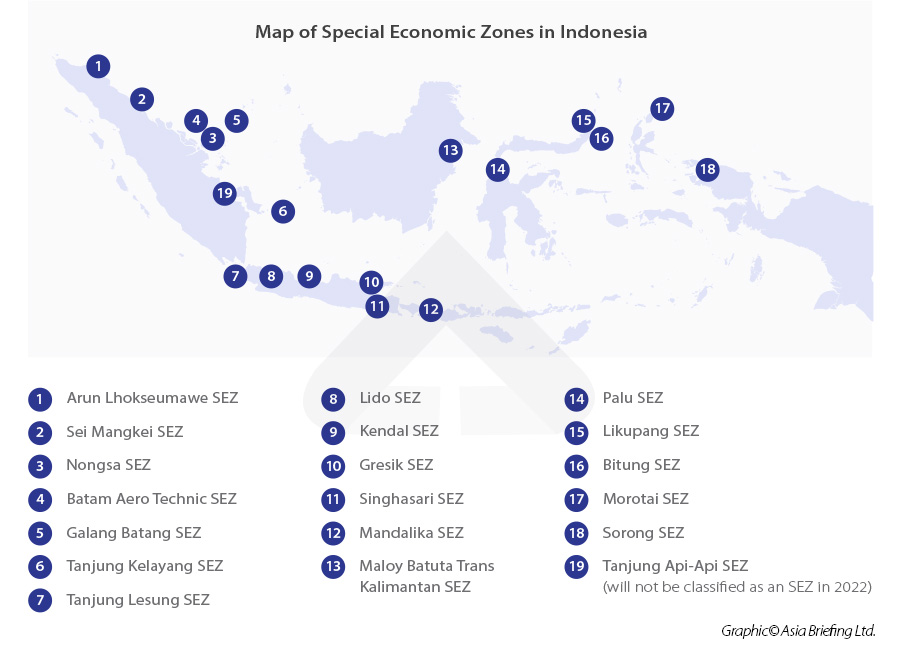

As of 2022, there are 19 SEZs of which 12 are in operation and the remainder in the construction phase. Eight are designated for tourism with the rest for manufacturing and processing. The concept of SEZs in Indonesia was only announced in 2014 when President Joko Widodo came to power. Buoyed by the success of the country’s free trade zones, SEZs were developed to further increase foreign investments into the country. As such, the first SEZs in Indonesia has only been in operation since 2015, with the majority only beginning operations in 2019.

In establishing the SEZs, the government has sought to diversify away from the island of Java and spread across the country. As of 2021, Indonesia’s SEZs have attracted just over US$5 billion in investments and employed over 28,000 workers.

The SEZs serves as a hub for selected activities from logistics, to export processing activities, to tourism. They are designed in this way to maximize the ready availability of local resources and cater to upstream and downstream industries. For instance, the Arun Lhokseumawe SEZ, located in Aceh province, has its primary activities surrounding petrochemicals, oil and gas, and paper production. The province is known for its vast resources of oil and gas. The Mandalika SEZ, located on the scenic island of Lombok, is being pushed as an SEZ that supports eco-tourism and the agro-industry.

Further, the Kendal SEZ has its primary activities in manufacturing, particularly garment and textiles, automotive furniture, electronics, and food and beverages. The SEZ is found in Central Java province, one of Indonesia’s main manufacturing hubs.

Within an SEZ, the following business activities can be undertaken:

- Production and processing;

- Logistics and distribution;

- Research, digital economy, and technology development;

- Tourism;

- Energy development;

- Education;

- Healthcare;

- Sports;

- Financial services;

- Creative industries;

- SEZ development and management; and

- Procurement of SEZ infrastructure.

Investors operating in Indonesia’s SEZs will find they are supported by well-integrated infrastructure from highways, drainage systems, high-speed internet and communication systems, ports, and airports. Moreover, the Indonesian government has prepared an array of fiscal and non-fiscal incentives in its special economic zones, such as an easier immigration process, corporate income tax reductions, and exemptions on import duties and excise duties, among many others.

For foreign investors, entering Indonesia’s special economic zones and taking full advantage of what they offer requires a long-term outlook. Companies must first ensure their industry is suited to the infrastructure and benefits afforded in the SEZs, as well as understand the long-term domestic and regional policies that could impact their industry.

Diversifying away from Java

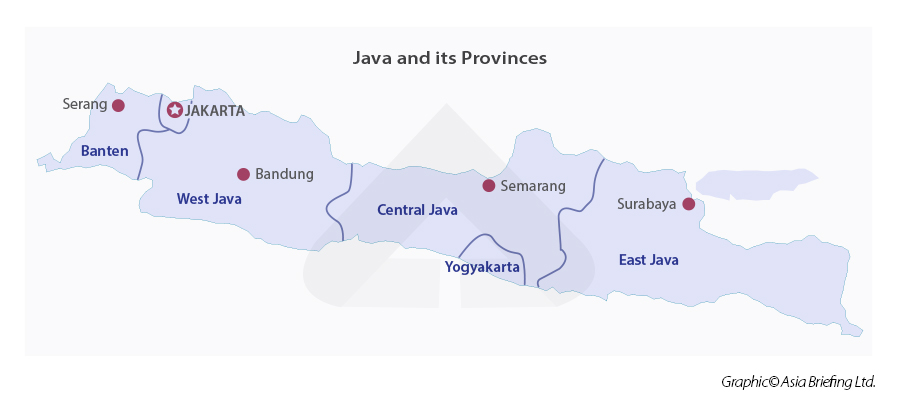

Indonesia’s special economic zones are located across the vast archipelago with the aim of stimulating equal economic growth. Until the year 2000, centralization and economic development policies were centered on Java and the country’s capital, Jakarta (also located in Java).

Java is supported by a strong consumer base since the island accounts for approximately 60 percent of Indonesia’s total population — making it the most populated island in the world (with over 141 million people). This also means Java accounts for 60 percent of the country’s GDP. Further, Java has the most developed services sector in Indonesia and more than half of the country’s 100 or so industrial estates are located on the island.

After Java, the biggest contributor to Indonesia’s GDP was the island of Sumatra (approx. 21 percent), followed by Kalimantan and Sulawesi (eight and six percent), respectively. Bali and Nusa Tenggara contributed three percent to the GDP while Maluku and Papua, the remaining two percent. The majority of Indonesia’s manufacturing sector is also located in Java, with West Java province accounting for 60 percent of the country’s manufacturing activities.

The main drag on national growth has come from the provinces outside of Java as they are heavily reliant on commodities processing and extractive industries, such as oil and gas, nickel, tin, palm oil, and coal.

This overreliance on commodities means that these provinces are susceptible to global price shocks, such as when the government began banning the export of unprocessed commodities in 2014, and when commodity prices declined at the beginning of the COVID-19 pandemic. As a result, supporting businesses related to commodities extraction, such as transport, were also impacted.

Since entering office, President Joko Widodo and his government have emphasized a regional development strategy with a focus on investing in roads, ports, railways, and power plants; spearheaded by the development of special economic zones. In his second term, the President plans to spend more than US$400 billion until 2024 on a variety of infrastructure projects that will help to integrate the country more effectively.

The development of SEZs can also stimulate regional administrations to take measures to improve the local business environment, such as by reducing corruption and improving healthcare and education. These are important steps that can support long-term growth.

How the government implements its infrastructure plans and SEZ development will be vital in not only reducing the economic dependency on Java but also helping Indonesia shift from exporting raw materials to that processed goods.

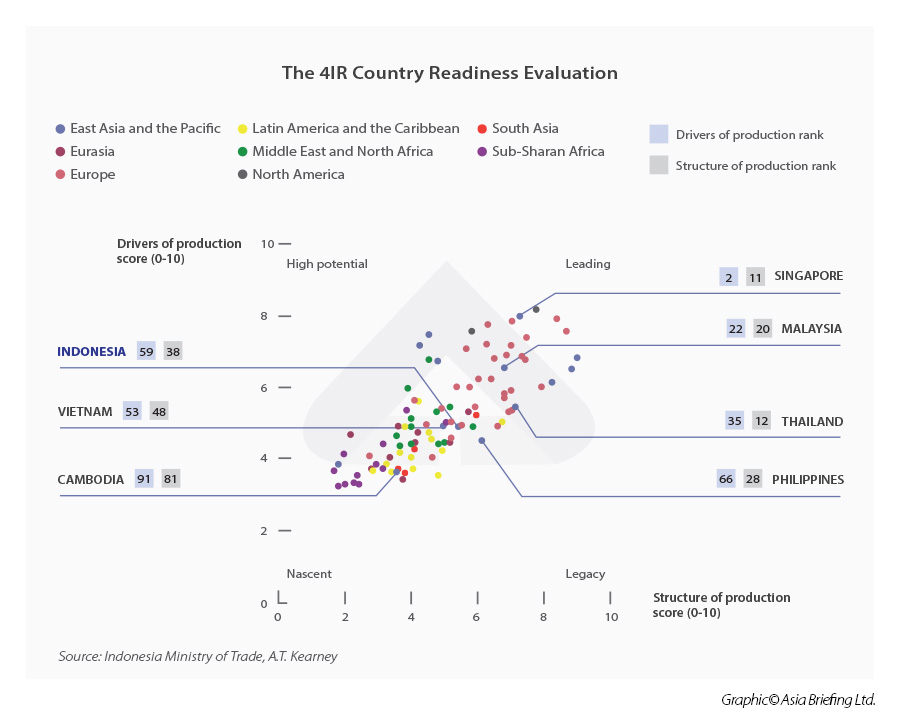

Indonesia’s fourth industrial revolution

The development of Indonesia’s special economic zones will be vital in pushing the country’s 4.0 industrial revolution (4IR) roadmap. The 4IR roadmap, also dubbed ‘Making Indonesia 4.0’, was first touted by President Joko Widodo in 2018 and lays out the government’s plans to transform the country’s manufacturing sector to a higher-value future with the capacity to add some 10 million new jobs. The industry contributed the largest to the national GDP, at 17.34 percent (in 2021).

The Making Indonesia 4.0 roadmap focuses on five key sub-sectors of manufacturing. These are:

- Food and beverage – to be an F&B powerhouse in ASEAN;

- Textile and apparel – to be a leading producer of functional clothing;

- Automotive – to become a leader in the export of internal combustion engine vehicles and electric vehicles;

- Chemicals – to become a leader in biochemical manufacturing; and

- Electronics – to nurture domestic industries to be globally competitive.

These five sectors account for 60 percent of the country’s GDP, and 65 percent of total exports, and employ some 60 percent of Indonesia’s workforce.

Through Making Indonesia 4.0, the government hopes to improve its net export-to-GDP from one percent to 10 percent by 2030 and increase the manufacturing sector’s contribution to GDP to 25 percent by the same year.

In addition to the five focus sectors, there are 10 national priorities for achieving the goals of industry 4.0. These are:

- Reform material flow to enhance domestic upstream production.

- Attract foreign manufacturers to incorporate in Indonesia and accelerate technology transfer.

- Redesign industrial zones to develop a single nationwide industry zoning roadmap.

- Encourage sustainability to explore opportunities in sustainable industries, such as renewables.

- Empower some 3.7 million SMEs by embracing digitization and technology. This is crucial since 62 percent of the workforce is employed in micro or small enterprises, which often have low productivity rates.

- Building a nationwide digital infrastructure to advance the national network and build digital platforms, such as 5G technology and data centers.

- Developing human capital for preparing Indonesian talent that is compatible with the industry 4.0 era. The country has the world’s fourth-largest working population; however, the majority are considered unskilled.

- Regulation and policy reforms to build more coherent policies.

- Establish an innovative ecosystem to enhance research and development initiatives by the public and private sector, and higher education institutions. Indonesia currently spends only 0.1 to 0.3 percent on R&D.

- Incentivize investments in technology to provide an array of incentives, such as tax exemptions and subsidies for local businesses that are adopting new technology in their operations.

Compared to other ASEAN states, Indonesia, along with the Philippines, Cambodia, and Vietnam, are still in the planning phase of their 4IR strategies. Singapore leads the bloc in 4IR adoption, which is focused on reskilling its workforce and transforming its industries. Singapore will invest over S$3 billion (US$2.1 billion) in manufacturing and engineering to this end.