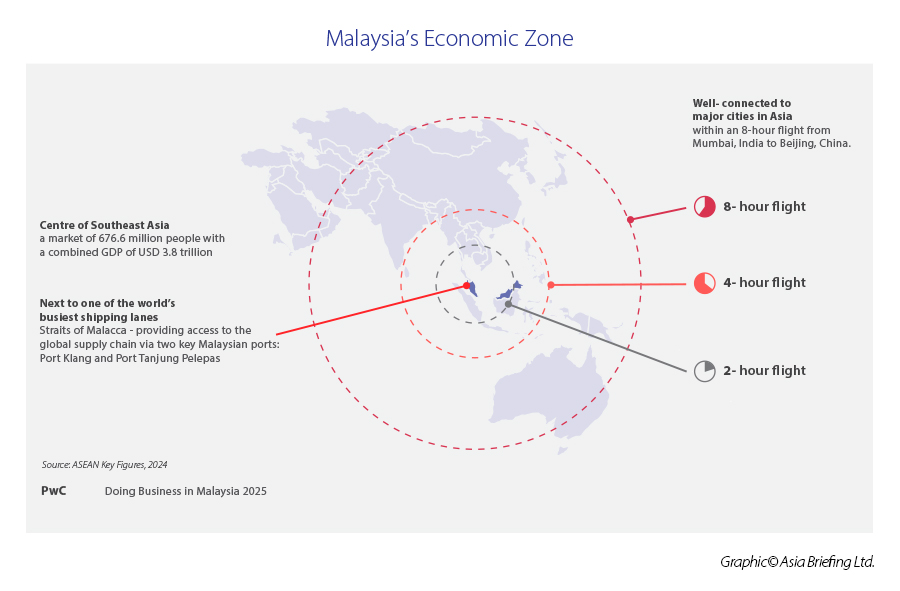

With RM 190.3 billion (US$ 46.1 billion) in approved investments during the first half of 2025—an 18.7 percent year-on-year increase—Malaysia has solidified its position as one of Southeast Asia's most attractive business destinations. The country's recent jump to 23rd position in the IMD World Competitiveness Ranking 2025, its best performance since 2020, underscores the effectiveness of ongoing economic reforms and business-friendly policies.

Choosing the right location to set up your business in Malaysia

The choice of the appropriate businesses’ location depends on several interconnected factors: industry focus, logistics proximity, regulatory incentives, workforce availability, and operational efficiency. Malaysia's geography presents two distinct investment landscapes—West Malaysia, which dominates commercial and industrial activity, and East Malaysia, which offers emerging opportunities in resource-based industries and new economic corridors.

Important note for foreign investors

Industry alignment and infrastructure connectivity

Different regions specialise in specific sectors. Penang leads in electronics and semiconductors, Selangor dominates financial services and logistics, and Johor increasingly attracts high-value manufacturing through the newly established Johor-Singapore Special Economic Zone (JS-SEZ). Proximity to air cargo facilities, seaports, and rail networks directly impacts operational costs and market access, making infrastructure connectivity a primary consideration.

Tax efficiency and regulatory incentives

Malaysia's tax framework varies significantly across regions and business zones. The JS-SEZ offers corporate tax rates as low as 5 percent for up to 15 years, whereas standard corporate tax rates in non-zone areas remain at 24 percent. Regulatory incentives—such as Pioneer Status, Investment Tax Allowance, and targeted sector support—can reduce effective tax burdens by 40–70 percent, making location selection directly impact financial performance.

Workforce availability and talent acquisition

Penang, the Klang Valley, and emerging zones in Johor each have distinct labour market profiles. Penang attracts skilled electronics technicians and engineers, while the Klang Valley offers a diverse talent pool across finance, technology, and corporate services. East Malaysia regions are increasingly developing specialised workforces in oil and gas, renewable energy, and resource extraction.

West Malaysia vs. East Malaysia strategic differences

West Malaysia, including the Klang Valley and Penang, offers mature infrastructure, established supply chains, and immediate market access.

East Malaysia—Sabah and Sarawak—presents lower operational costs, preferential tax treatment for strategic industries, and significant opportunities in renewable energy, palm oil processing, and petroleum. Companies seeking manufacturing cost advantages without sacrificing proximity to ASEAN markets increasingly consider East Malaysia.

Best regions and investment hotspots in Malaysia

Klang Valley (Selangor and Kuala Lumpur)

The Klang Valley, encompassing Selangor and Kuala Lumpur, remains Malaysia's undisputed investment epicentre. In the first half of 2025, the region attracted RM 34.7 billion (US$ 8.4 billion) in Selangor investments and RM 30.1 billion (US$ 7.3 billion) in Kuala Lumpur investments, collectively representing approximately 35 percent of Malaysia's total approved foreign direct investments.

|

Strategic Advantages and Sectoral Focus |

||

|

Sector |

Key Drivers |

Infrastructure Assets |

|

Financial Services and Banking |

Regional headquarters hub, BNM regulation |

KLCC, financial district density |

|

E-commerce and Digital Economy |

Alibaba-backed DFTZ infrastructure |

KLIA proximity, high-speed internet |

|

Real Estate Development |

Urban population growth, rental yields |

Extensive public transport (MRT, LRT, BRT) |

|

Logistics and Distribution |

Southeast Asia's busiest port (Port Klang) |

Multimodal transport integration |

|

Technology and Software Development |

Emerging startup ecosystem |

Rapid deployment of 5G, data centres |

The Klang Valley boasts Malaysia's primary airport (Kuala Lumpur International Airport), the nation's busiest seaport (Port Klang, handling millions of TEUs annually), and Southeast Asia's largest integrated rail and bus hub (KL Sentral). These assets enable seamless integration into regional and global supply chains, making the Klang Valley ideal for companies prioritising speed-to-market and operational flexibility.

Companies in the Klang Valley benefit from income tax exemptions for new manufacturing facilities, Pioneer Status for promoted products, and the New Investment Incentive Framework (NIIF), which allocates RM 1 billion (US$ 242 million) toward supply chain resilience initiatives. Additionally, the region's developed financial market facilitates secured funding and venture capital access.

Penang

Established in the 1970s, Bayan Lepas Free Industrial Zone has evolved into one of Asia's most critical semiconductor and electronics manufacturing clusters. The zone contributes over 10 percent of Penang's GDP and employs more than 100,000 workers. Penang itself exports approximately RM 450 billion (US$ 109.1 billion) annually, accounting for 30 percent of Malaysia's total exports and contributing 70 percent to the country's trade surplus.

The zone houses global technology leaders including Intel, Dell, AMD, Broadcom, Bosch, and Western Digital, alongside a robust network of precision engineering SMEs, structured cabling specialists, and supply chain service providers. This integrated ecosystem supports both original equipment manufacturers (OEMs) and component suppliers, creating competitive advantages through localised sourcing and rapid prototyping capabilities.

Penang continues expanding industrial capacity. The Batu Kawan Industrial Park III project—a RM 2.2 billion (US$ 533 million) initiative spanning 407 acres—commenced in 2024 with completion targeted by 2031. The first phase, covering 60 acres, is scheduled for completion by October 2025. Additionally, the Penang South Islands (PSI) reclamation project will introduce industrial parkland and support facilities by 2027, with plans to develop a 700-acre Green Tech Park to attract sustainable manufacturing and renewable energy industries.

Johor

Johor's geographical proximity to Singapore, combined with vast land resources and lower operational costs, positions the state as a strategic bridging economy. The state recorded RM 56.0 billion (US$ 13.5 billion) in approved investments during 1H 2025, the highest among all Malaysian states. The recently launched Johor-Singapore Special Economic Zone (JS-SEZ) represents a transformational initiative to deepen bilateral economic integration.

Announced on January 7, 2025, the JS-SEZ comprises nine flagship zones, each with sector-specific focus and tailored incentives. The tax incentive package includes:

|

Incentive type |

Description |

Duration / rate |

| Corporate tax rate |

5% tax rate for qualifying manufacturing and services activities (standard rate is 24%) |

Up to 15 years |

|

Knowledge worker tax rate |

Flat tax rate on chargeable employment income |

15% for 10 years |

|

Investment tax allowance |

Allowance on qualifying capital expenditure for high-impact industries |

Up to 100% |

|

Stamp duty exemption |

Exemption on commercial property transfers |

40% |

|

Accelerated capital allowance |

Allowance on qualifying renovation expenses |

Up to 60% |

The JS-SEZ prioritises artificial intelligence, quantum computing, aerospace manufacturing, medical device production, specialty chemicals, smart logistics, global services, and tourism. These sectors align with Malaysia's National Investment Aspirations and create pathways for companies investing in next-generation technologies and high-value manufacturing.

Applications for JS-SEZ incentives remain open from 1 January 2025 through 31 December 2034, providing a decade-long window for prospective investors to establish operations and claim benefits.

Key performing free zones in Johor

- Pasir Gudang Free Industrial Zone: Specialises in electronics, automotive, chemicals, and textiles; benefits from proximity to Pasir Gudang Port for direct maritime access

- Tanjung Pelepas Free Zone: A 1,586-acre multi-phase development adjacent to Tanjung Pelepas Port, positioning itself as a major Southeast Asian logistics hub

Sabah and Sarawak

East Malaysia—Sabah and Sarawak—offers distinct advantages for companies prioritising lower operational costs, preferential tax treatment, and emerging sector development. Both states have positioned themselves as renewable energy investment destinations, leveraging abundant hydroelectric resources and solar potential.

Sarawak Corridor of Renewable Energy (SCORE) initiative provides accelerated investment incentives:

- 100 percent Pioneer Status tax exemption for 5 years (or up to 10 years for strategic investments), compared to 70 percent exemption for mainland Malaysia.

- Investment Tax and Reinvestment Allowances.

- Exemption from Import Duties.

- Preferential Land Pricing.

- Subsidised Electricity and Water Rates (government-supported pricing).

- Enhanced support for high-tech and strategic industries.

|

Sector Opportunities |

||

|

Sector |

Sabah Focus |

Sarawak Focus |

|

Energy and Utilities |

Oil and gas exploration, LNG processing |

Hydroelectric power generation, SCORE renewable projects |

|

Manufacturing |

Palm oil processing, cocoa processing |

Specialty chemicals, downstream petroleum products |

|

Agriculture |

Sustainable palm oil, tropical crops |

Timber and plantation management |

|

Technology |

Emerging digital zones |

ICT infrastructure development |

The Sabah Development Corridor (SDC) and Sarawak Corridor of Renewable Energy (SCORE) are transitioning from resource extraction-focused economies toward value-added manufacturing and sustainable energy. Companies entering these markets today position themselves ahead of the curve as infrastructure matures and market access expands.

Negeri Sembilan and Melaka

Strategically located near Malacca International Airport and major highways, Batu Berendam provides competitive incentives for manufacturing, warehousing, and logistics operations. The zone offers tax incentives and exemptions and benefits from improved road connectivity via the North-South Expressway.

Negeri Sembilan and Melaka serve as consolidation hubs for companies seeking lower costs than the Klang Valley while maintaining connectivity to major ports and manufacturing centres. The regions attract contract manufacturers, warehousing operators, and third-party logistics (3PL) service providers.

Free Trade Zone (FTZ) overview

Malaysia operates multiple categories of investment zones, each with distinct regulations and strategic purposes. Understanding these distinctions is essential for selecting an appropriate operational base.

Free Trade Zones in Malaysia are areas designated by the Ministry of Finance for commercial and industrial activities, featuring streamlined customs procedures and duty exemptions on goods entering and circulating within the zone.

Free Industrial Zone (FIZ)

|

Characteristic |

Details |

|

Primary Focus |

Manufacturing and industrial production for export |

|

Export Requirement |

Minimum 80% of output must be exported (reducible to 60% upon Ministry approval) |

|

Tariff Treatment |

Goods are duty-free and exempt from excise duties when entering; goods exported from Malaysia face standard import tariffs and sales tax |

|

Eligible Industries |

Electronics, automotive components, precision engineering, chemicals, pharmaceuticals |

|

Notable Examples |

Bayan Lepas FIZ (Penang), Prai FIZ (Penang), Pasir Gudang FIZ (Johor) |

Free Commercial Zone (FCZ)

|

Characteristic |

Details |

|

Primary Focus |

Trade, commerce, and logistics operations |

|

Strategic Location |

Proximity to ports and transportation hubs |

|

Tariff Treatment |

Similar to FIZs; goods enter duty-free and are subject to standard tariffs when moved to domestic Malaysia |

|

Eligible Activities |

Warehousing, re-export trading, distribution, transshipment, packaging and labelling |

|

Notable Examples |

Port Klang Free Zone (Selangor), Batu Berendam FTZ (Melaka), Sungai Way Free Trade Industrial Zone (Selangor) |

The fundamental difference lies in business orientation: FIZs are production-centric, prioritising companies that manufacture and export goods. FCZs are trade-centric, serving companies whose primary activities involve warehousing, logistics, and cross-border commerce. A company manufacturing electronic components for export would operate from an FIZ; a company importing and repackaging consumer goods for regional distribution would operate from an FCZ.

|

Category |

Description |

Total |

|

Free Industrial Zones (FIZs) |

Designated areas for manufacturing and export-oriented industries |

21 |

|

Free Commercial Zones (FCZs) |

Designated areas for commercial, trading, and logistics activities |

24 |

|

Total Free Trade Zones |

Combined total of FIZs and FCZs across Malaysia |

45 |

.jpg)

Special Economic Zones (SEZs) and industrial parks

Bayan Lepas Free Industrial Zone (Penang)

Established in 1972 as Malaysia's first free industrial zone, Bayan Lepas remains the nation's flagship manufacturing hub. Expanding from its original 200 hectares to 4,000 hectares today, the zone exemplifies successful industrial cluster development.

Economic impact:

- Contribution to Penang GDP: Over 10 percent.

- Direct employment: More than 100,000 workers.

- Global top-tier in electronics and semiconductor manufacturing.

The zone hosts Intel, Dell, AMD, Broadcom, Bosch, Western Digital, and hundreds of supplier companies spanning precision tooling, structured cabling, custom engineering, and logistics services. This vertical integration—combining global OEMs with specialised local suppliers—creates competitive advantages in innovation speed and cost efficiency.

The Penang South Islands (PSI) reclamation project will add significant industrial capacity by 2027, with plans for a 700-acre Green Tech Park attracting next-generation sustainable manufacturing. New phases of development will focus on semiconductors, electric vehicle components, and renewable energy equipment.

Port Klang Free Zone (Selangor)

Adjacent to Port Klang—Southeast Asia's busiest container port, handling multiple million TEUs annually—the Port Klang Free Zone (PKFZ) functions as a pivotal regional logistics node. The zone integrates multiple transport modes: maritime, rail (KL Sentral), and highway networks.

PKFZ serves as a hub for:

- Containerised cargo consolidation and deconsolidation.

- Regional distribution and cross-docking operations.

- Manufacturing and assembly for export markets.

- Cold chain and specialised logistics services.

The zone features modern warehousing, customs facilities, and IT infrastructure supporting real-time cargo tracking and automated documentation. Recent infrastructure upgrades have enhanced processing capacity and reduced vessel turnaround times.

Tanjung Pelepas Free Zone (Johor)

The Tanjung Pelepas Free Zone spans approximately 1,586 acres across five development phases, positioning it as a major logistics hub. Adjacent to Tanjung Pelepas Port—a deep-water facility supporting large container vessels—the zone offers scale advantages for regional distribution operations.

Tanjung Pelepas emphasises regional transshipment, warehousing, and light manufacturing. Its deep-water port capabilities attract companies requiring efficient hub operations for Southeast Asian distribution networks. The zone functions as a viable alternative to traditional hub ports for companies seeking operational flexibility and cost advantages.

Iskandar Malaysia / Johor-Singapore SEZ

Iskandar Malaysia, now expanded through the Johor-Singapore Special Economic Zone framework, represents Malaysia's most ambitious integrated economic development initiative. The project envisions seamless cross-border economic integration combining Johor's land and labour resources with Singapore's financial and technological capabilities. The nine designated flagship areas include:

- Global Services Hub: Financial services, professional services, corporate headquarters

- Smart Logistics: Advanced warehouse management, e-commerce fulfillment, last-mile delivery

- Specialty Chemicals: Petroleum refining derivatives, specialty chemicals manufacturing

- Aerospace Manufacturing: Aircraft components, maintenance and repair services

- Medical Devices: Diagnostic devices, surgical equipment, pharmaceutical ingredients

- AI and Quantum Computing Supply Chains: Data centres, semiconductor packaging, software development

- Tourism and Hospitality: Integrated resorts, convention facilities, entertainment complexes

- Agriculture and Food Processing: Sustainable farming, food value addition, halal certification

- Renewable Energy: Solar manufacturing, battery storage, grid management systems

The JS-SEZ targets creation of 20,000 highly skilled jobs within 10 years through 100 high-impact projects. The initiative includes potential passport-free clearance systems at border crossings and enhanced customs harmonisation, fundamentally reshaping cross-border business operations.

East Coast Economic Region (ECER)

ECER (comprising Terengganu, Kelantan, and Pahang) specialises in petroleum, petrochemicals, mining, and emerging renewable energy sectors. The region attracts companies involved in:

- Petroleum refining and downstream processing.

- Liquified natural gas (LNG) operations.

- Metal processing and recycling.

- Agro-based manufacturing (palm oil, cocoa).

- Renewable energy generation and equipment manufacturing.

The region hosts major petroleum facilities and is expanding renewable energy infrastructure, positioning it for companies seeking energy-intensive operations or involvement in Malaysia's energy transition.

FAQ — Where to invest in Malaysia

Can foreigners own 100 percent of a Malaysian company?

General Position: Yes, with Sector Exceptions

Most business sectors in Malaysia permit 100 percent foreign ownership of a private limited company (Sdn. Bhd.). Sectors permitting unrestricted foreign ownership include:

- Consulting and professional services.

- Trading and e-commerce.

- Technology and software development.

- Manufacturing (non-restricted products).

- Logistics and distribution.

Certain regulated sectors impose foreign ownership caps or require local Malaysian partnership:

- Oil and Gas Exploration: Typically requires Petronas (national oil company) involvement or partnership.

- Telecommunications: Generally requires local operator partnership.

- Banking and Financial Services: Subject to central bank (Bank Negara Malaysia) approval; usually 49% foreign ownership cap per investor.

- Wholesale and Retail Trade: Historically restricted; recent liberalisation allows higher foreign ownership in specific circumstances.

- Broadcasting and Media: Local ownership majority typically required.

If the company employs expatriate staff (Employment Pass holders), the company must maintain minimum paid-up capital:

- RM 500,000 for services and technology sectors.

- RM 1,000,000 for trading and retail sectors.

- RM 2,500,000 for manufacturing companies.

Which state is best for manufacturing?

Answer depends on industry focus

|

Manufacturing sector |

Recommended state |

Rationale |

|

Electronics and semiconductors |

Penang |

Bayan Lepas ecosystem, established supply chains, 100,000+ skilled workforce, global OEM presence |

|

Automotive and components |

Selangor / Penang |

Infrastructure maturity, port access, NCER support |

|

Precision engineering |

Penang / Selangor |

Skilled labour, specialist suppliers, FIZ/FTZ access |

|

Chemical processing |

Johor (ECER/JS-SEZ) |

Energy cost advantages, feedstock proximity, JS-SEZ tax incentives (5% CIT) |

|

Palm oil and agro-processing |

Johor / Sabah / Sarawak |

Raw material proximity, established infrastructure, preferential tax treatment |

|

Renewable energy equipment |

Sarawak (SCORE) |

Energy cost advantages, preferential tax treatment (100% Pioneer Status for 5–10 years) |

|

Aerospace and advanced manufacturing |

Johor (JS-SEZ) |

Emerging cluster formation, 5% CIT incentive, skilled labour development |

|

Medical devices and pharma |

Selangor / Johor (JS-SEZ) |

Regulatory environment maturity, talent availability, healthcare infrastructure |

Overall Manufacturing Leadership: Penang for established sectors, Johor (via JS-SEZ) for emerging high-value manufacturing.

Is Malaysia better than Singapore for startups?

Comparative advantage matrix

|

Factor |

Malaysia |

Singapore |

Winner |

|

Startup cost (company registration) |

RM 1,000–5,000 |

SGD 300–500 (~RM 1,000) |

Roughly Equal |

|

Office and warehouse rent |

RM 2–5/sqft (Penang); RM 5–15/sqft (KL) |

SGD 2–4/sqft (~RM 5–10) |

Malaysia (20–40% lower) |

|

Labour costs (entry-level tech) |

RM 4,000–6,000/month |

SGD 3,500–5,500/month (~RM 10,500–16,500) |

Malaysia (significantly lower) |

|

Venture capital ecosystem |

Growing; RM 2–5 billion annual early-stage funding |

Mature; US$ 3–5 billion annual regional funding |

Singapore (access to larger pools) |

|

Talent availability (tech/engineering) |

Abundant; ~200,000 tech graduates/year |

Limited; ~30,000 tech professionals/year |

Malaysia (supply advantage) |

|

Business regulations |

Streamlined (improving via NIMP 2030 reforms) |

Highly efficient, predictable |

Singapore (regulatory certainty) |

|

Time-to-market advantage |

Moderate (2–4 weeks incorporation) |

Fast (1 week incorporation) |

Singapore (marginal advantage) |

|

Ip protection and legal enforcement |

Strong but developing (patent office modernisation ongoing) |

Excellent, internationally recognised |

Singapore (established precedent) |

|

Market access to asean |

Direct; gateway status |

Requires regional expansion |

Malaysia (ASEAN proximity) |

Verdict: Malaysia for Cost-Conscious Startups Targeting ASEAN; Singapore for Access to Premium Capital and Established VC Networks.

Malaysia offers compelling cost advantages (30–50% lower operational costs than Singapore) combined with direct ASEAN market access. This positioning favours startups in software development, business process outsourcing, and regional logistics. Singapore remains superior for startups requiring significant venture capital, advanced legal certainty, and premium international talent.