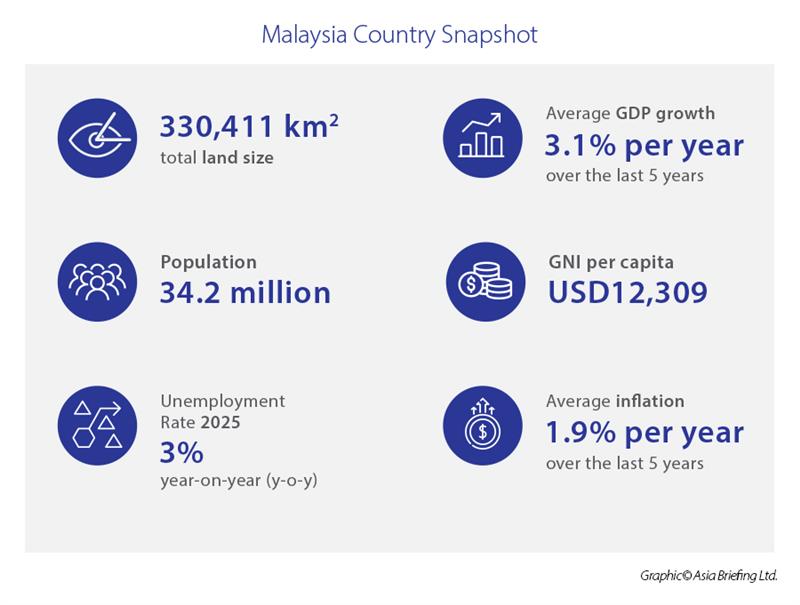

Malaysia has positioned itself as one of the most attractive investment destinations in Southeast Asia, hosting over 5,000 foreign companies from more than 50 countries with a cumulative foreign direct investment (FDI) stock reaching RM 985.1 billion (US$ 238.7 billion) as of December 2024. The country's strategic location, developed infrastructure, multilingual workforce, and favourable business environment have made it a gateway for multinational corporations seeking to establish regional operations. However, despite its pro-investment stance, Malaysia maintains specific equity restrictions in certain strategic sectors to protect national interests and ensure meaningful participation by Malaysian and Bumiputera (Malay and indigenous ethnic groups) investors.

How much foreign ownership is allowed in Malaysia?

Malaysia operates under a liberalised foreign ownership regime with minimal restrictions in most sectors. Since the abolishment of the Foreign Investment Committee in 2009, Malaysia removed its universal foreign equity ceiling of 70 percent, permitting 100 percent foreign ownership in the majority of industries. This regulatory shift transformed Malaysia into one of the most open economies in ASEAN for foreign capital participation.

The overarching principle governing foreign investment in Malaysia is that foreigners can hold up to 100 percent equity in most business ventures, subject to sector-specific modifications. This applies particularly to manufacturing and services sectors, where the Malaysian Investment Development Authority (MIDA) has explicitly permitted full foreign ownership for both new projects and expansion or diversification ventures, regardless of export orientation levels.

For manufacturing enterprises, the conditions are straightforward. A company with shareholding capital exceeding RM 2.5 million (US$ 606,000) or employing more than 75 full-time workers must obtain a manufacturing licence, but MIDA approval for 100 percent foreign equity is routinely granted. Similarly, in services sectors such as information technology, professional services (excluding some regulated professions), and tourism-related businesses, foreign investors face no inherent equity restrictions at the central government level.

Real property and asset restrictions

While equitable ownership in business ventures is generally unrestricted, foreign investors must navigate specific limitations regarding property acquisition. Foreign entities cannot acquire properties valued below a certain threshold—typically RM 1 million and above (though some states such as Johor, Selangor, and Sarawak have varying thresholds). Additionally, foreign investors are prohibited from purchasing Malay Reserved Land and properties allocated exclusively for Bumiputera interest. Restrictions also extend to sensitive areas including protected forests and government-designated development zones.

Bumiputera participation framework

A critical distinction in Malaysian foreign investment policy involves equity reserved for Bumiputera stakeholders. This is not a restriction on foreign investment per se, but rather a requirement ensuring meaningful participation by indigenous Malaysian groups in certain business activities. When regulatory authorities impose Bumiputera equity requirements—typically ranging from 30 to 70 percent depending on the sector—the foreign ownership ceiling is correspondingly reduced. Importantly, foreign investors retain the ability to structure ownership arrangements through preference shares, voting agreements, and phased divestment schedules to maintain operational control while satisfying regulatory requirements.

Which industries cannot be foreign-owned or solely foreign-owned?

Malaysia does not maintain a comprehensive prohibition on foreign investment in any single industry. However, certain sectors impose mandatory equity participation by Malaysian or Bumiputera stakeholders, effectively capping foreign ownership below 100 percent. Understanding these restrictions is essential for investment planning across multiple sectors.

|

Sectors with Mandatory Equity Requirements |

|||

|

Sector |

Maximum foreign ownership |

Regulatory authority |

Notes |

|

Commercial banking |

30% |

Bank Negara Malaysia (BNM) |

Islamic banks allow up to 70% foreign ownership; stricter limits reflect systemic importance |

|

Insurance and takaful |

70% |

BNM (Takaful) / Licensed insurers |

Foreign equity capped unless specific approval obtained; non-insurance becomes 100% |

|

Telecommunications infrastructure |

49-70% |

Malaysian Communications and Multimedia Commission (MCMC) |

Varies by network infrastructure type; final approval determined by licence category |

|

Oil and gas downstream (marketing and distribution) |

30% (petroleum); 0% (wholesale LPG) |

Petronas / Ministry guidelines |

Bumiputera equity minimum: 30% (petroleum), 51% (LPG); upstream operations subject to Petronas approvals |

|

Distributive trade |

70% (general); varies by scale |

Ministry of Domestic Trade (KPDN) |

30% Bumiputera minimum for hypermarkets, supermarkets, department stores; grace period typically 3 years |

|

Plantation and agriculture |

70% |

Ministry of Plantation Industries and Commodities |

Landholding regulations under state laws also apply; crop diversification restrictions may exist |

|

Freight forwarding |

49% |

Ministry of Transportation |

51% Malaysian ownership mandatory |

|

Professional services |

Varies (50-70%) |

Respective professional bodies |

Legal services, accounting, architecture, and engineering have specific restrictions |

|

Construction industry |

Varies by company grade |

Construction Industry Development Board (CIDB) |

Restrictions apply based on project size and contractor classification; escalating by capital requirements |

Sectoral licensing and approval requirements

Restricted sectors require obtaining specific licences, permits, or approvals from sector-specific regulatory authorities before commencing operations. These approval mechanisms serve as de facto foreign equity screening instruments. For instance:

- Banking: Requires BNM licence; foreign ownership capped at 30 percent for commercial banks.

- Insurance: Requires BNM approval; foreign ownership typically capped at 70 percent.

- Telecommunications: Requires MCMC licence; foreign ownership capped at 49-70 percent depending on service type.

- Oil and Gas: Requires Petronas agreements; foreign participation conditioned on partnership structures.

Regulatory authority discretion

Restricted sectors grant sector-specific regulatory authorities’ considerable discretion in approving or modifying equity restrictions on a case-by-case basis. This discretionary authority enables regulators to adjust restrictions based on strategic policy considerations, competitive dynamics, or bilateral trade negotiations. For example, during 2025 trade discussions with the United States regarding tariff reduction, Malaysia's Ministry of Investment, Trade and Industry engaged in discussions to potentially ease foreign ownership limits in banking and power sectors, reflecting regulatory flexibility.

Restricted vs. Unrestricted sectors classification matrix

The following matrix categorises major Malaysian industries according to foreign ownership accessibility:

|

Ownership classification |

Sectors |

Foreign equity potential |

Regulatory pathway |

|

Fully open |

Manufacturing (E and E, automotive, aerospace, pharmaceuticals), Digital economy (software, data centres, ICT), Professional services (accounting, consulting), Tourism, Real estate development |

100% |

MIDA registration/notification; minimal licensing requirements |

|

Moderately restricted |

Distributive trade, Professional services (law, architecture), Private healthcare, Hospitality, Food and beverage manufacturing |

70-100% (with conditions) |

Sector-specific ministry approval; Bumiputera equity partnerships; grace periods for compliance |

|

Highly restricted |

Commercial banking, Telecommunications, Petroleum downstream, Plantation, Freight forwarding, Insurance |

30-70% |

Specific agency licensing; central bank or ministry approval; mandatory partnership structures |

|

Strategic/government monopoly |

Defence manufacturing, Lottery operations, Core telecommunications infrastructure (select), Upstream oil and gas exploration |

0-30% (case-by-case) |

Government approval; joint venture mandates; equity partnerships with state entities |

Liberalisation trends have characterised regulatory reform, with government agencies progressively relaxing equity restrictions in sectors deemed important for economic growth and global competitiveness. Manufacturing, digital economy, healthcare, and aerospace sectors exemplify this liberalisation trajectory.

Conversely, strategic sectors such as banking, telecommunications, and energy have maintained or modestly adjusted equity restrictions, reflecting enduring government policy to preserve national control over critical economic infrastructure. The 2025 discussions regarding potential easing of foreign ownership limits in power and banking sectors underscore the government's willingness to recalibrate restrictions in response to macroeconomic pressures and international trade dynamics.

Sectoral restrictions and investment incentives alignment

An important regulatory principle governs the interaction between sectoral restrictions and tax incentive eligibility. Companies operating in restricted sectors and seeking to comply with equity requirements may simultaneously pursue tax incentives such as Pioneer Status (PS) or Investment Tax Allowance (ITA) under the Promotion of Investment Act 1986. However, group relief provisions exclude companies claiming these incentives, creating strategic considerations for equity structuring and incentive election.

Restricted sectors within growth sectors

Notably, several government-prioritised growth sectors—designated within the New Industrial Master Plan (NIMP) 2030 framework—contain internally restricted sub-sectors. For instance, while the Islamic finance sector enjoys liberalised foreign investment policies and ranks first in the Global Islamic Economy Indicator for the tenth consecutive year, specific Islamic banking and takaful insurance activities remain subject to foreign equity caps reflecting regulatory conservatism in financial services.

Similarly, within digital economy sectors—projected to contribute 25.5 percent of Malaysia's GDP by 2025—data centre development enjoys minimal restrictions and has attracted record investments exceeding US$ 31.5 billion in 2024, while telecommunications network infrastructure remains subject to MCMC foreign equity limitations.

Sectors driving Malaysia’s economy

Services and manufacturing

Malaysia’s economy is primarily driven by the services and manufacturing sectors, which contributed 59.2 percent and 23.4 percent to the nation’s GDP in 2023, respectively. Having moved away from its dependence on agriculture and primary commodities since the 1960s, Malaysia has evolved into a diversified, export-oriented economy centered on knowledge, innovation, and productivity.

Building on its strong foundation in manufacturing and services, Malaysia seeks to enter a new stage of industrial transformation through the National Industrial Master Plan (NIMP) 2030. The country aims to enhance its manufacturing capabilities in areas such as advanced electronics and green industries, supported by a vibrant, knowledge-driven services sector that includes digitalisation, research and development (R&D), finance, and business services.

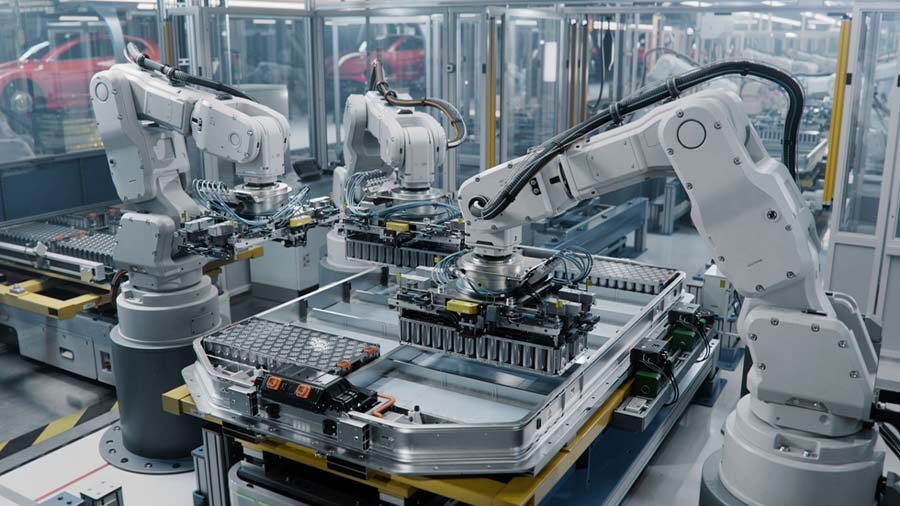

In response to global shifts, digitalisation, and increasing emphasis on environmental, social, and governance (ESG) priorities, Malaysia also plans to expand into emerging sectors such as advanced materials, electric vehicles (EVs), renewable energy, and carbon capture, utilisation, and storage (CCUS).

Electrical and electronics

Malaysia’s economy is predominantly powered by the services and manufacturing sectors, contributing 59.2 percent and 23.4 percent of GDP respectively as of 2023. Once dependent on agriculture and primary commodities in the 1960s, Malaysia has evolved into a diversified, export-oriented economy driven by knowledge, innovation, and productivity.

A key pillar of Malaysia’s manufacturing strength lies in its electrical and electronics (E&E) industry, which accounts for 6.8 percent of GDP and plays a vital role in national exports. Malaysia is currently the 12th largest E and E exporter and the 6th largest semiconductor exporter globally. The sector encompasses four main sub-sectors: electronic components, consumer electronics, industrial electronics, and electrical products. As a global hub for semiconductor manufacturing, Malaysia hosts major multinational technology firms and maintains a robust, integrated supply chain that supports both upstream and downstream activities.

Under the National Industrial Master Plan (NIMP) 2030 and the National Semiconductor Strategy (NSS), Malaysia aims to propel the E&E industry to new heights. The government’s vision focuses on strengthening the nation’s position in the global semiconductor value chain by establishing home-grown champions in integrated circuit (IC) design and advanced packaging, while attracting cutting-edge wafer fabrication investments.

Malaysia’s targets include developing at least 10 globally competitive IC design and advanced packaging companies and 100 new semiconductor-related firms, supported by a dynamic ecosystem that encourages research and development (R&D), innovation, and technological collaboration. Leveraging its strong manufacturing base and the ongoing global shifts toward digitalisation and sustainability, Malaysia is positioning itself at the forefront of emerging sectors such as advanced electronics, electric vehicles (EVs), renewable energy, and carbon capture, utilisation, and storage (CCUS).

Aerospace

Malaysia’s aerospace industry is a rapidly expanding sector comprising five key sub-sectors:

- Maintenance,

- Repair and overhaul (MRO),

- Aerospace manufacturing,

- Systems integration,

- Engineering and design services,

- As well as education and training.

Strategically located in the heart of the Asia-Pacific region—the world’s largest air travel market—Malaysia benefits from world-class infrastructure and geographic advantages that support growing regional and global demand.

With a strong emphasis on building local expertise, Malaysia has successfully attracted substantial foreign investment and forged strategic partnerships with leading global aerospace companies. The government continues to play an active role in driving the industry’s growth through policies and initiatives under the National Industrial Master Plan (NIMP) 2030, which aim to enhance innovation, strengthen talent development, and upgrade industry infrastructure.

The sector’s outlook is highly promising, with projected revenues reaching RM 552.2 billion by 2030 and an estimated 32,000 new jobs expected to be created. From 2006 to 2020, Malaysia’s aerospace exports recorded an impressive compound annual growth rate (CAGR) of 13.3 percent, reflecting the nation’s steady progress toward becoming a competitive regional aerospace hub.

Through continued focus on innovation, capability-building, and international collaboration, Malaysia is positioning itself as a key player in the global aerospace supply chain—driving technological advancement, job creation, and sustainable industrial growth.

Medical devices

Malaysia’s medical devices industry stands as the largest in the ASEAN region, with an estimated market size of US$ 1.8 billion. Positioned for continued expansion, the sector aligns closely with the government’s commitment to improving national health and wellbeing—one of the central pillars of the Twelfth Malaysia Plan (2021–2025).

The industry covers a broad spectrum of products, ranging from single-use consumables such as medical gloves to high-tech electromedical equipment including ultrasonic devices and MRI machines. Driven by rising global healthcare demand, technological innovation, and Malaysia’s strong manufacturing base, the sector is well-positioned to capture greater market share and investment opportunities.

Between 2006 and 2020, the medical devices industry recorded a compound annual export growth rate (CAGR) of 10.9 percent, alongside RM 33.4 billion in total approved investments. These achievements underscore Malaysia’s growing reputation as a trusted regional hub for medical device production, innovation, and export.

Chemical

The chemical industry plays a pivotal role in Malaysia’s economy, ranking among the top five export sectors and contributing 5.0 percent of total national exports in 2023. In 2020, the industry’s contribution to GDP reached RM 36.6 billion, underscoring its importance as a key driver of industrial and export growth.

The sector encompasses a broad range of products across three major sub-sectors: organic chemicals, inorganic chemicals, and bio-based feedstock. Over the years, Malaysia’s chemical industry has maintained a steady export compound annual growth rate (CAGR) of 5 percent from 2006 to 2020, reflecting consistent expansion and resilience.

Looking forward, the industry’s development is guided by the Chemical Industry Roadmap 2030, which outlines strategies to elevate Malaysia’s global competitiveness through enhanced ESG (environmental, social, and governance) practices, stronger integration of upstream and downstream activities, and diversification into high-value specialty chemicals.

Pharmaceutical

Malaysia’s pharmaceutical industry has experienced consistent growth over the past decade and is projected to achieve a total valuation of US$ 2.1 billion by 2027. Valued at RM 9.8 billion, the sector plays a vital role in supporting national healthcare and export performance.

The industry focuses on the manufacturing of medicines, health supplements, and related products, encompassing a wide range that includes generic pharmaceuticals, traditional medicines, nutraceuticals, and veterinary products. This diversity has enabled the sector to cater to both domestic healthcare needs and international markets.

Between 2006 and 2020, Malaysia’s pharmaceutical exports recorded a compound annual growth rate (CAGR) of 10.3 percent, supported by RM 5.3 billion in total approved investments during the same period. These achievements highlight Malaysia’s growing capabilities in pharmaceutical manufacturing and its increasing reputation as a reliable regional supplier.

Investment decision framework

Understanding Malaysia's foreign ownership architecture enables strategic investment planning across several dimensions:

- Investors must evaluate whether target sectors permit 100% foreign ownership, necessitate Bumiputera partnerships, or require joint ventures with strategic Malaysian stakeholders. Sectors permitting full foreign ownership—manufacturing, digital economy, healthcare—enable streamlined market entry and unified operational control. Restricted sectors demand partnership negotiation and extended approval timelines.

- Tax incentives such as Pioneer Status and Investment Tax Allowance offer substantial value; however, equity structuring decisions must accommodate both incentive eligibility criteria and sectoral ownership requirements. Phased equity structures satisfying Bumiputera participation mandates while maintaining investor control through preference share arrangements represent sophisticated structuring solutions.

- Early dialogue with sector-specific regulatory authorities—MIDA, BNM, MCMC, KPDN, Petronas—clarifies ownership requirements, approval timelines, and flexibility regarding partnership arrangements. Regulatory agencies increasingly engage proactively with foreign investors to facilitate investment approval, particularly for projects aligned with government growth priorities.

Frequently Asked Questions (FAQs)

Which investment is the best in Malaysia?

No single investment stands out as the absolute best in Malaysia, as it depends on risk tolerance and market conditions, but data centers, technology stocks like Telekom Malaysia, and funds such as Amanah Saham Bumiputera (ASB) are frequently recommended for 2025 due to strong returns in 2024 and growth potential.

Can foreigners invest in Malaysia?

Foreigners can invest in Malaysia, with up to 100% foreign equity allowed in most new projects and expansions, particularly in services and IT sectors. Restrictions apply in areas like oil and gas, banking, and education, where local ownership may be required, and structures like private limited companies (Sdn. Bhd.) are popular for full foreign control.

Which business is most profitable in Malaysia?

IT and software development, along with retail like department stores and T-shirt printing leveraging cultural designs, rank among the most profitable due to digital transformation support and consumer demand. Electronics manufacturing services (EMS) and affiliate marketing also thrive, aided by over 28 million social media users and government incentives.

What sector is booming in Malaysia?

The services sector leads with RM190.3 billion in approved investments in 1H2025, up 18.7 percent year-on-year, driven by information and communications (RM59.6 billion) and real estate (RM38.6 billion). Data centers and semiconductors continue booming, attracting foreign funds and boosting related construction and tech firms.

What business has the highest ROI?

Businesses in data centers, AI servers, and renewables like co-generation offer high ROI potential, with firms like NationGate Holdings and Kawan Renergy showing record profits from DC demand and tenders up to RM600 million. Specific stocks such as Duopharma Biotech in healthcare and Sunway Construction also signal strong returns amid sector growth.