Singapore’s extensive free trade agreements (FTA), coupled with a transparent legal system and educated workforce, have been credited with accelerating the country’s transformation to a first-world economy.

The country’s 15 bilateral and 12 regional FTAs include some of the largest combined trade agreements in the ASEAN-China, ASEAN-India, and ASEAN-Hong Kong trade blocs — providing Singapore-based businesses with access to preferential markets, free or reduced import tariffs, as well as enhanced intellectual property regulations.

Despite regional players maintaining strong FTA networks, they are not as extensive as Singapore’s. Due to these factors, the country will continue to be the default location for businesses seeking to expand into Southeast Asia and neighboring regions.

Foreign investors should seek the help of registered advisors to understand how they can benefit from the incentives covered under Singapore’s FTAs.

What are FTAs?

Free Trade Agreements (FTAs) are legally binding arrangements between governments, under which Singapore and its trading partners agree to specific commitments aimed at enhancing and easing trade. Each FTA is unique, with varying terms and obligations.

Typically, an FTA is organized into chapters, each addressing a distinct area of trade. The core sections generally focus on:

-

Trade in Goods

-

Trade in Services

-

Investment

Who benefits from the FTAs?

FTAs are particularly relevant for Singapore-based companies and individuals who are:

-

Exporters or manufacturers trading goods between countries that have FTAs with Singapore.

-

Exporters or manufacturers encountering tariff barriers in foreign markets.

-

Service providers and investors who are seeking to secure market access, protect their investments, and maintain business certainty.

However, you may not require the benefits of an FTA if:

-

You are exporting to a Free Trade Zone or Special Economic Zone.

-

Your product already qualifies for zero import tariffs in the destination market.

-

Existing WTO agreements, such as the WTO Information Technology Agreement, already remove tariffs for your product category.

What are the types of Free Trade Agreements in Singapore?

There are two types of FTAs:

- Bilateral (agreements between Singapore and a single trading partner);

- Regional (signed between Singapore and a group of trading partners); and,

Singapore has also signed several Digital economy agreements - a ‘digital-only’ trade agreement that establishes digital trade rules and digital economy collaborations.

|

FTA Name |

Countries Involved |

|

Agreement Between New Zealand and Singapore on a Closer Economic Partnership (ANZSCEP) |

New Zealand, Singapore |

|

ASEAN – Australia – New Zealand Free Trade Area (AANZFTA) |

ASEAN (Brunei, Cambodia, Indonesia, Laos, Malaysia, Myanmar, Philippines, Singapore, Thailand, Vietnam), Australia, New Zealand |

|

ASEAN – China Free Trade Area (ACFTA) |

ASEAN (Brunei, Cambodia, Indonesia, Laos, Malaysia, Myanmar, Philippines, Singapore, Thailand, Vietnam), China |

|

ASEAN – Hong Kong, China Free Trade Area (AHKFTA) |

ASEAN (Brunei, Cambodia, Indonesia, Laos, Malaysia, Myanmar, Philippines, Singapore, Thailand, Vietnam), Hong Kong, China |

|

ASEAN – India Free Trade Area (AIFTA) |

ASEAN (Brunei, Cambodia, Indonesia, Laos, Malaysia, Myanmar, Philippines, Singapore, Thailand, Vietnam), India |

|

ASEAN – Japan Comprehensive Economic Partnership (AJCEP) |

ASEAN (Brunei, Cambodia, Indonesia, Laos, Malaysia, Myanmar, Philippines, Singapore, Thailand, Vietnam), Japan |

|

ASEAN – Korea Free Trade Area (AKFTA) |

ASEAN (Brunei, Cambodia, Indonesia, Laos, Malaysia, Myanmar, Philippines, Singapore, Thailand, Vietnam), South Korea |

|

ASEAN Free Trade Area (AFTA) |

ASEAN (Brunei, Cambodia, Indonesia, Laos, Malaysia, Myanmar, Philippines, Singapore, Thailand, Vietnam) |

|

China – Singapore Free Trade Agreement (CSFTA) |

China, Singapore |

|

Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) |

Australia, Brunei, Canada, Chile, Japan, Malaysia, Mexico, New Zealand, Peru, Singapore, United Kingdom, Vietnam |

|

EFTA – Singapore Free Trade Agreement (ESFTA) |

Iceland, Liechtenstein, Norway, Singapore, Switzerland |

|

Eurasian Economic Union – Singapore Free Trade Agreement (EAEUSFTA) (Signed, pending ratification) |

Armenia, Belarus, Kazakhstan, Kyrgyzstan, Singapore (services & investment agreements with Armenia & Kazakhstan in force) |

|

European Union – Singapore Free Trade Agreement (EUSFTA) |

European Union, Singapore |

|

Gulf Cooperation Council – Singapore Free Trade Agreement (GSFTA) |

Bahrain, Kuwait, Oman, Qatar, Saudi Arabia, Singapore, United Arab Emirates |

|

India – Singapore Comprehensive Economic Cooperation Agreement (CECA) |

India |

|

Japan – Singapore Economic Partnership Agreement (JSEPA) |

Japan |

|

Korea – Singapore Free Trade Agreement (KSFTA) |

South Korea |

|

Mercosur – Singapore Free Trade Agreement (MCSFTA) (Signed, pending entry into force) |

Argentina, Brazil, Paraguay, Uruguay |

|

Pacific Alliance – Singapore Free Trade Agreement (PASFTA) |

Chile, Colombia, Mexico, Peru |

|

Panama – Singapore Free Trade Agreement (PSFTA) |

Panama |

|

Peru – Singapore Free Trade Agreement (PeSFTA) |

Peru |

|

Regional Comprehensive Economic Partnership (RCEP) |

Australia, Brunei, Cambodia, China, Indonesia, Japan, Lao PDR, Malaysia, Myanmar, New Zealand, Philippines, Singapore, South Korea, Thailand, Vietnam |

|

Singapore – Australia Free Trade Agreement (SAFTA) |

Australia |

|

Singapore – Costa Rica Free Trade Agreement (SCRFTA) |

Costa Rica |

|

Singapore – Jordan Free Trade Agreement (SJFTA) |

Jordan |

|

Sri Lanka – Singapore Free Trade Agreement (SLSFTA) |

Sri Lanka |

|

Trans-Pacific Strategic Economic Partnership (TPSEP) |

Brunei Darussalam, Chile, New Zealand |

|

Türkiye – Singapore Free Trade Agreement (TRSFTA) |

Türkiye |

|

United Kingdom – Singapore Free Trade Agreement (UKSFTA) |

United Kingdom |

|

US – Singapore Free Trade Agreement (USSFTA) |

United States |

Digital economy partnership agreement

Digital Economy Agreements (DEAs) are legally binding international accords designed to facilitate digital trade, promote digital connectivity, and harmonize standards across borders. They aim to establish and shape international norms in the digital space by aligning digital policies, rules, and frameworks. DEAs go beyond traditional trade agreements by focusing on enabling seamless digital transactions and cross-border collaboration in the digital realm.

Singapore, building upon its extensive network of Free Trade Agreements (FTAs) and digital cooperation efforts, has concluded negotiations on four DEAs and continues to pursue similar agreements with other digitally progressive economies.

DEAs play a strategic role in supporting the global digital economy by removing non-tariff barriers and aligning digital governance across jurisdictions. They help ensure consistency and interoperability between national digital systems, thereby reducing friction in cross-border digital activities.

These agreements support the secure and trusted flow of data across borders, while protecting personal information and upholding consumer rights. Moreover, DEAs serve as platforms for international cooperation in emerging technological areas such as Artificial Intelligence (AI), FinTech, digital identities, and data innovation. By creating a conducive environment for experimentation and deployment of digital tools across partner countries, DEAs foster innovation and accelerate digital transformation.

How can businesses benefit from DEAs?

For businesses, DEAs offer a broad range of benefits aimed at improving competitiveness and access to international markets. By establishing shared rules and frameworks, DEAs reduce regulatory uncertainty and facilitate smoother digital interactions with overseas partners. Companies can leverage these agreements to lower operational costs, enhance efficiency, and scale digital services internationally with greater ease. DEAs also provide businesses access to aligned digitalisation initiatives and infrastructure, enabling them to participate in cross-border trade more effectively. These initiatives include:

- Artificial Intelligence governance and collaboration frameworks that support responsible AI development and deployment

- Participation in the APEC Cross-Border Privacy Rules (CBPR) System, facilitating secure and trusted data flows

- Data Innovation initiatives encouraging the ethical use of data for economic growth

- Data Protection Trustmark Certification, building consumer trust and business credibility

- Nationwide E-Invoicing Network, enabling seamless electronic transactions across borders

- “SMEs Go Digital” programmes, supporting small and medium-sized enterprises in adopting digital solutions with international reach

The provisions in Singapore’s DEAs typically cover a wide array of digital economy components, including:

- Cross-Border Data Flows: Ensuring data can move freely between countries, subject to safeguards

- Personal Data Protection: Aligning personal data protection standards to build consumer confidence

- Artificial Intelligence: Promoting ethical AI use and fostering cross-border AI innovation

- Digital Identities: Encouraging mutual recognition and interoperability of digital ID systems

- FinTech and E-Payments: Supporting innovation and cooperation in digital financial services

- E-Invoicing: Facilitating paperless trade and streamlining business processes

- Open Government Data: Enhancing transparency and innovation through data-sharing

- Paperless Trade: Eliminating the need for hardcopy documentation in customs and trade processes

Major FTAs

Comprehensive and Progressive Agreement for Trans-Pacific Partnership

The Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) eliminates tariffs for 94 percent of Singapore’s exports to CPTPP markets. The agreement also addresses non-tariff barriers to trade through updated rules in technical standards, sanitary and phytosanitary measures, services, and investments.

The CPTPP was concluded on 23 January 2018 in Tokyo, Japan and signed on 8 March 2018 in Santiago, Chile. Singapore ratified the CPTPP on 19 July 2018, becoming the third nation to do so after Mexico and Japan.

India–Singapore Comprehensive Economic Cooperation Agreement (CECA)

The Comprehensive Economic Cooperation Agreement (CECA) is a bilateral free‑trade deal between Singapore and India, signed on 29 June 2005 and fully in force thereafter. CECA eliminated tariffs on approximately 81 percent of Singapore’s exports to India, enhancing the competitiveness of goods such as electronics, pharmaceuticals, food, plastics, and mechanical appliances in one of the world’s largest consumer markets. It also provides preferential market access for services—including finance, engineering, tourism, logistics, and IT—and strengthens investment protections, mutual recognition of qualifications, and dispute resolution mechanisms for investors from both sides.

Beyond tariff and service liberalisation, CECA went further: it removed double taxation, streamlined customs procedures, and fostered deeper economic cooperation in education, science and technology, intellectual property, aviation, and digital trade. Though it facilitates entry for certain Indian professionals into Singapore under movement-of-persons provisions, every applicant must still meet Singapore’s Ministry of Manpower criteria (including salary and qualifications)—CECA does not grant unrestricted access to Singapore’s job market. Trade and investment between India and Singapore have grown significantly since CECA’s implementation, highlighting its success in deepening bilateral economic ties.

RCEP (Regional Comprehensive Economic Partnership)

The Regional Comprehensive Economic Partnership (RCEP) is a sweeping trade agreement between the 10 ASEAN nations (including Singapore) and five key partners: China, Japan, South Korea, Australia, and New Zealand. In force for Singapore since 1 January 2022, RCEP covers nearly 30 percent of global GDP and population, creating one of the world’s largest free trade blocs. Singapore was the first country to ratify it, reaffirming its standing as a trade-forward economy.

Under RCEP, approximately 92 percent of goods traded among member countries will eventually become tariff-free, either immediately or phased over time, significantly lowering costs for Singaporean exporters in sectors such as electronics, chemicals, plastics, and food products.

A key innovation is the unified rules of origin, which allow manufacturers to combine inputs from multiple RCEP countries (with a 40% regional value content threshold) and qualify for preferential duties across the bloc using a single certification process—a concept known as regional cumulation.

In addition, RCEP enhances market access for services, digital trade, and investment. Singaporean service firms—especially in finance, logistics, IT, and professional services—benefit from a negative-list approach, guaranteeing broader and more automatic liberalization compared to previous ASEAN-plus-one FTAs. The agreement also introduces trade-friendly rules around e-commerce, intellectual property, competition policy, and government procurement, as well as faster customs processing (e.g. express shipments cleared within six hours), which together bolster Singapore’s position as a regional hub for business and logistics.

China-Singapore Free Trade Agreement (CSFTA)

Under the CSFTA agreement, investors from both countries receive a ‘high-level’ of investment protection through the application of a ‘national treatment’ and the ‘most favored nation treatment status’ (MFN) for businesses.

This means businesses from either country are not treated less favorably than their investors or investors from a third country with respect to operations, the management or other aspects related to their investments.

The GCC-Singapore Free Trade Agreement

Under the Gulf Cooperation Council and Singapore Free Trade Agreement (GSFTA), GCC countries and Singapore enjoy duty-free access to each other’s markets as well as reduced or eliminated tariffs on a large variety of goods and services.

The FTA also offers increasing opportunities for businesses in the GCC to expand into ASEAN, a fast-growing economic bloc that is predicted to have the world’s fourth-largest GDP by 2030.

The UK-Singapore Free Trade Agreement

The UKSFTA mirrors the FTA Singapore signed with the EU, providing preferential tariffs and a reduction of non-tariff barriers in key sectors, such as electronics and pharmaceuticals.

The UK also grants Singapore enhanced access to bid for more UK government projects at the city and municipal level.

EU-Singapore Free Trade Agreement (EUSFTA)

The EU reduced tariffs to 0 within 5 years after the EUSFTA coming in force in 2019– cutting 75 percent of the tariff lines to 0 percent and the remaining tariff lines within three to five more years. On the Singaporean side, more than 99 percent of all goods from the EU are already allowed duty-free access.

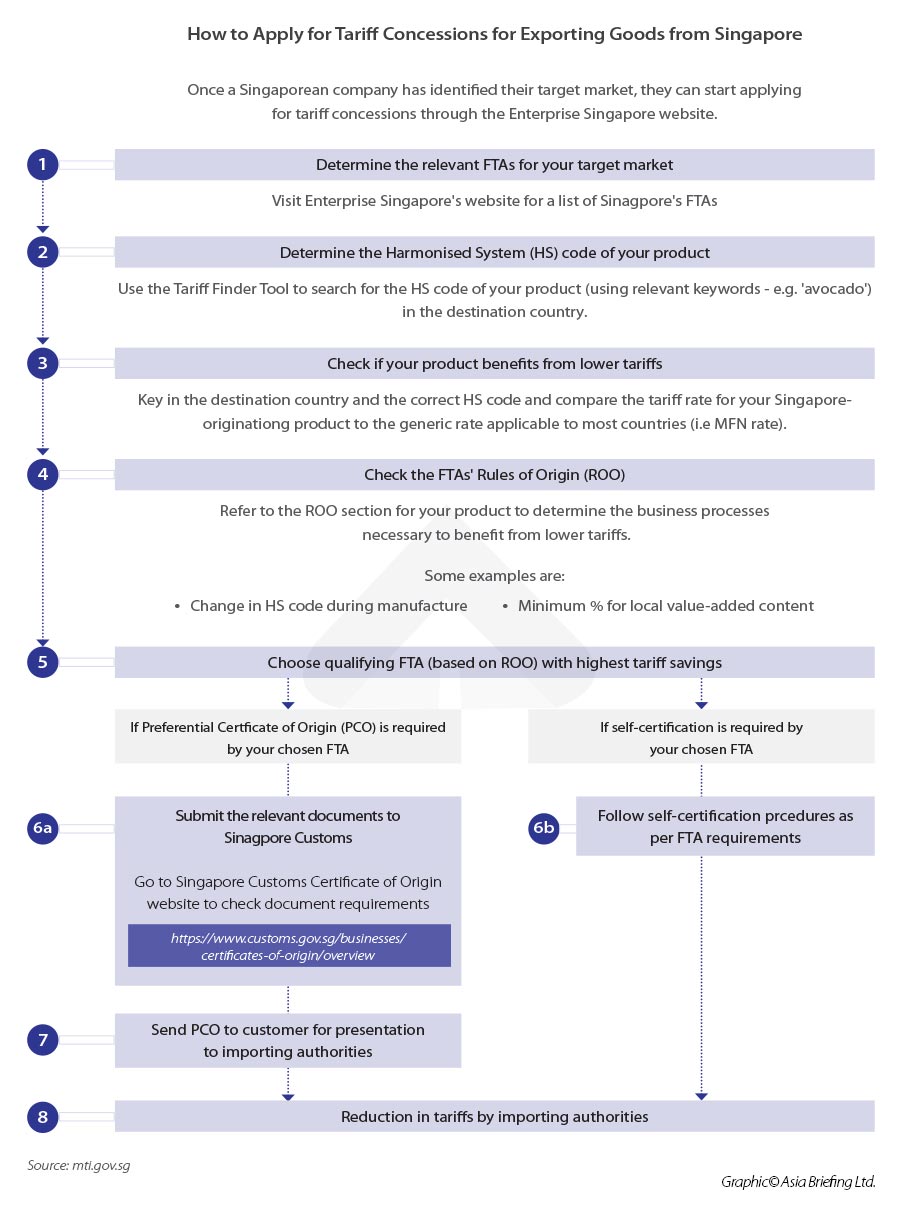

How to apply for FTA tariff concessions

Once a Singaporean company has identified its target market, it can start applying for tariff concessions through the Enterprise Singapore website.

Singapore’s DTA network

Singapore has one of the world’s most extensive double tax agreement (DTA) networks, attracting international businesses from a multitude of conventional and nuanced industries. DTAs eliminate instances of double taxation from cross-border activities, such as trade, knowledge sharing, as well as investments between two countries.

Singapore has signed around 100 DTAs with various countries and the full list can be found on the website of the Inland Revenue Authority of Singapore, or IRAS, the main tax authority in the country. Foreign investors should seek the help of registered tax advisors to better understand how they can benefit from Singapore’s vast DTA network.

These DTAs also include treaties with ASEAN’s 10 member states – Brunei, Cambodia, Indonesia, Laos, Malaysia, Myanmar, Philippines, Singapore, Thailand, and Vietnam – providing businesses with a greater competitive edge when entering this market.