The Cost of Business in Thailand Compared With China

By Chris Devonshire-Ellis

By Chris Devonshire-Ellis

Partner, Dezan Shira & Associates

Part Eight in our series comparing ASEAN nation business costs with China

Thailand is an ASEAN Tiger, and one of the wealthiest countries in South-East Asia. With a population of some 67 million and GDP of USD387 billion, the country also has one of the highest per capita incomes in Asia at USD14,390 per annum. At this moment the country is ruled by the military who have ensured recent upheavals remain in the past and that the country retains its inherent sense of calm. Although such situations worry Western markets, Thailand is in fact no stranger to coups, there having been eleven in the past eighty years. None of this seemingly volatile behavior, either historically or currently has ever impacted in a major way on the countries ability to deliver.

Bilateral trade with China has largely been unaffected, although there was a slight dip of just over 2% in total volume in 2014 as compared to the previous year. Overall however, the trend has been upwards, and especially since China signed a free trade agreement with ASEAN in 2010. That followed the two nations signing an agricultural products free trade agreement in 2003. Since that time bilateral trade has boomed, and signs are this will continue. From 1999, when bilateral trade was USD4.2billion, volume has increased to USD64 billion in 2014.

![]() RELATED: Dezan Shira & Associates’ Pre-Investment and Entry Strategy Advisory

RELATED: Dezan Shira & Associates’ Pre-Investment and Entry Strategy Advisory

Thailand benefits from being one of the Asian countries within the so-called “Bamboo Network” – the overseas Chinese diaspora of businesses operating throughout Southeast Asia that share common family and cultural ties.

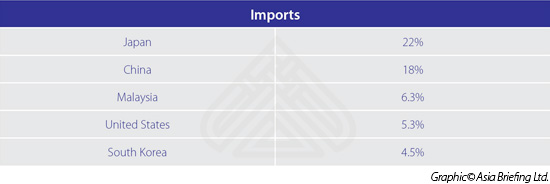

Thailand enjoys good trade relations with the following countries:

The top five products exported by Thailand are computers (8.8%), rubber (4.2%), delivery trucks (3.5%), refined petroleum (3.3%), and gold (3.0%). The top five products imported by Thailand are gold (5.6%), crude petroleum (4.5%), vehicle parts (4.2%), petroleum gas (2.6%), and computers (2.3%).

![]() RELATED: The Cost of Business in Malaysia Compared With China

RELATED: The Cost of Business in Malaysia Compared With China

The import-export status of gold, petroleum and computers illustrate Thailand’s jewelry processing and emerging petrochemical refining and IT development industries. The country has also been active to signing bilateral Double Tax Treaty agreements with several important countries worldwide, including China, India, the United States and many other Asian nations, and these can be immensely useful when looking to increase profitability in trade and investment. These may be viewed here.

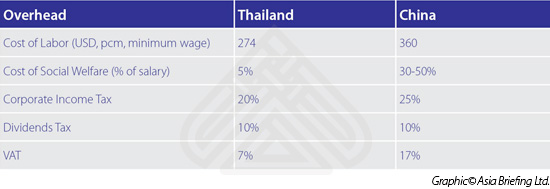

We can compare Thailand and China in terms of average operational costs as follows:

![]() RELATED: Wage Comparisons & Trade Flows Between China, ASEAN and India

RELATED: Wage Comparisons & Trade Flows Between China, ASEAN and India

The Thailand Foreign Investment Law

Generally, foreigners are prohibited from the majority of business activities in Thailand. The definition of a foreigner under Thai law includes the following:

- Natural person not of Thai nationality

- Juristic person not registered in Thailand

- Juristic person registered in Thailand having half or more of the juristic person’s capital shares held by a non-Thai person or entity.

Since most types of business activities are off limits to foreigners, the usual strategy to set up a company in Thailand is to ensure that at least 51 percent of the company’s shares are held by a Thai shareholder – this will make the company a Thai national and will allow the company to operate all business activities like a Thai. The following investment vehicles are available to investors in Thailand:

- Limited Liability Company (LLC)

The most common type of business entity registered in Thailand is a private limited liability company. The registration of the limited liability company formation must be conducted with the Ministry of Commerce, Department of Business Development.

Time line: approximately one to two weeks upon receiving all required information and documents.

- Joint Venture (JV)

A JV with Thai partners is often the most straightforward way for foreign investors to enter the country. There are two main options for the JV structure:

Enter into a JV agreement with a Thai partner to form a new JV Company to operate the business. It is recommended that a Shareholders agreement between the Thai and foreign shareholders be created in order to govern the operation of the business.

- Acquisition of shares in the existing local company.

In this event, a due diligence process would be compulsory to ensure no hidden liability.

Time line: depending on the structure, approximately two months.

![]() RELATED: The Cost of Business in the Philippines Compared With China

RELATED: The Cost of Business in the Philippines Compared With China

Wholly owned

Treaty of Amity (only available to American Nationals):

- Allows a U.S. national to own the majority of shares in a company.

- In order for a U.S. national to hold 100 percent of the shares, the company must receive Treaty of Amity approval and a Foreign Business License.

- The U.S. entity must be fully owned by American nationals. Any foreign element will disqualify this privilege under the Treaty of Amity.

Time line: approximately one to two months upon receiving all required information and documents.

Board of Investment Approval (BOI):

- Allows foreigners to own the majority of shares in a company in Thailand by seeking the Board of Investment’s approval.

- If the company is approved, it may be entitled to tax and non-tax privileges, which would be provided to the company on a case-by-case basis (the approval would depend on the type of your business, the 5-10 years business plan, the contribution which the company would bring into the Kingdom, etc.).

- A Foreign Business License is also required to allow the company to operate in Thailand as a foreign owned entity.

Timeline: approximately two to three months.

- Representative Office

To set up an RO in Thailand, the following must be completed:

- Apply for establishment of the RO with the Ministry of Commerce’s Department of Business Development.

- Apply for a license to operate business activities as an RO (the RO of a foreign company is also considered to be a foreign company, and is restricted to operating various activities unless it has obtained a Permit under the NEC Announcement No. 281).

- The business activities that an RO can carry out are limited to at least one of the following five activities:

- Source for goods or services in Thailand for the head office.

- Checking and controlling the quality and quantity of goods purchased or hired to manufacture in Thailand by the head office.

- Giving advice concerning goods of the head office sold to agents or consumers.

- Propagation of information concerning new goods or services of the head office.

- Report on business trends in Thailand to the head office.

The general characteristics of an RO are as follows:

- Non-revenue generating activities.

- No authority to accept purchasing orders or to make offers for selling, or to negotiate or carry on business with persons or juristic persons in the country in which it is originally registered.

- All expenditures incurred by the RO must be borne by the head office.

- Not subject to corporate income tax, however deposit interest on remitted funds from the head office are liable to tax.

Time line: approximately three months

![]() RELATED: Dezan Shira & Associates’ Tax Compliance Services

RELATED: Dezan Shira & Associates’ Tax Compliance Services

Additional requirements

Once the company has registered with the Ministry of Commerce, a corporate bank account can be opened. Most of the banks in Thailand require the physical presence of the signatories as part of their due diligence procedure in opening a bank account. If the signatory is a foreigner, a work permit of such foreigner is required to open a corporate bank account.

Thailand employs its own language and script in official documents and the majority of documentation must be in Thai and translated into the pertinent language.

Professional Resources

The Thai government has put out for tender the development of 12 development zones across the country, in addition to a policy of developing processing zones on its borders with Malaysia and Myanmar, and adding to joint ventures with China in Nanning and Kunming to process and repackage South-East Asian goods for the Chinese market. The new industrial zones are meant to prepare the country for the ASEAN Economic Community in 2015 and increased the trade flows with Cambodia, Laos and Myanmar that are expected to result.

![]() RELATED: The Cost of Business in Cambodia Compared With China

RELATED: The Cost of Business in Cambodia Compared With China

Thailand is well served in Bangkok and the main tourist resorts when it comes to banking and finance, however like much of Asia once one steps out of the capital it can get very local very fast. This can cause problems getting investment financing into the right places. However there are numerous Asian and International banks operating representative offices and some limited activity branches in the country. A full list can be seen here.

Summary

Thailand remains a significant player when it comes to an ASEAN strategy for foreign investors. Volkswagen have taken steps to manufacture cars there, as it is perceived the Thai middle and lower classes will begin to trade up from 2-wheeled motorbikes to autos. Auto manufacturing, including all aspects through to component parts is very much a government driven plan, with incentives on offer to investors in this field. Infrastructure, especially in rail, is also being upgraded, and when completed will ensure Thailand is well connected to all other ASEAN markets. As a central ASEAN hub and with a strong and relatively well educated and organized workforce, despite some chaotic foreign investment laws, Thailand represents a good case as a destination for investors looking to reach out into ASEAN, and via the ASEAN free trade agreements, into China and India as well.

|

Links to the other articles in this series are as follows: |

||||||||||

|

Chris Devonshire-Ellis is the Founding Partner and Chairman of Dezan Shira & Associates. The practice has been operational in Asia since 1992 and assists foreign investors establish and maintain their operations throughout China, ASEAN and India. The firm possesses 28 Asian offices with a staff of 800, and has an Alliance office in Bangkok. Please contact the firm at thailand@dezshira.com or visit www.dezshira.com. Please also look out for our Thailand Briefing Group on LinkedIn for additional updates. Stay up to date with the latest business and investment trends in Asia by subscribing to our complimentary update service featuring news, commentary and regulatory insight. |

E-Commerce in Vietnam: Trends, Tax Policies & Regulatory Framework

E-Commerce in Vietnam: Trends, Tax Policies & Regulatory Framework

In this issue of Vietnam Briefing Magazine, we provide readers with a complete understanding of Vietnam’s e-commerce industry. We begin by highlighting existing trends in the market, paying special attention to scope for foreign investment. We look at means for online sellers to receive payment in Vietnam, examine the industry’s tax and regulatory framework, and discuss how a foreign retailer can actually establish an online company in Vietnam.

The 2015 Asia Tax Comparator

In this issue, we compare and contrast the most relevant tax laws applicable for businesses with a presence in Asia. We analyze the different tax rates of 13 jurisdictions in the region, including India, China, Hong Kong, and the 10 member states of ASEAN. We also take a look at some of the most important compliance issues that businesses should be aware of, and conclude by discussing some of the most important tax and finance concerns companies will face when entering Asia.

The Asia Sourcing Guide 2015

The Asia Sourcing Guide 2015

In this issue of Asia Briefing, we explain how and why the Asian sourcing market is changing, compare wage overheads, and look at where certain types of products are being manufactured and exported. We discuss the impact of ASEAN’s Free Trade Agreements with China and India, and highlight the options available for establishing a sourcing and quality control model in three locations: Vietnam, China, and India. Finally, we examine the differences in quality control in each of these markets.

- Previous Article ASEAN’s 2015 AEC Compliance Deadline – What It Actually Means

- Next Article State by State: ASEAN and Texas Trade