The Cost of Business in Laos Compared With China

By Chris Devonshire-Ellis

By Chris Devonshire-Ellis

Partner, Dezan Shira & Associates

Part Three in our series comparing ASEAN nation business costs with China

The smallest member of ASEAN, Laos is also the organization’s most under-developed nation and has the lowest average income. Largely mountainous and with a predominantly agricultural-based economy, it nonetheless shares strategic borders with China and Thailand and is culturally close to Southwest China. With improving road and rail infrastructure, the country is now attracting some investment from Chinese businesses looking to reduce manufacturing costs and re-export back to China.

China is also funding hydroelectric power programs in Laos. The Middle Kingdom and Thailand are the country’s top two trade partners, accounting for close to 70 percent of all Laos’ trade. Bilateral trade between Laos and China is some USD3 billion, and has doubled in the past two years. China counts on Laos politically to support its interests within ASEAN, and rewards the country with investment. The Chinese businesses that have invested are generally either large SOEs that are involved in infrastructure projects, or small firms that establish trading and light manufacturing businesses, mostly for export to Yunnan Province.

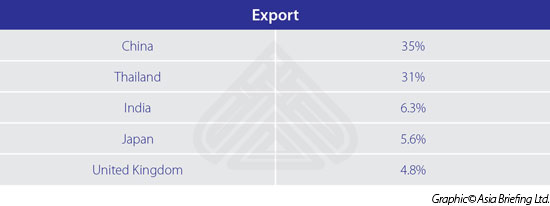

Elsewhere, Laos enjoys good trade relations with the following countries:

In terms of trade, Laos’ top five export commodities are Refined Copper (29%), Copper Ore (21%), Rough Wood (6.2%), Non-Knit Men’s Suits (4.2%), and Sawn Wood (3.8%). Its top imports are Cars (4.4%), Planes, Helicopters, and/or Spacecraft (4.0%), Delivery Trucks (3.8%), Refined Petroleum (2.8%), and Iron Structures (2.4%).

Laos is starting to develop the concept of Double Tax Treaties and has signed off agreements with China, Malaysia and Thailand. Other agreements, however, seem a long way off. The country is also expected to come into ASEAN AEC compliance at the end of this year, although doubts have been expressed in certain quarters if Laos will meet this deadline.

![]() RELATED: The Cost of Business in Vietnam Compared With China

RELATED: The Cost of Business in Vietnam Compared With China

Summary

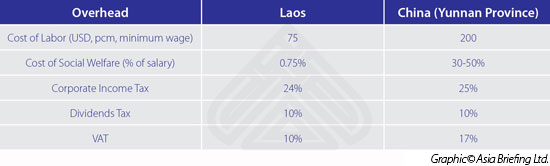

We can compare Laos and China in terms of average operational costs as follows:

RELATED: Wage Comparison & Trade Flows in Asia

RELATED: Wage Comparison & Trade Flows in Asia

Laos Foreign Investment Law

According to Article 8 of the Investment Promotion Law, there are three types of investment vehicles that foreign investors can choose from. These are as follows:

Wholly foreign-owned

A foreign investment registered by one or more foreign investors without the participation of a domestic partner. It can be a newly registered company or a representative office.

Joint Venture

A foreign investment jointly owned by one or more foreign investors and by one or more domestic Laos investors. Investors are required to set up a JV if they want to participate in certain industries, such as wood production.

Business by contract

Foreign companies are able to sign a contract or agreement with a local partner(s) in order to obtain products or goods from Laos or vice versa.

Additional requirements

Investors need to obtain their business license from one of three government agencies depending on the type of business they wish to engage in. The categories are as follows:

General Business

Requires a Business License from the Ministry of Industry and Commerce.

Concession Business

Requires a Concession License from the Ministry of Planning and Investment.

Activities for development of special economic zones and specific economic zones

Requires a License from the Secretariat to the National Committee for Special Economic Zones at the Government Office.

Professional Resources

![]() RELATED: The Cost of Business in Myanmar Compared With China

RELATED: The Cost of Business in Myanmar Compared With China

Laos is in the process of establishing a number of Special Economic Zones (SEZ) that offer tax incentives and negate the need to pay VAT on imports into the zone. These are useful structures when considering an export manufacturing base in the country, as they can attract tax incentives as well as alleviate the need to budget for VAT cashflow requirements. At present there are operating zones close to the borders with China and Thailand.

Laos is landlocked – the only South-East nation to be so, and relies heavily on road, rail and water transport to transport goods. Logistics therefore remains an issue and requires attention to make a viable operational business case. However, Laos is part of the proposed ASEAN rail link that will also connect via branches through to both India in the West, and China in the North. Construction of some of these routes is already underway, and will open up Laos to opportunities for further development.

To date, the Laos currency is not fully convertible, which means attention needs to be paid to budget issues. It can be easy to send money into the country, but harder to extract any unused portions. However, there are Asian regional banks operating in the Laotian market. A full list can be seen here.

![]() RELATED: The Cost of Business in Cambodia Compared With China

RELATED: The Cost of Business in Cambodia Compared With China

Summary

About 75 percent of all Laos’ trade is taken up with China and Thailand. This means Laos is an important nation to consider when looking at business opportunities that embrace both Chinese and Thai combinations. In addition to this, it can be expected that opportunities to increase trade with Myanmar and Vietnam exist, and it is worth noting that export trade with India is also on the increase. Laos may be small, but for businesses with the right mix it could be an interesting trade hub.

|

Links to the other articles in this series are as follows: |

||||||||||

|

Chris Devonshire-Ellis is the Founding Partner of Dezan Shira & Associates – a specialist foreign direct investment practice providing corporate establishment, business advisory, tax advisory and compliance, accounting, payroll, due diligence and financial review services to multinationals investing in emerging Asia. Since its establishment in 1992, the firm has grown into one of Asia’s most versatile full-service consultancies with operational offices across China, Hong Kong, India, Singapore and Vietnam, in addition to alliances in Indonesia, Malaysia, Philippines and Thailand, as well as liaison offices in Italy, Germany and the United States. For further information, please email asia@dezshira.com or visit www.dezshira.com. Chris can be followed on Twitter at @CDE_Asia. Stay up to date with the latest business and investment trends in Asia by subscribing to our complimentary update service featuring news, commentary and regulatory insight. |

Tax, Accounting, and Audit in Vietnam 2014-2015

Tax, Accounting, and Audit in Vietnam 2014-2015

The first edition of Tax, Accounting, and Audit in Vietnam, published in 2014, offers a comprehensive overview of the major taxes foreign investors are likely to encounter when establishing or operating a business in Vietnam, as well as other tax-relevant obligations. This concise, detailed, yet pragmatic guide is ideal for CFOs, compliance officers and heads of accounting who need to be able to navigate the complex tax and accounting landscape in Vietnam in order to effectively manage and strategically plan their Vietnam operations.

An Introduction to Tax Treaties Throughout Asia

An Introduction to Tax Treaties Throughout Asia

In this issue of Asia Briefing Magazine, we take a look at the various types of trade and tax treaties that exist between Asian nations. These include bilateral investment treaties, double tax treaties and free trade agreements – all of which directly affect businesses operating in Asia.

The 2015 Asia Tax Comparator

In this issue, we compare and contrast the most relevant tax laws applicable for businesses with a presence in Asia. We analyze the different tax rates of 13 jurisdictions in the region, including India, China, Hong Kong, and the 10 member states of ASEAN. We also take a look at some of the most important compliance issues that businesses should be aware of, and conclude by discussing some of the most important tax and finance concerns companies will face when entering Asia.

- Previous Article The Cost of Business in Indonesia Compared With China

- Next Article City Spotlight: Investing in Jakarta