The Cost of Business in Vietnam Compared With China

By Chris Devonshire-Ellis

Partner, Dezan Shira & Associates

Part Nine in our series comparing ASEAN nation business costs with China

Vietnam is a country to look out for, especially when it comes to comparisons with China. Right on the border of China’s Guangxi and Yunnan Provinces, and with easy access to the manufacturing hubs of Guangdong Province and wealthy consumer markets of cities such as Hong Kong, Guangzhou and Shenzhen, this Asian Tiger will prove to be highly influential in determining how much of China’s traditional light manufacturing base remains in the south of the country.

With a population of some 90 million and GDP of US$171 billion, the country has been pushing itself forward as a China alternative for some time now. That has been matched with deliberately assertive investment policies designed to attract foreign investors, and a huge improvement in infrastructure. That’s not to say that China minds that much – it is also keen to dissuade low cost manufacturers from continuing their life span in China – which is one reason that a decade ago, Premier Zhu Rongzhi stated Shenzhen’s role was to move away from making Christmas trees and become an IT hub. It is Vietnam that is set to inherit the lower end of light and medium manufacturing from China.

To make sure that happens, and to set Vietnam en route to being one of the collective manufacturers of the world, the country has taken an impressive stance to attracting foreign investors. It is about to come into AEC compliance at the year end, meaning that it will come into line with reducing all tariffs on goods imported from other ASEAN nations, and will also come into line with the ASEAN-China Free Trade Agreement. That FTA reduces tariffs on 97% of all ASEAN exported products entering China and will result in 2016 in a huge increase in Vietnam-China trade. It also means that just as China is becoming expensive to manufacture, Vietnam will step into the breach. Manufacturing products in Vietnam destined purely for the China market is already becoming a trend. From January 2016 it will become a flood.

![]() RELATED: Dezan Shira & Associates’ Pre-Investment and Entry Strategy Advisory

RELATED: Dezan Shira & Associates’ Pre-Investment and Entry Strategy Advisory

Vietnam also has its eyes on China’s manufacturing industry, and is looking to woo it from its traditional base in Guangdong. To do that, it has reduced its corporate income tax rate to 22% with a further reduction to 20% expected in 2016 – a full 5% lower than China.

Bilateral trade with China has boomed, and China is already Vietnam’s largest trade partner. Bilateral trade is expected to reach US$60 billion in 2015, although the process has not always been smooth. Vietnam occasionally sends back large quantities of foodstuffs and sometimes imposes bans on Chinese products entering the market due to health concerns. Politically also, the two nations have not always seen eye to eye. A brief maritime skirmish in the late 1980’s over disputed islands resulted in Vietnamese deaths, and tensions over such issues retain the potential for violence. Chinese owned factories were ransacked after one such incident in 2014. Vietnam may have its neighbor has its largest trade partner, but it does look to balance that with attracting a healthy amount of non-Chinese investment and trade as well, including from the United States and the EU.

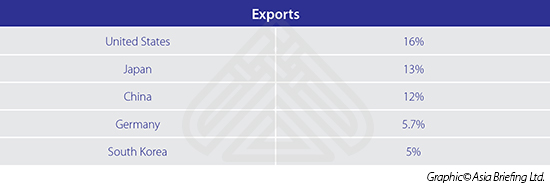

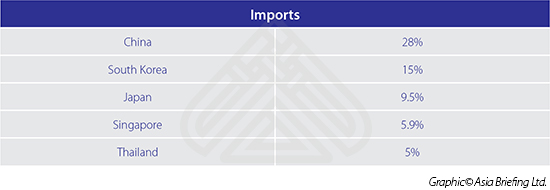

Vietnam enjoys good trade relations with the following countries:

Vietnam’s top five exports are broadcasting equipment (10%), crude petroleum (7.4%), leather footwear (4.0%), computers (3.4%), and coffee (3.1%). Its top five imports are refined petroleum (8.8%), telephones (3.8%), integrated circuits (3.3%), hot-rolled iron (2.0%) and light rubberized knitted fabric (1.7%).

In agriculture, Vietnam is a major exporter of Coconuts, Brazil Nuts, Cashews, and Pepper. In terms of exports, Vietnam has already poached a lot of what was a Guangdong based, Taiwanese series of investments in the shoe making industry, and this shows now in its footwear exports. An emerging IT sector is also finishing off computer parts and accessories, as can be noted by the importation of integrated circuits and exports of broadcasting equipment and computers. The country also has a developing petrochemical industry – the offshore source of some of the maritime disputes with China, who also wants them.

Vietnam has also been active to signing bilateral Double Tax Agreements with several important countries worldwide, including China, India, and many other Asian nations, in addition to several within Europe and elsewhere. These can be immensely useful when looking to increase profitability in trade and investment, and may be viewed here.

We can compare Vietnam and China in terms of average operational costs as follows:

![]() RELATED: Wage Comparisons & Trade Flows Between China, ASEAN and India

RELATED: Wage Comparisons & Trade Flows Between China, ASEAN and India

The Shifting Production from China to Vietnam Statistic

Dezan Shira & Associates clients in Vietnam, when asked to justify shifting of operations from China to Vietnam, typically quote a reference that if they can get Vietnamese production up to 70% of that achievable in China, it usually makes good economic sense to relocate.

Vietnamese Foreign Investment Structures

a. Limited Liability Companies

100 percent FOEs and JVEs can be established as limited liability companies (LLC).

In an LLC, members are only liable for the debts of the partnership to the extent of

the capital contribution they have poured into the company.

There is usually no minimum capital requirement for foreign investors that intend

to establish an LLC in Vietnam, although authorities will expect the investor to

commit a reasonable amount of charter capital according to the scale and business

scope of the project.

An LLC can consist of a single member or multiple members, but the total number

of members cannot exceed 50. Investors can be corporations or individuals. An

LLC cannot issue shares

b. Joint-stock Companies

FOEs and JVEs can also be established as joint-stock companies (JSC). A JSC can

issue securities and bonds, so investors will often choose this form if they plan to

go public in the future.

The JSC’s charter capital is composed of shares belonging to the founding

shareholders in proportion to the capital they have contributed. There is no

minimum requirement for the capital contributions of the foreign investors.

![]() RELATED: The Cost of Business in the Philippines Compared With China

RELATED: The Cost of Business in the Philippines Compared With China

A JSC is required to have at least three shareholders. There is no limitation on the

maximum number of shareholders, nor on their nature – they can be individuals

or institutions, Vietnamese or foreigners.

c. Partnership Companies

A partnership company is a legal entity established by at least two individuals who

are members of the partnership and co-owners of the enterprise. They are the

General Partners and are liable for all obligations of the partnership without limit.

In addition, a partnership company can consist of limited liability members

(individuals or organizations) who contribute only part of the capital and have

limited liability and rights in the operation of the company.

d. Representative Offices

In contrast to JV and 100 percent FOEs, a representative office (RO) is not a legal

entity and is forbidden from conducting any revenue-generating activities. Rather,

ROs are permitted to conduct market research, serve as a liaison with an overseas

parent company and/or serve other supporting roles such as ensuring quality

control, acting as a product showroom and helping to facilitate the execution of

the contracts of the parent company.

ROs are not subject to tax in Vietnam. Unlike in certain other Asian countries,

ROs are permitted to hire staff directly.

e. Branch Offices

A branch office is the subsidiary of a parent company and does not constitute a

separate legal entity according to Vietnamese law. Unlike the representative office, a

branch office is entitled to conduct business activities in Vietnam within the parent

company’s business scope.

To set up a branch, a parent company must have conducted business in its home

country for at least five years.

f. Other Investment Options

Other investment options include a number of business contract forms such as

BCCs, BOTs, BTOs, and BTs.

A business cooperation contract (BCC) is typically signed between a foreign investor

and a local company or the government of Vietnam with the objective of jointly

conducting business operations in Vietnam. BCCs are based on sharing allocation

of responsibilities, as well as sharing profits or losses without creating or forming

a legal entity in Vietnam.

![]() RELATED: The Cost of Business in Cambodia Compared With China

RELATED: The Cost of Business in Cambodia Compared With China

Build-operate-transfer contracts (BOT ), build-transfer-operate contracts (BTO) and

build-transfer contracts (BT) are specific projects carried out by foreign investors and

an authorized government agency. These additional investment vehicles have been

introduced in Vietnam to entice international capital into the infrastructure sector.

Business scopes can range from traffic, electricity, production and business, water

supply or drainage, waste treatment and other conditional or restricted sectors as

stipulated by the Prime Minister.

The difference between these contract types is at what point the title of the project

is transferred to the government, namely after the investor operates the project,

before the investor operates the project or immediately following completion (in

which case the investor does not operate the project and is compensated for capital

investment in other ways).

Vietnam employs its own language and script in official documents and the majority of documentation must be in Vietnamese and translated into the pertinent language.

Professional Resources

The Vietnamese government has built numerous development zones across the country, mainly along its long eastern coast, in addition to a policy of developing processing zones on its borders with China and Cambodia. The largest of these are currently centered around Ho Chi Minh City to the south, due to its proximity of well established sea port facilities. Zones close to the border with China repackage South-East Asian goods for the Chinese market. The new industrial zones are meant to prepare the country for the ASEAN Economic Community in 2015 and increase the trade flows via existing rail links from ASEAN nations as far away as Indonesia with Singapore, Thailand, and Laos all being viable routes en route to China.

![]() RELATED: The Cost of Business in Thailand Compared With China

RELATED: The Cost of Business in Thailand Compared With China

Vietnam is well served in Hanoi and Ho Chi Minh City and the main tourist resorts when it comes to banking and finance, however like much of Asia once one steps out of these areas it can get very local very fast. This can cause problems getting investment financing into the right places. However there are numerous Asian and International banks operating representative offices and some limited activity branches in the country. A full list can be seen here.

Summary

Vietnam is fast becoming a significant player when it comes to an ASEAN strategy for foreign investors. Part of this is the nations demographic dividend, which sees Vietnam today in possession of a large, business-friendly workforce. Vietnam has also taken a leaf directly out of China’s book in terms of its FDI strategy and has been canny in providing attractive tax breaks and incentives for foreign investors much as China did 25 years ago.

Infrastructure, especially in rail links both through to China and down through ASEAN, are also being upgraded, and when completed will ensure Vietnam is strategically placed as a repacking and consolidation hub for China-ASEAN two way trade. Vietnam represents a good study as a potential investment destination for investors looking to reach out into both China and ASEAN, as well as an ability to offer China-based businesses a culturally similar and less expensive manufacturing solution.

|

Links to the other articles in this series are as follows: |

||||||||||

|

Chris Devonshire-Ellis is the Founding Partner and Chairman of Dezan Shira & Associates. The practice has been operational in Asia since 1992 and assists foreign investors establish and maintain their operations throughout China, ASEAN and India. The firm possesses 28 Asian offices with a staff of 800, and has offices in Hanoi and Ho Chi Minh City. Please contact the firm at vietnam@dezshira.com or visit https://www.dezshira.com. Please also look out for our Vietnam Briefing Group on Linked In for additional updates. Chris can be followed on Twitter at @CDE_Asia. |

An Introduction to Doing Business in Vietnam 2014 (Second Edition)

An Introduction to Doing Business in Vietnam 2014 (Second Edition)

An Introduction to Doing Business in Vietnam 2014 (Second Edition) provides readers with an overview of the fundamentals of investing and conducting business in Vietnam. Compiled by Dezan Shira & Associates, a specialist foreign direct investment practice, this guide explains the basics of company establishment, annual compliance, taxation, human resources, payroll, and social insurance in the country.

Tax, Accounting, and Audit in Vietnam 2014-2015

Tax, Accounting, and Audit in Vietnam 2014-2015

The first edition of Tax, Accounting, and Audit in Vietnam, published in 2014, offers a comprehensive overview of the major taxes foreign investors are likely to encounter when establishing or operating a business in Vietnam, as well as other tax-relevant obligations. This concise, detailed, yet pragmatic guide is ideal for CFOs, compliance officers and heads of accounting who need to be able to navigate the complex tax and accounting landscape in Vietnam in order to effectively manage and strategically plan their Vietnam operations.

Import and Export: A Guide to Trade in Vietnam

In this issue of Vietnam Briefing Magazine, we provide you with a clear understanding of the current business trends related to trade in Vietnam, as well as explaining how to set up your trading business in the country. We also attempt to give perspective on what will be Vietnam’s place in the Association of Southeast Asian Nations (ASEAN) in 2015, and look at some of the country’s key import and export regulations.

- Previous Article State by State: ASEAN and Texas Trade

- Next Article China-ASEAN Cost of Business Comparisons – Executive Summary