The Cost of Business in Indonesia Compared With China

By Chris Devonshire-Ellis

By Chris Devonshire-Ellis

Partner, Dezan Shira & Associates

Part Two in our series comparing ASEAN nation business costs with China

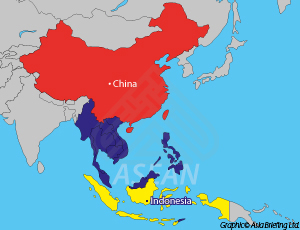

Indonesia is a major player in ASEAN and has by far its largest population – some 240 million people. It is a expected to become a trillion dollar economy in its own right later this year, and, with a huge landmass containing important mineral reserves, is of special economic significance to the economies of China, ASEAN, and Australiasia in particular.

Bilateral trade between Indonesia and China has tripled in the past five years to some US$70 billion in 2014, while Chinese companies invested around US$2 billion in FDI in 2013 – mainly establishing trading and light manufacturing businesses. This mass expansion of trade is down to the ASEAN Free Trade Agreement with China, and is set to continue.

While it was Chinese businesses who initially took advantage of the FTA, local Indonesian companies are now adapting and are boosting their own sales into the Chinese domestic market. The Chinese businesses that have invested in Indonesia are mainly looking for locations with lower production costs that will allow them to then export Indonesian manufactured component parts and goods across ASEAN as well as back to China.

Elsewhere, Indonesia enjoys good trade relations with the following countries:

Indonesia also possesses a large number of Double Tax Treaties, including with China, that can assist foreign companies reduce their overall tax burden in the country. These treaties also apply to many other Asian nations, European nations, and the United States. These agreements assist in making trade with the country a strongly viable commodity.

Indonesia also possesses a large number of Double Tax Treaties, including with China, that can assist foreign companies reduce their overall tax burden in the country. These treaties also apply to many other Asian nations, European nations, and the United States. These agreements assist in making trade with the country a strongly viable commodity.

![]() RELATED: The Cost of Business in the Philippines Compared With China

RELATED: The Cost of Business in the Philippines Compared With China

We can compare Indonesia and China in terms of average operational costs as follows:

![]() RELATED: Wage Comparisons & Trade Flows in Asia

RELATED: Wage Comparisons & Trade Flows in Asia

Indonesian Foreign Investment Law

Indonesia permits the following legal structures to be operated by foreign investors in the country:

- Representative Office

- A foreign company or a group of foreign companies may open a foreign RO in Indonesia in order to manage its/their interests, or to prepare for the establishment and development of its/their business in the country.

- Led by one or more Indonesian or foreign citizens who are considered to be the RO executive, the appointment of which is based on a letter of appointment from the relevant foreign company or group of foreign companies.

- A KPPA license must be obtained by submitting Form VI-A to the Indonesian Investment Coordinating Board BKPM. The RO must then obtain its Tax Identification Number (NPWP) and its Registered Statement Letter.

- The RO’s activities are limited to the following roles:

- Supervisor

- Intermediary

- Coordinator

- Manager of the foreign company group’s interests

- An RO cannot conduct the following activities:

- Participate in managing the foreign company, its subsidiary, or its branches in Indonesia.

- Generate revenues in Indonesia.

- Engage in any agreement or sale and/or purchase transaction of goods and services with an Indonesian company or Indonesian nationals.

- There are no minimum financial investment requirements to set up an RO.

- Limited Liability Company (Perseroan Terbatas / PT)

- The most common form of legal entity used for foreign investment into Indonesia.

- Shareholders have limited liability.

- A PT company formed with a foreign shareholder in accordance with the requirements of the Foreign Investment Law is referred to as a Foreign Capital Investment, or “Penanaman Modal Asing” (PMA), company.

- Can be fully owned by foreign shareholders or exist as a joint venture between local and foreign shareholders. A joint venture PT is also referred to as a PMA company. Any PT with a domestic investment status from the BKPM will be categorized as a Domestic Capital Investment, or “Penanaman Modal Dalam Negeri” (PMDN), company.

- Minimum capital investment requirement of US$100,000.

![]() RELATED: The Cost of Business in Vietnam Compared With China

RELATED: The Cost of Business in Vietnam Compared With China

Additional Requirements

Depending on their business line, a PT company or RO may be also be required to obtain the following licenses:

- Building Management Domicile Certificate

- Certificate of Company Domicile

- Company Registration Certificate (Tanda Daftar Perusahaan)

- Permanent Business Trading License (Surat Izin Usaha Perdagangan) – for PT companies only

Additionally, the business must apply for the Workers Social Security Program and the Workers Health Insurance Program. Businesses with more than 10 employees or with a monthly payroll of at least IDR1 million must register with the Ministry of Manpower.

According to Indonesia’s Company Law, companies are required to prepare annual statutory financial statements in accordance with the Indonesian Financial Accounting Standards. Additionally, companies must submit tax returns on a monthly and annual basis.

Professional Resources

Indonesia possesses a number of Special Economic Zones (SEZ) that offer tax incentives and negate the need to pay VAT on imports into the zone. These are useful structures when considering an export manufacturing base in the country as they can attract tax incentives as well as alleviate the need to budget for VAT cashflow requirements.

The country has port infrastructure along much of its coastline, with the main port located in Tanjong Priok in the north, and Surabaya becoming a key trade centre for Australia. Mooted rail and ferry links directly connecting western Indonesia to the Singapore rail network into the rest of ASEAN and reaching into China are also in the process of being developed.

As always in the emerging ASEAN nations, logistics and infrastructure issues need to be factored into any business modelling. Indonesia is relatively good, but it is still patchy. The capital city of Jakarta, for example, will not have its MTR system in place and operational until 2017.

In terms of overall development, Indonesia appears to be on the right track, and has a highly developed tourism infrastructure in islands such as Bali, with the eastern Indonesian islands also being targets for tourism investment. To date however, the nation has not been attracting as many Chinese tourists as it should – under a million per annum at this point. Casinos have been illegal in Indonesia, although an investment in the island of Bintan, close to Singapore, has been approved. The Government is likely to keep casino developments at arms length due to the nation being a Muslim state.

In terms of export manufacturing, Indonesia’s SEZs are not that well linked to the major ports at this moment, and policy improvements in this regard are required.

A bright point in Indonesia’s manufacturing development, however, has been in the electronics industry – the country has successfully wooed Foxconn from China to manufacture component parts for Apple products, with the facility likely to be in the vicinity of the capital, Jakarta. The company is investing US$1 billion into the plant, and have said they can expect Indonesia to take over from China as the world’s largest manufacturer of electronics products and components.

To date, Indonesia is relatively well served by foreign banks, although it can be difficult to find branches beyond the main commercial hubs. A list of local and foreign banks operating in the country can be found here.

![]() RELATED: The Cost of Business in Myanmar Compared With China

RELATED: The Cost of Business in Myanmar Compared With China

The Australian Connection

The southeast port of Surabaya is developing as a center for Australian invested manufacturing plants, looking at both the ASEAN and Chinese markets and also the South Korea and Japanese export markets. Australia recently signed an FTA with China and South Korea, and has agreements currently under negotiation for upgrades with Japan and India. These are in addition to the Australian domestic market. Component parts manufactured in Indonesia are now finding their way into “made in Australia” products being sold on to higher value markets in the developed world. The cost-competitiveness factor results from the lower Indonesian production overheads. The two countries also share a Comprehensive Economic Partnership Agreement (CEPA), and it can be expected that increasing amounts of Australian component parts will be manufactured in cities such as Surabaya.

Summary

Indonesia’s proximity to China makes it a viable proposition for complimenting existing production facilities in the country, while its overall size of population make it a viable target for its own domestic consumer market. Therefore, the country is suitable for investment not just as an export manufacturing base but as a consumer base in its own right, as well as further afield into ASEAN and Asia. The country retains strong trade links to the developed markets of Japan and South Korea for example, and Australian manufacturers are already making investments into Indonesia to take advantage of this.

Overall, Indonesia holds several strong cards as a destination for foreign investment. Its membership in ASEAN and the free trade agreement with China, its own comprehensive list of Double Tax Treaties, and its geographic position between the mass consumer market of China and the wealth of Australiasia. Indonesia will soon be one of the major global producers that plays a part in the “Asia Workshop of the World” and it offers an array of options for foreign investors to consider how best to use its strategic positioning within negotiated trade deals and advantageous geographic location.

|

Links to the other articles in this series are as follows: |

||||||||||

|

Chris Devonshire-Ellis is the Founding Partner of Dezan Shira & Associates – a specialist foreign direct investment practice providing corporate establishment, business advisory, tax advisory and compliance, accounting, payroll, due diligence and financial review services to multinationals investing in emerging Asia. Since its establishment in 1992, the firm has grown into one of Asia’s most versatile full-service consultancies with operational offices across China, Hong Kong, India, Singapore and Vietnam, in addition to alliances in Indonesia, Malaysia, Philippines and Thailand, as well as liaison offices in Italy, Germany and the United States. For further information, please email asia@dezshira.com or visit www.dezshira.com. Chris can be followed on Twitter at @CDE_Asia. Stay up to date with the latest business and investment trends in Asia by subscribing to our complimentary update service featuring news, commentary and regulatory insight.

|

Tax, Accounting, and Audit in Vietnam 2014-2015

Tax, Accounting, and Audit in Vietnam 2014-2015

The first edition of Tax, Accounting, and Audit in Vietnam, published in 2014, offers a comprehensive overview of the major taxes foreign investors are likely to encounter when establishing or operating a business in Vietnam, as well as other tax-relevant obligations. This concise, detailed, yet pragmatic guide is ideal for CFOs, compliance officers and heads of accounting who need to be able to navigate the complex tax and accounting landscape in Vietnam in order to effectively manage and strategically plan their Vietnam operations.

An Introduction to Tax Treaties Throughout Asia

An Introduction to Tax Treaties Throughout Asia

In this issue of Asia Briefing Magazine, we take a look at the various types of trade and tax treaties that exist between Asian nations. These include bilateral investment treaties, double tax treaties and free trade agreements – all of which directly affect businesses operating in Asia.

The 2015 Asia Tax Comparator

In this issue, we compare and contrast the most relevant tax laws applicable for businesses with a presence in Asia. We analyze the different tax rates of 13 jurisdictions in the region, including India, China, Hong Kong, and the 10 member states of ASEAN. We also take a look at some of the most important compliance issues that businesses should be aware of, and conclude by discussing some of the most important tax and finance concerns companies will face when entering Asia.

- Previous Article The Cost of Business in Cambodia Compared With China

- Next Article The Cost of Business in Laos Compared With China