The Cost of Business in Myanmar Compared With China

By Chris Devonshire-Ellis

Partner, Dezan Shira & Associates

Part Five in our series comparing ASEAN nation business costs with China

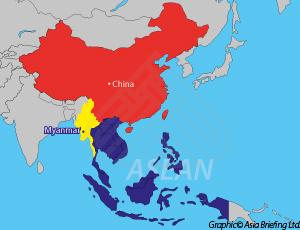

Myanmar remains an enigmatic country – one of the largest and most populated in Asia but also one of its poorest and least understood. It remains a country that has largely stood still for seventy years – hardly any infrastructure of note was developed in the country since the end of WWII. However, its admission into ASEAN, as well as an emerging sense of liberalization is slowly projecting Myanmar back onto the world stage. Infrastructure issues remain problematic however; communications of any sort are practically non-existent outside of the main cities, and even electricity and access to clean water remains awkward. As a result, although the country does attract a great deal of political and romantic imagery that will no doubt stand it in good stead in future years, Myanmar essentially remains a country invested in either by large MNC’s with deep pockets, or entrepreneurial traders and light manufacturers.

![]() RELATED: The Cost of Business in Vietnam Compared With China

RELATED: The Cost of Business in Vietnam Compared With China

Of the MNC’s with deep pockets, these can be split into two camps: resources driven – mainly from China and infrastructure developers – mainly from the West. Pockets of tribal insurgency still exist in Myanmar which can also make access and trade potentially tricky. Nonetheless, if there are ties that bind your commerce to Myanmar, it can be accessed as a market. However, it is not a destination for the fainthearted or inexperienced.

Crucially, Myanmar also acts as a buffer state between China and India. If that can be strategically exploited, then Myanmar could certainly rise to become an Asian Tiger in its own right within the next 25 years. But today, it remains somewhat backwards and with an emphasis on small holding agricultural and aquaculture industries, with raw oil and gas products also being largely exploited for export at the big ticket end. In between, there is very little mid-level commerce.

Myanmar is targeted to come into ASEAN economic union compliance at the end of this year, which will see certain parts of its economy open up to investment and import duties on various products scrapped. However, there is some uncertainty as to whether the country will be able to meet this deadline.

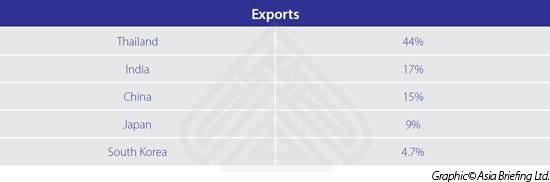

Meanwhile, Myanmar enjoys good trade relations with the following countries:

In terms of trade, the top five products exported by Myanmar are Petroleum Gas (42%), Rough Wood (11%), Dried Legumes (10%), Non-Knit Men’s Coats (2.9%), and Rubber (2.8%). The country’s top five imports are Iron Structures (6.3%), Cars (5.3%), Refined Petroleum (4.6%), Delivery Trucks (4.1%), and Palm Oil (4.0%).

Myanmar is feeling its way around the bilateral Double-Taxation Agreement (DTA) arena and is starting to develop more treaty arrangements with other countries. To date these are limited to specific agreements with its ASEAN partners Malaysia, Singapore, Thailand, and Vietnam, in addition to India and the United Kingdom. These may be viewed here.

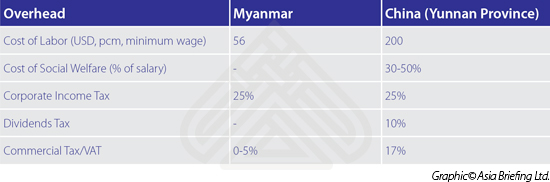

We can compare Myanmar and China in terms of average operational costs as follows:

Myanmar Foreign Investment Law

The following investment vehicles are available to investors in Myanmar:

- 100% Foreign-owned Company

- A limited liability company that is 100 percent owned by the foreign investor. However, there are certain controlled industries where private investment is still not allowed.

- Branch Office

- A branch office is allowed to perform as a manufacturing or a service company.

- Joint Venture

- Set up between one or more foreign investors and local investors. Foreign investors can set up their business either as a limited liability company or as a partnership. There are certain special sectors that require investors to set up a partnership with a Myanmar citizen or company.

- Representative Office (RO)

- An RO can only collaborate with the head office and collect useful data for the company, but is not permitted to act in direct commercial or revenue generating activities.

![]() RELATED: The Cost of Business in Cambodia Compared With China

RELATED: The Cost of Business in Cambodia Compared With China

Additional requirements

Businesses requiring substantial investment, such as manufacturing, construction, or mining, need to register under the Myanmar Foreign Investment Law (MFIL); foreign trade companies and service providers are able to register under the Myanmar Companies Act (MCA). In general, 100 percent foreign owned companies and joint ventures with the Myanmar government can be registered under the MFIL. Businesses registering under the Myanmar Companies Act (MCA) do not have to apply for the Myanmar Investment Commission’s (MIC’s) Permit.

![]() RELATED: Wage Comparisons & Trade Flows Between China, ASEAN and India

RELATED: Wage Comparisons & Trade Flows Between China, ASEAN and India

The minimum share capital requirement varies from case to case depending on the business activities of the investments. In general, the minimum share capital for foreign investors needs to be more than 35 percent.

The law states that for companies registering under the Myanmar Foreign Investment Law (MFIL), the minimum specified capital requirement is US$500,000. However, in reality the minimum share capital is determined on a case-by-case basis by the Myanmar Investment Commission (MIC) – businesses are often required to invest between US$1,000,000 to US$2,000,000.

For companies registering under the Myanmar Companies Act (MCA), the minimum rate tends to be much lower, with the minimum share capital being US$150,000 for a manufacturing company or US$50,000 for a service company.

If a company wishes to engage in import/export activities, it must first obtain an importer/exporter card (EI card). Currently, only companies with operations in the manufacturing and industrial sectors are able to obtain an EI Card. Additionally, an import/export License is required for each importing/exporting activity for each good that is to be imported/exported. The EI License must be issued in advance of shipping the good.

Professional Resources

As mentioned, Myanmar remains undeveloped and its infrastructure is fairly poor. Japan has invested in a significant special economic development zone – Thilwa – just south of Rangoon, and this is expected to provide tax breaks and other incentives. Two other zones are being built, at Dawei and Kyaukpyu, however none are expected to be operational until the end of this year at the earliest.

Myanmar has a very basic banking and financial infrastructure and it can be difficult to transfer capital around or to arrange remittances both in and out of the country. However, there are numerous Asian and International banks operating representative offices and some limited activity branches in the country. A full list can be seen here.

![]() RELATED: The Cost of Business in the Philippines Compared With China

RELATED: The Cost of Business in the Philippines Compared With China

Summary

Myanmar, although enigmatic, remains largely the preserve of MNC’s or rock and roll traders, although some light manufacturing capacity is leeching in from China, Singapore, and Thailand. Issues to be resolved are the ASEAN compliance at the end of 2015, and the timely opening of the proposed development zones. More government liberalization is still required on foreign investment and trading laws and certainly with infrastructure. Nonetheless, experienced investors with an eye on China, India, and ASEAN may well be able to make a business case for Myanmar given its geographical location and currently low overheads. Local knowledge and assistance in this country are key, and while business opportunities in the country will certainly not be dull, they could also – for those early enough to break into the market – offer enough potential to later develop into significant businesses.

|

Links to the other articles in this series are as follows: |

||||||||||

|

Chris Devonshire-Ellis is the Founding Partner of Dezan Shira & Associates. The practice has been operational in Asia since 1992 and assists foreign investors establish and maintain their operations throughout China, ASEAN and India. The firm possesses 28 Asian offices with a staff of 800, and has an Alliance office in Kuala Lumpur. Please visit https://www.dezshira.com and look out for Myanmar updates on the ASEAN Briefing website or on Linked In. Chris can be followed on Twitter at @CDE_Asia. |

Tax, Accounting, and Audit in Vietnam 2014-2015

Tax, Accounting, and Audit in Vietnam 2014-2015

The first edition of Tax, Accounting, and Audit in Vietnam, published in 2014, offers a comprehensive overview of the major taxes foreign investors are likely to encounter when establishing or operating a business in Vietnam, as well as other tax-relevant obligations. This concise, detailed, yet pragmatic guide is ideal for CFOs, compliance officers and heads of accounting who need to be able to navigate the complex tax and accounting landscape in Vietnam in order to effectively manage and strategically plan their Vietnam operations.

An Introduction to Tax Treaties Throughout Asia

An Introduction to Tax Treaties Throughout Asia

In this issue of Asia Briefing Magazine, we take a look at the various types of trade and tax treaties that exist between Asian nations. These include bilateral investment treaties, double tax treaties and free trade agreements – all of which directly affect businesses operating in Asia.

The 2015 Asia Tax Comparator

In this issue, we compare and contrast the most relevant tax laws applicable for businesses with a presence in Asia. We analyze the different tax rates of 13 jurisdictions in the region, including India, China, Hong Kong, and the 10 member states of ASEAN. We also take a look at some of the most important compliance issues that businesses should be aware of, and conclude by discussing some of the most important tax and finance concerns companies will face when entering Asia.

- Previous Article The Cost of Business in Malaysia Compared With China

- Next Article May 2015 ASEAN Regional Meetings