Auditing Requirements for Foreign Firms in Vietnam

Vietnam’s audit rules, thresholds, and deadlines guide foreign firms in turning compliance into investor confidence.

How Can Companies Establish Tax Residency in Singapore to Access Treaty Relief?

Foreign investors can access treaty relief and lower tax rates by establishing genuine management and control in Singapore.

GST in Singapore: When Overseas Vendors Must Register and Collect Tax

Understand Singapore’s GST rules for overseas vendors, registration thresholds, compliance duties, and filing obligations.

How Multinationals Should Manage Tax Filing and Compliance in Vietnam

Foreign investors should decide how to manage Vietnam’s tax compliance through structured planning, not reactive filings.

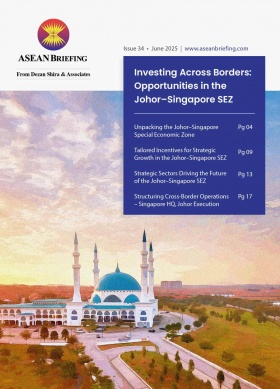

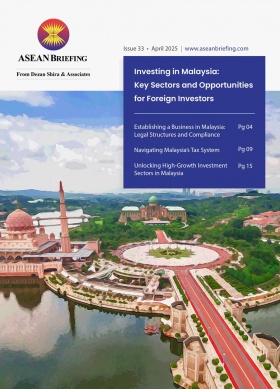

Which Entity in Malaysia Delivers the Strongest Tax Efficiency for Foreign Investors

Compare Sdn Bhd, Labuan, branch, and representative offices in Malaysia to determine the most tax-efficient structure for foreign investors.

Weighing Risks and Returns: Cambodia’s Capital Gains Tax Is Fully in Force

Cambodia’s 20% capital gains tax now applies to assets and property, reshaping investor returns and demanding careful planning.

Tax Incentive Requirements for Family Offices in Singapore: What’s New in 2025

We demonstrate the key requirements to qualifying for income tax exemption for family offices in Singapore.

Maximizing Malaysia’s Tax and Investment Incentives: What Foreign Investors Should Know

Discover how foreign investors can unlock Malaysia’s PS, ITA, RA, MD, and DESAC incentives to cut effective tax rates.

Withholding Tax in Vietnam: How to Handle Cross-Border Payments

Learn how Vietnam’s withholding tax applies to dividends, royalties, interest, and services, and how to reduce exposure with DTAs.

How Foreign Investors Can Use Malaysia’s Double Taxation Agreements

Malaysia’s DTAs cut withholding taxes, prevent double taxation, and help foreign investors boost returns on cross-border income.