Insights into the Philippines’ Standing in the 2024 Emerging Asia Manufacturing Index

The Emerging Asia Manufacturing Index 2024 report (“EAMI 2024”) published by Dezan Shira & Associates provides insights into the factors that influence the manufacturing sector in selected countries in Asia namely Indonesia, China, Vietnam, the Philippines, Thailand, India, and Bangladesh.

The report highlights the Philippines’ potential as a stable manufacturing destination for foreign investors, supported by a supportive labor market, low labor costs, and future infrastructure development plans.

The assessment in the report relies heavily on evaluating 48 specific parameters structured across eight key criteria: economy, political stability, business climate, global trade, taxation, infrastructure, labor force, and innovation.

Analyzing key parameters

Economic tier

The Philippines’ economic tier is ranked sixth in the report. The country’s economic growth was ranked third and economic resilience was ranked sixth.

Despite its low ranking, the Philippines expects its economy to grow between six and seven percent. The government has increased its budget deficit limits for the years 2024 to 2028 to provide greater flexibility for funding its infrastructure program.

For 2024, foreign exchange assumptions have been tightened to a range of 55 to 57 pesos per dollar. However, the assumptions for 2025 to 2028 remain broader, ranging from 55 to 58 pesos per dollar.

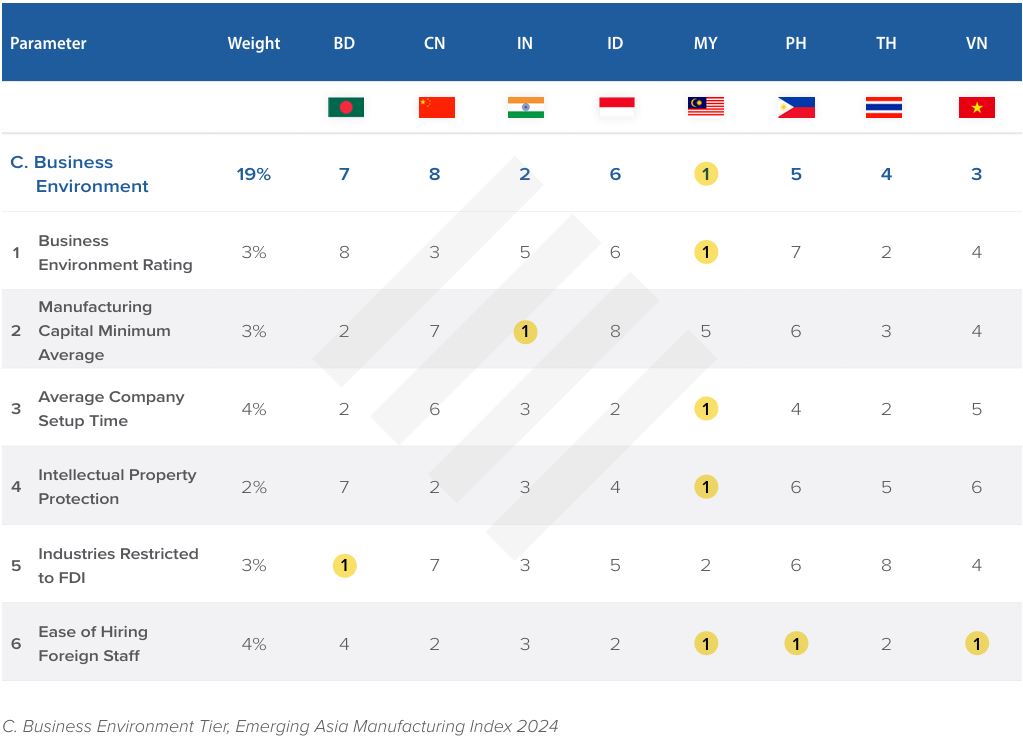

Business environment

The Philippines’ business environment was ranked fifth out of eighth. Further, the country was also ranked fourth for average company setup time, sixth for intellectual property protection, and first for the ease of hiring foreign staff.

The Philippines has tried to enact several key business reforms to ease foreign investment. The Corporate Recovery and Tax Incentives for Enterprises Act (CREATE Act) was enacted in March 2021. The Act’s purpose is to grant tax relief for companies in financial need, provide transparent tax provisions, and further increase the competitiveness of the Philippines. The Act is part of corporate fiscal reforms undertaken by the country since 2019. The CREATE Act still needs to be officially published to take effect.

International trade

In the report, the Philippines’ overall international trade rank was sixth. The country’s customs facilities were ranked sixth, trade balance was ranked fifth, and openness to trade was ranked fourth.

Under the ASEAN framework, the Philippines benefits from preferential trade agreements with China, Hong Kong, India, Japan, South Korea, Australia, and New Zealand.

The signing of a historic free trade agreement between the Philippines and South Korea was formalized during the 43rd ASEAN Summit in 2023. Within the scope of the FTA, both countries have committed to making substantial tariff concessions. South Korea will remove tariffs on approximately 94.8 percent of Philippine products, while the Philippines will reciprocate by abolishing tariffs on about 96.5 percent of South Korean products.

Further, in 2020, the Philippines and 14 other Asia-Pacific nations signed the Regional Comprehensive Economic Partnership (RCEP) agreement, which came into effect in 2022.

Infrastructure tier

The EAMI index placed the Philippines’ infrastructure ranking as last in eighth. The country also ranked sixth for energy availability, third for water availability, and fifth for fuel costs.

The lack of adequate infrastructure has significantly hindered economic growth and efforts to reduce poverty in the Philippines.

As such, former president Duterte introduced the ‘Build! Build! Build! Infrastructure program in 2017 and sought to spend some US$160 billion in infrastructure projects up to 2022. Under President Marcos, the government has implemented the Build Better More (BBM) initiative. The Marcos administration approved 194 infrastructure projects spanning public transport, energy, healthcare, information technology, water resources, and agriculture.

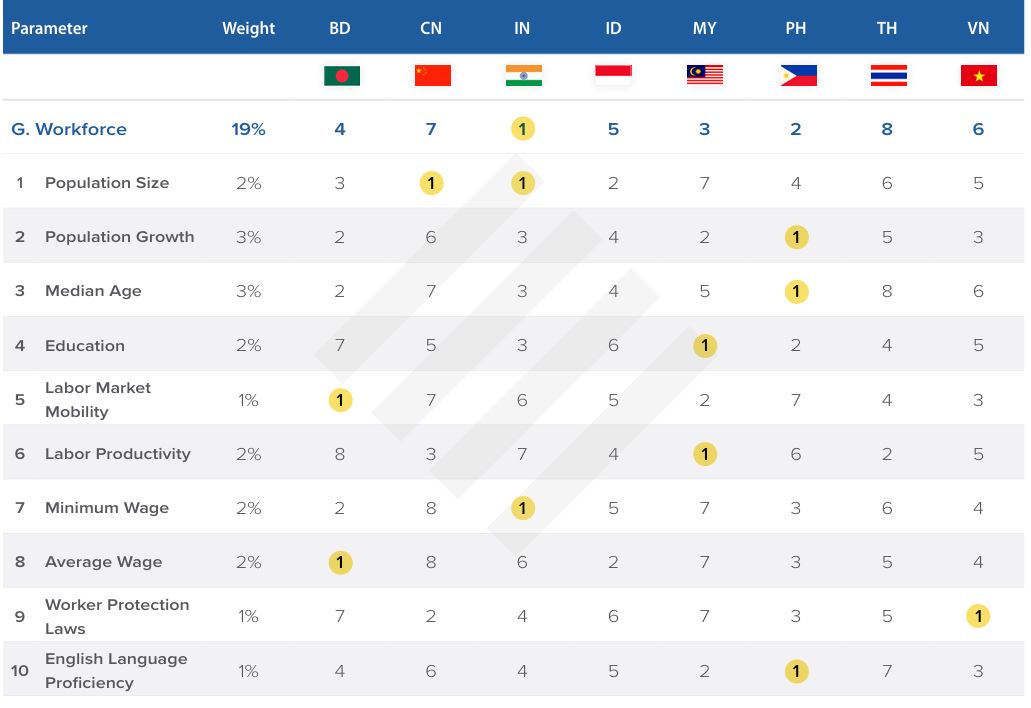

Workforce tier

The EAMI report ranks the Philippines’ workforce tier as second. The country was ranked fourth for its population size, first for population growth, and third for average wages. The country was also ranked sixth for education labor productivity.

The country’s rich talent pool offers a significant advantage for businesses seeking diverse skills and expertise. The Filipino workforce encompasses a wide range of industries and professions, from healthcare professionals and IT specialists to engineers and creative talents.

Such talent has been critical in advancing the BPO industry in the Philippines, which has become an important and dynamic industry for the country. The industry contributed around US$32.5 billion to the economy in 2022, an increase of 10 percent from 2021. The industry has improved its capacity to offer non-call center outsourcing solutions and is ripe for investments into more value-added levels of outsourcing, namely knowledge process outsourcing (KPO). This comprises of IT outsourcing, animation game development, financial research, software development, and data analytics, among others.

About Us

ASEAN Briefing is produced by Dezan Shira & Associates. The firm assists foreign investors throughout Asia and maintains offices throughout ASEAN, including in Singapore, Hanoi, Ho Chi Minh City, and Da Nang in Vietnam, in addition to Jakarta, in Indonesia. We also have partner firms in Malaysia, the Philippines, and Thailand as well as our practices in China and India. Please contact us at asean@dezshira.com or visit our website at www.dezshira.com.