Relocating Your Business Operations to Indonesia: A Guide for US Investors

- Indonesia’s robust economic growth, sound fiscal policies, and political reforms have long made the country an attractive investment destination for US investors.

- The government continues to enact such reforms to improve the business climate and open new sectors for foreign investments

- Indonesia’s digital landscape is one such sector, predicted to be valued at US$130 billion in 2025.

- Further, the country’s young demographic and growing middle-class presents new customers for US businesses in areas from fast-moving consumer goods to healthcare.

Indonesia is the 15th largest economy in the world based on purchasing power parity (PPP) and the fourth largest in East Asia – after China, Japan, and South Korea. By 2030, Indonesia’s robust economic development is expected to transform the country into the world’s seventh-largest economy.

Indonesia’s government is eyeing long-term reforms to improve its bureaucracy and investment environment. This includes introducing the Negative Investment List in 2016 that opened up more sectors for foreign ownership, preparing new labor laws, and simplifying business licenses, among others.Strong growth accompanied by reduced output volatility presents Indonesia as an important trade partner and investment destination for US companies. Moreover, with the onset of the US-China trade war and the pandemic, the government has been expanding its efforts in attracting US businesses relocating from China to low-cost jurisdictions in ASEAN.

What sectors should US companies invest in?

Digital economy-based industries

Indonesia’s digital economy is predicted to reach US$130 billion by 2025, gaining momentum from the 152 million internet users throughout the archipelago.

E-commerce and ride-hailing apps have come to dominate the digital industry. A report compiled by Google, Temasek, and Bain & Company cite Indonesia as the ‘king’ in the ride-hailing sector, which is set to reach US$18 billion in 2025.

The country’s first decacorn (startup unicorn) Gojek — a multi-service platform and digital payment technology group — has a market share of nearly 80 percent of the ride-hailing transportation industry, contributing some US$7.1 billion to the economy in 2019. Currently valued at US$10 billion, Gojek is implementing its ‘super app’ expansion plans through investments in its food delivery and digital payment businesses.

The remainder is owned by non-Indonesian companies, most notably, Singapore-based ride-hailing company Grab, which contributed US$5 billion to the Indonesian economy.

With 90 percent of Indonesia’s 171 million internet users engaging in online shopping, the country’s e-commerce industry is expected to hit US$40 billion by 2022. E-commerce was only seen as an ‘option’ rather than an essential tool by businesses in the country; however, changing consumer behavior due to the ongoing pandemic has forced businesses to embrace digital solutions.

New growth opportunities also lie in electronic payment methods, such as e-wallets and mobile banking. This is despite the fact that Indonesia is the second-largest cash-based economy in the world.

In addition to e-commerce, online education, telemedicine, telecommuting, and 5G industries offer scalable digital opportunities for US investors.

ASEAN alone requires between US$11 billion to US$18 billion in investments to roll-out 5G throughout the region. Indonesia has the highest-value potential for this industry with a potential of 100 million subscribers.

The country is expected to debut 5G in 2022, with demand initially expected to come from the corporate sector, and will boost revenues of telecom operators by up to US$1.8 billion by 2025 from US$1.3 billion presently.

Hurdles, however, remain, mainly because of the country’s archipelagic topography and divisions between the central and regional governments. These have delayed infrastructure development required for 5G expansion.

Fast-moving consumer goods

The medium- and long-term outlook of Indonesia’s fast-moving consumer goods (FMCG) remains strong, supported by a burgeoning middle-class (20 percent of the population) and a young demographic (more than 50 percent of the population is under 30). The middle-class has become the backbone of Indonesia’s consumer market.

For multinationals in the country’s FMCG sector, the greatest growth opportunities are in modern retail – in particular, the convenience trade sector, as major convenience store chains have already established themselves in second- and third-tier cities, such as Yogyakarta, Solo, and Banda Aceh and Mataram, respectively.

According to the 2019 Global Retail Development Index, Indonesia’s retail market was ranked fifth, based on its investment attractiveness. Only Malaysia was ranked above (third) Indonesia among ASEAN nations on the list.

Indonesians also have culturally specific shopping behaviors – brand familiarity is key, and consumers are risk-averse. Another factor is the increasing awareness of and preference for halal consumption.

In October 2019, Indonesia’s Halal Law came into effect, which meant consumer products that enter or are traded in the country must be Halal-certified. This law will initially cover only food and beverages. Cosmetics, drugs, and other goods and services related to these categories have until 2022 to comply.

Renowned US companies – KFC, McDonald’s, Burger King, and Coca-Cola – are just some of the many American multinationals that have developed significant Halal products in the country, capitalizing on the US$170 billion or so Indonesians spend on Halal food.

Manufacturing

Diversifying and upgrading Indonesia’s manufacturing sector is at the heart of the government’s goals to propel the country into one of the top 10 economies in the world by 2030.

The sector employs some 15 percent of the total workforce and contributes to 20 percent of total GDP. In 2019, Indonesia’s manufacturing value added (MVA) was US$220 billion, an increase from US$204 billion in 2018.

The main areas of production are food and beverages, textiles, electronics, automotive, footwear, chemicals, and textile and garments. An estimated 99 percent of manufacturers in this sector are micro, small, or medium enterprises (MSMEs), who account for two-thirds of the total employment.

The government wants to increase the sector’s contribution to GDP to 25 percent by 2025 and transform the country into a manufacturing hub in ASEAN that rivals the capacity of Germany and South Korea.

The government is looking to rely on the chemicals, electronics, and automotive industries, as well as other high-value and complex manufacturing products to achieve this goal. This new initiative is part of the ‘Making Indonesia 4.0’ roadmap.

Global commercial real estate services firm, Cushman & Wakefield’s, stated in its Global Manufacturing Risk Index that Indonesia is the fifth most cost-competitive manufacturing hub in the world. This ranking will improve as the government relocates manufacturing hubs outside of Java island; the island already accounts for 60 percent of the population and 58 percent of total GDP.

Healthcare and pharmaceuticals

Given its market size, Indonesia’s healthcare and pharmaceutical industry presents a lucrative investment opportunity for US businesses.

The country has the world’s largest healthcare program, covering over 200 million people. By providing people with greater access to healthcare, the government sought to increase foreign investment into the sector through the Negative Investment List, which provides foreign investors a larger stake in sub-sectors of the health industry, such as medical equipment, specialized clinics, and hospitals.

The medical devices industry was valued at US$4.5 billion in 2019 with the expansion of this industry being driven by the expansion of government and private hospitals and healthcare centers.

Foreign investors from outside ASEAN can now have up to 67 percent ownership in private hospitals. Opportunity in this sector lies in the growth of Indonesia’s second- and third-tier cities where bed occupancy is low. The country currently has the lowest rate of hospital beds per thousand patients (1.17) in ASEAN.

Within Indonesia’s pharmaceutical industry, foreign investors can have a 100 percent ownership in factories that produce essential raw materials in drug production. Indonesia imports some 90 percent of the raw materials. Since the roll-out of the universal healthcare program, the industry has experienced 10 to 13 percent annual growth, with sales expected to reach US$10 billion by 2021.

Infrastructure

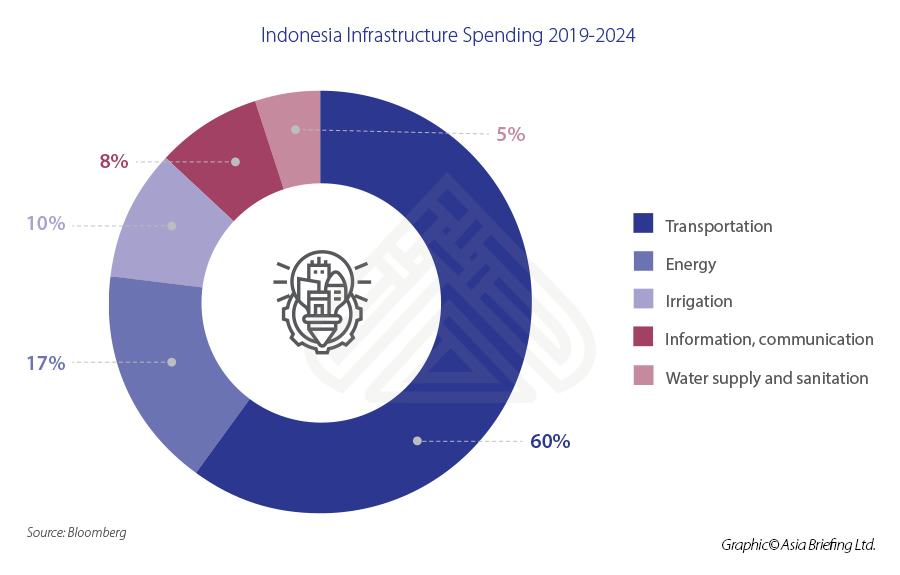

Indonesia has ambitious plans to spend more than US$400 billion in infrastructure projects until 2024. Some 40 percent of the total will be funded by the government, 25 percent through state-owned enterprises, and the rest through the private sector.

The majority of the spending will go towards transportation-related infrastructure as well as constructing 57 new airports. Furthermore, the government plans to build over 2,600 km (1,600 miles) of highways, maintaining 46,000 km of existing highways, and construct 35,000 MW of electricity of capacity.

By improving infrastructure throughout the country’s 17,000 islands, the government hopes to boost economic growth and spread wealth beyond Java.

Such projects have been challenging in the past due to land acquisition – the main obstacle to infrastructure development.

Defense

Indonesia has strong military ties with the US, being a regular buyer of US military hardware since after independence.

The government aims to increase military spending to between two to three percent of GDP as part of its modernization program. The US government’s end to its ban on arms sales in 2010, enabled Indonesia to buy much needed spare parts, in particular for US-made C-130 transport planes. The US Department of Defense approved the sales of US$2 billion worth of military hardware to Indonesia in 2020 and are in talks to deliver hypersonic weapons and weaponized artificial intelligence.

As part of the modernization program, the US military has conducted various bilateral exercises and training events focused on supporting peace operations in the region. The Indonesian government will also establish new military bases and begin recruiting 25,000 civilians for its military reserve component program, bolstering a reserve force of over 400,000 personnel and 434,000 active personnel.

What corporate structure should US companies operate from?

Investors should assess their specific needs carefully before deciding which corporate structure to operate from. Using a reliable local advisor is recommended for first-time investors in the country as they find it easier to remain compliant with applicable regulations.

There are two legal options for foreign investors looking to set up in the country: a foreign investment company (PT PMA) or a representative office (RO).

Foreign investment company

Establishing a foreign investment company, or PT PMA, is the preferred structure for companies looking to have a legal presence in the country. Foreign investors will need to have an investment plan of a minimum of 10 billion rupiah (US$750,000) and a minimum paid-up capital equivalent of 2.5 billion rupiah (US$178,000).

Prior to setting up, applicants should study the Negative Investment List (NIL) to see which business sectors are unavailable or restricted for foreign ownership. For business sectors that are restricted, foreign investors will need to engage in a joint venture with a local company.There are several advantages to PT PMAs, including:

- Special financial and non-financial incentives, particularly in pioneer industries;

- Incentives for setting up in special economic zones (SEZs);

- Foreign investors can own as little as one percent and as much as 100 percent of the company (depending on the industry);

- Able to participate in government-sponsored business tenders in the country;

- Ease of processing for business licenses;

- Ease of processing for work permits;

- Lower tax and import duties;

- Simple organization structure (requiring only one director, one commissioner, and two shareholders); and

- Ability to sponsor foreign executives and employees.

There are no restrictions on where the PT PMA can set up in the country, but the business can only focus on one specific sector or area. Moreover, all applicants will need approval from the Indonesian Investment Coordinating Board (BKPM) and should submit an investment plan (this must show their intended investment realizations).

Representative offices

Opening an RO is the fastest and simplest way of establishing a legal entity in the country. This set up is a temporary arrangement – ROs are not allowed to engage in any commercial activities, issue invoices, sign contracts, or earn any revenue. Foreign investors, however, can own 100 percent of this business entity and don’t have to contribute the same paid-up capital required by PT PMAs.

The business activities of ROs are limited to market research activities, obtaining information on potential clients, developing trade contacts, and gathering information on regulations and laws. There are four types of ROs:

General representative office (KPPA)

A KPPA is a general RO structure, ideal for investors who are still exploring opportunities in Indonesia. The KPPA has two main responsibilities:

- Represent, supervise, and manage its parent company in Indonesia; and

- Prepare for the establishment of a limited liability company for the parent company.

The KPPA must be incorporated in the capital of any Indonesian province and must be located in an office building. The KPPA permit is valid for an initial three years and can be extended twice for one year each time.

Representative office for a foreign trading company (KP3A)

A KP3A is similar to a KPPA but is more ideally suited for manufacturers or product owners looking to establish a network of distributors in the country. The KP3A is divided into the following categories:

- Can act as a buying/or selling agent for the parent company, performing liaising or promotional activities; or

- Act as a manufacturing agent with its activities also limited to market research and liaising.

Unlike a KPPA, the KP3A does not have to be established in the capital city of a province; they can set up in any district or regency in the country.

Foreign investors will also need to obtain a Foreign Company Trade Representative license (SIUP3A), which can be done through the OSS system of the BKPM. The KP3A permit is limited to two months (temporary license) to a maximum of one year (permanent license).

Representative office for a foreign construction company (BUJKA)

A BUJKA is an RO for foreign construction companies, and unlike the KPPA and KP3A entities, a BUJKA can undertake projects in Indonesia through a joint venture with a local construction company. The BUJKA license is valid for three years and the local partner must be a limited liability company.

Applicants must prove to the National Construction Services Development Board (LPJK) that they are classified as a ‘large’ construction company, and they must have a service business license issued by the Department of Public Works.

Representative office for a foreign oil and gas company (KPPA MIGAS)

Foreign oil companies can set up a representative office through a KPPA MIGAS permit. The license is valid for three years and applicants will need to seek prior approval from the BKPM.

About Us

ASEAN Briefing is produced by Dezan Shira & Associates. The firm assists foreign investors throughout Asia and maintains offices throughout ASEAN, including in Singapore, Hanoi, Ho Chi Minh City and Jakarta. Please contact us at asia@dezshira.com or visit our website at www.dezshira.com