Insights into Indonesia’s Standing in the 2024 Emerging Asia Manufacturing Index

The Emerging Asia Manufacturing Index 2024 report (“EAMI 2024”) published by Dezan Shira & Associates provides insights into the factors that influence the manufacturing sector in selected countries in Asia namely Indonesia, China, Vietnam, the Philippines, Thailand, India, and Bangladesh.

The report highlights Indonesia’s potential as a stable manufacturing destination for foreign investors, supported by its large domestic workforce, ongoing business reforms, and improving infrastructure.

The assessment in the report relies heavily on evaluating 48 specific parameters structured across eight key criteria: economy, political stability, business climate, global trade, taxation, infrastructure, labor force, and innovation.

Analyzing key parameters

Economic tier

Indonesia’s economic tier is ranked fourth in the report. The country’s economic growth and resilience are also ranked fourth and is ranked second for national debt.

Indonesia is expected to see growth of between 4.8 and 5 percent this year. On April 22, 2024, Indonesia’s General Election Commission officially declared Prabowo Subianto as the country’s next president, and Gibran Rakabuming Raka (the eldest son of President Joko Widodo) as the next vice president after appeals from two defeated presidential candidates over the presidential polls were rejected by the constitutional court.

Continuity is a key theme for the Prabowo-Gibran administration, promising to uphold many of Jokowi’s policies, including developing downstream commodities sectors, modernizing infrastructure, and maintaining a disciplined macroeconomic governing agenda. With plans to expand to other metals, the government’s ban on unprocessed nickel and bauxite export has elevated Indonesia’s position in the global resource supply chain, particularly for electric vehicle batteries, leading to increased exports. Additionally, Prabowo pledges to continue the ambitious US$35 billion project of relocating the capital to the island of Borneo, around 2,000km from Jakarta.

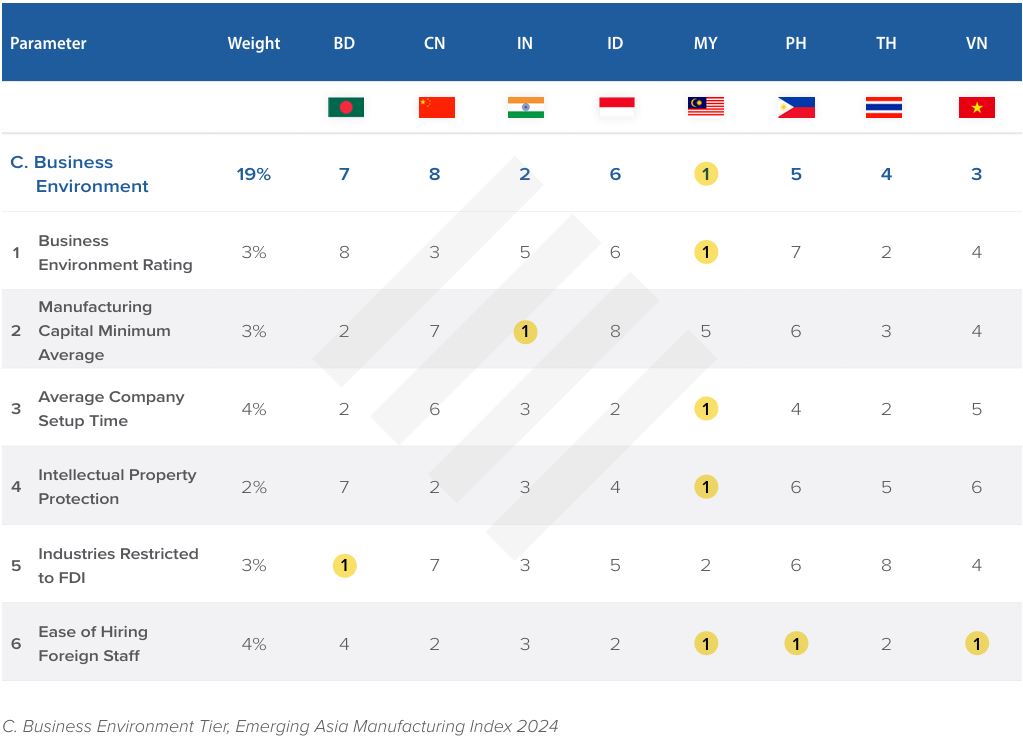

Business environment

Indonesia’s business environment was ranked sixth out of eighth. Further, the country is consistently ranked low for its business environment rating, minimum capital requirements, and the type of industries restricted for foreign investors.

Despite its low business environment ranking, Indonesia is working hard to implement business reforms to better attract foreign investment. One important reform is through the issuance of Government Regulation in Lieu of Law No. 2 Year 2022. The law removes bureaucratic inefficiencies, simplifies business licensing requirements, and liberalizes more industries for foreign investors.

International trade

In the report, Indonesia’s overall international trade rank was fifth. The country’s trade balance was ranked first, free trade integration second, and trade openness sixth.

Despite being ranked fifth in the report for international trade, Indonesia has actively pursued free trade agreements (FTAs) to expand its international trade relations and bolster its economy.

Some of Indonesia’s significant FTAs include:

- ASEAN Free Trade Area (AFTA);

- ASEAN-Australia-New Zealand Free Trade Area (AANZFTA);

- Indonesia-Japan Economic Partnership Agreement (IJ-EPA);

- Indonesia-Korea Comprehensive Economic Partnership Agreement (IK-CEPA); and

- Regional Comprehensive Economic Partnership (RCEP).

Infrastructure tier

The EAMI index has placed Indonesia’s infrastructure ranking sixth from eighth. The country also did not rank favorably for internet speed (8th) water costs (7th), and infrastructure investment (5th).

Infrastructure development has been at the forefront of the Joko Widodo government since 2014 and the country has seen huge inroads on this front. The President stated in late 2021 that in the last six years, his government has built 1,640km of highways and 4,600km of non-highway roads. In addition, there are now 15 new airports with expansion work and renovations happening on a further 38. Further, the government has built 22 dams and is in the process of developing 124 new ports. There will be 65 new dams nationwide by 2024.

Between 2022 and 2024, Indonesia intends to spend some US$445 billion on infrastructure investments.

Moreover, in October 2023, Indonesia launched Southeast Asia’s first high-speed railway that connects the capital Jakarta to the city of Bandung, 142km east. This has cut traveling time from 2-3 hours by conventional railway to just 40 minutes.

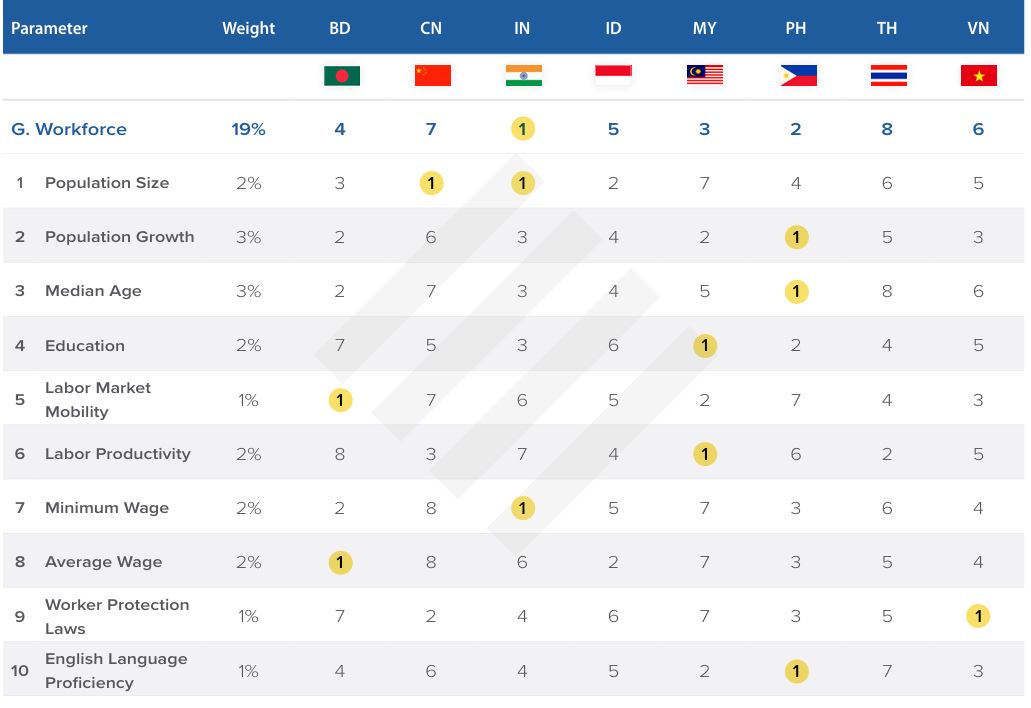

Workforce tier

The EAMI report ranks Indonesia’s workforce tier as fifth out of eighth. The country was ranked second for its population size and average wages but sixth for education and fourth for labor productivity.

Indonesia is the world’s fourth most populous country (275.7 million) with a young demographic averaging 30 years of age. Additionally, 60 percent of the population is under the age of 40. This makes Indonesia ASEAN’s largest labor market with over 130 million workers and the fourth largest labor market in the world.

The country’s current stage of development makes it ideal for labor-intensive manufacturing and the government is already a prominent producer of garments and textiles in addition to automobiles.

Despite its large labor market, only 55 million workers are considered ‘skilled’ and productivity is relatively low compared to its ASEAN counterparts. The government predicts that Indonesia will require 100 million skilled workers by 2030 as it aims to become the world’s fourth-largest economy in terms of purchasing power parity.

About Us

ASEAN Briefing is produced by Dezan Shira & Associates. The firm assists foreign investors throughout Asia and maintains offices throughout ASEAN, including in Singapore, Hanoi, Ho Chi Minh City, and Da Nang in Vietnam, in addition to Jakarta, in Indonesia. We also have partner firms in Malaysia, the Philippines, and Thailand as well as our practices in China and India. Please contact us at asean@dezshira.com or visit our website at www.dezshira.com.

- Previous Article New Thai Law Targets Cross-Border Data Flows

- Next Article Insights into Thailand’s Standing in the 2024 Emerging Asia Manufacturing Index