Insights into Thailand’s Standing in the 2024 Emerging Asia Manufacturing Index

The Emerging Asia Manufacturing Index 2024 report (“EAMI 2024”) published by Dezan Shira & Associates provides insights into the factors that influence the manufacturing sector in selected countries in Asia, namely Indonesia, China, Vietnam, the Philippines, Thailand, India, and Bangladesh.

The report highlights Thailand’s strong manufacturing base for foreign investors by evaluating 48 specific parameters structured across eight key criteria: economy, political stability, business climate, global trade, taxation, infrastructure, labor force, and innovation.

Key highlights of EAMI 2024 for Thailand

Economic tier

The report highlights that Thailand’s economic tier ranking was placed last. The economy is expected to grow between 2.2 and 2.7 percent in 2024, down from a previous forecast of between 2.8 to 3.3 percent.

This has been attributed to slowing exports, a key driver of the Thai economy. Further, the country’s household debt was 87 percent of GDP in 2023, among the highest in the world. Thailand is displaying the hallmarks of a country undergoing a middle-income trap where a low-skilled, low-paid workforce cannot compete with globalization’s changing nature where value-added services drive international trade.

The country, however, is expected to attract 36 million tourists in 2024, contributing 2.3 trillion baht (US$62 billion) to the economy. Tourism is an important sector for Thailand. The sector contributes to approximately 20 percent of GDP.

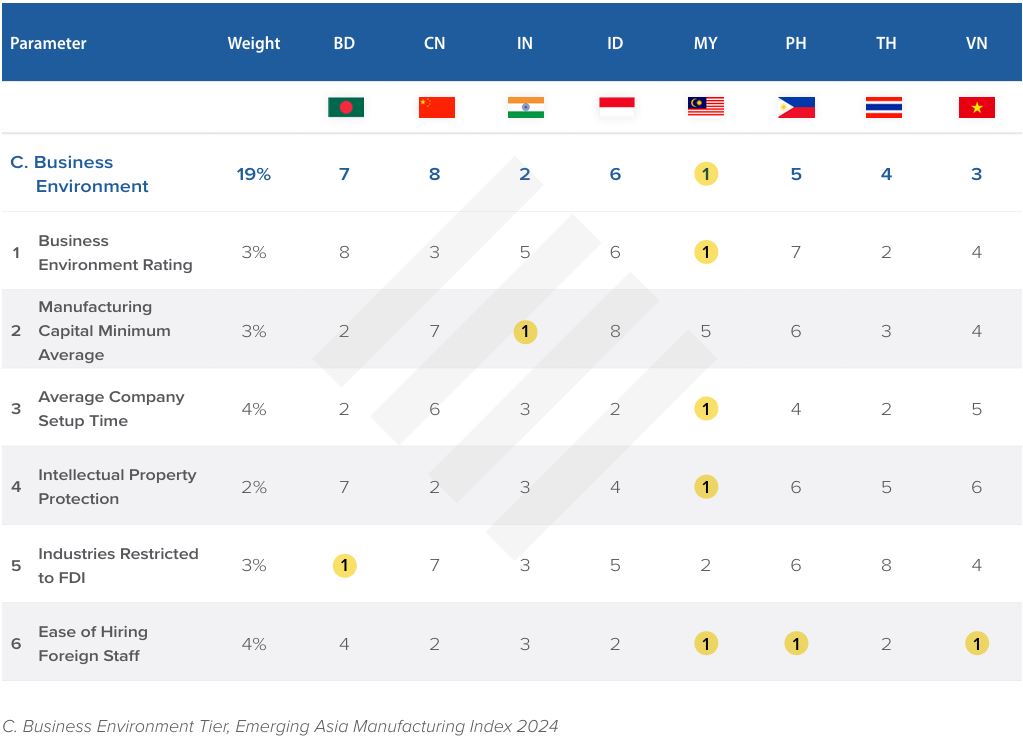

Business environment tier

Thailand’s business environment tier was ranked fourth from eighth. The country has been trying to improve its business environment, particularly in high-value industries, to attract more foreign investments.

One example is the latest incentives to support the electric vehicle industry. In February 2024, Thailand’s National Electric Vehicle Policy Committee (EV Board) approved new measures to support the uptake of electric buses (e-buses) and electric trucks (e-trucks), along with the establishment of battery bases. The measures are part of an effort to make Thailand a regional electric vehicle (EV) hub and help the country reach its carbon neutrality goals.

In addition to the e-truck and e-bus incentives, the EV Board approved the expansion of the EV3.5 scheme, which aims to support the production of EVs by offering a subsidy of up to 100,000 baht (US$2,722) per car from 2024 to 2027. This scheme focuses on electric passenger cars, motorcycles, and pickup trucks.

The new measures will allow companies or juristic partnerships to deduct expenses for e-bus and e-truck purchases from their payable corporate income tax (CIT) without a price ceiling, thus reducing their CIT burden. Moreover, purchases of domestically produced vehicles can be deducted at two times the price, while imported vehicles can be deducted at 1.5 times the price.

Infrastructure tier

The EAMI index placed Thailand’s infrastructure ranking as second from eighth. The country also ranked first for energy availability, fourth for water availability, and seventh for fuel costs.

Thailand’s infrastructure is marked by its extensive transportation networks, including over 180,000 kilometers of roads and a railway system spanning around 4,000 kilometers. Major ports like the Port of Bangkok and Laem Chabang handle significant volumes of cargo, contributing to the country’s position as a key player in regional trade.

The energy sector is diversified, with natural gas accounting for over 50 percent of electricity generation, followed by coal and renewable sources. Telecommunications penetration is high, with mobile subscriptions exceeding 100 percent of the population and internet users surpassing 60 million. While urban areas enjoy relatively good water supply and sanitation, rural regions still face challenges, with around 96 percent of the urban population having access to improved sanitation compared to only 67 percent of rural residents.

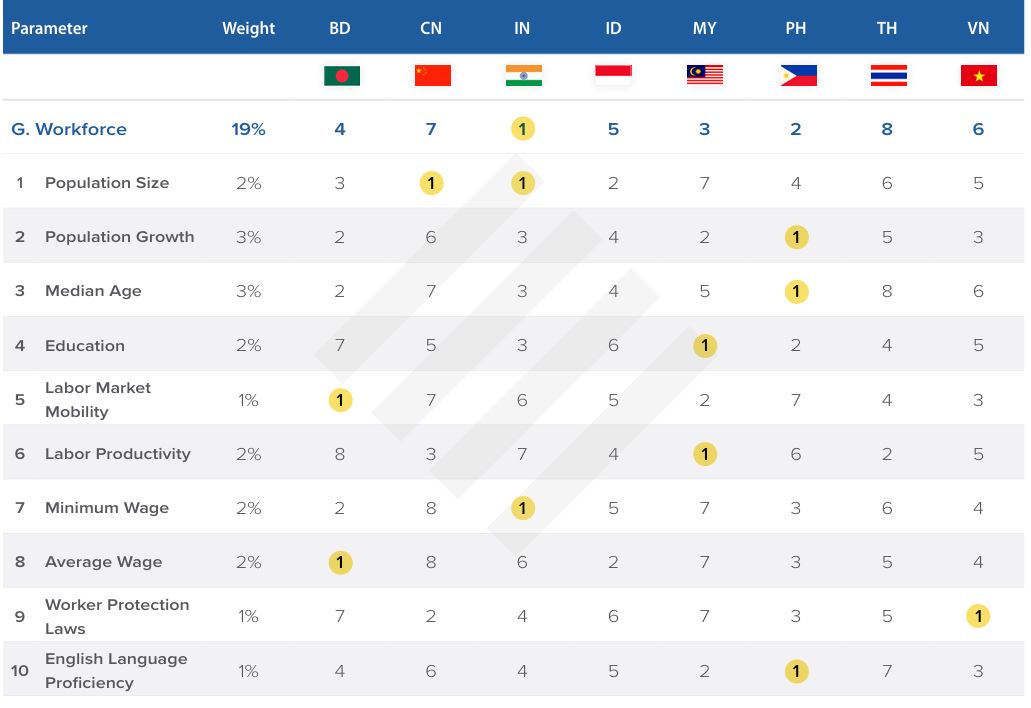

Workforce tier

The EAMI report ranks Thailand’s workforce tier as eighth. The country was ranked sixthfor its population size and fifth for average wages. Malaysia was ranked fourth for education and second for labor productivity.

Thailand’s workforce is diverse and dynamic, reflecting the country’s position as one of Southeast Asia’s leading economies. With a population of over 69 million people, the labor force is sizable and contributes significantly to various sectors of the economy. Agriculture, although declining, remains a key employer, particularly in rural areas, where traditional farming practices persist alongside modern agricultural techniques. The industrial sector, encompassing manufacturing, electronics, automotive, and textiles, has grown substantially and is pivotal in driving exports and economic development.

About Us

ASEAN Briefing is produced by Dezan Shira & Associates. The firm assists foreign investors throughout Asia and maintains offices throughout ASEAN, including in Singapore, Hanoi, Ho Chi Minh City, and Da Nang in Vietnam, in addition to Jakarta, in Indonesia. We also have partner firms in Malaysia, the Philippines, and Thailand as well as our practices in China and India. Please contact us at asean@dezshira.com or visit our website at www.dezshira.com.