Indonesia Proposes Limited FTA with the United States

Indonesia has proposed a limited free trade agreement (FTA) that will allow nickel and other critical commodities used in electric vehicle (EV) production to be shipped to the US, and thus enable Indonesian companies in the EV supply chain to benefit from US tax credits.

Indonesia currently does not have an FTA with the United States.

Washington unveiled new guidance on EV tax credits under the Inflation Reduction Act (IRA), which includes a US$369 billion clean energy package.

Under the IRA Act, companies are eligible for a US$7,500 tax credit if they fulfill one of the two following criteria;

- A total of 40 percent of the minerals used for EV battery production must be extracted or processed in the US, or with one of its free trade partners; or

- At least half of the battery components must be manufactured in North America.

Also, starting in 2024, an EV benefitting from the tax credit cannot contain components from a ‘foreign entity of concern’, and beginning in 2025, a vehicle cannot have any critical materials sourced, extracted, and processed by a foreign entity of concern.

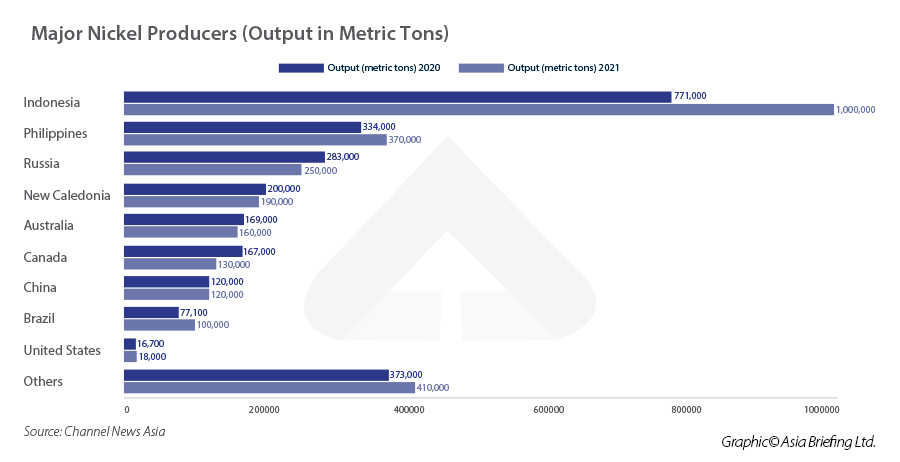

The US holds only 0.4 percent of global nickel reserves and produces only 18,000 metric tons per year. Further, US FTA partners accounted for less than 10 percent of global nickel production and these partnerships do not cover the top nickel exporters of Indonesia, Russia, and the Philippines.Indonesia has been trying to leverage its vast nickel reserves – which are estimated to be the world’s largest at 22 million tons – to attract investments into its downstream nickel industry as well as from EV and EV battery manufacturers. The country is also the world’s top producer of metal, with production hitting 1 million tons in 2021.

Could a US-Japan style agreement take fold?

Indonesia and the US could focus on a narrower deal like the US-Japan limited FTA, or Critical Minerals Agreement, covering critical minerals that are key to powering EVs, such as nickel, graphite, manganese, cobalt, and lithium – and reduce both countries’ dependence on China for such minerals. The agreement was signed in March 2023.

Under this FTA, both countries will not impose any undue prohibitions on the imports or exports of critical minerals to each other’s territory. Both the US and Japan are also committed to not imposing export duties on critical minerals.

The deal to not impose export duties is a boon for Japanese battery makers, such as Panasonic. For the US, the agreement ensures a stable supply chain for the supply of these crucial materials for EV batteries.

As such, the US-Japan Critical Minerals Agreement provides a blueprint for other US trading partners like Indonesia who currently do not have qualifying free trade agreements under the IRA. The US is in negotiations with the EU and the UK for a similar agreement on critical minerals.

Chinese investments in Indonesia could hinder talks

Indonesia’s nickel industry has seen massive investments by Chinese companies, particularly for the building of refining facilities, such as including high-pressure acid leach (HPAL) plants, and an Indonesia-US limited FTA would open the door for Chinese firms to benefit from the tax credits.

This could violate the provision regarding the sourcing of critical minerals from ‘foreign entities of concern’.

Jakarta needs to assure Washington that its policies do not lean too much towards China in addition to ensuring that it can increase environmental safeguards.

Indonesia’s nickel ban

Indonesia first imposed the ban on the export of nickel ores in 2014 and introduced a requirement for producers to purify the raw nickel in Indonesia before export.

Following a budget deficit in 2016 and a reduction in nickel production, the government partially relaxed the ban in 2017 with plans to reimpose it in 2022. At the time, Indonesia had constructed nine new nickel smelters.Eventually, the government brought the ban forward to January 2020.

Indonesia’s exports of processed nickel reached an estimated US$30 billion in 2022, a huge increase from just US$1 billion in 2015. The country is expected to account for half the world’s increase in nickel production by 2025.

Indonesia’s EV Hub goals

Indonesia’s nickel reserves are making the country indispensable to the global EV industry with the country aiming to be a global EV hub. The country’s Coordinating Minister for Maritime Affairs and Investment, Luhut Binsar Pandjaitan, stated that Indonesia aims to be one of the top three producers of EV batteries in the world by 2027.

Indonesia’s chance to seek a preferential trade agreement with the US

Despite the limited FTA still in the discussion stage, Indonesia should use this opportunity to seek a preferential trade agreement with the US instead of a fully-fledged FTA. For instance, Indonesia can exchange minerals for products, such as soybeans and corn; Indonesia imported 2.67 million tons of soybeans in 2021 – with 2.63 million tons coming in from the United States.

About Us

ASEAN Briefing is produced by Dezan Shira & Associates. The firm assists foreign investors throughout Asia and maintains offices throughout ASEAN, including in Singapore, Hanoi, Ho Chi Minh City, and Da Nang in Vietnam, in addition to Jakarta, in Indonesia. We also have partner firms in Malaysia, the Philippines, and Thailand as well as our practices in China and India. Please contact us at asean@dezshira.com or visit our website at www.dezshira.com.

- Previous Article How RCEP Ratification Benefits the Philippines

- Next Article Indonesia’s Social Security System: Key Considerations for Payroll