Unleashing Nickel’s Potential: Indonesia’s Journey to Global Prominence

We look at the foreign investment potential in Indonesia’s commodities sector, with a focus on nickel resources and EV battery manufacturing.

Indonesia’s economic development strategy is being spearheaded by its commodities exports from nickel to coal to gold and copper.

This approach — often referred as resource nationalism — is guided by Indonesia’s Constitution of 1945, which states that the waters, land, and natural resources of the country are controlled by the state and must be used for the benefit of the people. The country has begun to ban the export of mineral ores, most notably nickel ores with the government active in persuading foreign investments in processing plants and smelters. This move adds value to the country’s commodity reserves.

Although 70 percent of all nickel usage goes towards the stainless-steel sector, there is increasing demand for the manufacture of electric vehicle (EV) batteries. This demand from electric batteries is expected to account for one-third of total nickel demand by 2030, particularly as countries worldwide look to lower carbon emissions and meet their net-zero targets. As such, Indonesia is aware of the huge economic opportunities this provides and is focused on increasing production capacities along the EV supply chain and become an EV battery production hub.

Indonesia’s nickel reserves

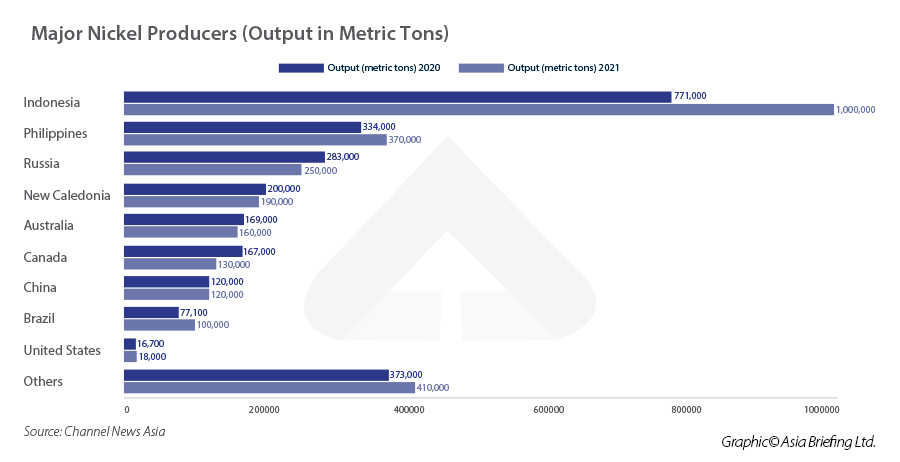

Indonesia holds the world’s largest nickel reserves with an estimated 21 million tons, which roughly accounts for 22 percent of global reserves. The country is also the world’s top producer of metal, with production hitting 1 million tons in 2021.

Australia has the second-largest nickel reserves of approximately 20 million tons or 21 percent of the global share. However, the country only produced 160,000 tons of the metal in 2021.

Brazil has an estimated 16 million tons in reserves but produced approximately 100,000 tons of the metal in 2021.

Indonesia’s nickel ban

Indonesia first imposed the ban on the export of nickel ores in 2014 and introduced a requirement for producers to purify the raw nickel in Indonesia before export.

Following a budget deficit in 2016 and a reduction in nickel production, the government partially relaxed the ban in 2017 with plans to reimpose it in 2022. At the time, Indonesia had constructed nine new nickel smelters.

Eventually, the government brought the ban forward to January 2020.

Foreign investors, primarily from China, began investing in the Indonesian nickel supply chain, particularly in the building of smelters – Indonesia’s Ministry of Energy and Mineral Resources has targeted to have 30 smelters by the end of 2023. This is an ambitious target – Indonesia had only two smelters in 2016 and 15 per current count.

Indonesia’s exports of processed nickel reached an estimated US$30 billion in 2022, a huge increase from just US$1 billion in 2015. The country is expected to account for half the world’s increase in nickel production to 2025.

However, the ban on nickel ores prompted the European Union to launch a complaint to the World Trade Organization (WTO) in 2019 who argued that Indonesia’s ban was unfairly harming the EU’s stainless-steel industry. In November 2022, the WTO ruled in favor of the EU, citing that Jakarta’s ban was not in line with global trade rules. Indonesia has appealed the ruling.

The WTO ruling poses a direct challenge to Indonesia’s desire to ensure its mineral raw materials are processed domestically. The government has not announced its next strategy if it loses the appeal but has not ruled out implementing a heavy tax on nickel raw exports as one initiative.

For 2023, the Indonesian government is determined to expand the raw mineral export ban with bauxite ores set for a June 2023 ban.

Electric vehicle batteries supply chain

Indonesia’s nickel reserves are making the country indispensable to the global EV industry with the country aiming to be a global EV hub. Global EV makers, which include US’s Tesla and China’s BYD, are said to be finalizing deals to invest in Indonesia, according to the country’s Coordinating Minister for Maritime Affairs and Investment, Luhut Binsar Pandjaitan. Indonesia aims to be one of the top three producers of EV batteries in the world by 2027.

Moreover, to complement its nickel-based battery industry, the country is also developing lithium refineries and anode material production facilities. Historically, Indonesian nickel smelters are equipped to produce Class 2 nickel (ferronickel/pig iron) while battery cathode production requires Class 1 nickel that contains at least 99.8 percent nickel.

With its 278 million population, Indonesia also presents opportunities for the sale of EV vehicles ranging from motorbikes to cars. Formidable challenges and opportunities for investors include consumer affordability and the lack of public charging infrastructure. The government has an ambitious target of having 2.5 million EV users by 2025.

Highlights of major foreign investments in Indonesia’s nickel industry

In the three years since the nickel export ban was introduced, Indonesia has signed deals worth over US$15 billion for electric battery production with multinationals such as Hyundai and LG. Tesla are also rumored to have plans to expand in Indonesia.

2020

- German company BASF and French mining company Eramet signed an agreement to develop a nickel and cobalt hydrometallurgical refining complex that includes a High-Pressure Acid Leaching (HPAL) plant. The US$2.6 billion partnership is expected to be finalized by the end of 2023.

- Also in 2020, Indonesia’s Ministry of Investment and LG signed a US$9.8 billion MoU for LG Energy Solution to invest across the EV supply chain.

2021

- LG Energy and Hyundai Motor Group being developing Indonesia’s first battery cell plant worth an investment value of US$1.1 billion. The facility is expected to have a capacity of 10 Gigawatt hours (GWh).

2022

- Indonesia’s Ministry of Investment signs an MoU with Foxconn, Gogoro Inc, IBC and Indika Energy on battery manufacturing, e-mobility, and their related industries.

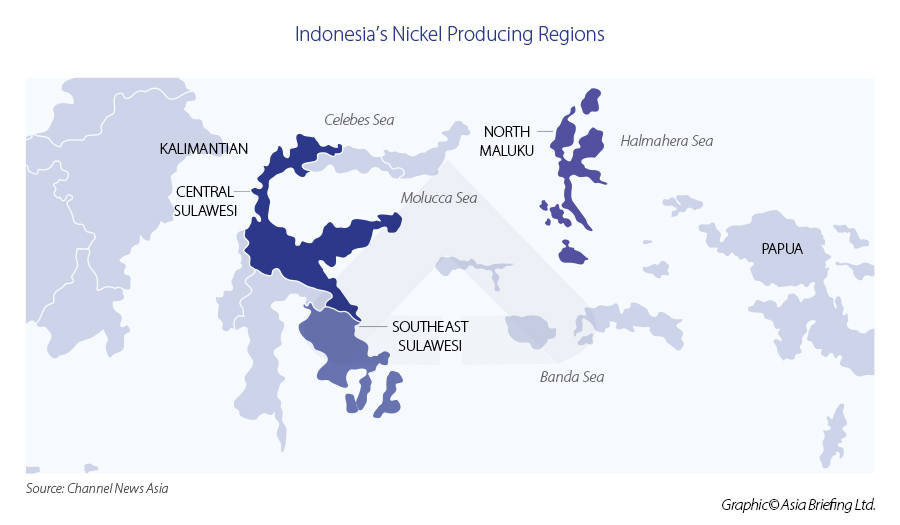

- Zhejiang Huayou Cobalt, Tsingshan Holding Group and China Molybdenum Co completed the first shipment of nickel mixed hydroxide precipitate to China from Indonesia’s biggest nickel processing hub in South Sulawesi province.

- Indonesian state mining company Aneka Tambang signed a framework agreement with China’s largest battery manufacturer CATL Group for partnership in EV manufacturing, battery recycling, and nickel mining.

- LG Energy breaks ground on a US$3.5 billion smelter in Central Java province. The smelter will have a capacity to produce 150,000 tons of nickel sulphate per year.

- Vale Indonesia and China’s Zhejiang Huayou Cobalt sign an agreement with Ford Motor to build a hydroxide precipitate (MHP) plant in Southeast Sulawesi province. The plant will have a capacity to produce 120,000 tons of hydroxide precipitate. Vale Indonesia and Zhejiang Huayou Cobalt have also agreed to build a second MHP plant with a 60,000 ton capacity.

About Us

ASEAN Briefing is produced by Dezan Shira & Associates. The firm assists foreign investors throughout Asia and maintains offices throughout ASEAN, including in Singapore, Hanoi, Ho Chi Minh City, and Da Nang in Vietnam, in addition to Jakarta, in Indonesia. We also have partner firms in Malaysia, the Philippines, and Thailand as well as our practices in China and India. Please contact us at asean@dezshira.com or visit our website at www.dezshira.com.