Singapore as a Payroll Processing Center for Companies in ASEAN

Editor: Bradley Dunseith

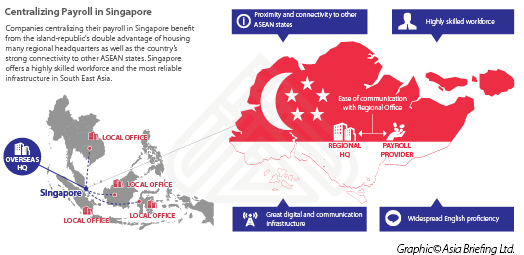

Located in the heart of South East Asia, Singapore is an attractive destination for centralizing payroll processing and wider regional HR functions for companies either entering ASEAN markets, or expanding their current operations. Singapore is well connected with all ASEAN member states and offers digital and communication infrastructure at global standards.

The high volume of regional headquarters already operating in Singapore makes the city-state an even more attractive destination for centralizing payroll. Additionally, Singapore’s unique history makes the city-state well equipped to maneuver the cultural worlds of South East Asia, Europe, and North America – an important skill when collecting information from offices in Asia and communicating the information to regional and overseas headquarters.

![]() RELATED: Payroll and Human Resources Services from Dezan Shira & Associates

RELATED: Payroll and Human Resources Services from Dezan Shira & Associates

The Singapore advantage

Singapore’s bustling port and airport offer efficient and reliable connectivity throughout South East Asia. Strategically located, Singapore is never more than an hour and a half ahead or behind other ASEAN member states – making same-day communication between regional staff and offices elsewhere in ASEAN practical.

Singapore as a guide to ASEAN

Singapore has a history of facilitating cross-cultural trade and commerce. A former British colony, the island-republic has served as an important trading hub and port for much of South East Asia. Now, Singapore’s port is the second busiest in the world. Most residents in Singapore are at least bilingual in two of the four official languages: Malay, Mandarin, Tamil, and English.

Regional proximity and strong business and political relations with its neighbors lend Singapore-based companies a deeper understanding of the legal and regulatory landscapes of ASEAN states. Centralizing payroll processing in Singapore allows professionals with in-depth knowledge of ASEAN regulations to ensure a company delivers timely and state-compliant pay to its diverse workforce.

Technological advantages

Using new technologies to input and organize payroll information increases levels of transparency and efficiency; digitizing payroll systems makes information easier to access and faster to process. Singapore has the best digital connectivity among all ASEAN states, making it the best provider of tech-based payroll solutions.

Perhaps more important than efficiency when a company considers digitizing its payroll system is security. Singapore has robust cyber security laws, reliable digital infrastructure, and a technically proficient labor pool. Centralizing payroll in the city-state minimizes the risk of personal information being stolen or lost.

English as a language of business

English is the main working language in Singapore. Having a payroll team fluent in English makes communication with head offices outside of ASEAN states easier and more efficient. Fluency in English also means a stronger paper trail which a foreign manager can understand when examining work in case of disputes or discrepancies. Companies centralizing their payroll processing in Singapore will not face the same linguistic hurdles common in other ASEAN states.

Efficient business environment

While labor costs in Singapore are typically higher than in other ASEAN states, the standards of quality are also much higher. Singapore boasts world renowned universities and business centers. Its existing financial infrastructure and higher wages has created a competent workforce with an internationalist perspective.

Singapore, furthermore, is a politically stable country. Its own regulatory landscape favors transparency and pro-business efficiency, meaning that the government is unlikely to enact laws which create difficulty or confusion in processing a foreign company’s payroll.

RELATED: The Guide to Employment Permits for Foreign Workers in Singapore

RELATED: The Guide to Employment Permits for Foreign Workers in Singapore

Why choose Singapore?

Singapore’s government has a history of business-friendly policies and is one of the most stable regimes in South East Asia. Singapore boasts world renowned universities and its work force is highly skilled – meeting international standards in terms of quality and reliability. As Singapore is already a business and technology hub of Asia, the city state offers exceptional digital and communication infrastructure. Similarly, Singapore has recently passed robust cyber-security laws and has the existing capacity to offer protection from digital hacks.

While labor costs in Singapore are relatively higher than in neighboring countries, centralizing payroll processing in the city-state can save a company money in the long term. Choosing Singapore as a payroll processing center minimizes communication gaps and frees up management to focus on expanding and strengthening their ASEAN operations.

|

This article is an excerpt from the June 2017 issu |

|

Dezan Shira & Associates Brochure

Dezan Shira & Associates Brochure

Dezan Shira & Associates is a pan-Asia, multi-disciplinary professional services firm, providing legal, tax and operational advisory to international corporate investors. Operational throughout China, ASEAN and India, our mission is to guide foreign companies through Asia’s complex regulatory environment and assist them with all aspects of establishing, maintaining and growing their business operations in the region. This brochure provides an overview of the services and expertise Dezan Shira & Associates can provide.

An Introduction to Doing Business in ASEAN 2017

An Introduction to Doing Business in ASEAN 2017

An Introduction to Doing Business in ASEAN 2017 introduces the fundamentals of investing in the 10-nation ASEAN bloc, concentrating on economics, trade, corporate establishment, and taxation. We also include the latest development news for each country, with the intent to provide an executive assessment of the varying component parts of ASEAN, assessing each member state and providing the most up-to-date economic and demographic data on each.

How to Set Up in the Philippines

How to Set Up in the Philippines

In this issue of ASEAN Briefing magazine, we provide an introduction to the Philippines as well as analyze the various market entry options available for investors interested in expanding to the island nation. We also discuss the step-by-step process for setting up a business entity in the Philippines, highlighting the various statutory requirements for overseas investors. Finally, we explore the potential for Singapore to serve as a viable base to administer investors’ Philippine operations.

- Previous Article Malaysia-Thailand Trade and Economic Relations

- Next Article IP Protection in the Philippines Pharmaceutical Industry