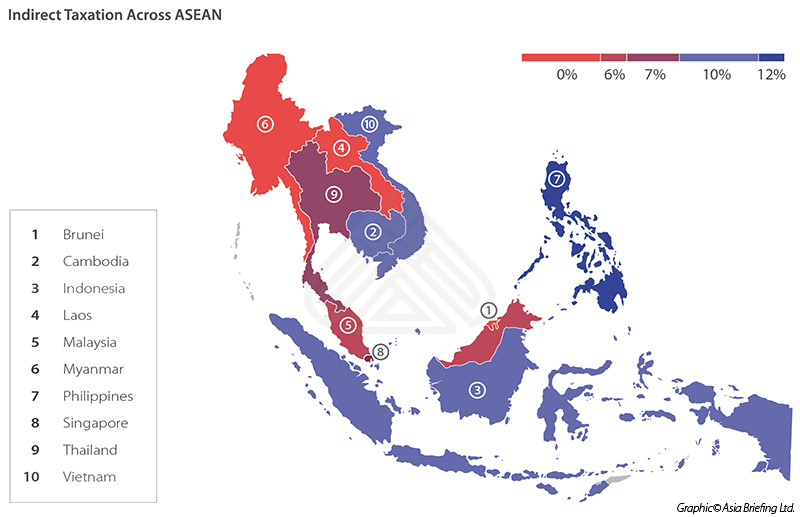

Indirect Taxation Across ASEAN

Among a myriad of factors which determine competitiveness within ASEAN member states, rates of taxation are a particularly salient judge of character for the treatment of foreign investment. In recent years, corporate income tax (CIT) has become the standard bearer for tax benchmarking, however, foreign investors will be faced with a variety of different taxes in the event that capital is committed. For those importing and exporting, indirect taxation, including value added taxation (VAT) and goods and services tax (GST) are significant forms of tax that should not be disregarded.

In essence, an indirect tax adds to the price of a purchasable product or a payable service, thereby increasing the cost of that product or service and causing consumers to indirectly pay its rate of taxation. Indirect taxes thus differ from other forms of taxation, such as corporate income and individual income tax; both of which require a business or an individual to pay the applicable amount directly to a government.

![]() RELATED: International Tax Planning Services from Dezan Shira & Associates

RELATED: International Tax Planning Services from Dezan Shira & Associates

VAT and GST rates within ASEAN vary widely between member states – from 12 percent in the Philippines to countries which do not currently levy these taxes at all, such as Laos and Myanmar. For those considering investment, GST, VAT, and other taxation tied to the purchase of specific goods should be watched closely.

Regional Business Publications from Asia Briefing

The above is an excerpt from our latest ASEAN Briefing Magazine, titled “The 2016/17 ASEAN Tax Comparator and available to subscribers for download in the Asia Briefing Bookstore. In this edition, we discuss the importance of taxation within ASEAN, while highlighting the differences between individual member states on a variety of fronts. We examine trends within regional taxation, compare rates of corporate, indirect, and withholdings taxation, and present an overview of the compliance environments found across the region. Finally, we analyze ASEAN’s tax rates in the context of the time and documentation required to achieve compliance, and showcase the role that residency definitions can play in determining operational exposure to taxation.

|

Asia Briefing Ltd. is a subsidiary of Dezan Shira & Associates. Dezan Shira is a specialist foreign direct investment practice, providing corporate establishment, business advisory, tax advisory and compliance, accounting, payroll, due diligence and financial review services to multinationals investing in China, Hong Kong, India, Vietnam, Singapore and the rest of ASEAN. For further information, please email asean@dezshira.com or visit www.dezshira.com. Stay up to date with the latest business and investment trends in Asia by subscribing to our complimentary update service featuring news, commentary and regulatory insight. |

Annual Audit and Compliance in ASEAN

For the first issue of our ASEAN Briefing Magazine, we look at the different audit and compliance regulations of five of the main economies in ASEAN. We firstly focus on the accounting standards, filing processes, and requirements for Indonesia, Malaysia, Thailand and the Philippines. We then provide similar information on Singapore, and offer a closer examination of the city-state’s generous audit exemptions for small-and-medium sized enterprises.

The Trans-Pacific Partnership and its Impact on Asian Markets

The Trans-Pacific Partnership and its Impact on Asian Markets

The United States backed Trans-Pacific Partnership Agreement (TPP) includes six Asian economies – Australia, Brunei, Japan, Malaysia, Singapore and Vietnam, while Indonesia has expressed a keen willingness to join. However, the agreement’s potential impact will affect many others, not least of all China. In this issue of Asia Briefing magazine, we examine where the TPP agreement stands right now, look at the potential impact of the participating nations, as well as examine how it will affect Asian economies that have not been included.

An Introduction to Tax Treaties Throughout Asia

An Introduction to Tax Treaties Throughout Asia

In this issue of Asia Briefing Magazine, we take a look at the various types of trade and tax treaties that exist between Asian nations. These include bilateral investment treaties, double tax treaties and free trade agreements – all of which directly affect businesses operating in Asia.