Foreign Exchange Volatility in ASEAN: Assessing Exposure & Managing Risk

By Dezan Shira & Associates

Editor: Maxfield Brown

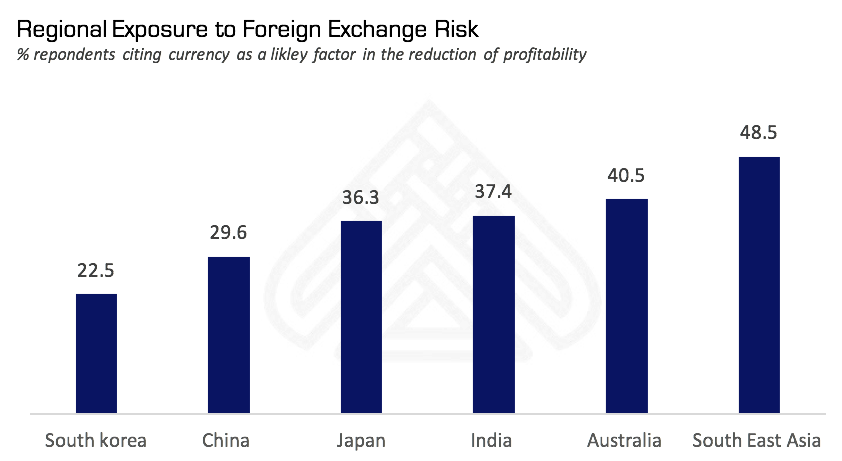

Exchange rate volatility has emerged as a pressing challenge for investors seeking to establish and scale regional production chains within ASEAN. 2015 survey data from the Economist indicates these fluctuations have overtaken regulatory compliance as the single greatest impediment to profit maximization in South East Asia – with nearly 50 percent of respondents voicing concerns. Understanding that this volatility is likely to be a long term risk associated with regional production, the following article overviews the issues surrounding foreign exchange within ASEAN and highlights market entry strategies which can be utilized to reduce operational exposure.

Should any questions arise, and for more in depth analysis on how to assess and manage your FX exposure within ASEAN, please contact our Business Intelligence specialists

RELATED: Pre Investment and Market Entry Advisory from Dezan Shira & Associates

RELATED: Pre Investment and Market Entry Advisory from Dezan Shira & Associates

Foreign Exchange Volatility in ASEAN

Unlike the common market of the European Union (EU), firms entering ASEAN’s Economic Community – the AEC – will be greeted by the notable absence of a common currency. Although the risks of adopting such an arrangement have been born out over the course of the European sovereign debt crisis, utilization of regional supply chains, without the assistance of a common form of exchange, it creates a unique subset of risks that investors within ASEAN must now contend.

Under ASEAN’s common marketplace, debt service, input pricing, and remittance of profits are all subject to the shifts in the value of the regions ten currencies. Sudden fluctuations in a given currency’s value can have significant cost implications for firms holding outstanding contracts or debts within the currency in question. While changes to valuation may move in a company’s favor in the short term, the potential for volatility to negatively impact profitability of operations should not be disregarded.

As ASEAN continues to attract record levels of capital inflows, the volatility of regional exchange rates will likely continue into the near to medium term. This, in conjunction with a lack of risk mitigation tools ,has not gone unnoticed by investors. As indicated by the chart below, currency risk is thought to be a more pronounced in South East Asia than in China, South Korea, or even Australia – which is currently suffering at the hands of falling commodity prices.

RELATED: The ASEAN Trade In Goods Agreement (ATIGA) – Local Content Requirements

RELATED: The ASEAN Trade In Goods Agreement (ATIGA) – Local Content Requirements

Managing Foreign Exchange Risk in ASEAN

When managing foreign exchange risk in large markets with established and liquid currencies – such as the United States, EU, or Japan – forwards contracts are a widely utilized and effective tool to reduce uncertainty. Forwards allow investors to lock in fixed exchange rates at low costs which can then be used to settle contracts with suppliers, make payments on loans, and remit profits.

In ASEAN however, lowered liquidity, lagging availability of derivatives products such as forwards, and heightened levels of government regulation make “onshore forwards contracts” a rare and ineffective tool for risk mitigation. While these traditional methods fall short of their counterparts in developed economies, tools do exist to assist investors in their efforts to expand into the dynamic markets of South East Asia.

NDF Markets

In response to the underdeveloped state of derivatives markets in many of ASEAN’s frontier economies, Non Deliverable Forwards (NDF) have become the “offshore” alternative of choice for those seeking the coverage of traditional forwards contracts. NDFs allow investors to sidestep the absence of onshore hedging tools and mitigate the risks posed by foreign exchange through the establishment of forwards contracts with financial institutions in third party states. Within ASEAN, Singapore – with its deep financial infrastructure – has emerged as a hub for this activity, allowing buyers and sellers to settle payments through financial intermediaries within its boarders.

Although NDF brokers offer substantial liquidity under normal market conditions, the domination of the marketplace by a few large financial institutions is likely to result in diminish capacity under adverse market conditions. With this in mind, and in light of prevalent trends in China as well as the European Union, it is highly recommended that NDF mitigation be employed in conjunction with additional risk mitigation tools.

Strategic Planning

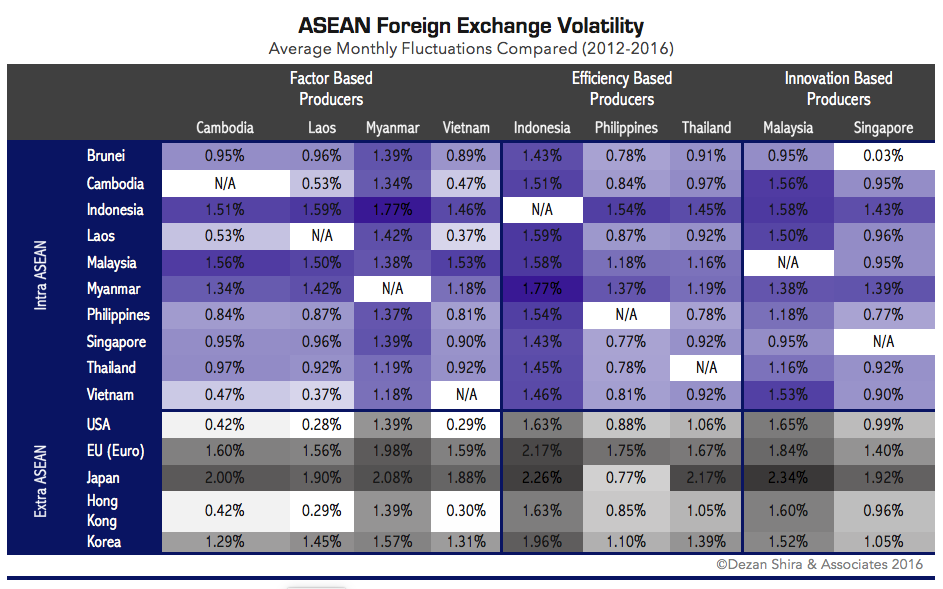

Both as a means of mitigating exposure to foreign exchange risk as well as ascertaining areas warranting the introduction of NDF contracts, substantial market research should always be conducted on the front end of investment within ASEAN states. The following chart provides a first step in this direction by outlining the average monthly exchange rate volatility between ASEAN states, and with their key trading partners over the past four years.

Understanding that optimal utilization of ASEAN’s tariff harmonization is likely to require linkages of production in truly regional supply chains, the chart above breaks down ASEAN members into their respective production strengths – factor based, efficiency based, and innovation based production. For each stage of the production process, it thus becomes an integral component of due diligence to assess alternative markets on foreign exchange, in addition to traditional metrics such as labor and regulatory compliance costs.

In practice, this analysis can be applied to those considering expansion or establishment within the region. Prospective investors in the production of computing products, for example, must consider the volatility between their home markets – the US or EU – innovation based economies with the capacity to build high tech components – Singapore or Malaysia – as well as markets within ASEAN where these products will be assembled – Vietnam or Cambodia. Depending on the combination of production required to finish a given good, the adjustment of supply chains to mitigate exchange rate exposure may lead to substantial profit retention over the long term of a project.

Further Support From Dezan Shira & Associates

ASEAN is one of the most dynamic regions in the world with four out of the ten fastest growing economies of 2016 projected to be members of the regional economic bloc. With a team of experienced professional bringing years of market risk and supply chain analysis to their work, Dezan Shira can help to ensure that investments are structured in a manner that maximizes their ability tap into the advantages of the ASEAN region while mitigating exposure to exchange rate risk.

|

Asia Briefing Ltd. is a subsidiary of Dezan Shira & Associates. Dezan Shira is a specialist foreign direct investment practice, providing corporate establishment, business advisory, tax advisory and compliance, accounting, payroll, due diligence and financial review services to multinationals investing in China, Hong Kong, India, Vietnam, Singapore and the rest of ASEAN. For further information, please email asean@dezshira.com or visit www.dezshira.com. Stay up to date with the latest business and investment trends in Asia by subscribing to our complimentary update service featuring news, commentary and regulatory insight. |

Annual Audit and Compliance in ASEAN

For the first issue of our ASEAN Briefing Magazine, we look at the different audit and compliance regulations of five of the main economies in ASEAN. We firstly focus on the accounting standards, filing processes, and requirements for Indonesia, Malaysia, Thailand and the Philippines. We then provide similar information on Singapore, and offer a closer examination of the city-state’s generous audit exemptions for small-and-medium sized enterprises.

The Trans-Pacific Partnership and its Impact on Asian Markets

The Trans-Pacific Partnership and its Impact on Asian Markets

The United States backed Trans-Pacific Partnership Agreement (TPP) includes six Asian economies – Australia, Brunei, Japan, Malaysia, Singapore and Vietnam, while Indonesia has expressed a keen willingness to join. However, the agreement’s potential impact will affect many others, not least of all China. In this issue of Asia Briefing magazine, we examine where the TPP agreement stands right now, look at the potential impact of the participating nations, as well as examine how it will affect Asian economies that have not been included.

An Introduction to Tax Treaties Throughout Asia

An Introduction to Tax Treaties Throughout Asia

In this issue of Asia Briefing Magazine, we take a look at the various types of trade and tax treaties that exist between Asian nations. These include bilateral investment treaties, double tax treaties and free trade agreements – all of which directly affect businesses operating in Asia.

- Previous Article Unternehmensgründung in Singapur

- Next Article A Guide to ASEAN’s Strategic Transport Action Plan