ASEAN’s Leading Manufacturing Destinations

By Matthew Zito, Dezan Shira & Associates

Singapore

Located at the heart of Southeast Asia, this successful and highly developed free-market economy offers a host of opportunities to investors. The cultural melting pot that is Singapore has been referred to as one of the most business-friendly and competitive economies in the world, and for good reason.

As the commercial hub of ASEAN, Singapore is characterized by its open, efficient, and corruption-free government, low-interest rates, state-of-the-art infrastructure, significant investment incentives, and highly-educated workforce. These reasons and more led to Singapore ranking first on the World Bank’s “Ease of Doing Business Index” for nine consecutive years (2006-2014).

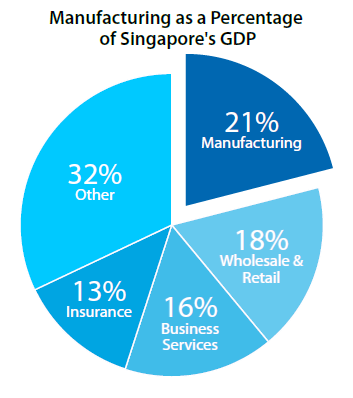

Contrary to the belief of many, Singapore is not only home to thriving finance, business, and retail sectors, but is also an important manufacturing hub. Singapore’s diverse economy depends heavily on exports, and manufacturing accounts for approximately 21 percent of the country’s GDP—a percentage much higher than in other advanced economies such as the United Kingdom, Canada, or the United States. In comparison, wholesale and retail, business services, and finance and insurance—all sectors more strongly associated with Singapore— constitute 18 percent, 16 percent, and 13 percent of GDP, respectively.

Singapore’s specialized industries include chemicals, which made up 33.4 percent of total manufacturing output in 2013, electronics (27.8 percent), precision engineering (11.4 percent), transport engineering (11.1 percent), biomedical manufacturing (8.2 percent), and general manufacturing (8.1 percent).

However, despite all of the positive aspects of Singapore’s business environment, there are some concerns that the country will become less competitive in coming years as a result of increasing business costs—which are already significantly higher than those of other ASEAN nations. The average wage of a worker in Singapore’s manufacturing sector was US$3,375 per month in Q3 2013 versus US$350 in Thailand during the same period. Furthermore, between Q3 2009 and Q1 2013, business costs in the manufacturing sector rose by 19 percent cumulatively.

Analysts are also worried about the country’s dependence on China, the U.S., and the Eurozone as export markets because these areas are all expected to experience slow growth over the next few years. However this fear may be mitigated as a result of an expected increase in intra-ASEAN trade after the implementation of the ASEAN Economic Community in 2015.

In order to sustain its manufacturing competitiveness, the Singaporean government offers significant incentives for productivity-driven growth, including cash payouts for training and R&D. The country also maintains a favorable corporate tax rate of 17 percent, the lowest of any ASEAN nation, India, or China.

Despite having some obstacles to overcome, Singapore seems certain to maintain its manufacturing competitiveness for the foreseeable future, with Deloitte predicting that the city-state will remain in ninth place (the highest ranked ASEAN country) in the World Manufacturing Competitiveness Index through 2018.

Malaysia

Boosted by an average annual GDP growth rate of 4.68 percent between 2000 and 2014, Malaysia has transformed itself within a short span of time to become a diverse multi-sector economy. With its central location in Southeast Asia making it an ideal base for regional ambitions, this market oriented economy remains an investor favorite. Malaysia offers a vibrant and dynamic business atmosphere distinguished by its pro-business policies, comparatively stable economic and political environment, sophisticated financial facilities, and well-developed infrastructure.

Malaysia’s manufacturing industry constitutes approximately 25 percent of GDP and as such is a significant driver of the economy. The Q1 2014 sales value of the manufacturing sector expanded by 10.9 percent year-on-year to reach approximately US$69 billion. The leading manufacturing sector by some margin is electrical and electronic products, which constitute 32.9 percent of Malaysia’s exports. A broad range of products are exported within this category, such as high-end consumer electronics, information and communication technology (ICT) products, and photovoltaic cells and modules. Other key export sectors include petroleum products, chemicals and chemical products, machinery, appliances, and parts, and optical and scientific equipment.

Malaysia as an investment prospect is often misinterpreted as primarily being a cost-competitive alternative to Singapore. While many key business costs are significantly lower in Malaysia than in its regional neighbor—for example, the average monthly income of workers in the manufacturing sector is US$875 in Malaysia versus US$3,375 in Singapore—this simplification of matters drastically underestimates the benefits of doing business in Malaysia. Malaysia was ranked as the world’s best manufacturing destination by global property agent Cushman & Wakefield in their 2014 Manufacturing Index, which assessed countries in 30 sub-categories based on three principle criteria: costs, risks, and conditions.

Malaysia is also narrowing the gap with Singapore in terms of ease of doing business, having jumped from 12th to sixth in the most recent World Bank Doing Business report—making Malaysia the second highest ranked ASEAN country. In addition, the country’s infrastructure is among the most developed in Southeast Asia and investors can take advantage of significant incentives in select industries.

The Malaysian government has recently been looking to Singapore and other Asian countries for inspiration on how to further advance its economy. In line with the goal of achieving high-income status by 2020 under the Economic Transformation Programme (ETP), the government has encouraged innovation-based growth similar to that seen in Singapore, Hong Kong, South Korea, and Taiwan in an attempt to move further up the value-added production chain. Malaysia has also taken inspiration from the Chinese model by implementing joint venture business parks with tax incentives for resident companies.

Thailand

Thailand, ASEAN’s second largest economy after Indonesia, provides investors with an ideal platform for export manufacturing, as well as offering access to the country’s booming domestic consumer market. Despite its current state of political turbulence, Thailand’s open, market-oriented economy continues to be an attractive investment proposition.

The Thai economy, traditionally based on agricultural exports, has dramatically transformed itself within the past few decades, and today industry and services constitute much larger shares of the economy. The manufacturing sector remains concentrated around Bangkok, yet the previous government created several development zones throughout the country in a bid to decentralize the sector.

With a value of around US$120 million, manufacturing constituted approximately 33 percent of Thailand’s GDP in 2013, the highest percentage of any ASEAN country by a significant margin. Key segments within manufacturing include jewelry, electronic appliances, garments, computers and parts, furniture, petrochemicals, and automobiles. Thailand is also rapidly moving into higher value industries, such as green automobiles, high value electronics, and ICT.

Thailand has acted as a manufacturing hub for Japan and the U.S., among others, for decades, and is home to a highly skilled labor force. As of this year, the minimum wage rate per day is fixed at THB300 (US$9.25) with an average monthly wage for a worker in the manufacturing sector of approximately US$360 in Q1 2014—an increase of 44 percent from Q2 2011. The country’s unemployment rate of 0.94 percent is one of the lowest in the world, which can result in upward pressure on wages.

In late 2011, Thailand was battered by the worst floods in 70 years, crippling its manufacturing sector. This affected 60 of Thailand’s 77 provinces, especially Bangkok and its five surrounding provinces, where many key industrial estates are located. Nevertheless, the flood crisis highlighted the resilience of the Thai economy, which had recovered by 2012 due to government stimulus programs and strong domestic demand. Since then, government investment of US$11.7 billion into flood mitigation projects has been critical in restoring and maintaining investor confidence.

Despite a military coup in May, Thailand continues to host a friendly and manageable business environment. The country features excellent infrastructure and is strategically located at the crossroads of Southeast Asia, China, and India. Thailand’s appeal as a production base is enhanced by a number of free trade agreements and significant investment incentives. Moreover, Bloomberg recently named Thailand the fifth most promising emerging market in the world, and the second in Southeast Asia after Malaysia.

This article is an excerpt from the July 2014 edition of Asia Briefing Magazine, titled “Manufacturing Hubs Across Emerging Asia.” In this issue, we explore several of the region’s most competitive and promising manufacturing locales including India, Indonesia, Malaysia, Singapore, Thailand, and Vietnam. Exploring a wide variety of factors such as key industries, investment regulations, and labor, shipping, and operational costs, we delineate the cost competitiveness and ease of investment in each while highlighting Indonesia, Vietnam and India’s exceptional potential as the manufacturing leaders of the future.

This article is an excerpt from the July 2014 edition of Asia Briefing Magazine, titled “Manufacturing Hubs Across Emerging Asia.” In this issue, we explore several of the region’s most competitive and promising manufacturing locales including India, Indonesia, Malaysia, Singapore, Thailand, and Vietnam. Exploring a wide variety of factors such as key industries, investment regulations, and labor, shipping, and operational costs, we delineate the cost competitiveness and ease of investment in each while highlighting Indonesia, Vietnam and India’s exceptional potential as the manufacturing leaders of the future.

Asia Briefing Ltd. is a subsidiary of Dezan Shira & Associates. Dezan Shira is a specialist foreign direct investment practice, providing corporate establishment, business advisory, tax advisory and compliance, accounting, payroll, due diligence and financial review services to multinationals investing in China, Hong Kong, India, Vietnam, Singapore and the rest of ASEAN. For further information, please email asean@dezshira.com or visit www.dezshira.com.

Stay up to date with the latest business and investment trends in Asia by subscribing to our complimentary update service featuring news, commentary and regulatory insight.

Related Reading

The Gateway to ASEAN: Singapore Holding Companies

The Gateway to ASEAN: Singapore Holding Companies

In this issue of Asia Briefing Magazine, we highlight and explore Singapore’s position as a holding company location for outbound investment, most notably for companies seeking to enter ASEAN and other emerging markets in Asia. We explore the numerous FTAs, DTAs and tax incentive programs that make Singapore the preeminent destination for holding companies in Southeast Asia, in addition to the requirements and procedures foreign investors must follow to establish and incorporate a holding company.

Are You Ready for ASEAN 2015?

Are You Ready for ASEAN 2015?

ASEAN integration in 2015, and the Free Trade Agreements China has signed with ASEAN and its members states, will change the nature of China and Asia focused manufacturing and exports. In this important issue of Asia Briefing we discuss these developments and how they will impact upon China and the Global Supply Chain.

- Previous Article Foreign Ministers Rekindle Interest in EU-ASEAN FTA

- Next Article E-Commerce Retail Sales See Rapid Growth in ASEAN