ASEAN Tax Comparator

As more and more free trade agreements and double tax treaties between Asian nations and other jurisdictions around the world continue to come into effect, it is clear now more than ever that careful planning should go into choosing the most tax efficient structure and market for your business in Asia. When looking to establish a business in any market around the world, one of the main areas that will dictate a company’s level of profitability will be the issue of taxation. Although this is admittedly only one of many factors that will determine the success of a business, some companies search the world looking for just the right partner country where they can establish a physical presence. Each jurisdiction’s differing tax rates and incentives undoubtedly play a major role in the eventual decision.

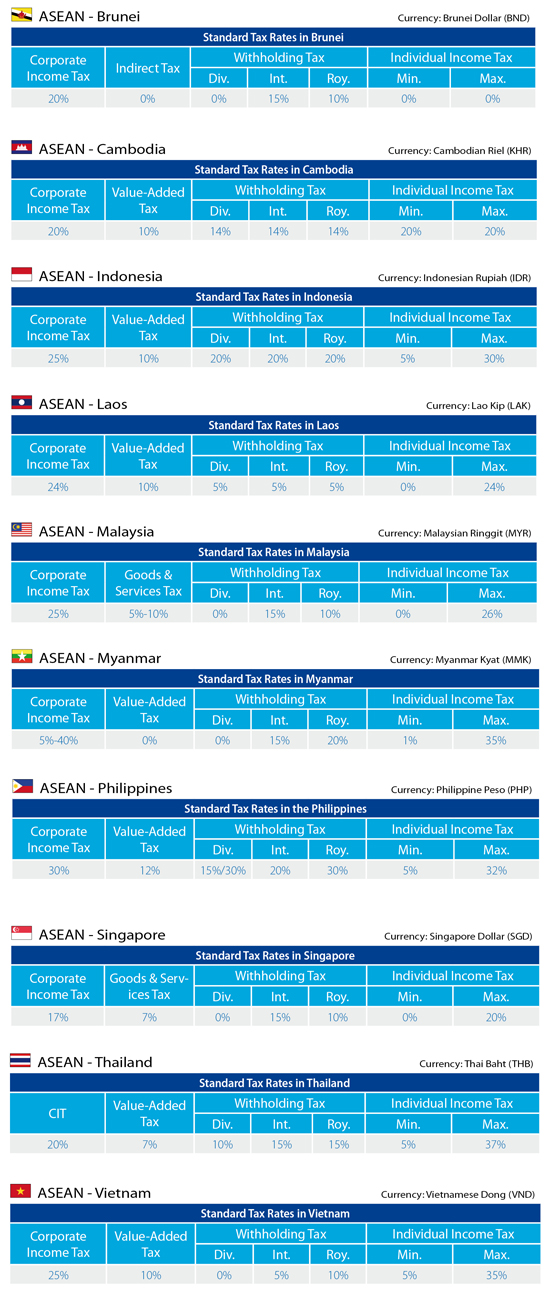

Businesses operating in the closely interconnected continent of Asia need to be aware of the various taxes they may be subject to, which include corporate income tax (CIT), individual income tax, withholding tax, and indirect taxes such as value-added tax (VAT) or goods and services tax (GST).

In this article, we outline the key corporate and individual income tax rates for the 10 member states of the Association of Southeast Asian Nations (ASEAN) – Brunei, Cambodia, Indonesia, Laos, Malaysia, Myanmar, the Philippines, Singapore, Thailand and Vietnam.

This article is an excerpt from the November and December issue of Asia Briefing Magazine, title “The 2014 Asia Tax Comparator.” In this issue of Asia Briefing Magazine, we examine the different tax rates in 13 Asian jurisdictions – the 10 countries of ASEAN, plus China, India and Hong Kong. We examine the on-the-ground tax rates that each of these countries levy, including corporate income tax, individual income tax, indirect tax and withholding tax. We also examine residency triggers, as well as available tax incentives for the foreign investor and important compliance issues.

This article is an excerpt from the November and December issue of Asia Briefing Magazine, title “The 2014 Asia Tax Comparator.” In this issue of Asia Briefing Magazine, we examine the different tax rates in 13 Asian jurisdictions – the 10 countries of ASEAN, plus China, India and Hong Kong. We examine the on-the-ground tax rates that each of these countries levy, including corporate income tax, individual income tax, indirect tax and withholding tax. We also examine residency triggers, as well as available tax incentives for the foreign investor and important compliance issues.

Dezan Shira & Associates is a specialist foreign direct investment practice, providing corporate establishment, business advisory, tax advisory and compliance, accounting, payroll, due diligence and financial review services to multinationals investing in emerging Asia. Since its establishment in 1992, the firm has grown into one of Asia’s most versatile full-service consultancies with operational offices across China, Hong Kong, India, Singapore and Vietnam as well as liaison offices in Italy and the United States.

For further details or to contact the firm, please email asia@dezshira.com, visit www.dezshira.com, or download the company brochure.

You can stay up to date with the latest business and investment trends across Asia by subscribing to Asia Briefing’s complimentary update service featuring news, commentary, guides, and multimedia resources.

- Previous Article New Issue of Asia Briefing: Payroll Processing Across Asia

- Next Article Understanding ASEAN’s Free Trade Agreements