Why Establish a Family Office in Singapore

A family office is typically a private wealth management firm that oversees and manages the financial needs of ultra-high-net-worth families. The family office will not just ‘manage’ the family’s assets but also develop long-term investment strategies that help the family preserve their wealth over generations.

Family offices may take the form of a single-family office—that manages the assets of one family or a multi-family office—that contains the assets on behalf of multiple families.

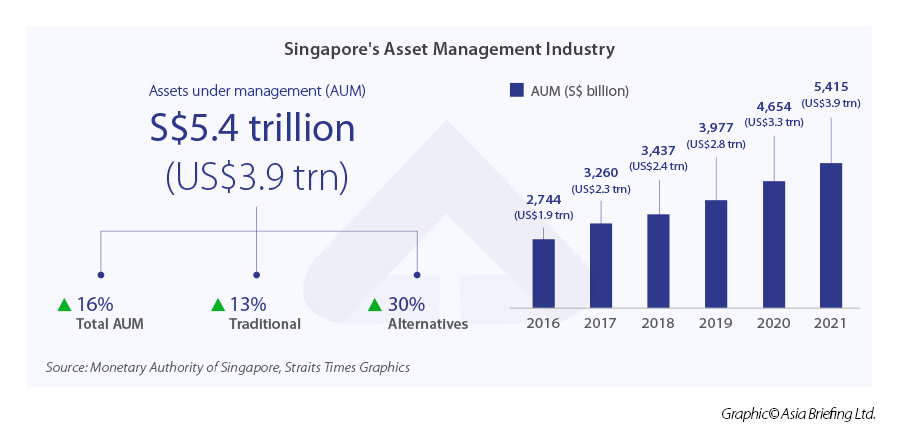

In recent years, Singapore has become a hub for family offices, attracting several renowned ultra-high-net-worth individuals. Among the most notable people to establish a family office in Singapore are Google co-founder Sergey Brin, the former CEO of Fosun International Liang Xinjun, and Chairman of Reliance Industries Mukesh Ambani. A report by KPMG stated that Singapore is home to an estimated 59 percent of family offices located in Asia.According to the Monetary Authority of Singapore, there were 1,500 family offices in Singapore by the end of 2022, managing around S$90 billion (US$66.8 billion) worth of assets. This is just under two percent of the S$5.4 trillion (US$4 trillion) of assets managed in Singapore.

What factors make Singapore an attractive destination to establish a family office?

A stable political and regulatory environment

Singapore is globally renowned as a business-friendly destination that offers a stable socio-political environment, a free market economy, highly efficient infrastructure, and an attractive tax regime.

Singapore’s transparent business, tax, and regulatory environment provides easy online access to the information most businesses require. This significantly simplifies the market research process for international decision-makers during market entry.

A primary advantage of Singapore is its ability to act as a centerpiece for the holding and management of regional assets. Holding companies are a vital component of any international expansion strategy, and Singapore offers investors a stable environment from which to administer operations in more speculative markets in Asia.

The city-state has more than 37,000 international companies and 7,000 multinational companies that utilize Singapore as their regional headquarters. Further, MAS and the Singapore Economic Development Board (RDB) formed the Family Office Development Team (FODT) in 2019 to enhance and lead initiatives that strengthen the country’s standing as a hub for family offices.

Targeted support

Singapore provides support to family offices through targeted tax incentives. These are covered under three schemes:

- Onshore fund tax exemption scheme section 130;

- Offshore fund tax exemption scheme section 13D; and

- Enhanced tier tax incentive scheme section 13U.

These schemes would allow for most of the investment profits managed by a family office to be exempted from income tax. However, each scheme has its own eligibility requirements.

Strong trade and tax networks

Despite regional players maintaining strong free trade agreement (FTA) networks, they are not as extensive as Singapore’s. Due to these factors, the country will continue to be the default location for businesses seeking to expand into Southeast Asia and neighboring regions. There are two types of FTAs: bilateral (agreements between Singapore and a single trading partner) and regional (signed between Singapore and a group of trading partners).

The country’s 14 bilateral and 13 regional FTAs include some of the largest combined trade agreements in the ASEAN-China, ASEAN-India, and ASEAN-Hong Kong trade blocs—providing Singapore-based businesses with access to preferential markets, free or reduced import tariffs, as well as enhanced intellectual property regulations.

In addition, Singapore has one of the world’s most extensive double taxation avoidance (DTA) networks, attracting international businesses from a multitude of conventional, technology-based, and niche industries. The country has signed over 90 DTAs, which comprise of three types: comprehensive, limited, and exchange of information arrangements (EOIAs).

Gateway to Southeast Asia and global connectivity

Singapore is located within a six-hour radius of any country in Southeast Asia, a region that is expected to be the world’s fourth-largest economy by 2030.

The country’s main international airport, Changi Airport, serves more than 100 airlines flying to over 400 cities in 100 countries. The airport is designed to handle some 85 million passengers annually and a new Terminal 5 development will add capacity by 50 million passengers.

Further, the Port of Singapore is strategically located at the crossroads of East-West trade channels and is connected to 600 ports in over 120 countries. It also handles over 37.2 million twenty-foot equivalent units (TEUs) of containers and 626.2 million tons of cargo annually, making it one of the world’s busiest.But there are also softer factors that make Singapore ideal for family offices. Singaporeans share various cultural and linguistic connections with ASEAN members, while English is the main working language. The country’s highly skilled labor force is equipped to act as intermediaries for investments in Asia while maintaining the capacity to communicate with investors from abroad.

Singapore vs Hong Kong: Choosing the ideal location for family offices

Hong Kong has over 400 family offices with plans to increase this by 200 over the next few years and the city also announced new tax incentives that exempt family offices from paying the 16.5 percent tax on profits on transactions, such as forex, futures, securities, and a number of other investment vehicles.

In response, Singapore also introduced new incentives that include expanding tax incentives to investments in non-listed companies in Singapore and tax incentives for family offices that invest in philanthropic activities or in climate-related projects.

However, Singapore has seen an increasing number of affluent Chinese setting up family offices in the city-state with many looking to diversify their exposure to the potential headwinds of Beijing’s increasing influence in Hong Kong. Many high-net-worth individuals are also starting to manage their family wealth outside of China for the first time.

Singapore and Hong Kong will continue to battle over which jurisdiction is the best at attracting affluent families with the winner set to determine the future central hub for private wealth management in Asia. This makes it a crucial area to watch for investors and businesses seeking to enter the region’s wealth management sector.

About Us

ASEAN Briefing is produced by Dezan Shira & Associates. The firm assists foreign investors throughout Asia and maintains offices throughout ASEAN, including in Singapore, Hanoi, Ho Chi Minh City, and Da Nang in Vietnam, in addition to Jakarta, in Indonesia. We also have partner firms in Malaysia, the Philippines, and Thailand as well as our practices in China and India. Please contact us at asean@dezshira.com or visit our website at www.dezshira.com.