US Exempts Tariffs on Vietnamese Solar Panels for Two Years

The US government recently approved a 24-month tariff exemption for solar panels from four Southeast Asian countries: Vietnam, Cambodia, Malaysia, and Thailand to meet national renewable electricity demand. Vietnam Briefing looks at the opportunities and how Vietnam’s solar panel manufacturing is likely to benefit in the long term.

On June 6, 2022, the US announced a tariff exemption for solar panels from Vietnam along with Cambodia, Malaysia, and Thailand for up to 24 months to meet the skyrocketing solar energy demand in the US.

The transition to renewable energy is a priority for the US as it strives to transform into a sustainable and green economy. However, the shortage of domestic manufacturing capacity has led the US to mass import solar panels from Vietnam – a trusted partner in trade.

While experts had anticipated that further tariff expansion on Asian countries would be the case after the US announced an extended tariff for China’s solar panels in 2011, the exemption of tariff for the four Southeast Asian countries was not expected.Here, we examine the current situation of solar panel manufacturing in Vietnam and how it can serve the US electricity market.

Vietnam’s solar panel manufacturing industry

The solar panel manufacturing industry in Vietnam is growing for both foreign and domestic firms specializing in manufacturing photovoltaic cells and modules. The competition is especially fierce, given that there are mostly foreign-owned companies, including China and the US, with only one Vietnamese firm.

First Solar is a US-based firm and the leading performer of solar panel production in Vietnam, with an annual production capacity of up to 2.7 GW, far exceeding all other players. First Solar is committed to a long-term partnership with the Vietnamese industry, as it has invested a total capital investment of US$830 million out of the US$1.2 billion committed capital investment.

The majority of other firms are either owned or invested by prominent Chinese conglomerates. That is, both Trina Solar Vietnam and JA Solar receive 100 percent investment from China’s TrinaSolar group and JA Solar group, respectively. The two firms combined currently make up a large portion of Vietnam’s solar panel supply.

The only Vietnamese firm in the industry, IREX is a subsidiary of SolarBK. This is the only local firm known to manufacture solar panels, with a market share of just 1 percent.

Vietnam is slowly positioning itself on the global market as a leading exporter of solar panels, exporting to 50+ countries worldwide and making up a considerable share of the world’s electricity supply pie. Vietnam’s current export of solar panels as of 2020 is as follows:

|

Country/Region |

Export value (US$) |

|

US |

3.4 billion |

|

Canada |

91 million |

|

EU |

57.8 million |

|

Turkey |

19.5 million |

|

UK |

17.2 million |

|

Japan |

15.6 million |

|

Australia |

1.5 million |

US electricity consumption and supply

Electricity consumption in the US has been at an all-time high for the past several years, ranging from 3,800 to 4000 terawatt-hours.

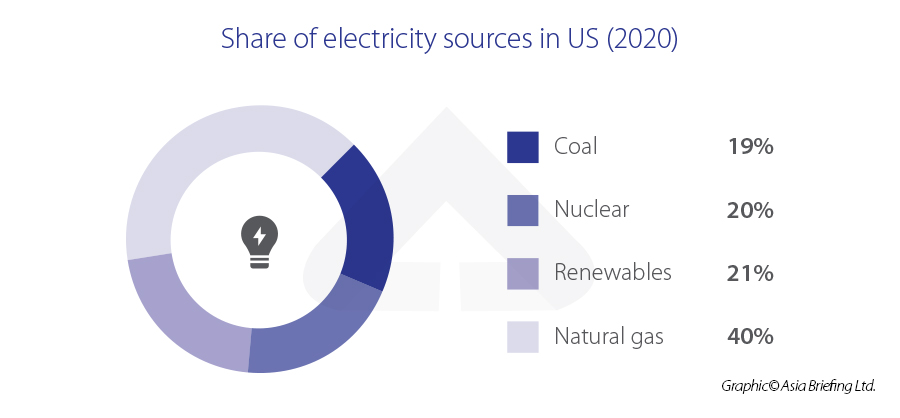

The US’ electricity needs have been met by a combination of different sources, including coal, natural gas, renewable sources, and nuclear power. The market share of the sources can be seen in the below infographic.

Natural gas still boasts the number one position as the leading generator of electricity in the US, claiming 40 percent, while renewables, coal, and nuclear power share relatively equal proportions at 21 percent, 19 percent, and 20 percent respectively.

It can be assumed that renewable energy utilization in the US is on the rise, up 9 percent compared to 2019, and projected to claim a further 10 percent by 2025, overtaking natural gas as the dominant source of electricity.

The pattern has indicated an immense potential for solar panel export to the US as the country shifts its focus to renewable energy.

Tariff exemption for Vietnam’s solar panels: What does it mean for businesses?

Vietnam has been a prominent exporter of solar panels to the US for the past couple of years, claiming over US$3.4 billion in export value in the industry as of 2020. Today, the US is the biggest export market for Vietnam while the latter is the former’s 10th supplier of import goods. The top Vietnam export category is electrical machinery, generating US$27 billion in 2020 and US$ 36 billion in 2021, which includes the export of photovoltaic panels.

Data shows that in Q3 2021, solar panel module imports of the US fell sharply by 27 compared to Q2, due to the consequences of US tariffs on solar panels from China.

A drastic fall in photovoltaic panel imports due to tariff expansion in parallel with post-pandemic supply chain disruption and difficulties in global shipping has left the US deficit in solar cell supply, which has been leveraged as a call for emergency measures by US President Joe Biden who invoked the Defense Production Act after complaints from industry groups of supply chain issues hampering the solar panel industry.

The tariff exemption for solar panels from Vietnam and three other Southeast Asian countries comes as an ideal push for solar manufacturers in these countries and will help ramp up production to meet domestic solar panel production demand.

The exemption indicates the promising prospects of investing in manufacturing solar panels in Vietnam. Vietnam offers immeasurable opportunities for developing photovoltaic production, with an increasing number of economic zones and industrial parks on the rise, making Vietnam an attractive China+1 destination. Meanwhile, the US tariff exemption of the commodity means businesses in the industry are bound to multiply their profits while the costs remain unchanged.

However, the Vietnam Trade Remedies Authority advised businesses to stay cautious when it comes to the anti-circumvention investigation by the US. It’s reported that the US is still conducting further investigation into whether the four Southeast Asian nations are practicing circumvention on anti-dumping and tariff-countervailing on solar panels from China.Although there has yet to be any official statement from the US on the issue, it is advisable for investors and manufacturers to take advantage of the 24-month tariff exemption to elevate their business while looking to diversify their markets to avoid dependence on the US.

Further, businesses should ensure their products comply with rules or origin guidelines to be eligible for exports to the US. That is, the manufacturing of solar panel components and modules must be manufactured in Vietnam to ensure the origin of the finished products.

Tax exemption expiration: What to expect?

Following the next 24 months, the concern is on whether the US will lift the exemption. Experts have held the view that should the domestic solar panel industry in the US fail to scale up, either tariff exemption or reduced tariff may be implemented to meet the country’s renewable energy demand.

However, as the future of renewable energy is promising and countries are uniformly shifting their focus to a green and sustainable economy, the demand for solar panels is likely to remain intact in the long term. Should the US no longer provide tariff support, investors may seek to diversify their markets due to growing demand. As of now, Vietnam is exporting solar panels to well over 50 countries, and this list is likely to grow.

For further insights on how to enter the solar panel market or actively manage the current operation for greater efficiency, investors can contact our experts for an in-depth discussion.

About Us

ASEAN Briefing is produced by Dezan Shira & Associates. The firm assists foreign investors throughout Asia and maintains offices throughout ASEAN, including in Singapore, Hanoi, Ho Chi Minh City, and Da Nang in Vietnam, Munich, and Essen in Germany, Boston, and Salt Lake City in the United States, Milan, Conegliano, and Udine in Italy, in addition to Jakarta, and Batam in Indonesia. We also have partner firms in Malaysia, Bangladesh, the Philippines, and Thailand as well as our practices in China and India. Please contact us at asia@dezshira.com or visit our website at www.dezshira.com.