Southeast Asia’s First EV Battery Plant Begins Operations in Indonesia

Indonesia has launched Southeast Asia’s first electric vehicle battery plant located in the province of West Java. The plant will have an estimated annual capacity of 10 gigawatt hours (GWh) of batter cells, sufficient to power 150,000 electric vehicles.

The plant, a result of a $1 billion investment by a consortium comprising Hyundai Motor Group, LG Energy Solution, and the Indonesia Battery Corporation, highlights the collaborative efforts needed to spearhead such transformative projects. The battery plant will also be integrated with Hyundai’s auto factory, which will produce 50,000 units per year of the Kona Electric vehicle

The consortium has plans to increase the plant’s capacity to 20 GWh with investments of US$2 billion.

Indonesia’s strategic EV battery ambitions

For Indonesia, the development of this EV plant is part of the country’s strategy of being one of the top three producers of EV batteries in the world by 2027. Moreover, Indonesia aims to have a capacity of 140 GWh per year by 2030, which will account for between 4 to 9 percent of global demand.

The goal to reach an annual capacity of 140 GWh is indicative of the country’s forward-thinking strategy and its determination to play a crucial role in the future of electric mobility.Indonesia’s nickel reserves

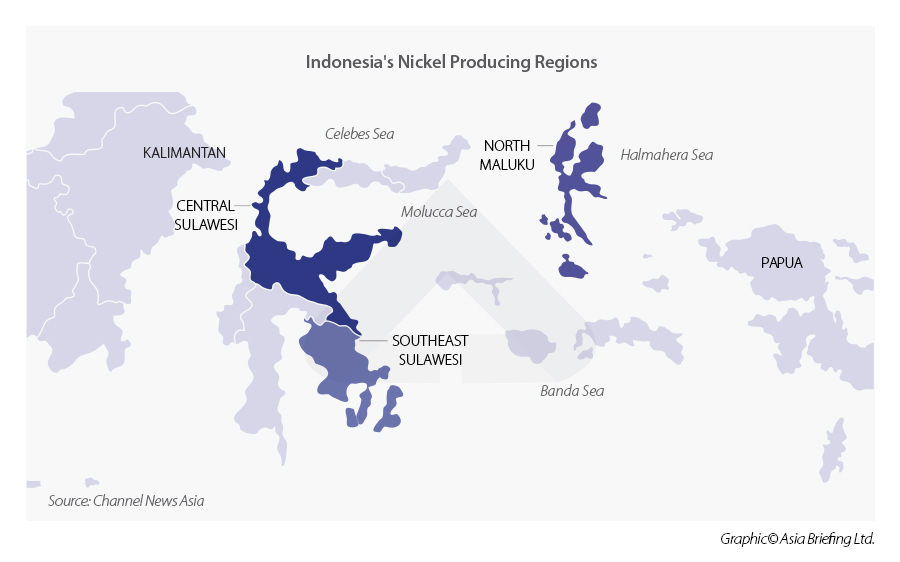

Indonesia holds the world’s largest nickel reserves with an estimated 21 million tons, accounting for 22 percent of global reserves. Although 70 percent of all nickel usage goes towards the stainless-steel sector, there is increasing demand for the manufacture of EV batteries.

According to the S&P Global Market Intelligence data, Indonesia produced 40 percent of the world’s nickel in 2023.

The country banned the export of nickel ores in 2014 and introduced a requirement for producers to purify the raw nickel in Indonesia before export.

Indonesia nickel

Building a comprehensive EV supply chain

Global EV makers, which include China’s BYD and Wuling, have invested in Indonesia and their EVs are already in the market. Moreover, the country is also developing lithium refineries and anode material production facilities to complement its nickel-based battery industry. Historically, Indonesian nickel smelters are equipped to produce Class 2 nickel (ferronickel/pig iron) while battery cathode production requires Class 1 nickel that contains at least 99.8 percent nickel. However, Indonesia lacks rich deposits of lithium. Australia supplies approximately half the world’s lithium and can export this mineral to Indonesia. Most of Australia’s lithium exports currently head to China.

About Us

ASEAN Briefing is produced by Dezan Shira & Associates. The firm assists foreign investors throughout Asia and maintains offices throughout ASEAN, including in Singapore, Hanoi, Ho Chi Minh City, and Da Nang in Vietnam, in addition to Jakarta, in Indonesia. We also have partner firms in Malaysia, the Philippines, and Thailand as well as our practices in China and India. Please contact us at asean@dezshira.com or visit our website at www.dezshira.com.