Indonesia’s Electric Battery Industrial Strategy

Indonesia’s ambitious targets in the electric battery industry offer a prime opportunity for strategic investments and partnerships. Foreign stakeholders are advised to adopt a comprehensive approach that includes regulatory compliance, sustainable practices, and market differentiation, to stay ahead of the curve.

Indonesia is developing an integrated electric vehicle (EV) supply chain and aims to become one of the world’s top three producers of EV batteries by 2027. The country is seeking to take advantage of natural resource abundance, particularly nickel, to create a domestic EV market. Further, Indonesia aims to produce EV batteries with a total capacity of 140GWh per year by 2030, which will account for between 4 to 9 percent of global demand.

Indonesia is ambitiously charting its course within the EV industry, aiming to achieve 2.5 million EV users by 2025.

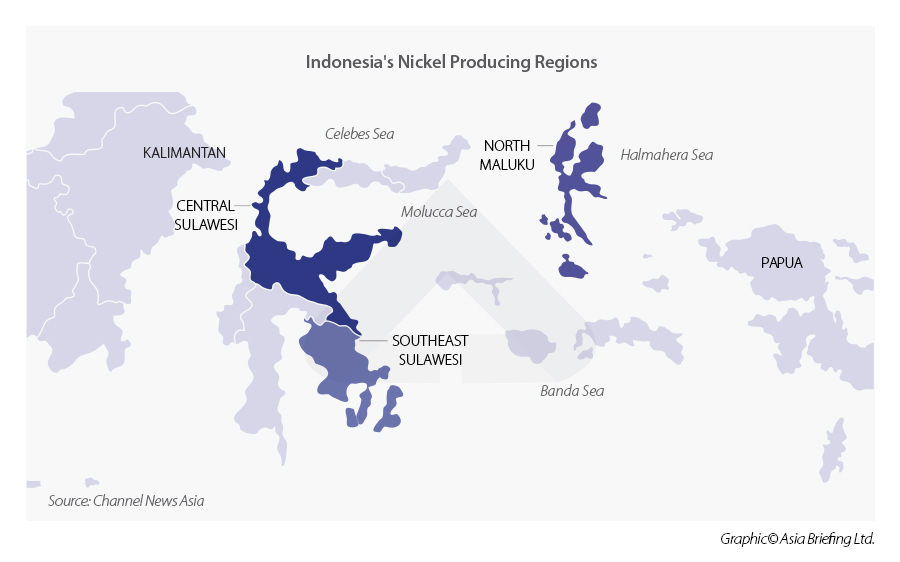

Indonesia’s nickel reserves

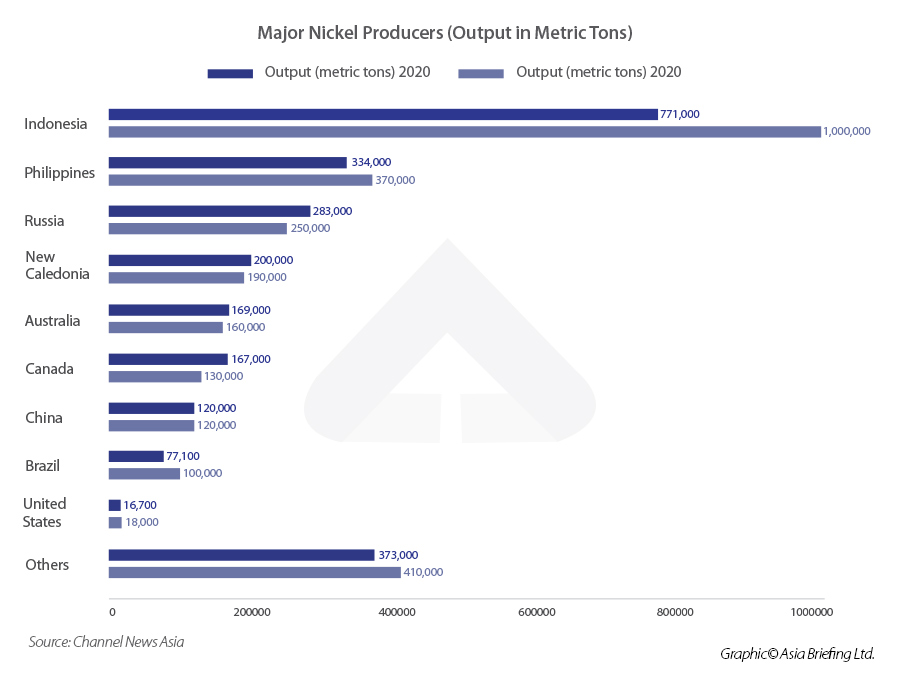

Indonesia holds the world’s largest nickel reserves with an estimated 21 million tons, which roughly accounts for 22 percent of global reserves. The country is also the world’s top producer of the metal, with production hitting 1 million tons in 2021.

Although 70 percent of all nickel usage goes towards the stainless-steel sector, there is increasing demand for the manufacture of EV batteries. This demand for battery production is expected to account for one-third of total nickel demand by 2030, particularly as countries worldwide look to lower carbon emissions and meet their net-zero targets. As such, Indonesia is aware of the huge economic opportunities this provides and is focused on increasing production capacities along the EV supply chain and becoming an EV battery production hub.

Indonesia’s nickel ban

Indonesia first imposed the ban on the export of nickel ores in 2014 and introduced a requirement

for producers to purify the raw nickel in Indonesia before export. Following a budget deficit in 2016 and a reduction in nickel production, the government partially relaxed the ban in 2017 with plans to reimpose it in 2022. At the time, Indonesia had constructed nine new nickel smelters. Eventually, the government brought the ban forward to January 2020.

a huge jump from just two in 2016. Indonesia’s exports of processed nickel reached an estimated US$30 billion in 2022, a huge increase from just US$1 billion in 2015. The country is expected to account for half the world’s increase in nickel production by 2025.

Electric vehicle batteries supply chain

Global EV makers, which include US’s Tesla and China’s BYD, are said to be finalizing deals to invest in Indonesia. Moreover, to complement its nickel-based battery industry, the country is also developing lithium refineries and anode material production facilities. Historically, Indonesian nickel smelters are equipped to produce Class 2 nickel (ferronickel/pig iron) while battery cathode production requires Class 1 nickel that contains at least 99.8 percent nickel. However, Indonesia lacks rich deposits of lithium.

Australia supplies approximately half the world’s lithium and can export this mineral to Indonesia.

Most of Australia’s lithium exports currently head to China.

Indonesia’s Minister for Maritime Affairs and Investment, Luhut Binsar Pandjaitan, stated that the government planned to import 60,000 tons of lithium from Australia starting in 2024. The lithium will be processed at the Morowali Industrial Park in Morowali, Central Sulawesi province, where the government inaugurated a hydrometallurgical nickel laterite production facility in October 2022. The plant has the capacity to produce 50,000 tons of pure nickel annually.

2023

• Indonesian company Aneka Tambang and Hong Kong CBL Limited sign a conditional share purchase agreement for the partial ownership of Aneka’s nickel mine in North Maluku province.

• German company BASF, French mining group Eramet, and auto producer Volkswagen have stated that they will invest in Indonesia’s EV ecosystem.

• BASF plans to invest US$2.6 billion to develop a car battery plant in North Maluku province.

• Indonesia will grant incentives to EV makers that plan to open EV plants – based on their imports

of completely built-up EVs until 2025. As such, the new rules will remove import duties and luxury goods tax on EV vehicles brought into the country.

2024

• Chinese EV producer BYD plans to build a production facility in Indonesia in 2024. The company also launched three car models in the Indonesian market.

• BYD’s investment is expected to reach US$1.5 billion with a production capacity of 150,000 units per year.

• Hyundai and LG’s joint venture to build a lithium battery plant in Indonesia is expected to begin

production in 2024. The plant is expected to have a production capacity of 10 GWh of battery cells.

• Chinese EV producer Neta, will begin production of completely knocked-down (CKD) EV cars in Indonesia in 2024.

• Vietnamese EV maker, VinFast, announced that it would invest US$1.2 billion to build an EV manufacturing facility in Indonesia.

• Vale Indonesia and China’s Zhejiang Huayou Cobalt sign an agreement with Ford Motor to build a hydroxide precipitate (MHP) plant in Southeast Sulawesi province. The plant will have a capacity to produce 120,000 tons of hydroxide precipitate. Vale Indonesia and Zhejiang Huayou Cobalt have also agreed to build a second MHP plant with a 60,000-ton capacity.

Webinar – Doing Business in Indonesia 2024: Elections, Industry Trends & Capital City Relocation

Live Session for Asia: March 27, 2024

10 AM Brussels / 4 PM Jakarta / 5 PM China

Rebroadcast for North America: March 27, 2024

9 AM Los Angeles / 12 PM New York / 6 PM Brussels

Join us for a recap of Indonesia’s economic performance in 2023, key industry trends in 2024, implications of the 2024 general election results for businesses and updates, and Indonesia’s new capital city, Nusantara.

This webinar is FREE of charge.

Register now for Indonesia’s Live Session

Register now for North America’s Rebroadcast

About Us

ASEAN Briefing is produced by Dezan Shira & Associates. The firm assists foreign investors throughout Asia and maintains offices throughout ASEAN, including in Singapore, Hanoi, Ho Chi Minh City, and Da Nang in Vietnam, in addition to Jakarta, in Indonesia. We also have partner firms in Malaysia, the Philippines, and Thailand as well as our practices in China and India. Please contact us at asean@dezshira.com or visit our website at www.dezshira.com.