Rooting Out Slave Labor: An Introduction to Sustainable Manufacturing in ASEAN

By: Maxfield Brown & Aysha Nesbitt

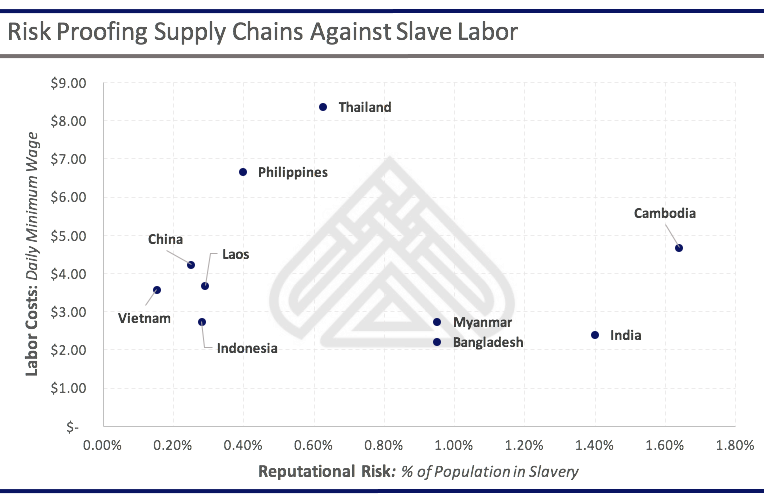

Though more companies than ever are making strides to manage and improve the image of their operations, the constant appetite for cost reduction exposes supply chains to the reputational risk of worker exploitation. With some of the world’s most cost competitive hubs, ASEAN and its regional competitors offer a diverse array of labor conditions. Investors choosing ASEAN as a means of gaining an edge over competitors must therefore be cautious of where they choose to commit capital and the characteristics of the markets in which these investments are made.

Of the nearly 21 million people in the world today trapped under forced labor, 56 percent reside in the Asia-Pacific Region. Forced labor refers to any work people are forced to do against their will, including bonded labor, child labor, and all slave practices. Today it is tied closely to construction, manufacturing and agriculture, with 68 percent of forced laborers working in these industries.

For investors in at risk industries seeking to expand into ASEAN and its surrounding competitors, understanding the factors that drive exploitation and creating investment strategies to avoid these risks can provide significant mitigation against future losses. Furthermore, given effective due diligence, the implementation of these strategies can come at a minimal up-front cost.

RELATED: Pre Investment and Market Entry Advisory from Dezan Shira & Associates

RELATED: Pre Investment and Market Entry Advisory from Dezan Shira & Associates

Drivers of Exploitation

Countries at a high risk for exploitative labor practices share a number of similarities. While all countries targeted for low cost production are still developing and employ low wages, those found to have higher decrees of corruption often permit practices that would be considered illegal even by local standards. Without strong government regulation, the prevalence of informal sector employment in developing economies perpetuates these risks and makes the monitoring of operations increasingly difficult.

Another contributing factor to high rates of exploitation is subcontracting. Subcontracting is a common supply chain strategy, yet it is known to contribute to non-transparent working conditions. While the use of third party producers may absolve investors of liability depending on the country in which they invest, increased transparency brought about by social networks can present a serious reputational risk for firms choosing to invest in at risk countries. Heightened levels of subcontracting and corruption within emerging markets has led to notable cases where investors have invested with strict contracts and the best intentions, only to be caught off guard as their partners chose to disregard existing labor law.

High Risk Destination: Bangladesh

Businesses seeking opportunities in countries like Bangladesh, which sets its minimum wage at among the world’s lowest, should be aware that savings achieved within these jurisdictions come with a hefty price. Over one percent of Bangladesh’s population operates under forced labor, which is significantly higher than alternative low cost destinations such as Vietnam, China, or Indonesia.

As mentioned above, the root of this problem stems from systemic conditions that prevail throughout the country. The first of these is a disproportionate level of corruption. According to the Corruption Perceptions Index, which measures how corruption is perceived to exist among officials, Bangladesh ranks 25th. As a result, it can prove difficult to enforce and monitor forced labor clauses within contracts.

In addition to rampant corruption, Bangladesh currently does not employ serious limitations on subcontracting. Even the most conscientious investors may therefore see multiple layers of subcontracts within their supply chains. Given heightened levels of corruption, it may not be possible to prevent even areas of subcontracting that are currently limited by governmental regulation.

RELATED: Singapore & Australia Announce FTA Upgrades

RELATED: Singapore & Australia Announce FTA Upgrades

Low Risk Opportunities: Vietnam & Indonesia

In stark contrast to Bangladesh, both Vietnam and Indonesia present investors with low cost options which also ensure better treatment of workers. With some of the lowest percentages of their populations in forced labor, Vietnam and Indonesia are even safer bets when compared to relatively more expensive markets such as Thailand and the Philippines. In fact, Vietnam’s prevalence of exploitation is so low that it even beats out developed economies such as Italy and South Korea.

Much of this has to do with comparatively lower rates of corruption found within these markets as well as their steadier application of subcontracting regulations. Vietnam for instances, places 117th in its corruption perception ranking, contrasting heavily with Bangladesh’s previously stated ranking of 25th.

Vietnam’s labor code also strictly states that the primary employer and an employee must directly enter into a labor contract. Though generally most employer-employee contracts ban unauthorized subcontracting, it is important to understand that the practice can still occur. It is therefore of utmost importance to thoroughly vet production locations and partners to ensure their credibility and track record with regard to labor exploitation.

Risk Proofing Supply Chains

In pursuit of low wage opportunities, companies that opt for investment in Vietnam and China will be much better protected against potential lawsuits and reputational risks in their home markets. However, with the costs of wages, prevalence of corruption, and existing governmental policy differing significantly between each market, the attractiveness of differing locations will likely be determined by the resources and risk appetite of a given firm.

To better understand individual exposure and to develop the capacity to implement mitigation strategies effectively, companies must be familiar with the legal environment in ASEAN and South Asia regarding both written and enforced regulation. Through this understanding, companies will be better positioned to identify optimal markets to invest in which to invest. Dezan Shira & Associates is a foreign direct investment firm that provides legal, tax and advisory services to multinationals interested in investing in Asia. As such, Dezan Shira & Associates can assist companies in finding an optimal markets and vetting potential production locations and local partners. For a free consultation, please get in contact with our business intelligence and market entry specialist at ASEAN@Dezshira.com

|

Asia Briefing Ltd. is a subsidiary of Dezan Shira & Associates. Dezan Shira is a specialist foreign direct investment practice, providing corporate establishment, business advisory, tax advisory and compliance, accounting, payroll, due diligence and financial review services to multinationals investing in China, Hong Kong, India, Vietnam, Singapore and the rest of ASEAN. For further information, please email asean@dezshira.com or visit www.dezshira.com. Stay up to date with the latest business and investment trends in Asia by subscribing to our complimentary update service featuring news, commentary and regulatory insight. |

Annual Audit and Compliance in ASEAN

For the first issue of our ASEAN Briefing Magazine, we look at the different audit and compliance regulations of five of the main economies in ASEAN. We firstly focus on the accounting standards, filing processes, and requirements for Indonesia, Malaysia, Thailand and the Philippines. We then provide similar information on Singapore, and offer a closer examination of the city-state’s generous audit exemptions for small-and-medium sized enterprises.

The Trans-Pacific Partnership and its Impact on Asian Markets

The Trans-Pacific Partnership and its Impact on Asian Markets

The United States backed Trans-Pacific Partnership Agreement (TPP) includes six Asian economies – Australia, Brunei, Japan, Malaysia, Singapore and Vietnam, while Indonesia has expressed a keen willingness to join. However, the agreement’s potential impact will affect many others, not least of all China. In this issue of Asia Briefing magazine, we examine where the TPP agreement stands right now, look at the potential impact of the participating nations, as well as examine how it will affect Asian economies that have not been included.

An Introduction to Tax Treaties Throughout Asia

An Introduction to Tax Treaties Throughout Asia

In this issue of Asia Briefing Magazine, we take a look at the various types of trade and tax treaties that exist between Asian nations. These include bilateral investment treaties, double tax treaties and free trade agreements – all of which directly affect businesses operating in Asia.