Singapore – Australia Announce Updates to Existing FTA

By: Andrew Kaung

By: Andrew Kaung

The Singapore-Australia relationship was recently strengthened by the joint announcement of a Comprehensive Strategic Partnership on 6 May 2016. The partnership is based on the third review of the 2003 Singapore-Australia Free Trade Agreement (SAFTA), aimed at addressing current business needs of the two economies and furthering integration.

The third review will address education, science and innovation, labor mobility, and defense collaboration between the two countries. Importantly, the agreement will also cover the partnership between Singapore and Northern Australia on agribusiness and encourage Singaporean and Australian companies to work on securing reliable supply chains in the agribusiness sectors. The most significant upgrade of the agreement is the facilitation of government procurement contracts through the reduction of red tape.

On the whole, the Comprehensive Strategic Partnership is thought to pave the way for business opportunities in both countries. For a detailed look at the history of the Australia-Singapore Free Trade Agreement please click here

RELATED: Pre Investment and Market Entry Advisory from Dezan Shira & Associates

RELATED: Pre Investment and Market Entry Advisory from Dezan Shira & Associates

Singapore – Australia Trade

Currently, Singapore is the largest trading partner of Australia in Association of Southeast Asian Nations (ASEAN), and Australia’s fifth largest trading partner in the world. Singapore currently invests more than US $60 billion in Australia, making it the nation’s fifth largest foreign investor. In 2015, bilateral merchandise trade between Singapore and Australia amounted to more than US $14 billion. The total goods and services trade between Singapore and Australia amounted to US $30 billion.

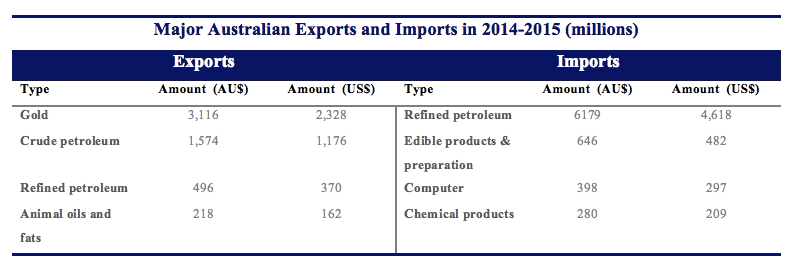

According to the Department of Foreign Affairs and Trade (DFAT), major Australian exports to Singapore in 2015 included gold, crude petroleum, refined petroleum and animal oils and fats, due to the country’s rich mineral resources. On the other hand, Australian imports from Singapore in 2015 were refined petroleum, edible products and preparations, computers and chemical products. The table below shows each export and import type with the respective amount in both Australian and US currencies.

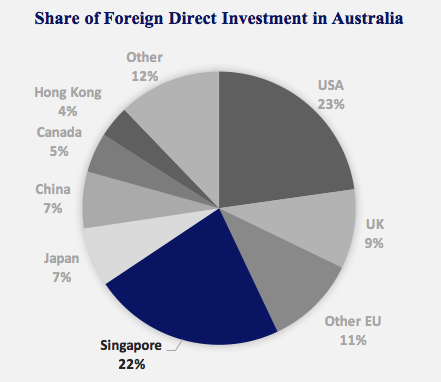

Singapore’s foreign investment in Australia accounted for about US $23.85 billion in 2014. ASEAN countries accounted for 6.1% of total foreign investment in Australia (FIA), or US $24.97 billion in new direct investment. Singapore injected about US $23.85 billion, making it the largest country among ASEAN. The total net inflows of direct FIA were valued at US $43.27 billion – the largest being the United States (US $24 billion), followed by Singapore (US $23.85 billion) and the European Union (US $21.2 billion). The net inflow was increased by US $41.25 billion or 8.7 per cent from 2013.

The annual growth of inbound FIA from ASEAN has slowed down in recent years to around 10 per cent. Although growth is projected to further slow to around 5 per cent per annum, according to the Australia and New Zealand Banking Group, the amount will still be equal to an additional US $50 billion by 2030.

![]() RELATED: Setting Sail in the Sea of Java – An Introduction to Indonesian Aquaculture

RELATED: Setting Sail in the Sea of Java – An Introduction to Indonesian Aquaculture

Opportunities for Investment

This new cooperation package between Australia and Singapore is a substantial first step in a decade-long plan to enhance bilateral links and boost investment. Elements of the agreement will encourage economy growth, and lead to wider integration by forging new business frontiers.

For companies currently managing pan ASEAN operations from Singapore, improving trade ties with the Australian economy provide a unique opportunity for future expansion. Given the recent slump in energy prices and subsequent shocks that have been reverberating throughout the Australian economy, it may well be possible to lock in bargain prices from Australian suppliers. Furthermore, as the TPP comes into force in the next few years, the linkage between Singapore and Australia is only set to become more pronounced.

|

Asia Briefing Ltd. is a subsidiary of Dezan Shira & Associates. Dezan Shira is a specialist foreign direct investment practice, providing corporate establishment, business advisory, tax advisory and compliance, accounting, payroll, due diligence and financial review services to multinationals investing in China, Hong Kong, India, Vietnam, Singapore and the rest of ASEAN. For further information, please email asean@dezshira.com or visit www.dezshira.com. Stay up to date with the latest business and investment trends in Asia by subscribing to our complimentary update service featuring news, commentary and regulatory insight. |

Annual Audit and Compliance in ASEAN

For the first issue of our ASEAN Briefing Magazine, we look at the different audit and compliance regulations of five of the main economies in ASEAN. We firstly focus on the accounting standards, filing processes, and requirements for Indonesia, Malaysia, Thailand and the Philippines. We then provide similar information on Singapore, and offer a closer examination of the city-state’s generous audit exemptions for small-and-medium sized enterprises.

The Trans-Pacific Partnership and its Impact on Asian Markets

The Trans-Pacific Partnership and its Impact on Asian Markets

The United States backed Trans-Pacific Partnership Agreement (TPP) includes six Asian economies – Australia, Brunei, Japan, Malaysia, Singapore and Vietnam, while Indonesia has expressed a keen willingness to join. However, the agreement’s potential impact will affect many others, not least of all China. In this issue of Asia Briefing magazine, we examine where the TPP agreement stands right now, look at the potential impact of the participating nations, as well as examine how it will affect Asian economies that have not been included.

An Introduction to Tax Treaties Throughout Asia

An Introduction to Tax Treaties Throughout Asia

In this issue of Asia Briefing Magazine, we take a look at the various types of trade and tax treaties that exist between Asian nations. These include bilateral investment treaties, double tax treaties and free trade agreements – all of which directly affect businesses operating in Asia.