Singapore’s Social Security Requirements – What a Foreign Employer Should be Aware of

By Dezan Shira & Associates

Editor: Amelia Tsui

Singapore has one of the world’s most transparent and honest retirement systems. Its mandatory social security system, the Central Provident Fund (CPF), strives to provide eligible contributors with a safe and secure retirement. The system is quite complex, and there are many different schemes and policies to be aware of. Foreigners living in Singapore, as either business owners or members of the workforce, should be aware of mandatory contributions to the CPF and what they can use the funds for.

How Foreigners are Impacted

This social security system is not only reserved for Singaporeans – foreigners working in the city-state can be impacted in a number of ways. If the foreigner is a business owner, they must contribute to all eligible employees’ retirement funds. If the foreigner is a permanent resident working in Singapore, they must contribute to their own social security fund. Any permanent resident or Singaporean citizen working abroad, however, is not required to contribute to the CPF.

Business Owners

The employer is required to contribute for both the employer and employee each month, and is entitled to hold back the employee share from their wages. All contributions to the employee’s fund are to be made before the 14th day after the end of the month, when wages are due. If that day falls on a public holiday or weekend, the contribution must be made the next working day.

RELATED: Dezan Shira & Associates’ Payroll and Human Resources Services

RELATED: Dezan Shira & Associates’ Payroll and Human Resources Services

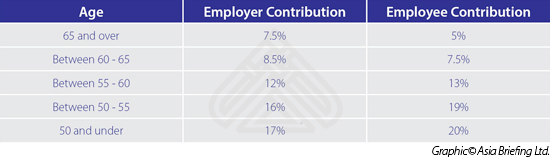

Permanent Residents

Permanent residents working in Singapore and their employers are required to contribute to the CPF. The mandatory contribution amount varies depending on the contributor’s age. First and second year permanent residents contribute at a lower rate, but can apply jointly with their employer to contribute at full rates. A foreigner in or past their third year as a permanent resident and their employer must contribute normally.

How Contributions are Made and Used

Once the contributions are made, the money is separated and distributed into three different CPF Accounts: 1) Ordinary Account, 2) Special Account, and 3) Medisave Account.

For contributions made to employees in the private sector who make at least S$750 a month, the following rates apply dependent on age:

Ordinary Account

The ordinary account can be used for different government schemes. For example, someone can purchase property with the savings under either the Public Housing Scheme or the Residential Properties Scheme. Another available scheme is the CPF Investment Scheme, which allows individuals to invest their ordinary account in insurance, bonds, and other investment vehicles.

Special Account

Special accounts are generally reserved for old age and retirement related expenditures. Schemes, such as the CPF Investment Scheme, are also available for Special Account investment.

Medisave Account

As the name suggests, the Medisave is used for medical procedures and medical insurance. Medisave is not reserved for the plan’s contributor, and can also be used for their immediate family members (spouse, child, parent, etc.). Similarly, if one does not have enough in their Medisave account, they may make payments using funds from a family member’s account.

Once a CPF member reaches the age of 55, a Retirement Account is automatically created for them. This account must hold a statutory Minimum Sum, which is to be used solely for the purpose of retirement. Money is taken from both the Ordinary Account and the Special Account to fund this.

RELATED: Applying for Permanent Residency in Singapore – What a Foreigner Needs to Know

RELATED: Applying for Permanent Residency in Singapore – What a Foreigner Needs to Know

Conclusion

As money is contributed to the fund, it sits there and earns interest. The interest rates are reviewed quarterly, and according to the CPF website, Ordinary Account interest rates reach up to 3.5 percent p.a. Special and Medisave Account and Retirement Account interest rates reach up to 5 percent as of this year.

In addition to helping the contributor save for retirement, contributing to CPF also gives them the opportunity to deduct the contributed amount from their salary when filing taxes. Similar to the social security policies in other countries, money in the Fund is locked away till the contributor turns 55. However, there are exceptions. The money can be withdrawn for special events such as buying real estate, medical emergencies, and education, as mentioned in the schemes above. If a permanent resident decides they wish to remove their status, they may apply to have the money withdrawn.

The social security system in Singapore has a variety of other schemes and opportunities for CPF members to contribute additional money. For more information, contact the Dezan Shira & Associates professionals in Singapore.

|

Asia Briefing Ltd. is a subsidiary of Dezan Shira & Associates. Dezan Shira is a specialist foreign direct investment practice, providing corporate establishment, business advisory, tax advisory and compliance, accounting, payroll, due diligence and financial review services to multinationals investing in China, Hong Kong, India, Vietnam, Singapore and the rest of ASEAN. For further information, please email asean@dezshira.com or visit www.dezshira.com. Stay up to date with the latest business and investment trends in Asia by subscribing to our complimentary update service featuring news, commentary and regulatory insight. |

The Asia Sourcing Guide 2015

The Asia Sourcing Guide 2015

In this issue of Asia Briefing, we explain how and why the Asian sourcing market is changing, compare wage overheads, and look at where certain types of products are being manufactured and exported. We discuss the impact of ASEAN’s Free Trade Agreements with China and India, and highlight the options available for establishing a sourcing and quality control model in three locations: Vietnam, China, and India. Finally, we examine the differences in quality control in each of these markets.

The 2015 Asia Tax Comparator

In this issue, we compare and contrast the most relevant tax laws applicable for businesses with a presence in Asia. We analyze the different tax rates of 13 jurisdictions in the region, including India, China, Hong Kong, and the 10 member states of ASEAN. We also take a look at some of the most important compliance issues that businesses should be aware of, and conclude by discussing some of the most important tax and finance concerns companies will face when entering Asia.

The Gateway to ASEAN: Singapore Holding Companies

The Gateway to ASEAN: Singapore Holding Companies

In this issue of Asia Briefing Magazine, we highlight and explore Singapore’s position as a holding company location for outbound investment, most notably for companies seeking to enter ASEAN and other emerging markets in Asia. We explore the numerous FTAs, DTAs and tax incentive programs that make Singapore the preeminent destination for holding companies in Southeast Asia, in addition to the requirements and procedures foreign investors must follow to establish and incorporate a holding company.