Singapore’s Resilience Package: Support for Businesses and Jobs in 2021

- Singapore’s government issued the COVID-19 Resilience Package as part of its 2021 national budget announcement on February 16, 2020.

- Valued at S$11 billion (US$8.3 billion), the package extends existing schemes to help businesses and workers – from providing subsidized wages to supporting specific industries.

- The government is expected to draw S$53.7 billion (US$40.6 billion) from its reserves for 2021 as it looks to recover from the economic impact of the pandemic.

On February 16, 2021, Singapore’s government announced its 2021 national budget where it allocated S$11 billion (US$8.3 billion) for a new fiscal package, named the COVID-19 Resilience Package, which extends existing schemes to help businesses and save jobs by subsidizing wages of workers, providing access to working capital for businesses, and supporting targeted industries like aviation.

Budget allocation for business support

The Singapore government is expected to draw S$53.7 billion (US$40.6 billion) from its reserves for this year as well as S$24 billion (US$18.1 billion) over the next three years to assist businesses in their transition to a post-pandemic world. Singapore is expected to record a deficit of S$11 billion (US$8.3 billion) in 2021. From this, S$4.8 billion (US$3.6 billion) is earmarked for safe reopening measures, such as free vaccinations, contact tracing, and testing strategies.

The government predicts the economy will grow between four to six percent this year after recording the worst economic recession in the country’s history in 2020. More than S$90 billion last year to soften the economic hit, and without these measures, Singapore’s economy could have shrunk by more than 12 percent.Which schemes have been extended?

Extension of the temporary bridging loan program

The temporary bridging loan program (TBLP) provides working capital for eligible businesses. Until March 31, 2021, eligible enterprises can borrow up to S$5 million (US$3.78 million). This will be lowered to S$3 million (US$2.27 million) for applications from April 1, 2021, to September 30, 2021.

The interest rate is capped at five percent, and until March 31, 2021, the government’s risk share of the loan is 90 percent. This will be lowered to 70 percent for applications from April 1, 2021, to September 30, 2021.

Enterprise financing scheme – trade loan

The enterprise financing scheme – trade loan (EFS-TL) supports a company’s trade financing needs with a maximum loan quantum of S$10 million (US$7.5 million) until September 30, 2021.

The government’s risk-share of loans, however, will be lowered from 90 to 70 percent, starting from April 1, 2021, to September 30, 2021.

Enterprise financing scheme – project loan

The enterprise financing scheme – project loan (EFS-PL) enables Singaporean companies to access financing throughout their various stages of growth. The EFS-PL has been enhanced to support domestic projects for construction companies until March 31, 2022.

The maximum loan quantum for domestic projects is S$30 million (US$22.7 million) and the government’s risk-share of loans is up to 70 percent.

The supportable loan types for overseas projects include:

- The purchase, renovation, or construction of land, buildings, or factories;

- Working capital loan; or

- The hire or purchase of fixed assets, such as machinery or equipment.

The maximum loan quantum for overseas projects is S$50 million (US$37.8 million).

Extension of the JSS program

The second part of the package focuses on support for businesses and workers through the extension of the Jobs Support Scheme (JSS).

JSS was introduced in 2020 to provide wage support for employers to retain their employees during this period of economic uncertainty. The program has also been extended to firms in Tier 1 and 2 sectors to September 2021.

Tier 1 sectors (tourism, aerospace, and aviation) that are currently receiving 50 percent JSS support, will receive 30 percent support for wages from April to June 2021, and 10 percent support for wages paid from July to September 2021.

Tier 2 sectors (arts and entertainment, marine and offshore, retail, and food services) that are currently receiving 30 percent JSS support for wages will receive 10 percent support for wages from April to June 2021.

For firms in other sectors, they will continue to receive 10 percent JSS support for wages until March 2021.

Continuation of the SGUnited jobs and skills package

The government has pledged an additional S$5.4 billion (US$4.08 billion) to extend the SGUnited and skills packages (SGU JS) which have also been extended for 2021.

The SGU JS program was introduced in May 2020 to provide transitional upskilling and employment facilitation support to workers affected by COVID-19. As of December 2020, the program has facilitated nearly 76,000 individuals into jobs, skills training, and traineeships.

The updated components of the SGU JS package are the following programs:

- Jobs growth incentive (JGI);

- SGUnited traineeships;

- SGUnited mid-career pathway program;

- SGUnited mid-career pathways program – Company training; and

- SGUnited skills.

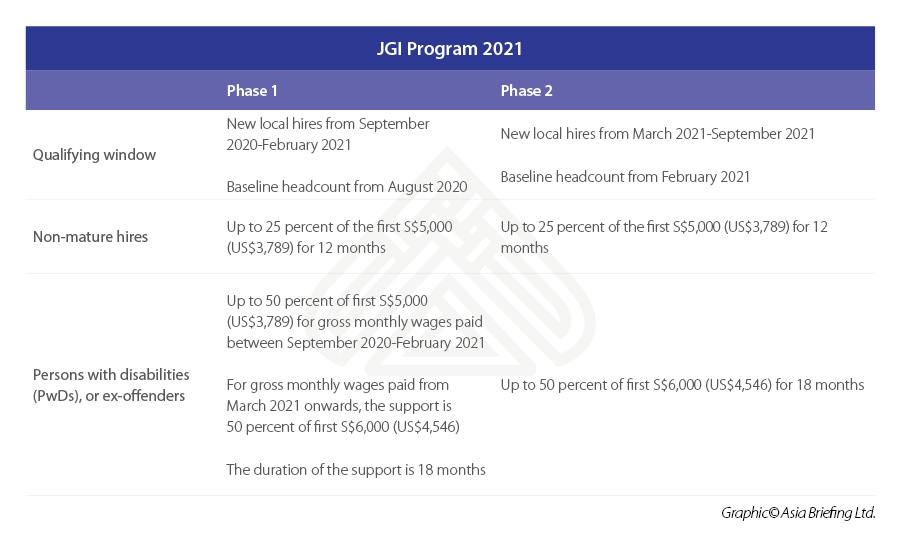

Job growth incentive

The JGI program aims to support employers to expand their local hiring (Singaporean citizens and permanent residents) from September 2020 to September 2021. The JGI will provide up to 12-months of salary support for each ‘non-mature’ local hire (below the age of 40) and 18-months salary support for each mature hire (above the age of 40).

There are two qualifying windows for new local hires:

- Phase 1: September 2020 to February 2021; and

- Phase 2: March 2021 to September 2021.

To be eligible for a JGI, the company must prove that there is an increase in the overall workforce size and an increase in the local workforce size earning more than S$1,400 (US$1,060), compared to the August 2020 local workforce for Phase 1, or February 2021 for Phase 2.

The amount of support available is between 25 to 50 percent of the gross monthly salary, as illustrated in the table below.

SGUnited traineeships

The SGUT program provides recent graduates with the opportunity to gain industry-based work experience. Workforce Singapore, the statutory board under the country’s Ministry of Manpower, will co-fund 80 percent of the training allowance with the remainder being funded by the employer.

The government has extended SGUT until March 2022 to support graduates from the 2021 cohorts, with the following adjustments:

- From April 1, 2021, the stipend for the Institute of Technical Education (ITE) and diploma SGUT positions has been increased from S$1,000-S$1,500 to S$1,600-S$1,800 and from S$1,300-S$1,800 to S$1,700-S$2,100 respectively; and

- The maximum duration for each internship has been reduced from nine to six months starting from April 1, 2021.

SGUnited mid-career pathway program

The SGU-CA program aims to provide mid-career individuals with new industry-based experience to develop their skills and employability.

Those eligible to join the program are provided with a S$3,000 (US$2,273) allowance per month for the duration of the program. The government funds 80 percent of this allowance with the remainder being funded by the host organization.

This program has been extended until March 31, 2022, and adjusted to encourage greater participation. These adjustments are:

- The maximum training allowance for mature trainees (over the age of 40) has increased to up to S$3,800 (US$2,879) per month;

- The minimum training allowance for non-mature trainees (below the age of 40) has increased to S$1,600 (US$1,212) per month;

- The co-funding rate from the government for mature trainees has increased to 90 percent; and

- The maximum training duration has been reduced from nine to six months from April 1, 2021.

SGUnited mid-career pathways program – company training

The SGUnited mid-career pathways program – company training (SGU-PCT) is for mid-career individuals delivered by multinationals, such as Google, IBM, and Shopee.

Participants receive a monthly allowance of S$1,500 (US$1,136) for the duration of the program. SGU-PCT has now been extended until March 31, 2022, with the following adjustments:

- The capacity of in-demand courses will be expanded to improve jobseekers’ chances of securing employment in high growth sectors; and

- From April 1, 2021, SGU-PCT courses will now last only six months.

SGUnited skills

The SGUnited skills (SGUS) program provides full-training courses certified by Continuing Education and Training (CET) Centers as well as higher learning institutes. Trainees are also given the opportunity to apply skills learned through a program in workplace internships and industry projects.

SGUS has been extended until March 31, 2022, and trainees are given a S$1,200 (US$909) monthly allowance.

During this extension period, the capacity of in-demand courses has been expanded and the duration of the courses has been reduced to six months.

Continued support for specific sectors

The government has allocated S$870 million (US$659 million) to its aviation industry through the OneAviation Support Package.

From this total, S$330 million (US$249 million) has been pledged to a special grant named the Aviation Workforce Retention Grant (AWRG), which provides additional wage support to companies in the aviation industry.

Under the AWRG, companies will receive an additional 20 percent of the first S$4,600 (US$3,484) of gross monthly wages to each local employee from April to June 2021. This is in addition to the 30 percent support received under the JSS program.

From July to September 2021, companies will receive an additional 40 percent of the first S$4,600 (US$3,484) of gross monthly wages paid to each local employee, in addition to the 10 percent support from the JSS program.

The remaining S$540 million (US$409 million) has been allocated to extending the existing rebates on fees and charges at Changi International Airport as well as Selatar Airport until March 2022. The list of rebates can be found here.

To support taxi and private car hire drivers, the government will pay eligible drivers S$3,150 (US$2,386), spread over six months from January to June 2021. The payments will be broken down into two schemes:

- January to March 2021 — S$600 (US$454) per vehicle per month; and

- April to June 2021 — S$450 (US$340) per vehicle per month.

The COVID-19 recovery grant

The COVID-19 recovery grant was launched in January 2021 to support lower-to-middle-income workers and self-employed persons (SEPs) affected by job or income losses.

There are two types of assistance available.

- Employees can receive up to S$700 (US$530) per month for three months if they are unemployed due to retrenchment or placed on involuntary no-pay leave for three consecutive months; or

- Employees and SEPs can receive up to S$500 (US$378) per month for three months if they are presently facing salary loss of at least 50 percent on average for three consecutive months or a SEP is facing a 50 percent loss in net trade income for three consecutive months.

To be eligible, applicants must be Singaporean citizens or permanent residents aged 21 years or above.

They must be living in a property valued at no more than S$21,000 (US$15,912), and prior to the job or income loss must have had a household income of no more than S$7,800 (US$5,910) or per capita household income of no more than S$2,600 (US$1,970).

About Us

ASEAN Briefing is produced by Dezan Shira & Associates. The firm assists foreign investors throughout Asia and maintains offices throughout ASEAN, including in Singapore, Hanoi, Ho Chi Minh City, and Da Nang in Vietnam, Munich, and Esen in Germany, Boston, and Salt Lake City in the United States, Milan, Conegliano, and Udine in Italy, in addition to Jakarta, and Batam in Indonesia. We also have partner firms in Malaysia, Bangladesh, the Philippines, and Thailand as well as our practices in China and India. Please contact us at asia@dezshira.com or visit our website at www.dezshira.com.