Canada, Indonesia Trade Talks Begin for Comprehensive Economic Partnership Agreement

- In January 2021, Canada announced that it launched public consultations on a Comprehensive Economic Partnership Agreement (CEPA) with Indonesia.

- Bilateral trade between the two countries is still relatively low at approximately US$3.7 billion; however, there is potential for growth in several sectors.

- This includes increasing exports of Canadian wheat to Indonesia, among the world’s largest importers of the crop.

- Canada has also launched exploratory discussions for a potential free trade agreement with the ASEAN bloc.

On January 11, 2021, Canada’s Minister of Small Business, Export Promotion, and International Trade, Mary Ng, announced that the country has launched public consultations on a Comprehensive Economic Partnership Agreement (CEPA) with Indonesia.

This public consultation is a regulatory process that takes into account the public’s input for large-scale projects, policies, and laws, among others. Canadians will have until February 23, 2021, to submit their response to these consultations. The CEPA would benefit Canadian exporters and importers as it will improve access to ASEAN’s largest economy and the world’s fourth most populous country.

Additionally, developing a CEPA with Indonesia will help Canada’s cause in reaching a free trade agreement (FTA) with ASEAN, which is at the exploratory discussion phase of negotiations. Canada has been an ASEAN dialogue partner since 1977 — only one of 10 countries to have this status — through which the two regions cooperate on economic interests, political and security issues, regional integration, and inter-faith dialogue.Bilateral trade remains small with huge potential for growth

Bilateral trade between Canada and Indonesia remains small — amounting to just over US$3.7 billion in 2019 — compared to its neighbor, the US, whose total bilateral trade with Indonesia reached US$30 billion in the same year.

Agriculture

Canada is a major exporter of wheat and meslin products to Indonesia, valued at over US$500 million and although demand dipped in 2020 due to the COVID-19 pandemic, it is expected to increase again in 2021, presenting scalable business opportunities for Canadian suppliers.

Indonesia imports over 11 million tons of wheat annually — making it one of the world’s largest importers of the crop — as the country’s tropical climate makes it difficult to grow the crop. Rising per capita income as well as the growing middle-class have been attributed to the increased consumption of wheat-based products.

Canada roughly holds a 16 percent market share, exporting over 2.28 million tons to Indonesia and thus making the country Canada’s largest export market for the crop. Canadian durum wheat is especially popular in Indonesia, as it is used to make bread and noodles. Indonesia is the world’s second-largest instant noodle market only after China with demand reaching over 12 billion servings yearly.

The country does face competition from Australia, which accounts for between 40 to 60 percent of Indonesia’s annual wheat imports, valued at over US$1.2 billion. Australian businesses have also another advantage in this sector the Indonesia and Australia ratified the Indonesia-Australia Comprehensive Economic Partnership Agreement (IA-CEPA), which was ratified in February 2020. The IA-CEPA will improve market access for goods and nearly all goods exported from each other’s market will have reduced tariffs or will be tariff-free.

Livestock

Indonesia’s beef industry is another scalable opportunity for Canadian companies. Canada itself was ranked seventh in the world for beef exports in 2020, totaling around 500,000 tons. If the country can navigate Indonesia’s Halal certification requirements, then it can tap into one of Asia’s largest beef markets. Again, competition is rife as Indonesia is also Australia’s largest customer for live cattle, annually importing over 675,000.

Infrastructure

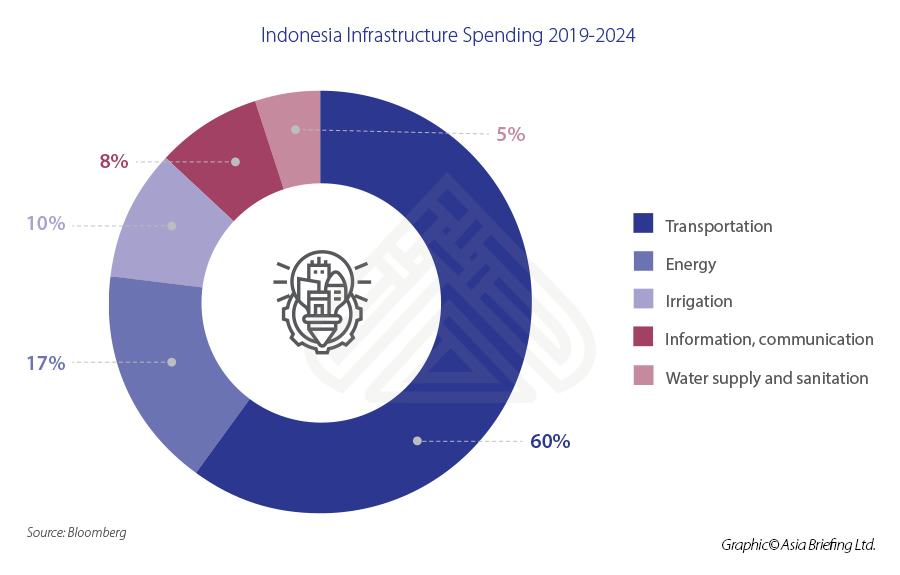

Infrastructure is another important sector that Canadian businesses should explore, especially in specialized engineering services, such as port development and smart cities. Indonesia is continuing to expand its public transit network, airports, and utilities as its government looks to spend more than US$400 billion for infrastructure development until 2024.

The government is also building its US$33 billion new capital on the island of Borneo. Intended to be a smart green city, Canadian SMEs providing niche solutions for this project would do well to explore these opportunities.

Digital services sector

In a report conducted by Temasek, Google, and Bains & Co, Indonesia’s digital economy is expected to be valued at US$124 billion by 2025, supported by e-commerce, online travel, financial services, online media, transport, and food delivery, health tech, and edtech sectors.

Canadian companies that can provide digital services from ridesharing to fintech platforms can gain from Indonesia’s large and growing digital economy. It is essential, however, that they tailor their strategy to the local market, such as providing online as well as traditional payment methods.

Digital financial services, for instance, have immense room for growth in Indonesia, considering the country is home to 42 million underbanked and 92 million unbanked adults, in addition to a large pool of SMEs. Fintech companies can develop an alternative credit scoring assessment for Indonesian SMEs.

Updates on the Canada-ASEAN FTA

While Canada continues to engage in establishing a CEPA with Indonesia, the country is also looking for opportunities in exploring an FTA with the ASEAN bloc. Canada already has a free trade arrangement with several ASEAN states (Malaysia, Singapore, Vietnam, and Brunei) through their membership of the Comprehensive Progressive Agreement for the Tran-Pacific Partnership (CPTPP), which was formally signed in 2018.

Canada became a dialogue partner in 1977 and established the Canada-ASEAN Joint Declaration on Trade and Investment (JDTI) in 2011, which provides a platform for Canada and ASEAN to exchange information on opportunities for trade and investment.

Canada and ASEAN launched exploratory discussions for an FTA in 2017 and both have since undertaken several feasibility studies to assess the potential economic gains from the FTA in mid-2018. The two regions announced the conclusion of the exploratory discussions for a possible Canada-ASEAN FTA at the 8th ASEAN Economic Ministers (AEM)-Canada Consultations in September 2019.

About Us

ASEAN Briefing is produced by Dezan Shira & Associates. The firm assists foreign investors throughout Asia and maintains offices throughout ASEAN, including in Singapore, Hanoi, Ho Chi Minh City, and Da Nang in Vietnam, Munich, and Esen in Germany, Boston, and Salt Lake City in the United States, Milan, Conegliano, and Udine in Italy, in addition to Jakarta, and Batam in Indonesia. We also have partner firms in Malaysia, Bangladesh, the Philippines, and Thailand as well as our practices in China and India. Please contact us at asia@dezshira.com or visit our website at www.dezshira.com.