An Introduction to Doing Business in ASEAN 2017

An Introduction to Doing Business in ASEAN 2017, the latest publication from Dezan Shira & Associates, is out now and available in the Asia Briefing Bookstore. This guide introduces the fundamentals of investing in ASEAN to foreign investors and provides an overview of current legislation throughout the region.

Cambodia’s FDI Outlook for 2017: Understanding the Challenges and Opportunities Ahead

Understand current conditions for foreign investment in Cambodia for 2017 and learn how to position operations to avoid obstacles and maximize opportunity.

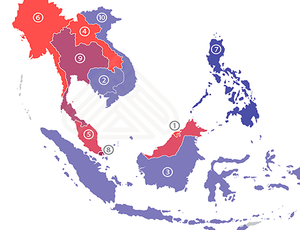

Personal Income Tax in ASEAN: a Guide to 2017 Rates

Personal income tax, or PIT as it is commonly referred, is a tax levied on all wage earners within a given jurisdiction. In the following article, we outline PIT tax brackets in individual member states of ASEAN.

Thailand in 2017: a Changing Investment Landscape

After a challenging year, both economically and socially, 2017 has been touted by some as a pivotal year for the Thai economy and ‘the year of concrete national reform’. Here, we discuss what is on the horizon for Thailand’s investment landscape in 2017.

Sourcing Talent in ASEAN: A Guide to Regional Opportunities

With over 625 million inhabitants spanning 10 member states, ASEAN is endowed with a diverse workforce capable of supporting a multitude of manufacturing and service based investments. In this extract from the latest issue of ASEAN Briefing Magazine, we look at sourcing talent in Southeast Asia.

Protecting IP while Transferring Technology to Southeast Asia

In this article, South-East Asia IPR SME Helpdesk discusses the strategies European SMEs looking to enter markets in Southeast Asia should adopt to mitigate the risks of infringements of their intellectual property when transferring technology to local partners.

Myanmar Opens Three Overland Crossings to e-Visas

Myanmar has extended e-visas for tourists and business professionals to three land crossings: Tachileik, Myawaddy, and Kawthaung. Learn what you will need to apply.

Indirect Taxation Across ASEAN

VAT and GST rates within ASEAN vary widely between member states – from 12 percent in the Philippines to countries which do not currently levy these taxes at all, such as Laos and Myanmar. For those considering investment, GST, VAT, and other taxation tied to the purchase of specific goods should be watched closely.

ASEAN Market Watch: Indian SEZs in Myanmar, US Increasing Engagement in Cambodia, and Innovation in the Philippines

In this week’s ASEAN Market Watch we look at Indian sponsored SEZs in Myanmar, highlight Increasing US engagement in Cambodia, and discuss recent moves up the Global Innovation Index by the Philippines

Malaysia Raises Minimum Wage to Enhance Automated Production

Malaysia has raised its minimum wage in a bid to incentivize a shift towards automated manufacturing. Learn the details of this new policy and understand its implications for specific sectors and the Malaysian economy at large.