Planning Your 2021 Investment Budgets: Singapore as a Key Trading Hub in ASEAN

- Singapore’s stable legal, tax, and business environment makes the country a key trading hub in ASEAN.

- The country is already a hub for over 7,000 multinational companies, who have incorporated their Asia-Pacific headquarters in the city-state.

- Singapore also has one of the most extensive double taxation networks and free trade agreements in the region that can benefit investors.

As businesses worldwide plan their 2021 investment budgets, Singapore will remain a key trading and financial hub in ASEAN.

Strategically located in the region, Singapore has the expertise and infrastructure to enable foreign investors to access other ASEAN markets, in addition to offering stable legal, tax, and business environment, which is highly integrated with international financial markets.In addition to these advantages, there are a variety of factors that make Singapore the ideal location for foreign investors seeking to tap into ASEAN’s promising business potential.

An efficient business set up

Singapore has one of the most transparent processes for setting up a business, as the majority of the legal regulations can be found readily online, meaning businesses can assess the market before fully committing to the entry process.

Once a company is ready to incorporate, they will need to register their credentials on Bizfile, an electronic filing system that combines the tax and business requirements on a single form. The system is managed by the Accounting and Corporate Regulatory Authority (ACRA), which is the statutory body responsible for the monitoring of new companies in Singapore.

There is a one-time payment of S$15 (US$11) to register the company name and S$300 (US$220) to register the company. This efficient set up has resulted in over 7,000 foreign multinationals using Singapore as their HQ for many of their Asia operations.

A favorable tax system

Singapore has one of Asia’s most favorable tax systems with a corporate income tax rate (CIT) of 17 percent — the lowest in ASEAN. The country practices a single-tier corporate tax system, which means businesses pay CIT only on chargeable income (profits), and all dividends are exempt from further taxation.

There are several advantages for a company to be a tax resident in Singapore, which can lower the total effective CIT tax rate.

These incentives include new startups being eligible to receive a tax exemption of 75 percent on the first S$100,000 (US$7,000) of chargeable income and a further 50 percent exemption on the next S$100,000 (US$73,000) of chargeable income (available for the first three years of operations). All other companies will receive a tax exemption of 75 percent on the first S$10,000 and a further 50 percent on the next S$190,000 of chargeable income.

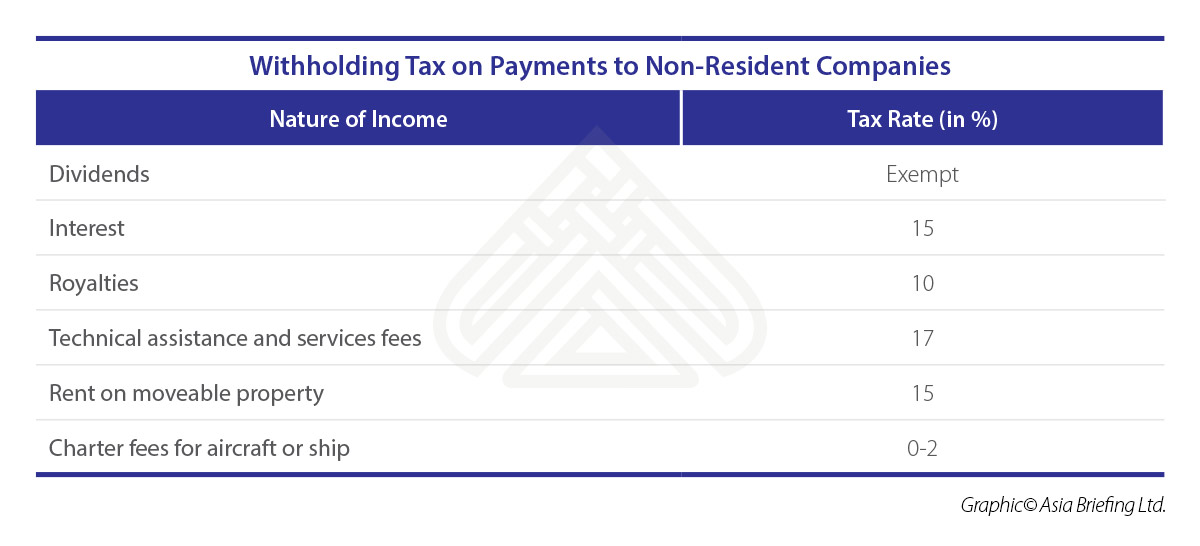

Further, withholding tax applies to non-resident companies or individuals who have sourced their income from Singapore.

There is also no capital gains tax in Singapore.

Industry-specific tax incentives

There are four main government agencies that can administer business and tax incentives for Singaporean entities in specific domains. These are:

- Singapore Economic Development Board (EDB) – which is responsible for developing and executing strategies that facilitate investment into the country’s industries;

- Inland Revenue Authority of Singapore (IRAS) – the tax regulatory authority in the country;

- Enterprise Singapore (ESG) – which aids Singaporean companies to expand worldwide and promotes local exports; and

- Monetary Authority of Singapore (MAS) – the central bank and financial services authority.

A full list of industry-specific incentives can be found on the individual websites of these agencies. The industries eligible for tax incentives are:

- Financial services;

- Banks;

- Fund management;

- Tourism;

- Shipping and maritime;

- Global trading industries;

- Insurance;

- Processing services;

- Research and development;

- Headquarter activities;

- Legal firms;

- E-commerce; and

- Event organization.

Taking advantage of strong DTA and FTA networks

Using Singapore as a base for a company’s operations means benefiting from the country’s large number of double tax (DTA) and free trade agreements (FTA). No other country in ASEAN has a more extensive DTA and FTA network than Singapore, hence adding to its attractiveness to foreign investors.

The country has over 85 DTAs and the tax relief under each DTA treaty differs for each country. They normally cover several income types:

- Tax on royalties;

- Tax on dividends;

- Tax on capital gains;

- Tax on interests;

- Shipping and air transport;

- Directors’ fees;

- Independent and dependent personal services;

- Researchers;

- Students; and

- Income from immovable property.

Singapore is a signatory to 24 FTAs, which includes exclusive access to some of the world’s largest free trade areas through its agreement with ASEAN, in addition to FTAs with the EU, India, and Hong Kong.

Singapore vs Hong Kong

Hong Kong is the preferred option for investors seeking to tap into the Chinese market, but recent developments like the protests have placed the spotlight more firmly on Singapore as a regional hub for trade.

Moreover, Singapore has more DTAs and FTAs than Hong Kong (the latter has signed 31 DTAs and 7 FTAs), and offers a more diverse investment community, with over 7,000 multinationals running their Asia-Pacific businesses from the city-state. Hong Kong has just over 1,000 multinational companies based there.

Singapore is also strategically located among the fastest growing economies in Southeast Asia, particularly Indonesia and Vietnam. ASEAN itself is predicted to become the fourth-largest economy by 2050, supported by its favorable demographics as 334 million are expected to be in the middle-class by 2030. Its labor force will also become the third-largest in the world, at 135 million, by that time.

There are other softer factors that favor the city-state. Singaporeans share various cultural and linguistic similarities with other ASEAN countries, particularly with Indonesia and Malaysia.

The country also has a highly skilled and diverse labor force, easily able to act as intermediaries for investments in Asia while also being able to communicate with investors from other regions.

About Us

ASEAN Briefing is produced by Dezan Shira & Associates. The firm assists foreign investors throughout Asia and maintains offices throughout ASEAN, including in Singapore, Hanoi, Ho Chi Minh City and Jakarta. Please contact us at asia@dezshira.com or visit our website at www.dezshira.com.