Indonesia Establishes New Investment Ministry

- Indonesia’s government has established a new Investment Ministry, as the president initiates another cabinet reshuffle.

- The new ministry is the result of upgrading the bureaucratic status of the Investment Coordinating Board (BKPM) — a government agency mandated to boost domestic and foreign investments — into a fully-fledged government ministry.

- The government has targeted a total investment realization of 900 trillion rupiah (US$62.2 billion) for 2021.

On April 28, 2021, Indonesia’s government established a new Ministry of Investment to enhance the ease of doing business in the country. In addition, the Ministry of Education and Culture has now merged with the Ministry of Research and Technology, to form the Ministry of Education, Culture, Research, and Technology.

The move is the second cabinet reshuffle in four months, the first of which occurred in December 2020, where six ministers were replaced, including the Minister of Health, retired General Terawan Agus Putranto, Minister of Trade Agus Suparmanto, Marine Affairs, and Fisheries Minister Edhy Prabowo, and the Minister of Social Affairs, Juliari Batubara.

The Ministry of Investment is the result of upgrading the bureaucratic status of the Investment Coordinating Board (Badan Koordinasi Penanaman Modal – BKPM) — a government agency mandated to boost domestic and foreign direct investments (FDI) — into a fully-fledged government ministry. Chairman of the BKPM, Bahlil Lahadalia, will assume the new role of Minister of Investment.

Since his appointment as Chairman of the BKPM, Lahadalia has managed to increase total investment realization (FDI and domestic diaspora investments (DDI)) in 2020 — despite the pandemic — to 826 trillion rupiah (US$57.16 billion), from 817 trillion rupiah (US$65.54 billion) in 2019. The government has targeted a total investment realization of 900 trillion rupiah (US$62.2 billion) for 2021.

Investment realization for Q1 on the uprise

Total investment realization for Q1 of 2021 has seen an uptick compared to the same period in 2020. Between January and March, Indonesia saw a total investment realization of 219.7 trillion rupiah (US$15.20 billion), an increase of 4.3 percent, or 210.7 trillion (US$14.58 billion). This is already 25 percent of the government’s 2021 investment target.

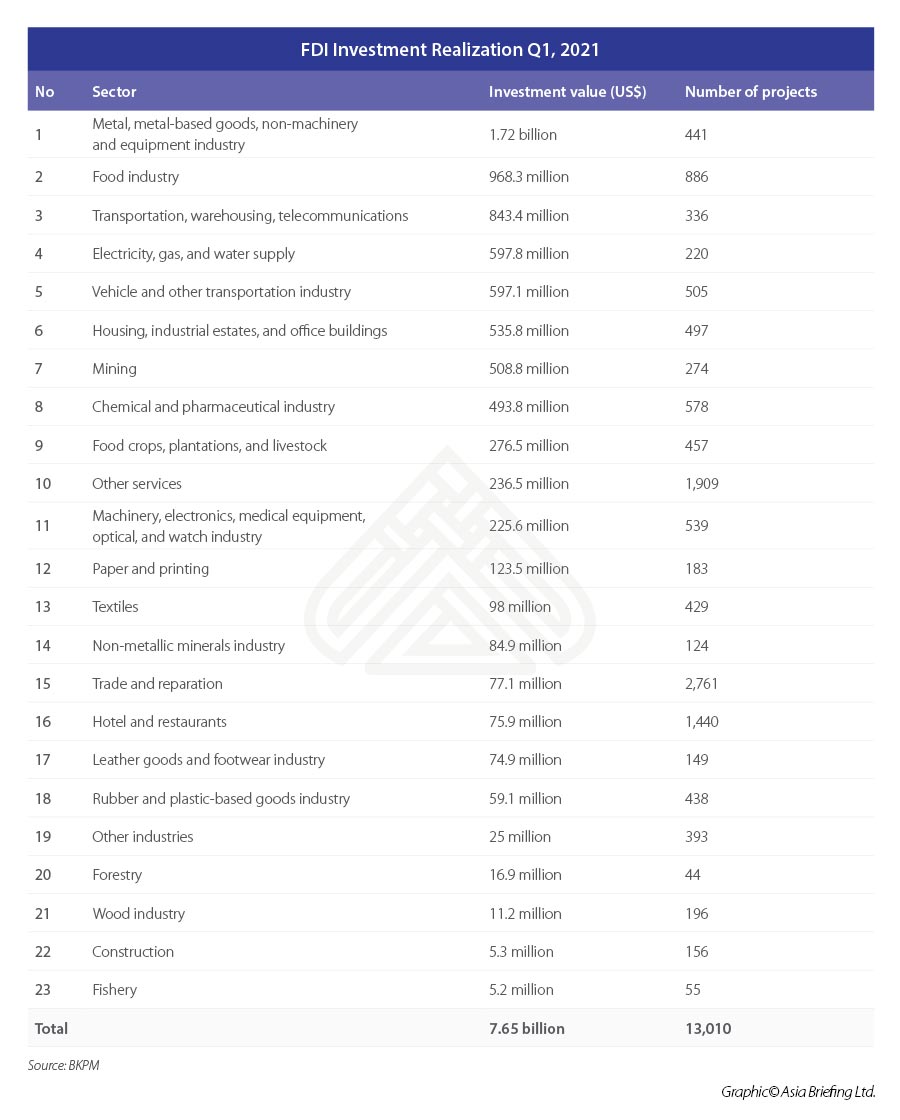

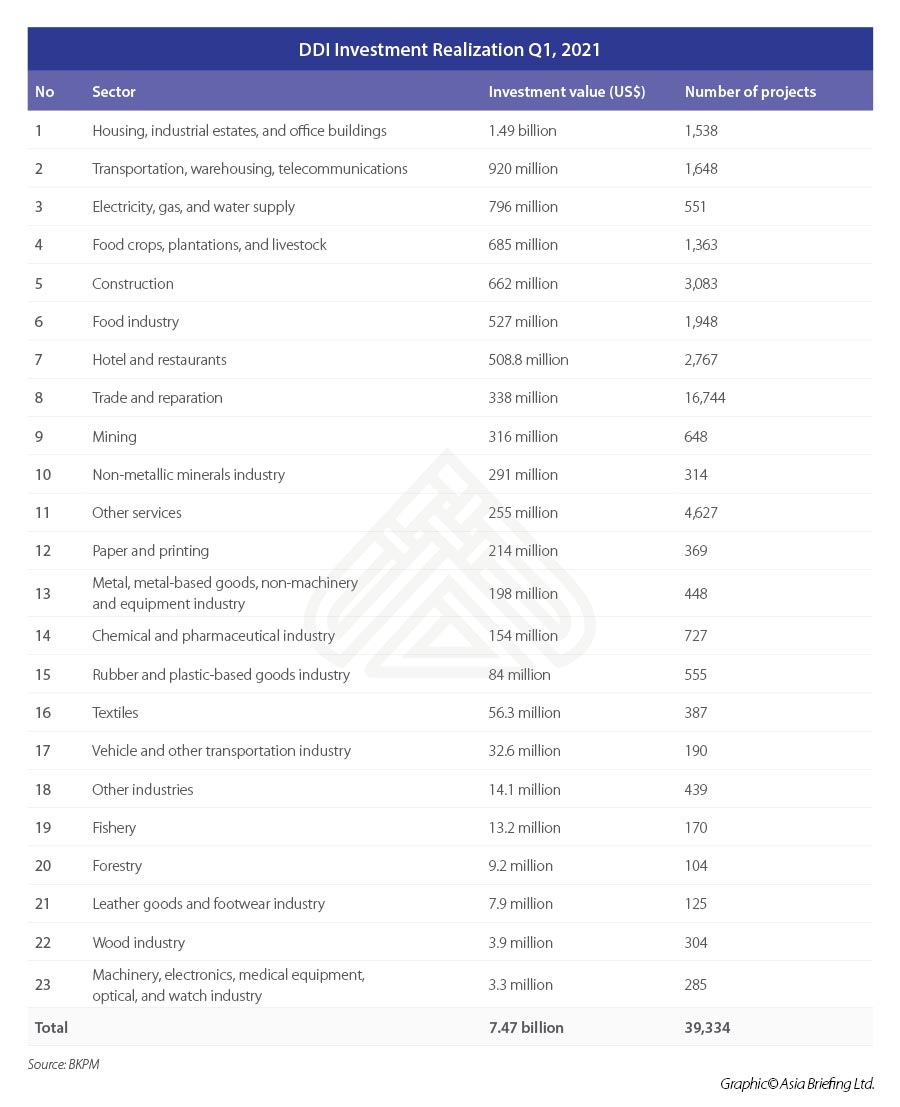

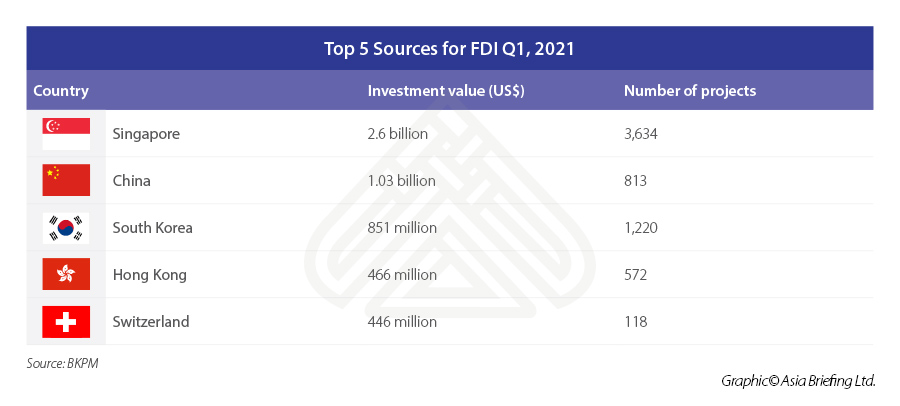

Data from the BKPM showed that FDI and DDI investments outside the island of Java increased by 11.7 percent compared to Q12020 and that manufacturing dominated Indonesia’s total investment realization, namely in the metal, metal-based goods, non-machinery and equipment category, food manufacturing, as well as automobile manufacturing. Further, investments in housing, industrial estates, and office buildings contributed to 29.4 trillion rupiah (US$2 billion).Singapore continued to be the number one source of FDI for this period with US$2.6 billion in investments for 3,634 projects. China came second with just over US$1 billion. Surprisingly, Switzerland for the first time came in fifth with close to US$ 500 million in investments for 118 projects. According to the BKPM, Q1 investments have created more than 300,000 new jobs.

Indonesia’s business reforms continue

The new ministry is part of the government’s ongoing business reforms to lure investments into the country and create jobs. The ministry will become a key point in connecting and synergizing both domestic and foreign investments through a single door.

Supporting the government is the newly issued Omnibus Law and its implementing regulations. The Omnibus Law has already made drastic changes to fixed-term employment contracts, outsourcing, hours of work, and the termination of employment procedures, in addition to implementing a risk-based business licensing system.

The latter issues business permits based on the assessment of ‘business risk level’ determined by the scale of hazards a business can potentially create. This is set to impact 16 business sectors in the country.

Moreover, the government has started to liberalize more sectors to foreign investment through the issuance of the Positive Investment List (another implementing regulation). The general principle under the positive investment list is that a business sector is open to 100 percent foreign investment unless it is subjected to a specific type of limitation. The regulation presents one of the greatest liberalizations in foreign ownership limitations in Indonesia since the negative investment list was first introduced in the 1980s.

About Us

ASEAN Briefing is produced by Dezan Shira & Associates. The firm assists foreign investors throughout Asia and maintains offices throughout ASEAN, including in Singapore, Hanoi, Ho Chi Minh City, and Da Nang in Vietnam, Munich, and Esen in Germany, Boston, and Salt Lake City in the United States, Milan, Conegliano, and Udine in Italy, in addition to Jakarta, and Batam in Indonesia. We also have partner firms in Malaysia, Bangladesh, the Philippines, and Thailand as well as our practices in China and India. Please contact us at asia@dezshira.com or visit our website at www.dezshira.com.

- Previous Article Indonesia’s Omnibus Law: Risk Based Business Licensing

- Next Article Vietnam to Start Regulating Cryptocurrencies