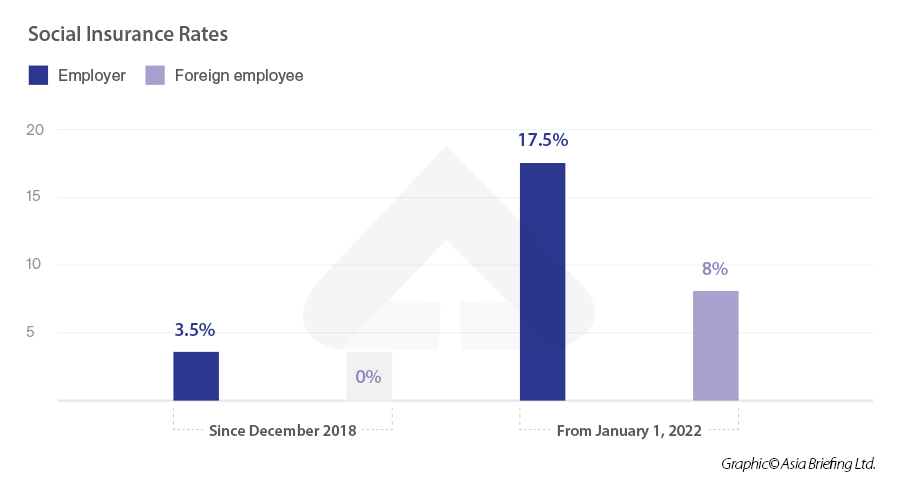

Increase in Social Insurance Rates for Foreign Employees in Vietnam

Since January 1, 2022, Vietnam has increased the social insurance rates for foreign employees. Foreign employees will have to pay an eight percent rate, while employers contribute 17.5 percent to the social insurance fund. This will be in line with the same rates as Vietnamese employees.

As with Vietnamese employees, the mandatory social insurance scheme for foreign employees covers sickness, maternity, occupational diseases, accidents, retirement, and death.

The salary subject to social insurance contribution is what is defined as per the labor contract, but this is capped at 20 times the minimum salary for social insurance contributions set by the government. At present, the maximum salary cap for the social insurance contribution is US$1,295 (VND 29 million).

Social insurance was made mandatory for all working foreigners as of December 1, 2018, under Decree 143/2019/ND-CP.

What are the criteria for social insurance contribution for foreign workers in Vietnam?

As per the Ministry of Labor, Invalids and Social Affairs (MoLISA), foreign workers are subject to mandatory social insurance when they meet all the following conditions:

- Working in Vietnam with a work permit;

- Employed under a Vietnamese labor contract with an indefinite or definite term of one year or more;

- Below 60 years of age for men or 55 years of age for women; (Please note that the retirement age is being gradually increased as per the new labor code to 62 for men and 60 for women by 2028 and 2035 respectively); and

- Are not an intra-company transferee (must be a manager/executive/expert/technician employed by the overseas entity for at least 12 months before being assigned to the company’s operations in Vietnam).

Once a foreign worker’s employment in Vietnam expires, the foreign worker can claim a one-off payment on the contributed amount from the social insurance agency in the following circumstances:

- Reach retirement age, but have not contributed social insurance for the full 20 years;

- Suffer from a fatal disease such as cancer, polio, HIV, or other diseases regulated by the Ministry of Health;

- Satisfying conditions for pension, but are not living in Vietnam anymore; and

- Their employment contract is terminated or their work permit expires without renewal.

Foreign employees should make the allowance request within 30 days before their contract or work permit expires. The insurance authority is required to settle and pay the allowance to the employee within 10 days from the date of receipt.

About Us

ASEAN Briefing is produced by Dezan Shira & Associates. The firm assists foreign investors throughout Asia and maintains offices throughout ASEAN, including in Singapore, Hanoi, Ho Chi Minh City, and Da Nang in Vietnam, Munich, and Esen in Germany, Boston, and Salt Lake City in the United States, Milan, Conegliano, and Udine in Italy, in addition to Jakarta, and Batam in Indonesia. We also have partner firms in Malaysia, Bangladesh, the Philippines, and Thailand as well as our practices in China and India. Please contact us at asia@dezshira.com or visit our website at www.dezshira.com.