Philippines Set to Lower Corporate Income Tax under Duterte

The Duterte administration has successfully taken office and promises exciting changes for the Philippine economic landscape. A key highlight in its plans is a promise to lower income based taxation while supplementing government income with VAT hikes and slashes to investment incentives.

Malaysian Tax Stoppages: Understanding Liability and Maximizing Mobility

With the passing of Ruling No. 12/2015, it is time for Malaysian residents to double check their taxes. Section 104 of the Income Tax Act of 1967 had established that individuals with outstanding tax dues would be forbidden from leaving the country until the debt was settled, but this law was never enforced – until last year.

The 2016/17 ASEAN Tax Comparator – New Issue of ASEAN Briefing Magazine

In this issue of ASEAN Briefing, we examine regional taxation in ASEAN through a comparison of corporate, indirect, and withholdings taxation. Read more for a more effective understanding of your tax options throughout the region.

ASEAN Legal and Tax Alert: Developments in Mekong Tax & Financing

Recent events have seen significant movement in tax and financing regulation within the Mekong region. Read more for analysis on Thailand’s Business Collateral Act, Myanmar’s Union Tax Law of 2016, and Cambodia’s most recent guidance on VAT invoicing.

Understanding Tax Treatment of Representative Offices in Indonesia

In this joint analysis conducted by Dezan Shira & Associates and Winnindo Business Consult Indonesia, the issue of Representative Office Tax Treatment is explored. Read more to find out why companies such as twitter and Facebook have faced tax troubles and others may be exposed.

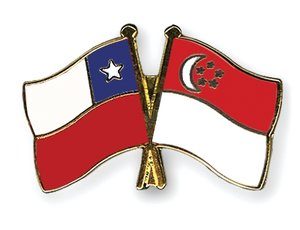

Case Study: Routing Chilean Investments Through Singapore

Withholdings tax can be among the most inhibitive forms of compliance associated with the remittance process. Find out how your operation can benefit from double taxation treaties through a close look at routing Chilean Investments through Singapore.

In Depth: The Singapore – Thai DTA

Singapore, long known for its exemplary investment climate and lucrative trading arrangements, continues to improve upon its competitiveness with the implementation of an updated Double Taxation Agreement (DTA) with Thailand. Here, we examine how companies can qualify for lowered withholding rates on their dividends, royalties, and interest payments.

Thai Financial Reporting Standards: Guidelines for Annual Compliance

Annual reporting and compliance deadlines are rapidly approaching in Thailand. With this in mind, the following article provides an overview on how to ensure compliance with Thai Financial Reporting Standards (TFRS).

Thailand’s New Transfer Pricing Guidelines

Thailand’s vote this past May to implement a new transfer pricing law is expected to come into effect in the early part of the new year, effecting compliance requirements in the country.

Indonesia’s New SEZ Tax Incentives Explained

On November 5th, Indonesia unveiled its sixth economic stimulus package since September, the most recent incentive aimed at revitalizing its under-performing economy, introducing new SEZ tax incentives and holidays.