An Overview of US Trade and Investment in ASEAN

The United States became an ASEAN dialogue partner in 1977, 10 years after the founding of the Southeast Asian economic union. The US views ASEAN as strategically important to US interests in the Asia Pacific and the country became the first non-ASEAN nation to establish a dedicated Mission to ASEAN in Jakarta (the location of ASEAN’s headquarters).

With ASEAN being the US’ fourth-largest trading partner, the region is becoming of increasing importance to US businesses and its government, particularly in the areas of climate, transportation, energy, and healthcare.

ASEAN enjoys trade surplus in the trade of goods

ASEAN enjoys a trade surplus of more than US$250 billion – the majority of which are due to exports of electrical machinery. The bloc exported some US$73 billion of electrical machinery and equipment in 2021, which makes up 28 percent of all ASEAN exports to the US. Nuclear reactors, boilers, and their parts contributed to US$38 billion in exports, or 14 percent, while apparel and clothing accessories and furniture contributed to approximately US$15 billion each in exports, or six percent of total ASEAN exports.

|

Top 10 Goods Exported from ASEAN to USA 2021 |

||

|

Commodity |

Value (US$) |

Share (%) |

|

Electrical machinery and equipment and parts thereof |

73 billion |

28 |

|

Nuclear reactors, boilers, machinery and mechanical appliances |

38 billion |

14 |

|

Apparel and clothing accessories (knitted or crocheted) |

15.9 billion |

6 |

|

Furniture; bedding, mattresses, mattress supports |

15.8 billion |

6 |

|

Rubber and articles thereof |

14.7 billion |

5.8 |

|

Footwear |

10.3 billion |

4 |

|

Apparel and clothing accessories (not knitted or crocheted) |

9.7 billion |

3.8 |

|

Optical, photographic, cinematographic, measuring, checking, medical or surgical instruments and apparatus |

9.6 billion |

3.8 |

|

Plastics and articles thereof |

4.8 billion |

1.9 |

|

Miscellaneous edible preparations |

4.2 billion |

1.7 |

Source: ASEAN Statistical Yearbook 2022

Electrical machinery and equipment also dominate US exports to ASEAN, valued at US$22.4 billion, or 20 percent of all US exports to the bloc. This was followed by the export of nuclear reactors and boilers (US$20 billion), mineral fuels (US$8.6 billion), and medical equipment (US$6 billion).

|

Top 10 Goods Imported to ASEAN from the USA 2021 |

||

|

Commodity |

Value (US$) |

Share (%) |

|

Electrical machinery and equipment and parts thereof |

22.4 billion |

20 |

|

Nuclear reactors, boilers, machinery and mechanical appliances |

38 billion |

18 |

|

Mineral fuels, mineral oils and products of their distillation |

8.6 billion |

7.9 |

|

Optical, photographic, cinematographic, measuring, checking, medical or surgical instruments and apparatus |

6 billion |

5.6 |

|

Plastics and articles thereof |

4.7 billion |

4.3 |

|

Aircraft, spacecraft and parts thereof |

4.6 billion |

4.2 |

|

Food industries, residues and wastes thereof |

3.2 billion |

3 |

|

Chemical products |

2.9 billion |

2.7 |

|

Pharmaceutical products |

2.9 billion |

2.7 |

|

Oil seeds and oleaginous fruits; miscellaneous grains |

2.7 billion |

2.5 |

Source: ASEAN Statistical Yearbook 2022

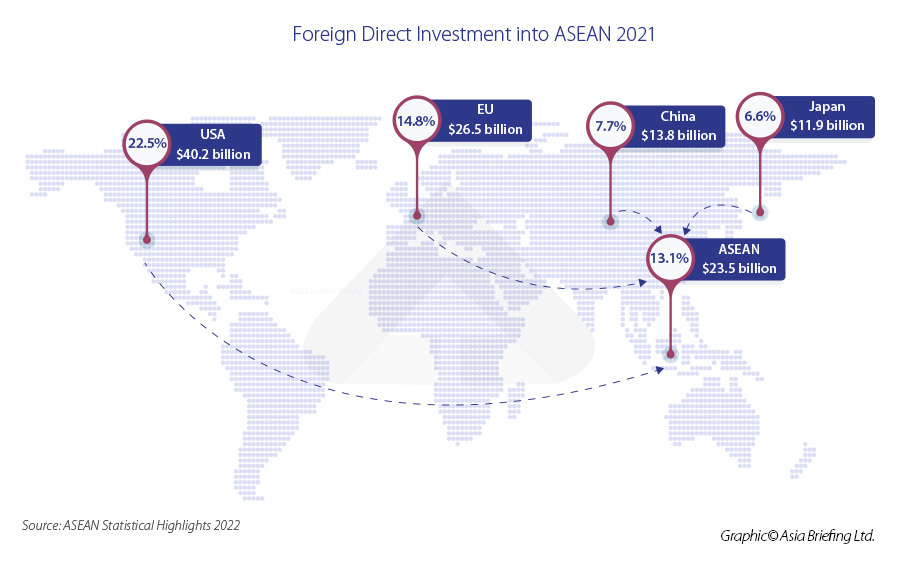

The US is ASEAN’s largest foreign direct investor

The US is ASEAN’s largest FDI investor with US$40.2 billion worth of FDI in 2021, representing 22.5 percent of total FDI flowing into ASEAN. This was an increase of 41 percent from 2020. According to the ASEAN Investment Report 2022, which was compiled by the ASEAN organization, there were significant increases in investment in banking and finance, semiconductors, pharmaceutical and biomedical industries by US investors.

“US investment in ASEAN is already quite sizable; however, it is US investments in other countries in the Indo-Pacific region that typically garners more attention. In fact, US investment in ASEAN is great than the US investment in China, India, Japan, and South Korea combined. With the changing geopolitical landscape, we should expect US investment in ASEAN to continue to grow” says Kyle Freeman, Partner at Dezan Shira & Associates and head of the firm’s North America Desk.

Other major sources of FDI in ASEAN were from the EU (US$26.5 billion), China (US$13.8 billion), and Japan (US$11.9 billion). Intra-ASEAN investments accounted for 13.1 percent of total FDI, or US$23.5 billion.

Global supply chain disruptions are driving many US companies to expand their operations into ASEAN, particularly in electronics and semiconductors. Further, the region is seeing increasing investments in the digital economy, such as for the development of data centers, e-commerce, and information and communication infrastructure.

Another key industry that has the potential to drive more US businesses into the region is the electric vehicle (EV) value chain. Notably, Indonesia is aiming to become a global EV battery production hub as the country looks to take advantage of its vast nickel reserves. The Ford Motor Company in collaboration with Vale Indonesia and China’s Zhejiang Huayou Cobalt signed an agreement in late 2022 to build a hydroxide precipitate (MHP) plant in Indonesia’s Southeast Sulawesi province to produce refined nickel that can be used in EV batteries. The plant will have the capacity to produce 120,000 tons of hydroxide precipitate.

Ford and Tesla are among the top 10 major EV producers present in ASEAN. They operate in various stages of the EV supply chain from research and development to EV components assembly to sales and distribution.

FDI in semiconductors was particularly active in ASEAN in 2021, with a significant portion of this investment coming from US companies. In late 2021, Intel commenced the construction of its US$7 billion semiconductor plant in Malaysia, which is anticipated to be finished by early 2024. Additionally, the company is expanding its plant in Vietnam to facilitate the production of 5G products.

US firms are also at the forefront of biomedical and pharmaceutical investments in the region. Thermo Fisher Scientific opened its new high-speed drug manufacturing facility in Singapore in May 2023 as it became only one of five companies to open a drug manufacturing plant in the city-state. Before the onset of COVID-19, Singapore did not have any facilities to produce finished vaccines.

German biotechnology company BioNTech, who developed the COVID-19 vaccine —BNT162b2 — with American pharmaceutical firm Pfizer, will establish its Asia-Pacific regional headquarters in Singapore, where it will also set up an mRNA manufacturing facility, expected to be completed in 2024. The facility will produce several hundreds of millions of mRNA vaccine doses per year, boosting Singapore’s capacities for vaccines and therapeutics for cancer and infectious diseases. More importantly, it will help build a rapid-response production capability to address the threat of future pandemic threats in the Asia-Pacific region.

An ASEAN-US free trade agreement can enhance ties

US reticence on global trade is in wide contrast to China’s own trade liberalization agenda. Beijing is boosting its engagement with regional trade pacts and recently applied to join the CPTPP. Although its application is likely to be rejected, as geopolitics stands now, it does refocus international dialogue on the credibility of the US and the economic balance of power in the Asia-Pacific.

While ASEAN’s total trade with the US amounted to US$441 billion for 2020, it was dwarfed by China’s total trade with the Southeast Asian bloc reached US$800 billion. And, while the US spent the last five years turning away from the CPTPP, China, Japan, South Korea, Australia, New Zealand, and the 10 members of ASEAN signed the RCEP FTA, which came into force on January 1, 2022.

The RCEP trades US$2.5 trillion among its members and its 15 signatories account for 30 percent of global GDP.

What ASEAN countries are seeking is a framework for a robust economic plan that offers growth prospects to the region and increased access to the prized US domestic market; this is vital for the US to counter ASEAN’s trade dependency on China.

“Seven of the 10 ASEAN member countries are currently involved in negotiations for the US-led Indo-Pacific Economic Framework (IPEF), While the final version of the Framework should serve to boost economic cooperation, it is important to note that it is not a free trade agreement and it does not reduce tariffs or offer great market access. Though the US put great effort into developing strategic partnerships in the region, it is also important that the US be able to offer tangible benefits to trade partners in the region” says Freeman.

About Us

ASEAN Briefing is produced by Dezan Shira & Associates. The firm assists foreign investors throughout Asia and maintains offices throughout ASEAN, including in Singapore, Hanoi, Ho Chi Minh City, and Da Nang in Vietnam, in addition to Jakarta, in Indonesia. We also have partner firms in Malaysia, the Philippines, and Thailand as well as our practices in China and India. Please contact us at asean@dezshira.com or visit our website at www.dezshira.com.