German Investment in ASEAN Part V: Thailand and Vietnam

The ten member states of the Association of Southeast Asian Nations (ASEAN) have seen a steady inflow of German investment in recent years. Current trends are expected to continue in the coming years. We looked at German investment in Brunei and Cambodia in the first part of this five-part article, covered Indonesia and Laos in the second part, focused on Malaysia and Myanmar in the third part while looking at the Philippines and Singapore in the fourth part. We now focus on Thailand and Vietnam in this concluding part of the article.

Thailand

Thailand is one of the key member states of ASEAN and an important regional actor.

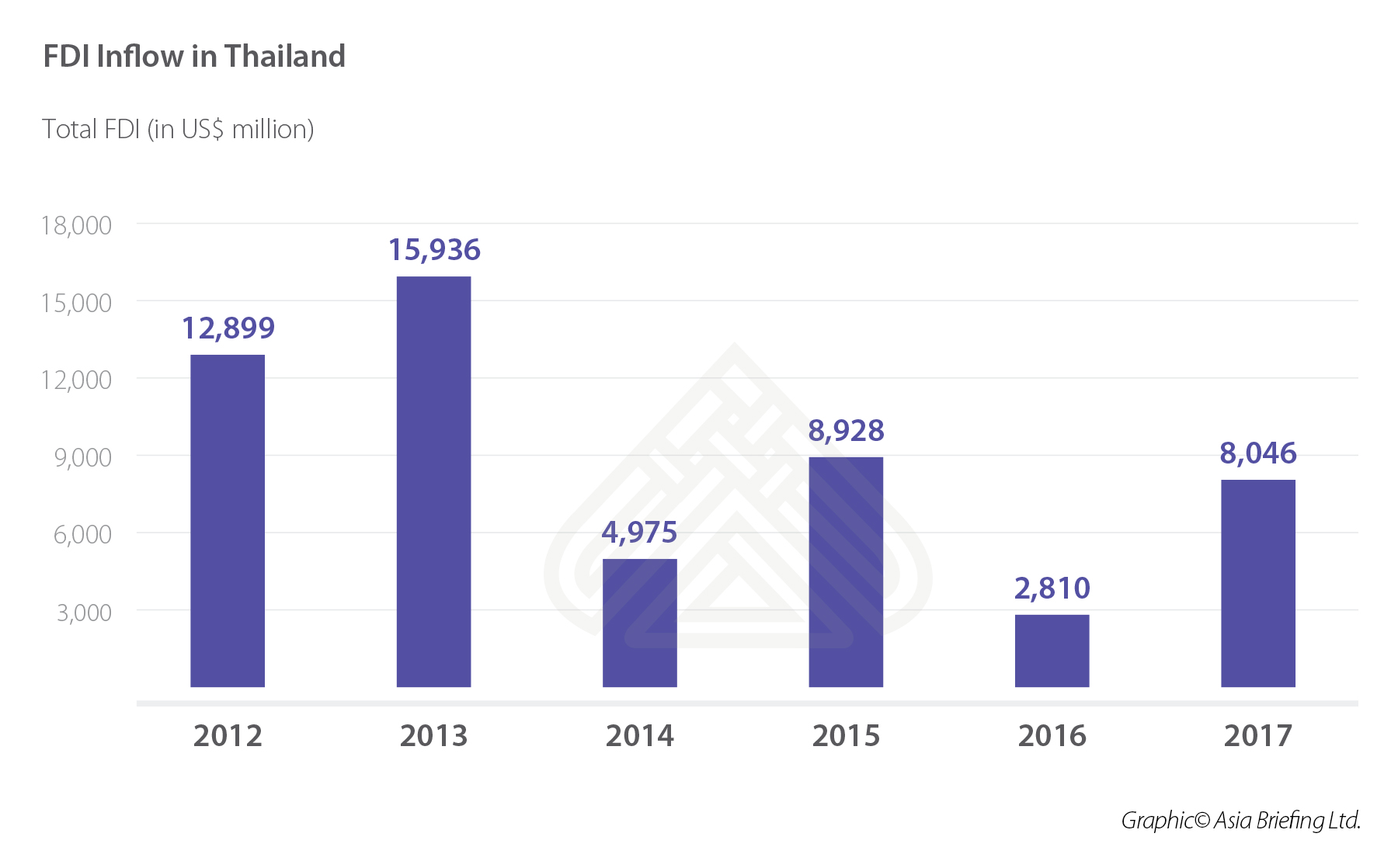

Located in the middle of the regional bloc, the country borders several other fellow ASEAN states. The country occupied the 55th position on the Market Potential Index 2018. The investment climate is open and easily accessible by overseas investors due to many recent incentive programs. Thailand is ranked 27th on the World Bank’s Ease of Doing Business Index 2018. FDI inflows have remained high in the recent years but experienced relative decline in recent months due to political uncertainty and rising wages. German – Thai Relations at a Glance

German – Thai Relations at a Glance

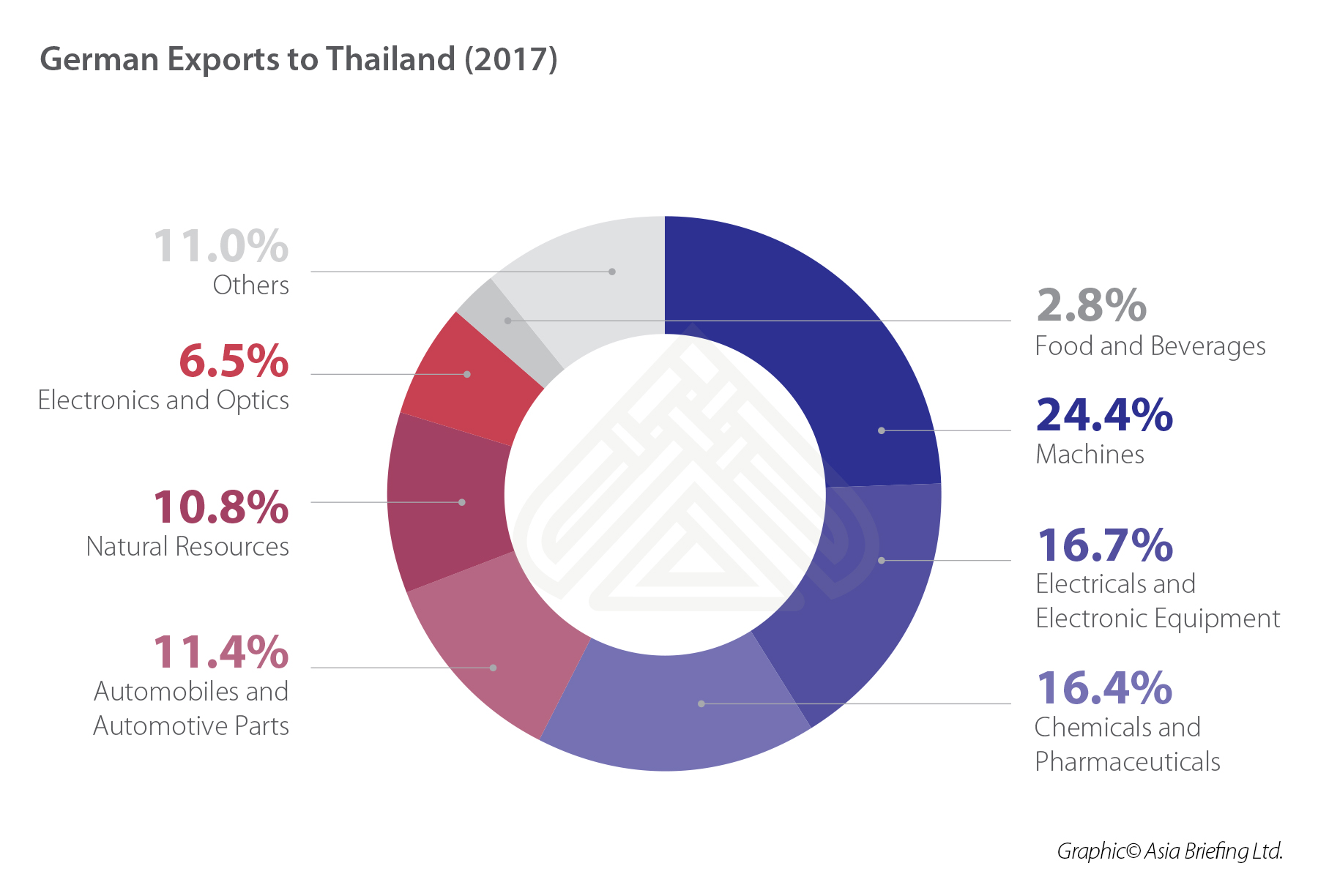

Exports and imports to and from Thailand have grown in recent years. In 2018, goods worth US$5.98 billion were exported into Thailand. This represents a major increase in relation to the preceding year. On the other hand, imports from Thailand increased to US$7.2 billion in 2018. Especially, electronics and electrical equipment are Thailand’s main imports to Germany.

Thailand has also in recent years attracted the interest of German car producers. Daimler, Mercedes Benz and Volkswagen have established their regional hubs in Thailand. Several companies supplying parts and components have also explored options to move to Thailand to be closer to the production facilities of major car manufacturers. These supporting industry companies include Schaeffler Manufacturing.

Investment Outlook

With an annual growth rate of over 3 percent, Thailand represents for Germany, despite the already strong economy, a perfect place for further development and investments. The government’s energy development plan aspires to increase the share of renewable energy by 2035 up to 20 percent. Especially, solar energy is planned to play a major role due to good conditions in Thailand and the decentralized supply possibilities it offers.

Especially, the large involvement of Thailand in car manufacturing and the aspirations for automatization have led to a rise in machine imports. The increasing construction business and infrastructure opens further opportunities for German machine exports to Thailand. German exporters can get more involved especially as they are well positioned in relation to industry 4.0.

The market for medical equipment represents additional opportunities for German investors. The already high penetration of German exports in this segment and annual growth rates of around 8 to 9 percent let this market become increasingly interesting for long-term investments. Thailand’s well-developed medical tourism has played a major role in boosting this sector.

Thailand 4.0

Thailand 4.0 is a government strategy to make the country ready for industry 4.0 in several business sectors. Digital economy is tipped to be the driver of Thailand’s economic development in the coming years. Getting Thailand out of the Middle-Income trap and to bring it to the level of a developed nation is the objective of the plan. The National Digital Economic Masterplan 2016-2020 objectives are to introduce digital change especially in infrastructure but also to introduce digital development programs for workers.

Further development of the already established industries like logistics, electronics and health secure center stage. But new areas of economic development such as start-ups, aerospace industry, biochemicals, robots, and medical devices have also attracted increasing attention.

Risk analysis

The ease of doing business in Thailand combined with available skills and relative cheap wages represent the main advantages of the country. The workforce is better skilled than other ASEAN countries but still not yet ready for developments like industry 4.0 as aspired by the government. The country’s uncertain political climate poses another problem for long-term German investments. The development of Thailand as a regional hub has large advantages especially for export businesses. On the other hand, Thailand is increasingly dependent on the world economy, and global shocks can have significant impact on the local economy.

Vietnam

Located close to China and alongside one of the major global trade routes, Vietnam represents an attractive option for German businesses. Securing the 45th position on the Market Potential Index 2018, the country provides vast future market opportunities for German investors. In the World Bank’s Ease of Doing Business Index 2018, the country ranks top in securing credit, construction permits and electricity supply. Vietnam has experienced steady increases in recent years.

German – Vietnamese Relations at a Glance

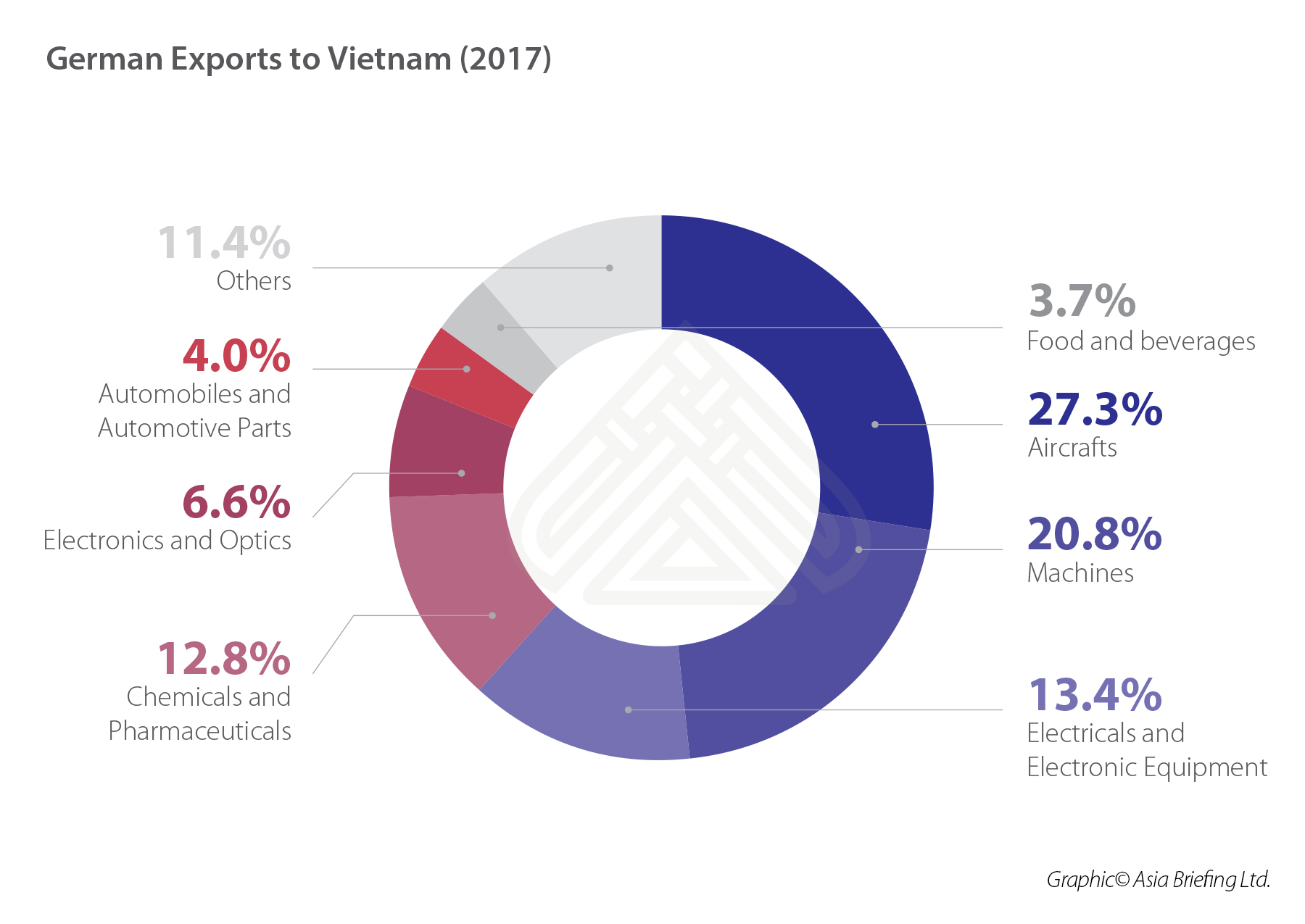

Germany has extensive economic ties with Vietnam. Exports to Vietnam increased to around US$4.8 billion in 2018. On the other hand, imports from Vietnam to Germany increased to more than US$11.55 billion in 2018. Electronics, shoes and textiles are mainly imported from Vietnam to Germany. Food products play a major role as well.

Apart from major chemical industry corporations such as Bayer, BASF and Beiersdorf, many other German companies have opened offices in Vietnam to benefit from its growing economy. Especially, automotive parts supplying companies such as Bosch and Henkel have opened offices; so has Siemens, the major German electronics manufacturer. Most of the large German logistics companies have offices, which can support further German investments as the country’s logistics infrastructure is quite well-established.

Investment Outlook

Annual growth rates of more than 6 percent in recent years make Vietnam’s economy attractive for further investments. Cheap wages and a good strategic location within ASEAN supports this development. The Medical equipment sector in Vietnam remains highly dependent on imports with around 91 percent of the locally used products coming from other countries. Still, the government aspires to invest in the health sector to increase efficiency. German products, which are known for their high quality, have a good potential to succeed in the Vietnamese market.

The increasing attractiveness of Vietnam for manufactures is somewhat constrained by the prevalence of vastly outdated machine equipment in several industrial sectors in the country.

The country’s growing economy demands new machines and especially from abroad as the local industry’s production capacity for machines cannot serve the market. At present, China mainly exports machines to Vietnam but the demand for high-tech machines and reliable equipment have increased. German exports can fill the gap. With an increasing energy demand of approximately over 10 percent annually, Vietnam heavily relies on its expansion of a steady energy supply. New power plants as well as renewable energy sources are being sought after, including solar and wind energy.With the rapid development of the country, the production of waste increases extensively and poses a problem. Modern recycling facilities are being planned in the urban areas. The sector largely depends on foreign investments and technology which further open opportunities for German high-tech recycling companies.

Risk analysis

The relative lack of skilled workers and supporting industries could pose long-term risks to investment in Vietnam. The need for better infrastructure makes the supply-chain and distribution of products more expensive. Further investments are required to close this gaps.

Vietnam’s over-reliance on exports could also pose problems in the long-term. However, in the short-term, Vietnam will continue to attract export-processing industries and manufacturers looking to relocate from China in view of that country’s ongoing trade dispute with the US and rising wages and costs of production.

About Us

ASEAN Briefing is produced by Dezan Shira & Associates. The firm assists foreign investors throughout Asia and maintains offices throughout ASEAN, including in Singapore, Hanoi, Ho Chi Minh City and Jakarta. Please contact us at asia@dezshira.com or visit our website at www.dezshira.com.

- Previous Article German FDI in ASEAN Part IV: The Philippines and Singapore

- Next Article Deutsche Direktinvestitionen in ASEAN Teil 3: Malaysia und Myanmar