Thailand’s Automotive Industry: Opportunities and Incentives

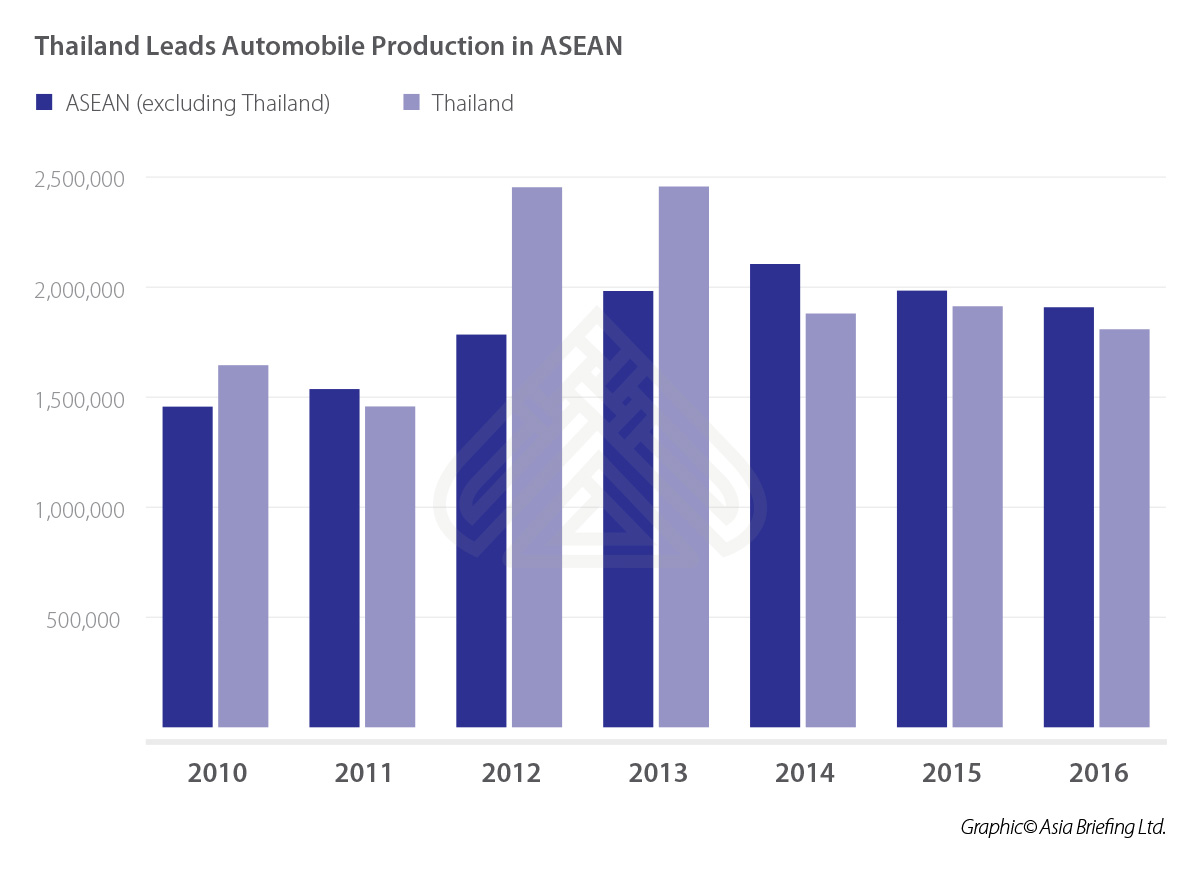

Thailand offers great investment potential as a leading automotive production base in the Association of Southeast Asian Nations (ASEAN) – a fast developing region for automotive manufacturing. Over a period of 50 years, the country has developed from an assembler of auto components into a top automotive manufacturing and export hub.

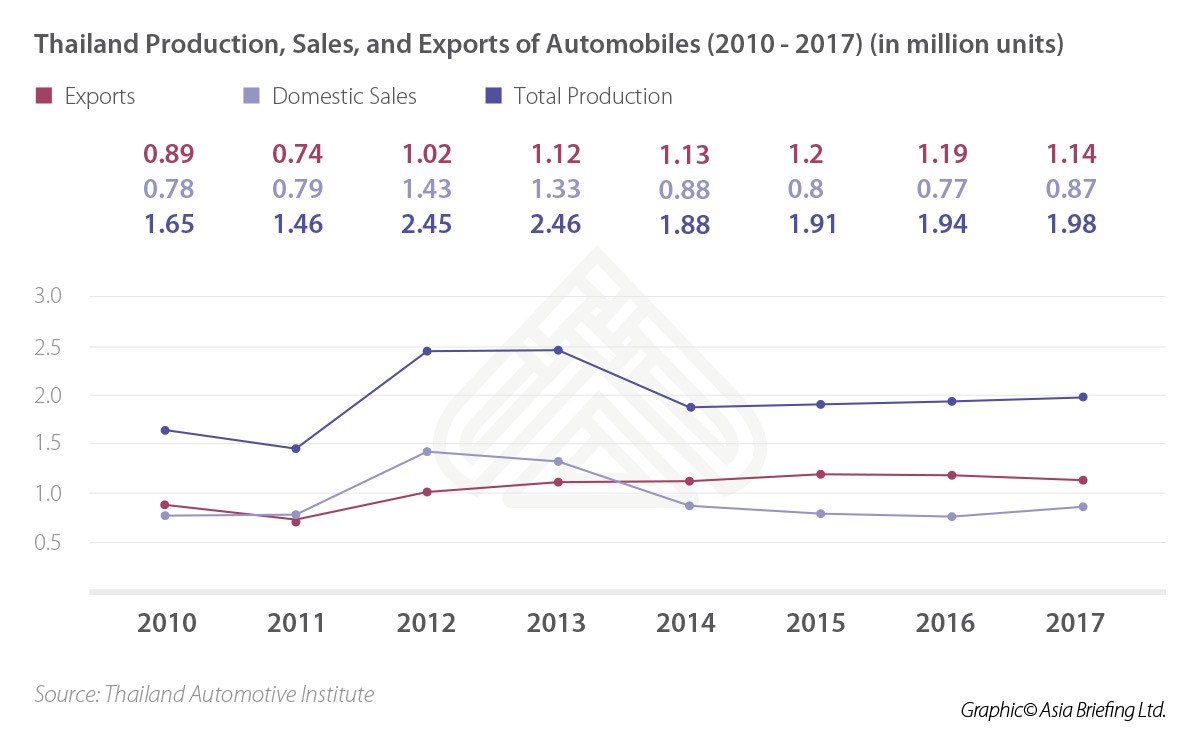

With shipments bound for more than 100 countries, Thailand is the 13th largest automotive parts exporter and the sixth largest commercial vehicle manufacturer in the world, and the largest in ASEAN. By 2020, Thailand aims to manufacture over 3500000 units of vehicles to become one of the top performers in the global automotive market.

The Thai automobile and auto parts industry accounts for nearly 12 percent of Thailand’s economic growth and employs more than 500,000 people.

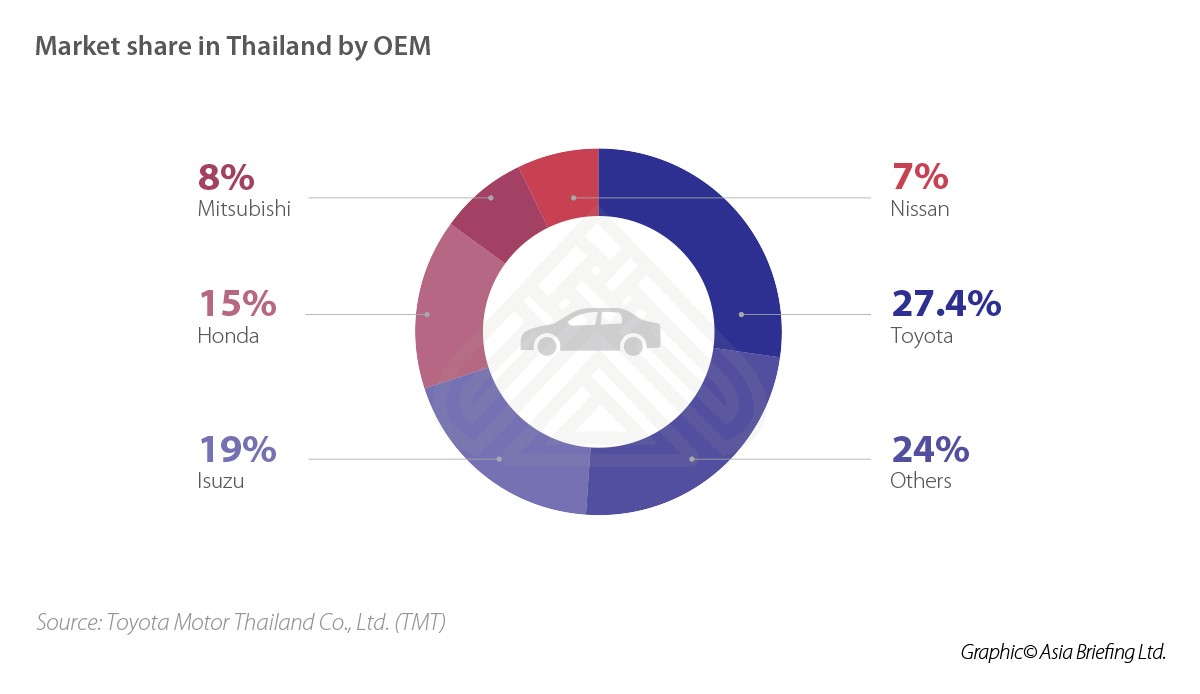

The country has an established presence of virtually all of the world’s leading automakers, assemblers and component manufacturers. Companies such as Toyota, Isuzu, Honda, Mitsubishi, Nissan, and BMW together account for a lion’s share of the approximately two million vehicles produced in the country each year.

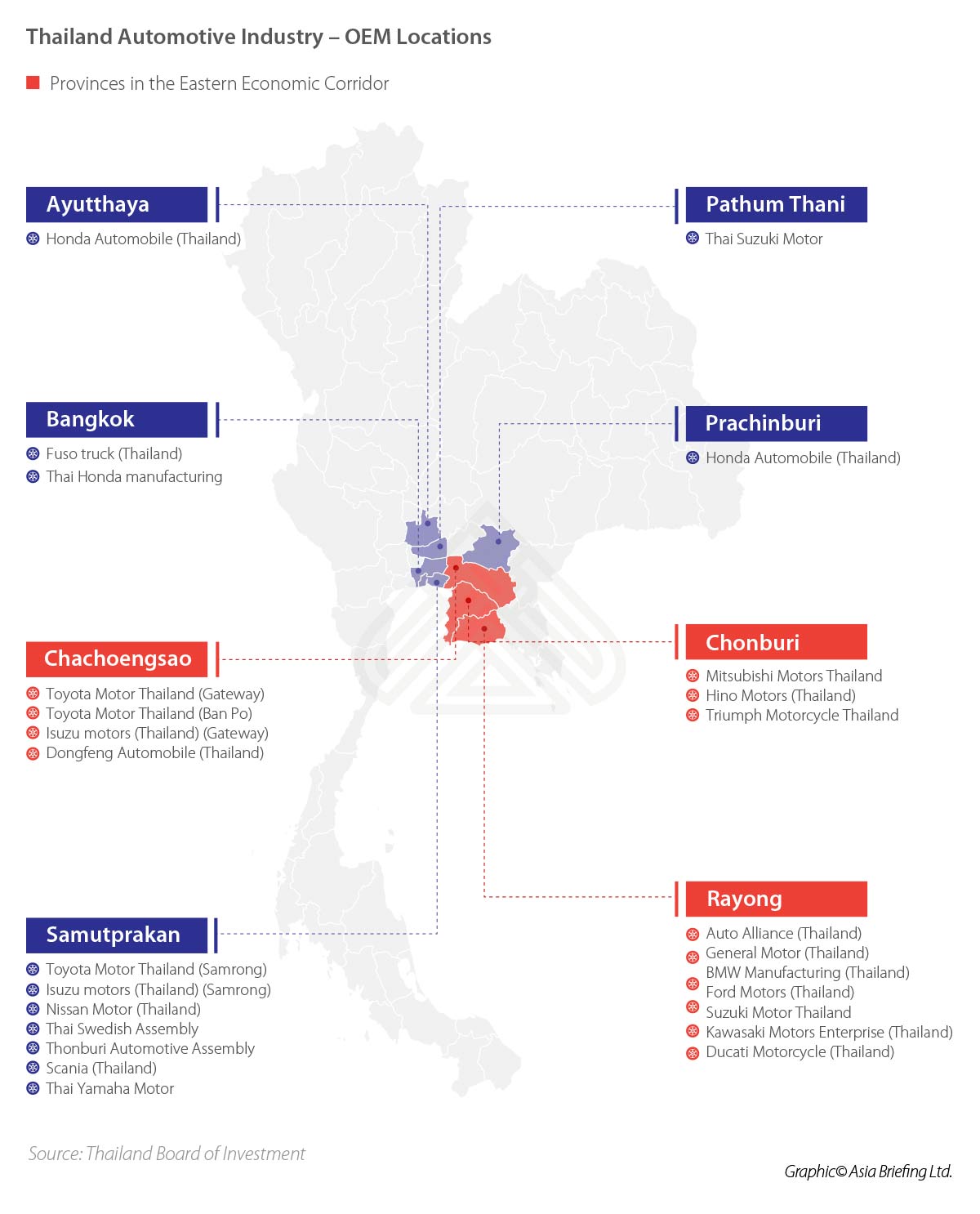

Most of these manufacturers and parts suppliers are located in the central provinces of Bangkok, Ayutthaya, Pathum Thani, Samutprakarn, Prachinburi, Chachoengsao, Chonburi, and Rayong, offering easy access into leading markets of ASEAN, China, and India.Structure of the Thai automotive industry

Thailand’s automotive industry has a vibrant foreign original equipment manufacturer (OEM) competition and an extensive network of supporting industries. As the country continues to expand its manufacturing base, auto part suppliers are increasing their presence – setting up research and development (R&D) departments to better serve their customers.

The Thai automotive market is dominated by Japanese automakers that have established Thailand as the production base of one-ton pick-up trucks and eco cars for exports. American and Europeans are gaining ground as the manufacturers of large, luxury cars.

Opportunities for foreign investors

Board of Investment’s (BOIs) investment promotion scheme

One of the key factors that give a competitive edge to Thailand’s automotive industry is its supportive government policies. The Thai government offers substantial backing in the form of tax and non-tax incentives to encourage foreign investment in the industry. Some of the general benefits available to foreign investors include the following.

- Corporate Income Tax (CIT) exemption for up to eight years;

- Import duty exemption on machinery;

- Import duty exemption on raw materials used in manufacturing export products;

- Permit to bring skilled workers and experts to work in investment promoted activities;

- Permit to own land; and

- Permit to take out or remit money in foreign currency.

There are additional benefits available to companies investing in the supercluster automotive zones in Pathum Thani, Ayutthaya, Nakhon Ratchasima, Prachin Buri, Chachoengsao, Chonburi, and Rayong. These include reduced CIT – 50 percent of the normal rate – for five years, in addition to the tax-exempt period of up to 8 years under the general BOI promotion scheme; possibility to extend to 10-15 year CIT exemption; personal income tax for specialists both Thai and Foreign; and possibility to get a permanent residence permit.

Free Trade Agreements

Auto manufacturers and investors in Thailand can benefit immensely from the country’s free trade agreements (FTAs). At present, Thailand has six FTAs with Australia, China, India, New Zealand, and the 10 member states of ASEAN.

The FTAs provide investors an opportunity to expand their supply chain and gain competitive advantages in the importation of raw materials, components, and other production inputs by reducing and eliminating import duties. Besides, some of the FTAs harmonize customs codes and product standards, speeding trade flows.Auto manufacturers in Thailand can use FTAs to gain greater market access in Southeast Asia, and enforce restrictions to protect their investments and intellectual property, while expanding upon business opportunities in terms of price competitiveness, market and business development, investment expansion, and government procurement.

Opportunites from the EEC

Given the world’s tightening emission standards, Thailand is keen to expand its automotive manufacturing industry to produce green vehicles. Supporting this vision is the Eastern Economic Corridor (EEC) initiative that places a great importance on bringing next-generation automotive industry to Thailand, in particular, the electronic vehicle (EV) industry.

Located in the three eastern provinces of Chonburi, Rayong, and Chachoengsao, the EEC framework is designed to support 10 target industries, including automobile, to promote emerging technology, innovation, and creativity within each sector through government policies and investment. The aim of the EEC is to expand the value chain of the automotive industry with particular focus on surface integration design and prototyping. Further, it plans to expand and enhance the manufacturing process of electronic accessories and automotive parts. Some of the benefits available to automobile investors in the EEC include corporate income tax exemption up to 15 years; financial incentives for investment in R&D, innovation or human resources development; permit to own land used for BOI promoted projects; and facilitation of foreign workers’ visas and work permits

Growing Hub for Green Vehicles

The global demand for green vehicles is growing. Internationally, the number of electric vehicles (EVs) is projected to rise to 35 percent of all vehicles by 2040. Though Thailand is moving towards production of more fuel-efficient vehicles, the popularity of EVs is still low in the country; sales of hybrid petrol-electric cars or plug-in hybrid cars in Thailand accounted for just one percent of total auto sales in 2015. To help spur the industry, the Thai government is actively promoting and attracting foreign manufacturers to use Thailand as a base for the production of green vehicles in the region. Thailand’s Board of Investment (BOI) offers generous tax incentives to both auto manufacturing and auto parts industry in the country.

Incentives for EV vehicle production

In 2016, the Thai government created a roadmap for the general popularization of electric vehicles (EVs) and approved a tax incentive scheme for EV production in the country.

Currently, there are four types of EVs that have been developed in the world. The first two technology to be developed are hybrid electric vehicles (HEVs) and plug-in hybrid electric vehicles (PHEVs) with two respective systems – electricity-petrol and electricity-diesel. The latest models of EVs available are battery-powered electric vehicles (BEVs), fuelled purely by electricity, and the fuel-cell electric vehicle (FCVs).In Thailand, there are three HEV models that have been locally assembled in since 2009: the Toyota Camry, Nissan X-Trail, and Honda Accord. BMW began PHEV assembly in 2016. Mercedes-Benz assembled its Blue-TEC hybrid engines in 2013 before upgrading to the PHEV platform in 2016. It now produces four EV models.

By 2036, Thailand aims to boost the number of electric cars to 1.2 million and have 690 charging stations operating across the country.

Under the announced scheme, investments in BEVs are eligible to five to eight years of CIT exemptions. Manufacturers producing more than one key EV component may avail an additional year of tax exemption per key component, capped to a maximum of 10 years.

Manufacturers of PHEV are eligible for slightly less generous incentives, with three- year corporate tax exemptions as well as import tariff exemptions on machinery. Manufacture of key components, like for BEVs, will be eligible for an additional year of CIT relief per component, with a maximum of six years.

Investments in HEV are entitled to an import tariff exemption for relevant machinery. Battery electric buses, on the other hand, are entitled to tariff exemptions for imported machinery and a three-year CIT exemption. The relief for the manufacturing of a key component for HEV – and the maximum duration of relief – is identical to that for PHEVs.

Besides, the government has also announced excise tax rate changes to encourage EVs. Excise tax on EVs is now 2 percent, down from 10 percent. The tax rates for hybrids and PHEVs have been reduced, depending on their emission levels. For passenger cars emitting less than 100 g/km of CO2, the tax rate has been reduced from 10 percent to 5 percent; for cars emitting less than 150 g/km of CO2, the rate has been reduced from 20 percent to 10 percent. The maximum tax rate for electrified cars is 12.5 percent for vehicles emitting less than 200 g/km, down from 25 percent.

To boost the component industry, the Thai government has recognized 10 components eligible for eight-year CIT holidays. These include batteries, EV smart charging systems, DC/DC converters, traction motors, battery management services, inverters, portable electric vehicle chargers and electrical circuit breakers.

Incentives for NGV Vehicles

Thailand’s Ministry of Energy supports fuel-efficient transportation through a natural gas vehicle (NGV) initiative. This initiative includes the introduction of over 10,000 natural gas-powered taxicabs, natural gas subsidization, a reduced import duty on NGV tanks from 17 percent to 10 percent, and a reduced import duty on NGV control system parts and components from 35 to 10 percent.

Incentives for E85

The Ministry of Finance is offering three-year exemptions on import duties of foreign auto parts used to make vehicles E85-ready (85 percent ethanol, 15 percent gasoline). The Ministry has also reduced the excise tax on cars using E85 to 22, 27 and 32 percent, depending on engine size.

Outlook for 2018

According to the Federation of Thai Industries (FTI), the Thai automotive industry is poised for moderate growth in 2018. While car production will continue to increase, country’s car exports will remain stable due to unstable global economic outlook and non-tariff barriers imposed by several countries.

The outlook for the domestic market is positive, largely due to the expiry of the five year lock-up period for vehicles bought under the first-time car buyer scheme in 2017, new model launches by foreign manufacturers, and increased government spending.

With the end of the first-time buyer scheme, the number of out-of-warranty passenger vehicles in Thailand is expected to exceed 14 million units by 2020, with more than five million units between the age of three and eight years – offering tremendous opportunities for auto manufacturers in the country.

About Us

ASEAN Briefing is produced by Dezan Shira & Associates. The firm assists foreign investors throughout Asia and maintains offices throughout ASEAN, including in Singapore, Hanoi, Ho Chi Minh City and Jakarta. Please contact us at asia@dezshira.com or visit our website at www.dezshira.com.

- Previous Article Tratados de libre comercio en la ASEAN

- Next Article Corporate Establishment in Thailand: What You Need to Know