Thai Labor Contracts: What You Need to Know

In Thailand, the employee-employer relationship is governed by a series of laws and regulations, the chief one being the Thai Labor Protection Act B.E.2541 (LPA) and the Thai Civil and Commercial Code (TCCC). Other laws include the Labor Relations Act, the Social Security Act, the Act establishing the labor court and labor court procedure, the State Enterprise Labor Relations Act, the Workmen’s Compensation Act, and the Foreign Employment Act. These laws cover all areas related to employment such as working hours, holidays and leave, notice, overtime, sick pay, and severance, and are applicable to both Thai and foreign employees. The Ministry of Labor (MOL) is the primary authority responsible for setting and enforcing minimum employment standards in the country.

Thailand does not mandate a written agreement between the employer and an employee. However, it does impose strict labor regulations with regards to working terms and conditions. In practice, therefore, it is advisable for employers to set out written terms and conditions of employment to avoid legal disputes or liability with regards to remuneration.

If an employment agreement is made in writing, an employer must provide a copy to the employee immediately after it has been signed.

Further, companies employing 10 or more workers must publish written work rules at the workplace and file them with the district labor office within the prescribed period. These rules must be published in the Thai language as well as in English for foreign workers. The published rules must include the following: working days; regular working hours and rest periods; holidays and rules for taking holidays; rules concerning overtime work and work on holidays; date and place of payment of basic pay, overtime pay, holiday pay and holiday overtime pay; leave and rules for taking leave; discipline and punishment; submission of complaints; and termination of employment, severance pay and special severance pay. Additionally, a workplace having 20 or more employees must also provide a written working conditions agreement as part of the employees’ contractual employment terms.Probationary period

Thai law does not explicitly mention probationary period in employment relationships. However, it does specify severance pay for employees who have worked for 120 days or more and are terminated without cause. As a result, to avoid paying severance, many employers in Thailand set probation periods of up to 119 days.

Working hours

Provisions related to working hours are set out in ministerial regulations issued by the MOL and are based on the nature and type of work. In general, working hours must not exceed eight hours per day and 48 hours per week. For employees involved in hazardous work, normal working hours are restricted to seven hours per day and 42 hours per week.

Terminating an employment contract and severance pay

If the employment agreement does not specify the duration of the contract, both the employer and employee have a statutory right to terminate the contract after giving prior notice. The minimum notice period must be at least one week and not more than three months long. In certain circumstances, however, an employer may dismiss an employee without prior notice and due compensation. For example, if an employee intentionally causes the employer to suffer losses; does not perform his duties honestly, or commits a crime against the employer or another employee.

In case of termination, the LPA entitles employees who have worked for at least 120 days to severance pay equivalent to 30 days’ pay; those who have worked for one to three years, to severance pay equivalent to 90 days’ pay; whereas those who have worked for six to ten years are entitled to receive a compensation equivalent to 240 days’ pay. As per amendments to the LPA, which were passed by the Thai National Assembly on December 13, 2018, employees with at least 20 years of service will be entitled to a severance pay equivalent of 400 days’ of the last drawn salary.

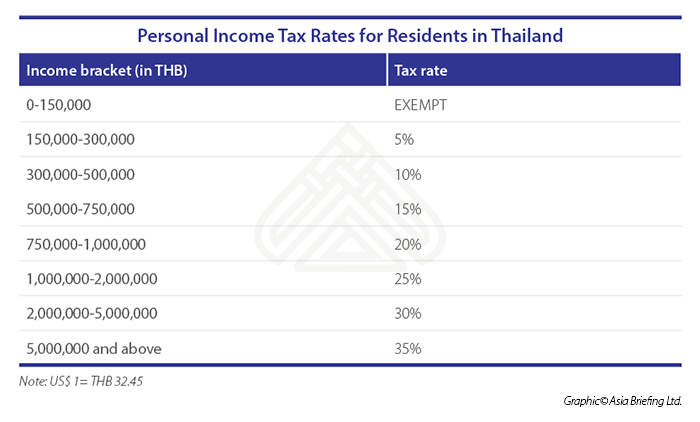

Personal income tax

For the purpose of taxation, individual taxpayers are categorized into “resident” individuals or “non-resident” individuals.

Thai laws define resident individuals as those who have lived in the country for an aggregate period of 180 days in any calendar year.As a result, all foreign employees working in Thailand qualify as resident individuals and are liable to pay tax on their income earned in the country as well as on the income earned from abroad. A non-resident, however, is exempted from paying tax on income earned in Thailand. Current personal income tax rates for resident individuals are given in the table below.

Foreign employees working in Thailand may seek tax benefits available under relevant double taxation treaties between Thailand and their home country.

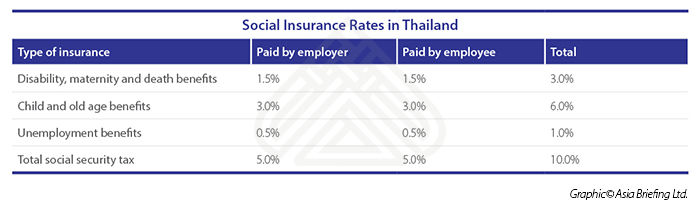

Social Protection

Employers are generally required to register their employees with the workmen compensation fund and social security fund. Both employers and employees are required to contribute to the Social Security Fund at the rate of 5 percent of the employee’s income, up to a maximum of THB750 (US$23) per month.

Further, a provident fund is managed wherein both employer and employee make equal monthly contribution ranging between two to 15 percent of the monthly remuneration.

Conclusion

Thailand has a complex and strictly regulated employment system. Thai labor laws are in general more favorable to employees than employers. Professional advice in preparing an employment contract can significantly help employers avoid legal disputes with their employees and ensure complete compliance with Thai labor laws.

Editor’s Note: This article was first published on December 18, 2017 and has been updated on December 20, 2018 as per latest developments.

About Us

ASEAN Briefing is produced by Dezan Shira & Associates. The firm assists foreign investors throughout Asia and maintains offices throughout ASEAN, including in Singapore, Hanoi, Ho Chi Minh City and Jakarta. Please contact us at asia@dezshira.com or visit our website at www.dezshira.com.

- Previous Article Arbeitsverträge in ASEAN

- Next Article Investing in ASEAN’s Coffee Industry