Tokopedia and Gojek Merger Creates Indonesia’s Largest Digital Services Company

- Indonesia’s biggest internet companies Gojek and Tokopedia announced an US$18 billion merger to create ‘GoTo Group’, in what is the country’s largest-ever business deal.

- The ultimate aim of GoTo would be to go public, with a market valuation estimated at between US$30 and US$40 billion in Jakarta and the US.

- GoTo’s inception highlights the huge potential of Indonesia’s digital economy, which is expected to have a gross merchandise value of US$125 billion by 2025, making it the largest in Southeast Asia.

On May 17, 2021, two of Indonesia’s biggest internet companies — ride-hailing and payments giant Gojek and e-commerce leader Tokopedia — announced an US$18 billion merger to create ‘GoTo Group’, in what is the country’s largest-ever business deal.

The ultimate aim of GoTo would be to go public, with a market valuation estimated at between US$30 and US$40 billion in Jakarta and the US. This will be the first IPO by an Indonesian tech start-up and paves the route for others to follow, such as Bukalapak (another e-commerce platform). The merger will help Gojek and Tokopedia compete with its regional rivals Grab Holdings, and internet company Sea Ltd., which operates the e-commerce platform Shopee. Sea has a market valuation of US$112 billion and Grab announced last month a US$40 billion special purpose acquisition company (SPAC) merger to go public on the Nasdaq.

The combined ecosystem of Gojek and Tokopedia accounts for some two percent of Indonesia’s GDP, with a combined number of active users in excess of 100 million. Further, GoTo has over two million registered drivers and more than 11 million merchants. As of 2020, the combined gross transaction value of Gojek and Tokopedia reached US$22 billion with over 1.8 billion transactions recorded in the same year.Merger highlights the huge potential of Indonesia’s digital economy

GoTo’s inception highlights the huge potential of Indonesia’s digital economy. According to a report by Bain & Co, Temasek, and Google, Southeast Asia’s digital economy is poised to reach a gross merchandise value (GMV) of over US$300 billion by 2025, of which roughly US$125 billion can be attributed to Indonesia’s market, making it the largest in the region.

Indonesia is Southeast Asia’s fastest-growing internet economy, boosted by more than 170 million internet users, and an e-commerce landscape that had a GMV of US$40 billion in 2020.

Indonesia’s large market is also a draw for big competition resulting in the country’s successful technology unicorns constantly innovating new ways to grow.

Gojek, for instance, originally started as an online motorbike taxi service in 2010 but has since developed into a ‘super app’ offering over 20 services, ranging from food and grocery delivery, e-payments, ticketing, and even on-demand make-up-artists.

Tokopedia provides digital products, such as credit cards, utility payments, game vouchers, and healthcare payments, in addition to its main consumer-to-consumer (C2C) business platform.

E-commerce: The driver of Indonesia’s digital economy

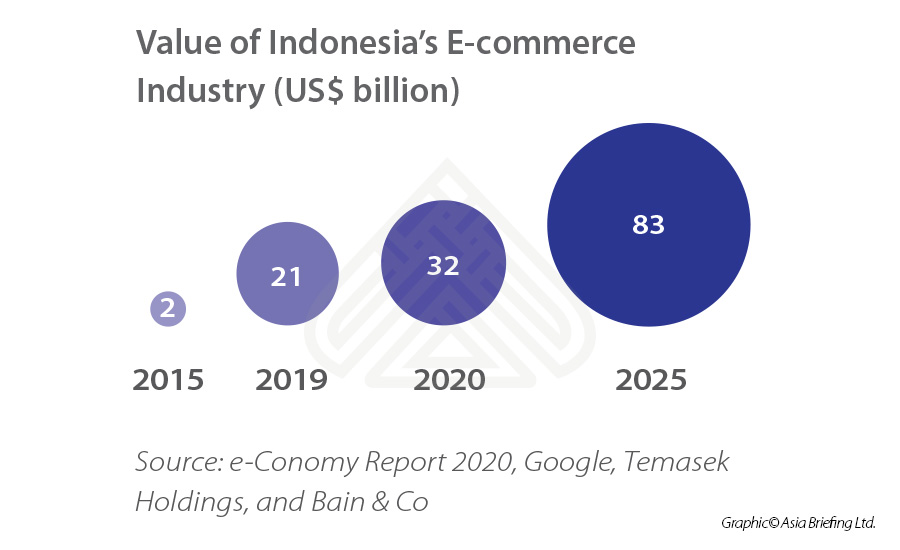

E-commerce is set to be the main driver of growth for Indonesia’s digital economy; an industry poised to be valued at US$83 billion by 2025.

Over 10 percent of Indonesia’s population of 270 million is already engaged in online shopping, with over 58 percent of transactions conducted through mobile shopping services. Notable foreign e-commerce platforms that have taken advantage of Indonesia’s large consumer market are Singapore’s Lazada and Shopee, who garnered over 140 million monthly visits between them.

GoTo will make Indonesia’s fintech industry more competitive and dynamic

Indonesia is home to 20 percent of all fintech companies in Southeast Asia, and despite its infancy, is expected to generate some US$8.6 billion in revenue over the next five years.

GoTo has the potential to provide financial solutions to the country’s underbanked and unbanked population, which is estimated at 47 million and 92 million people respectively. This is because some 60 percent of Indonesia’s workforce and micro, small, and medium-sized enterprises (MSMEs) are in the informal sector and thus do not have access to financing from banks.

Traditionally, such MSMEs do not have business models that are compatible with the characteristics of banking products. For instance, many MSMEs do not have collateral of large value and many do not qualify for loan schemes.

Fintech firms have been trying to fill this gap through P2P lending schemes, whereby they provide microloans with the terms of maturity that are small and short, usually within a few weeks and with borrowers typically receiving no more than US$100. The funds are also disbursed within 24 hours, making them popular for their convenience.

As of 2020, P2P lending reached US$7.7 billion from 160 fintech companies officially listed by the Financial Services Authority (OJK).

About Us

ASEAN Briefing is produced by Dezan Shira & Associates. The firm assists foreign investors throughout Asia and maintains offices throughout ASEAN, including in Singapore, Hanoi, Ho Chi Minh City, and Da Nang in Vietnam, Munich, and Esen in Germany, Boston, and Salt Lake City in the United States, Milan, Conegliano, and Udine in Italy, in addition to Jakarta, and Batam in Indonesia. We also have partner firms in Malaysia, Bangladesh, the Philippines, and Thailand as well as our practices in China and India. Please contact us at asia@dezshira.com or visit our website at www.dezshira.com.