The Philippines to Suspend Social Security and Healthcare Premium Hikes for 2021

- The Philippines House of Representatives passed House Bill’s No. 8461 and 8512 which authorizes the President to suspend the premium contribution hikes for social security programs.

- The suspension pertains to the premiums for Philippine Health Insurance Corporation (PhilHealth) and the Social Security System (SSS).

- The government has cited the ongoing economic impact caused by the COVID-19 pandemic as the main reason for the suspension.

- The Bills only require the signature of the President to become law.

The House of Representatives in the Philippines have passed House Bill No. 8461 (HB 8461) which seeks to authorize the President to suspend the premium contribution hike to the Philippine Health Insurance Corporation (PhilHealth), in addition to House Bill No. 8512 (HB 8512), which provides the President the power to defer the scheduled hike in contributions to the Social Security System (SSS).

Both PhilHealth and the SSS were mandated by existing laws to increase their premium rates in 2021. However, the onset of the pandemic has drawn opposition from Filipinos and businesses for any increases in premium rates. As such, the government hopes the suspension would provide tax relief for businesses, workers, and the self-employed as the country continues to reel from the economic impact caused by the virus. GDP shrank 9.5 percent in 2020, the biggest contraction on record and resulted in the Philippines suffering from its first recession in 30 years.

PhilHealth is government-controlled cooperation that implements the country’s universal healthcare program, providing Filipinos with access to affordable healthcare services and financial assistance. It covers, hospital costs, medicine, and subsidies for room and boarding, among others. The government had planned to increase the premium rate to 3.5 percent but instead will remain at the three percent rate.

The SSS is a state-run social insurance program established to protect members and their families. The SSS provides maternity leave, funeral, disability, retirement, death, sickness, involuntary separation, and unemployment benefits, with all private employers and employees obligated to join the program. The contribution rate for the SSS was supposed to increase from the current 12 percent to 13 percent, but this has now been suspended.

The two bills only require the signature of the President to come into law.

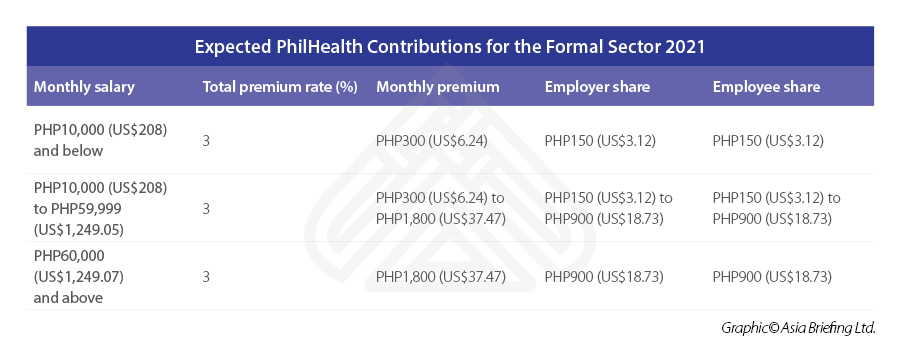

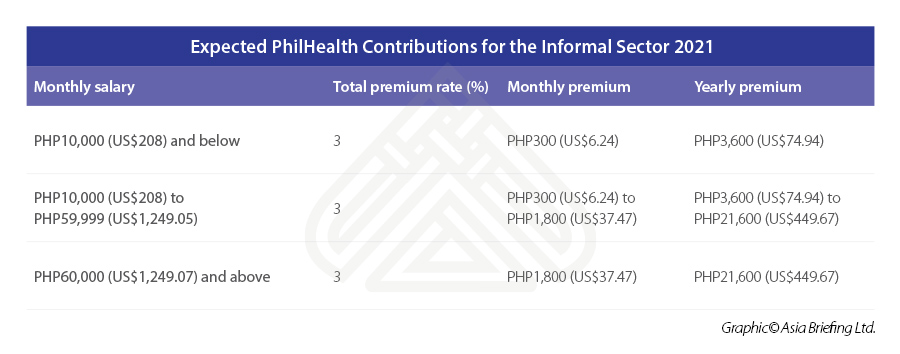

How much do you need to contribute to PhilHealth?

As mentioned, the contribution to PhilHealth will be shared by the employer and employee (formal employment), meanwhile, direct contributory members (freelancers, self-employed, professional practitioners, etc) will pay the sum annually.

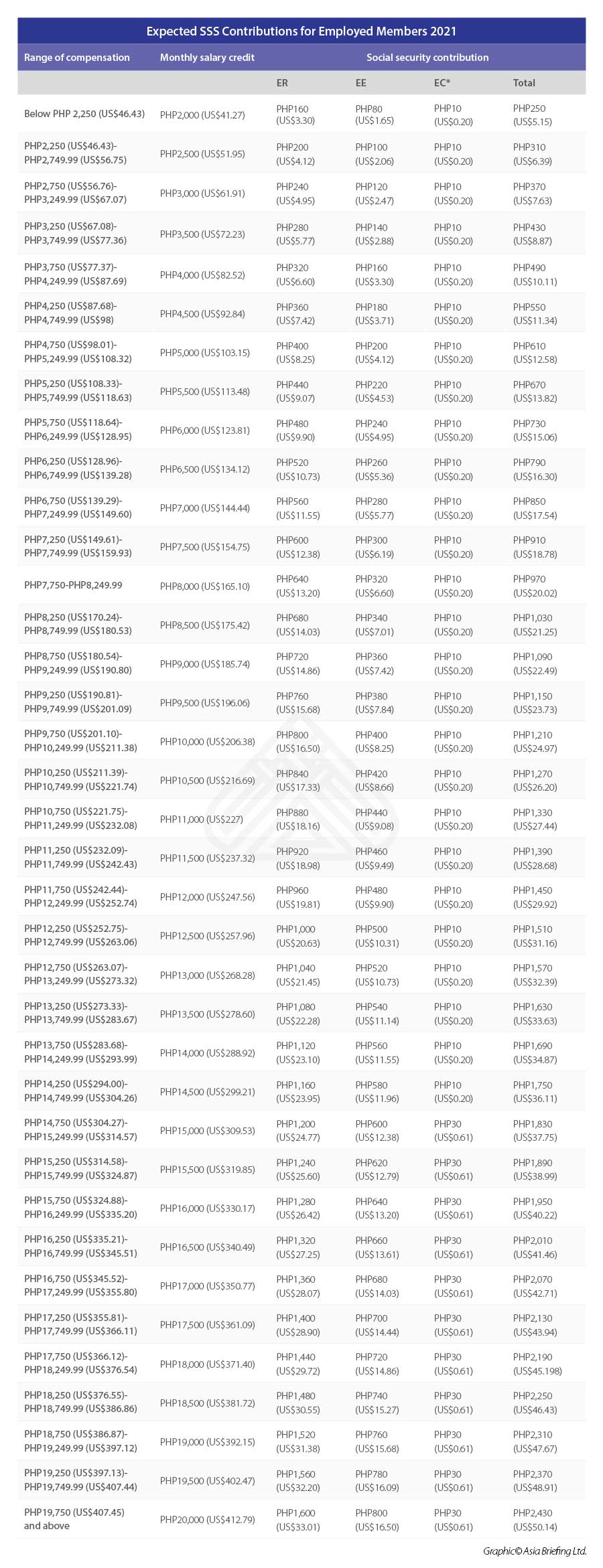

What is the SSS Contribution Schedule for 2021?

The SSS premium for employers and employees will differ depending on the employee’s monthly compensation bracket. The SSS was scheduled to increase the premium rate by one percent for 2021, before the suspension. This is in accordance to Social Security Act of 2018, which was signed by the President in 2019, and which allowed the pension fund to increase the premium contribution rate by one percentage point every other year starting in 2019 until it reaches 15 percent.

For formal employees, the SSS contribution rate is 12 percent of the monthly salary credit.

Key

- Monthly salary credit — The compensation base for benefits and contributions related to total monthly earnings.

- Employer social security (ER) —Employer’s contribution

- Employee social security (EC) — Employee’s contribution

- EC* — Contribution from the Employees’ Compensation Program which provides a range of benefits to workers and their dependents in the event of work-connected injury, sickness, or death. For employed members, EC* is paid by the employer.

The contribution rate is also 12 percent and as of September 2020, the Employees’ Compensation Program was expanded to include self-employed SSS members.

There will be a monthly charge of three percent for any overdue contributions to the SSS program.

About Us

ASEAN Briefing is produced by Dezan Shira & Associates. The firm assists foreign investors throughout Asia and maintains offices throughout ASEAN, including in Singapore, Hanoi, Ho Chi Minh City, and Da Nang in Vietnam, Munich, and Esen in Germany, Boston, and Salt Lake City in the United States, Milan, Conegliano, and Udine in Italy, in addition to Jakarta, and Batam in Indonesia. We also have partner firms in Malaysia, Bangladesh, the Philippines, and Thailand as well as our practices in China and India. Please contact us at asia@dezshira.com or visit our website at www.dezshira.com.