Income Tax Exemptions on Export Revenues from Indonesian Natural Resources

Explore Indonesia’s GR 22/2024 regulation offering tax exemptions for natural resource exporters.

Taxation of Foreign Sourced Income in Thailand Begins in 2024

Instruction No. Paw 161/2566 states that Thai taxpayers who derive assessable income from abroad must pay tax on that income after bringing such income to Thailand.

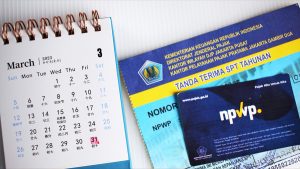

How to File Your Individual Tax Returns in Indonesia

Taxpayers in Indonesia must file their tax returns by March 31. This can be done online or through a registered tax office.

A Guide to Taxation in Cambodia

A tax resident in Cambodia is someone who domiciles in the country or is in Cambodia for more than 182 days in any 12-month period.

Cambodia Introduces New Income Tax Thresholds for 2023

Cambodia has introduced new income tax thresholds for 2023 under Sub-Decree 196.

Malaysia Issues Tax Exemption for Foreign Sourced Income

The Malaysian government has decided to provide a tax exemption on foreign-sourced income for individual taxpayers, backtracking from their earlier proposal made in the 2022 budget.

Vietnam Circulars 40 and 100: Guiding PIT and VAT Administration for Businesses and Individuals

Circulars 40 and 100 provide new guidelines on tax administration for businesses and individuals.