State by State – ASEAN and Connecticut Trade

By: Dezan Shira & Associates

Editor: Maxfield Brown

Connecticut – known for its financial services and high end manufacturing – is rapidly emerging as an important trading partner for the ASEAN region. Since 2007, strong export growth (up 60 percent) and advancing firm participation in trade (up 49 percent) have deepened the states ties to international markets and increased ASEAN bound exports to US $1.32 billion. With 30 percent of the state’s business leaders identifying Asia as their market of choice for expansion, ASEAN’s share of Connecticut exports – currently standing at 5 percent – is only set to increase.

Advancing exports will likely center around Connecticut’s comparative advantage in manufacturing. As of 2014, top exports to ASEAN included transportation equipment, computers and electronic products, fabricated metal products, machinery, and chemicals. In the face of an emerging middle class and increased scaling of production in many ASEAN states, Connecticut’s ability to produce high value added components and complex finished goods is bound find traction in both the public and private sectors.

Although opportunities exist throughout the regional bloc, the inclusion of several ASEAN states within the TPP presents unique opportunities for exporters. Below are some of the most promising bilateral trading partnerships between the nutmeg state and the ASEAN Region.

Connecticut – Indonesia Trade

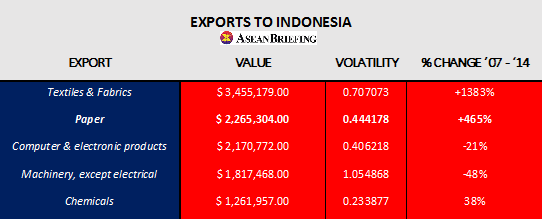

As ASEAN’s largest economy and most populous member, Indonesia offers great potential for producers and consumers alike. In 2014, trade volume exceeded of US $100 million, with imports from Indonesia comprising US $86.4 million. Exports to the archipelago – originally driven by strong demand for machinery and electrical products – reached a high of US $65.5 million in 2011, but have seen annual declines of up to 19 percent in recent years. While slowing demand from Indonesia is certainly a cause for concern, a strong consumer base and pending introduction of liberalization through the ASEAN Economic Community (AEC) look ready to boost demand in the coming years.

It is also clear that Indonesia’s slowing demand has not been uniform across sectoral lines. Although Connecticut’s machinery exporters have has seen high levels of volatility accompanied by declining in sales, opportunities do exist in many of the state’s top industries. With some of the lowest levels of volatility among Connecticut’s exports and growth of 465 percent in the last seven years, paper producers are among the best positioned for success in the Indonesian market. Other Industries that have seen growth in recent years include chemicals, and textiles.

RELATED: State by State – ASEAN and Pennsylvania Trade

RELATED: State by State – ASEAN and Pennsylvania Trade

Connecticut – Singapore Trade

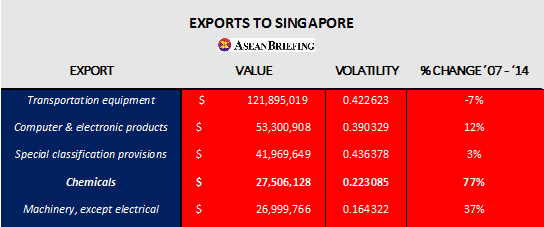

With trade volume reaching US $825 million in 2014, Singapore is by far the most important trading partner for Connecticut within ASEAN. Boasting a booming airline industry and the largest electronics production hub in the region, Singapore ranks 12th as an export destination for producers in the state. Since 2005, Connecticut’s sales to Singapore have risen from US $246 million to US $338 million in 2014. Although trade between the two partners has shown steady growth, slowing demand for transportation equipment resulted in a 37 percent drop in exports and 17.7 percent drop in imports in 2014.

While transportation equipment comprises a substantial share of Connecticut’s exports to Singapore, rapidly increasing demand for computers & electronic products, chemicals, and machinery provide opportunities for a wide variety of producers within the state. Chemical companies in particular have shown strong sales growth (77 percent) over the past seven years with relatively low levels of demand fluctuation.

Connecticut – Malaysia Trade

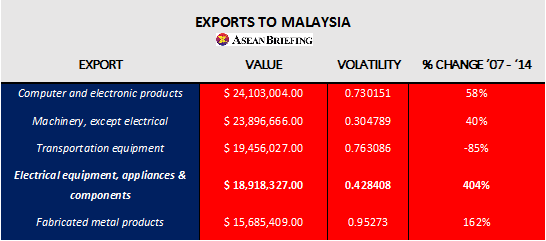

Despite a 55 percent drop in 2014 exports, Malaysia remains Connecticut’s second most important trading partner within ASEAN, and its 20th most important overall. Trade volume reached US $264 million dollars in 2014 with sales to Malaysian buyers growing by 21 percent over the last seven years. Much like Singapore, falling demand for transportation equipment – which saw an 85 percent reduction in demand over the last seven years – has largely been responsible for recent declines in exports and helped to precipitate a 20.9 percent decline in imports from Malaysia.

Fortunately, Malaysian demand for Connecticut’s goods is diversified and offers many opportunities for future investment. In 2014, top exports from Connecticut included: computer and electronic products, machinery, electrical equipment, and fabricated metal products. Advancing by 404 percent since 2007, sales of electrical equipment reached US $18 million dollars in 2014. With high growth and low sales volatility, investments in this industry will help to provide coverage from rapid declines seen in transportation equipment while allowing exporters to tap into rising demand.

TPP

Eagerly anticipated by businesses throughout the state – 75 percent of whom say it will benefit their business – the recent passage of TPP is sure to have a substantial impact on Connecticut’s trading relationship with ASEAN. With both Malaysia and Singapore party to the agreement, exporters and importers alike will benefit from reduced tariffs and increased protection of intellectual property. With the AEC deadline rapidly approaching, Connecticut’s exporters will likely be able to leverage increased trading opportunities with Singapore and Malaysia to service the regions need for high value added machinery and intermediate electronics products.

RELATED: Pre-Investment Services from Dezan Shira & Associates

RELATED: Pre-Investment Services from Dezan Shira & Associates

Investment Opportunity: Malaysia

While the TPP stands to improve bilateral trade between many of its signatories, the relationship between the United States and Malaysia offers some of the most important concessions. Exporters in Connecticut will gain from tariff reductions on machinery and protein concentrate which stood at 30 percent and 15 percent respectively. With machinery exports up 40 percent over the last seven years, it is likely that tariff reductions will substantially improve competitiveness for producers in the state and add to this trend. For Connecticut’s importers, textile tariff reductions stand to reduce the cost of many clothing items imported from Malaysia. Men’s cotton shirts and pants in particular – which had tariffs of 19.7 percent and 16.6 percent respectively – are likely to come at a much cheaper cost.

Further Support from Dezan Shira & Associates

Dezan Shira & Associates can service Connecticut-based companies that are looking to further develop their operation in ASEAN. The firm can help companies establish a direct office in the country and can guide them through the affiliated tax, legal and HR issues that come with doing so. To arrange a free consultation, please contact our U.S. office at usa@dezshira.com.

|

Asia Briefing Ltd. is a subsidiary of Dezan Shira & Associates. Dezan Shira is a specialist foreign direct investment practice, providing corporate establishment, business advisory, tax advisory and compliance, accounting, payroll, due diligence and financial review services to multinationals investing in China, Hong Kong, India, Vietnam, Singapore and the rest of ASEAN. For further information, please email asean@dezshira.com or visit www.dezshira.com. Stay up to date with the latest business and investment trends in Asia by subscribing to our complimentary update service featuring news, commentary and regulatory insight. |

An Introduction to Doing Business in ASEAN

An Introduction to Doing Business in ASEAN

An Introduction to Doing Business in ASEAN introduces the fundamentals of investing in the 10-nation ASEAN bloc, concentrating on economics, trade, corporate establishment and taxation. We also include the latest development news in our “Important Updates” section for each country, with the intent to provide an executive assessment of the varying component parts of ASEAN, assessing each member state and providing the most up-to-date economic and demographic data on each.

An Introduction to Tax Treaties Throughout Asia

An Introduction to Tax Treaties Throughout Asia

In this issue of Asia Briefing Magazine, we take a look at the various types of trade and tax treaties that exist between Asian nations. These include bilateral investment treaties, double tax treaties and free trade agreements – all of which directly affect businesses operating in Asia.

The 2015 Asia Tax Comparator

In this issue, we compare and contrast the most relevant tax laws applicable for businesses with a presence in Asia. We analyze the different tax rates of 13 jurisdictions in the region, including India, China, Hong Kong, and the 10 member states of ASEAN. We also take a look at some of the most important compliance issues that businesses should be aware of, and conclude by discussing some of the most important tax and finance concerns companies will face when entering Asia.