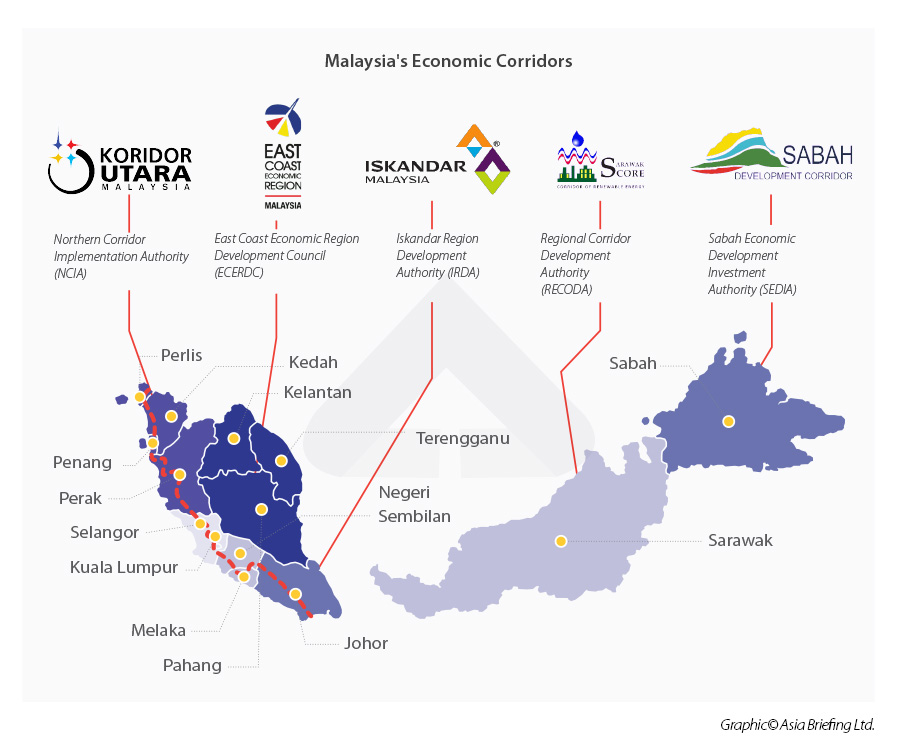

Promising Sectors for Investments in Malaysia’s Economic Corridors

The attractive incentives afforded in Malaysia’s economic corridors have resulted in the high-quality growth of several manufacturing and service industries, propelling the country to become a prominent economic force in Southeast Asia.

Malaysia’s economic corridors offer foreign businesses ample opportunities to invest in sectors that have transformed the country into a leading economic power in Southeast Asia. Further, a well-educated workforce, good infrastructure, and business-friendly policies have turned Malaysia into one of the most reliable investment destinations in recent decades.

The country is also gaining increasing importance in global supply chains—particularly due to trade tensions between the U.S. and China—such as a location for semiconductor producers looking to diversify their business risks. Moreover, Malaysia has a well-established industrial sector and thus presents opportunities in the fields of healthcare, electronics, the digital economy, and Islamic finance, among many others.

Manufacturing

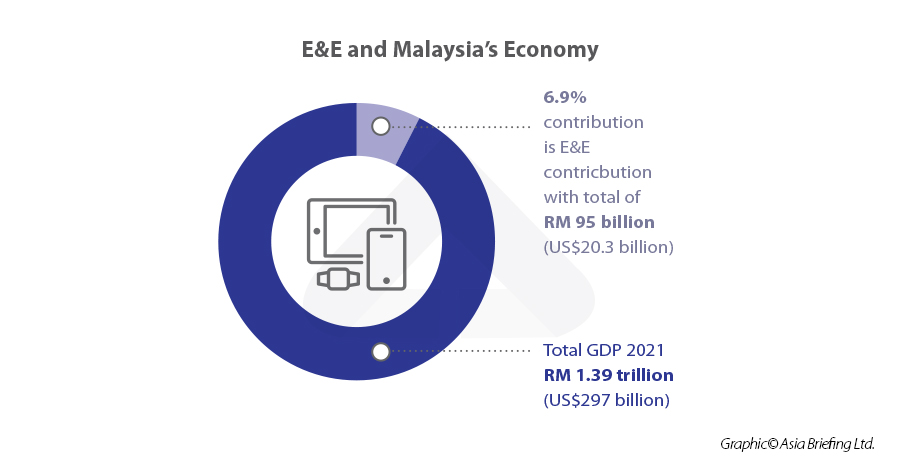

Manufacturing plays a vital role in Malaysia’s economy, contributing an estimated 23 percent of GDP, and is the second largest sector of the economy behind services. Malaysia produces a large range of goods, predominantly exported from electrical and electronics (E&E) to chemicals to rubber products. Electronics are the biggest contributors to the sector with approximately 4.9 percent of GDP. Intel, Hewlett Packard, Bosch, and Hitachi are just a few of the multinational firms that have production hubs in Malaysia for E&E products.

The government is encouraging industry players to move towards Industry 4.0 by providing incentives such as tax breaks for businesses that incorporate automation and data informatics in their manufacturing process and migrate to high-value manufacturing. To achieve this, the country needs to upskill the labor force. Opportunities thus also exist for businesses that engage in upgrading and upskilling the local workforce.E&E and semiconductors

Malaysia is a prominent player in the global E&E industry, with the country responsible for 13 percent of global chip production, testing, and packaging, in addition to seven percent of global semiconductor production. Malaysia’s main export destinations for its E&E products include Singapore, the U.S., China, Japan, as well as countries in Europe.

In 2022, Malaysia exported approximately 593 billion ringgit (US$126 billion) of E&E products, or 38 percent of the country’s total exports an increase from 455 billion ringgit (US$97 billion) from the previous year. Also in 2022, the country was the ninth-largest exporter of E&E products and the sixth-largest exporter for semiconductors.

With global E&E and semiconductor demand set to grow, Malaysia offers new opportunities for businesses that are looking to expand their production capacities to meet this demand. Further, Malaysia’s E&E industry will be pivotal in

assisting the country’s goal of becoming a high-technology nation by 2030 with research and development targeted to reach 3.5 percent of GDP.

Medical devices and tourism

Malaysia is becoming a hub for medical device manufacturing in the region and over 90 percent of the medical devices manufactured in the country are exported. Revenue from medical devices is expected to reach over US$3.3 billion by the end of 2023.

Malaysia’s medical devices industry comprises of more than 200 manufacturers, of which 30 are multinationals that have made Malaysia their manufacturing base. These include reputable names, such as Abbott, Toshiba Medical Systems, and Braun.

The government views this industry, alongside electrical and electronics, chemicals, aerospace, and machinery and equipment subsectors, as high-potential growth areas that can revitalize the country’s manufacturing sector.

Other medical devices produced in Malaysia are:

- Surgical tools;

- Syringes and needles;

- Orthopedic products;

- Optical lenses;

- Hospital furniture;

- Blood transfusion sets;

- Dental dams; and

- First aid kits.

Businesses are looking to shift production into more value-added products and services, through embracing technology and enhancing research and development methods. New areas of growth lie in the production of medical imaging devices, such as the components or part of components of magnetic resonance imaging (MRI) machines, x-rays, computed tomography (CT) scanners, and nuclear imaging systems.

Malaysia is also on track to become the preferred destination for medical tourism in Southeast Asia. The Malaysia Healthcare Travel Council revealed that some 800,000 medical tourists arrived in 2022 and revenue from the industry is expected to reach US$225 million by the end of 2023. Although this is still lower than revenue recorded in 2019 (US$433 million), the country did only reopen its borders following the COVID-19 pandemic in April 2022.

In 2005, the Ministry of Health established an agency called the Malaysia Healthcare Travel Council (MHTC), designated to facilitate and promote the country’s healthcare travel industry by establishing public-private partnerships at home and abroad.

The MHTC provides an all-encompassing service to foreign clients, such as providing localized outreach through representative offices in Indonesia, Vietnam, and Myanmar. Their services also extend to assisting the procurement of medical visas in conjunction with the Immigration Department of Malaysia. Medical tourists are not limited to specific hospitals, and the MHTC has partnered with 79 hospitals and clinics – of which 21 are ‘elite’ and 58 are ‘ordinary’. Elite hospitals have been accredited by international healthcare agencies, such as the Australian Council on Healthcare Standards (ACHS), Accreditations Canada, and the CHKS Accreditation Unit (UK).

Malaysia is carving itself as a provider of specialized treatments, carving a niche for fertility and cardiology treatments, enabling the country to compete with world-class medical centers across Asia. The country has over 30 advanced heart treatment centers, which includes the renowned National Heart Institute which has a reputation of being among the best in the continent.Halal industry

The Halal industry in Malaysia is one of the most robust and contributes to some 10 percent of GDP. The industry is projected to grow to over US$113 billion by 2030 and encompasses a wide range of industries from food and beverages to pharmaceuticals to banking to travel, among others. Malaysia exports over 60 billion ringgit (US$12.8 billion) of Halal products in 2022, a 64 percent increase from 2021.

Malaysia was among the first Muslim countries to have a documented Halal assurance and certification system in the year 2000. This prompted the government to expand the mandate of the Department of Islamic Development (JAKIM) to include the regulation of Malaysia’s Halal Industry.

As a result, JAKIM was able to develop stringent Halal standards which are recognized worldwide. This offers an important guardrail for foreign companies seeking to be Halal accredited in Malaysia and the region.

With the global Halal market valued at an estimated US$3 trillion, Malaysia stands to benefit as a leader not only for Halal manufacturing but also in Halal certification. JAKIM’s Halal certification is recognized in more than 47 countries and more than 80 certification bodies worldwide. In addition to Halal manufacturing, Malaysia also has a well-developed Islamic finance ecosystem and is currently the world’s third-largest Islamic banking market. Islamic bank loans constituted some 40 percent of local banking system loans in 2022.

Moreover, Malaysia controls 20 percent of the global Islamic banking assets and 62 percent of the Asia Pacific’s Islamic banking assets. Malaysia also offers the opportunity to act as a base to cater to the untapped demand and market potential in Indonesia, Bangladesh, and Pakistan for Islamic finance products.

Digital economy

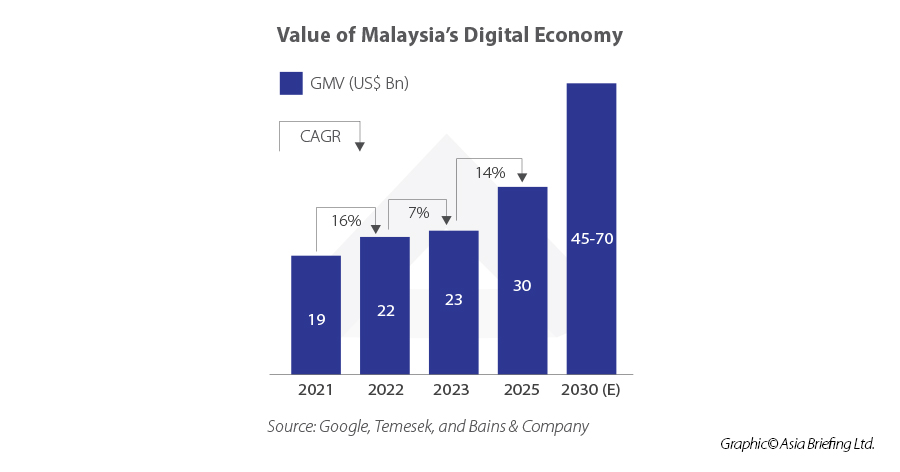

In 2022, Malaysia’s digital economy accounted for 22 percent of GDP, and it is projected to reach 25 percent by 2025, positioning it as one of the country’s fastest-growing sectors. According to the e-Conomy 2023 report by Google, Temasek, and Bains & Company, Malaysia’s digital economy is expected to achieve a gross merchandise value (GMV) of US$23 billion in 2023, with estimates rising to a range of US$45-US$70 billion by 2030. E-commerce presents lucrative investment opportunities, with a projected GMV of US$13 billion in 2023, potentially increasing to US$25 billion by 2030. Other growth segments include online travel (US$10 billion), transport and food (US$5 billion), and online media (US$5 billion).

The government has identified nine priority sectors for digital transformation, encompassing trade, agriculture, smart cities, healthcare, finance, tourism, content, services, and the Islamic digital economy. Malaysia’s thriving data center industry has attracted major players such as Amazon Web Services, Google Cloud, Alibaba, and Microsoft. With competitive land costs and proximity to Singapore, Malaysia experienced substantial growth in new data center uptake, securing 113 MW in 2022—four times more than Indonesia and Thailand combined.

The government’s Digital Ecosystem Acceleration scheme, initiated in 2022, provides tax waivers for qualifying data center investments, aiming to achieve a revenue target of US$800 million by 2025, doubling the current figure of US$400 million.

Webinar – Unveiling Southeast Asia’s Opportunities: 2023 Achievements and 2024 Prospects

February 29, 2023, | 9:00 AM Los Angeles / 12:00 PM New York / 6:00 PM Brussels

Join us in this data-driven webinar as Kyle Freeman, Partner and Head of the North American Client Services Desk in Asia, shares insights on Southeast Asia’s 2023 economic indicators and provides an overview of what to expect in 2024. The focus will be on trade and investment trends, noteworthy developments affecting businesses, and opportunities for foreign companies.

About Us

ASEAN Briefing is produced by Dezan Shira & Associates. The firm assists foreign investors throughout Asia and maintains offices throughout ASEAN, including in Singapore, Hanoi, Ho Chi Minh City, and Da Nang in Vietnam, in addition to Jakarta, in Indonesia. We also have partner firms in Malaysia, the Philippines, and Thailand as well as our practices in China and India. Please contact us at asean@dezshira.com or visit our website at www.dezshira.com.

- Previous Article Policy to Profit: Shaping ASEAN-GCC Investment Dynamics in 2024

- Next Article Renewable Energy Manufacturing Potential in Southeast Asia