Reshoring China Production to Thailand: Key Sectors That Benefit

As the second-largest economy in ASEAN behind Indonesia, Thailand presents ample investment opportunities for foreign businesses. The country has experienced growing domestic consumption over the decades coupled with robust export-oriented manufacturing, resulting in the country gaining the status of an upper-middle income nation in 2011.

Further, Thailand is also benefitting from Sino-US trade tensions with several Chinese-based firms relocating part of their supply chain to Thailand, especially for electronics, chemicals, and automotive. The Board of Investment (BOI) announced in February 2022 that the combined value of foreign and local investment applications in 2021 totaled 643 billion baht (US$19.4 billion), an increase of 59 percent from the previous year.

Electricals and electronics topped the list of targeted sectors, attracting 104.5 billion baht (US$2.8 billion) followed by the medical sector (62.2 billion baht (US$1.6 billion)), petrochemicals (48.4 billion baht (US$1.3 billion)), agriculture (47.7 billion baht (US$1.3 billion)), and automotive and parts (24.6 billion baht (US$672 million)).

Despite the shift from an agrarian to an industrial economy, the bulk of the workforce remains in low-scale and low-productivity activities. Failure to upgrade to higher-value industries and improve competitiveness in services may constrain Thailand’s long-term growth potential.

Value-added manufacturing

Thailand’s economy is dependent on exports, which accounted for some 60 percent of GDP before the pandemic. As such, the country’s manufacturing sector plays an important role, contributing 27 percent of GDP in 2021; the sector’s success or failure often dictates the overall health of the economy.

Over the last fifty years, Thailand has built up a robust manufacturing sector. It is now keen to attract investments for mid/high-tech manufacturing, especially as regional rivals like Vietnam and Cambodia become new centers for low-cost production in the region.

Electric vehicles

The Thai government wants Thailand to evolve into a base for electric vehicle (EV) production. German luxury carmaker, Mercedes, chose Thailand as its first site in Southeast Asia to manufacture its electric EQS model with Toyota as well as Chinese car manufacturer Great Wall Motor signing up for a government incentive plan to produce EVs in Thailand.

The country’s emergence as an EV production hub in the region has been fast-tracked by generous incentives, such as 3-11 years of tax holidays and investment incentives for EV infrastructure.

Further, EV manufacturers are attracted by Thailand’s well-developed automotive supply chains, which have garnered its nickname ‘Detroit of Asia’. Before the pandemic, Thailand had the largest automotive industry in Southeast Asia and the 10th largest in the world. Car exports are expected to increase to over 1 million units in 2022 from the 956,530 units sold in 2021 and 704,626 units in 2020. The National EV Committee announced a goal to have at least 50 percent of locally made vehicles be EVs by 2030, and in February 2022, the government introduced exemptions for import duty and excise tax for a wide range of EV models.

Additionally, Thailand plans to attract 400 billion baht (US$12.08 billion) in investments over the coming years and support the production of 1.2 million EVs and 690 charging stations by 2036.

Electrical and electronics

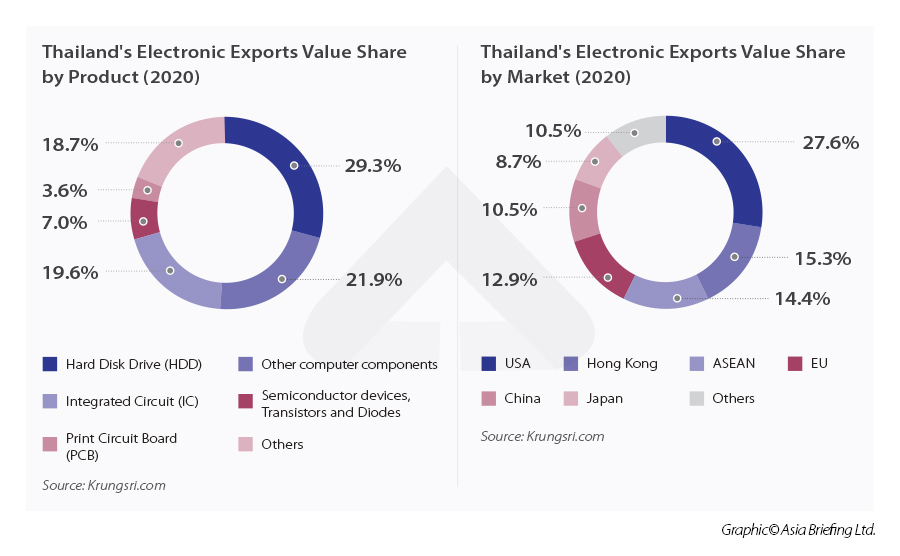

The exports of electrical and electronics (E&E) products amounted to over US$42 billion in 2021, leading other major export groups, such as automotive, machinery, and food. Before the pandemic, Thailand’s electronics manufacturing sector was the 13th largest hub in the world, with most large-sized manufacturers focusing on the production of integrated circuits, hard disk drives, semiconductors, diodes, and capacitors.

According to Government Savings Bank (GSB), Thailand’s largest state-owned bank, the country is the world’s second-largest exporter of hard-disk drives, washing machines, and air conditioners, and ranks sixth for compressors and eighth for refrigerators — accounting for approximately 24 percent of exports and just over 10 percent of GDP. Thailand boasts an E&E supply chain covering more than 2,500 companies, which includes global giants like Samsung, Toshiba, Mitsubishi, Sony, LG, and Siemens, among others.

With increasing global demand for smart devices across the industrial and consumer landscape, Thailand can be a leading supplier of such devices, particularly for IoT devices as the 5G rollout continues worldwide. Moreover, this growing demand will spur the development of new products not just in the E&E sector but also in other industries that are digitally transforming, such as in the automotive industry where digital components are replacing analog equipment.

Medical devices

Thailand’s healthcare industry is a priority sector for investment as part of the government’s Thailand 4.0 policy. The government wants to position the country as a medical hub in the region, in particular for medical tourism and exports of medical devices.

In 2021, the value of Thailand’s medical devices industry was approximately US$6 billion, and over 80 percent of local production was exported. Most medical devices produced in Thailand are those that do not require complex technology or are single-use devices, such as rubber gloves and syringes.

Other leading sub-sectors include:

- Cardiovascular devices;

- Neurological and surgical devices;

- Ultrasound and X-ray devices;

- Orthopedic and fracture devices; and

- Dental devices, among others.

Further opportunities for foreign investors lie in catering to Thailand’s aging population with 30 percent of the population forecasted to be over 60 by 2035. The societal change will create demand for support services that serve an increasingly elderly population.

Digital economy

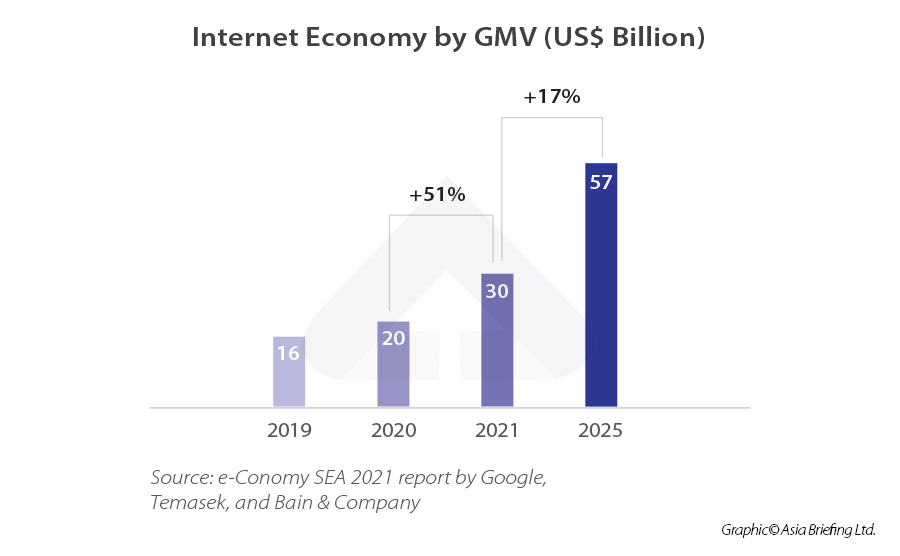

Thailand’s digital businesses are among the fastest growing in ASEAN and had a gross merchandise value of (GMV) US$30 billion in 2021, according to a report compiled by Google, Temasek, and Bain & Company. By 2025, the digital sector is expected to have a GMV of US$57 billion, second behind Indonesia with US$146 billion. E-commerce continues to be the main growth driver of the Thai digital economy with a GMV of US$21 billion in 2021 and is expected to rise to US$35 billion by 2025.

This heightens the need for skilled labor in Thailand as the digital economy is expected to account for 30 percent of the nation’s GDP in 2030. According to a report by ONDE and Time Consulting, by 2030, the total demand for digital talents in Thailand will exceed 1 million, and there will be a 400,000-person gap in the digital workforce supply. The private sector is now stepping in to fill this gap.

According to a report by consultancy firm AlphaBeta, Thailand’s digital transformation can unlock up to 2.5 trillion baht (US$65 billion) worth of economic value per year by 2030. Further, approximately 65 percent of Thailand’s digital opportunity can be driven by applications that help businesses mitigate the economic impact of the pandemic.

Foreign companies can provide solutions in the form of cloud computing, big data, the Internet of Things, and data analytics, for Thai industries. The main barriers to digital transformation in the country are the slow adoption of digital solutions by businesses and the digital talent gap.

High-end tourism

The economic impact of COVID-19 continues to be felt in Thailand’s tourism industry despite the country reopening its doors to international tourists and facing a tough rebuild. The industry accounted for 18-20 percent of the country’s GDP in 2019, when nearly 40 million international tourists visited the kingdom and generated approximately $US64 billion in revenue. As such, the government hopes to attract up to 10 million foreign tourists for the remainder of 2022.

In response to the slowdown, the Thai government is encouraging industry players to stop cheapening their goods and services and aim to attract higher-value tourists to turn the country into a premium travel destination.

The incentives apply to four categories of foreigners: wealthy global citizens, wealthy pensioners, work from Thailand professionals, and highly skilled professionals.

Wealthy global citizens

People with at least US$80,000 in income over the last two years and at least US$1 million in assets can qualify for the incentives. Further, they must have medical insurance covering at least US$100,000 and invest at least US$500,000 in Thai government bonds or real estate.

Wealthy pensioners

Retired pensioners with a stable pension of at least US$40,000 per year and aged 50 or older can apply. They too must have medical insurance covering at least US$100,000 and invest at least US$250,000 in Thai government bonds or real estate.

Work from Thailand professionals

Foreign professionals who work remotely from Thailand (often referred to as digital nomads), with at least US$80,000 in income over the last two years and at least five years of work experience will be eligible.

Highly skilled professionals

This category refers to professionals with at least US$80,000 in income over the last two years or US$40,000 per year who work in targeted industries, including building infrastructure, logistical systems, and digital systems, or experts and researchers who work with state agencies or as university lecturers.

Medical tourism

Thailand introduced universal health coverage in 2001, one of only a few lower-middle-income countries to do so, and has some 64 hospitals that meet the Joint Commission International (JCI) accreditation standards. This is the highest number among ASEAN countries and the fourth highest in the world. The JCI is recognized as a global leader in healthcare accreditation and certification.

Thailand earned US$1.8 billion from over four million medical tourists in 2019, which amounted to three percent of the GDP and is projected to reach 3.5 percent until the pandemic struck. The country served clients mainly from the US, the Middle East, and Europe.

Medical treatments can be lower by up to 30 percent compared to the West and the quality of healthcare is comparable to leading hospitals worldwide. The Thai government has targeted revenue growth from this industry at five percent for 2022.

Smart farming and precision agriculture

A country endowed with fertile soil and favorable weather cycles, Thailand possesses the right attributes to be a global agricultural powerhouse. At present, agriculture accounts for six percent of Thailand’s GDP but employs one-third of the country’s total workforce. Thailand is a leading global exporter of canned pineapples, frozen shrimp, tapioca products, canned tuna, and rubber. The agriculture, hunting, and forestry sector contributed approximately 1.38 trillion baht (US$37.9 billion) to the GDP in 2021.

The sector is plagued with a litany of challenges that hinder its growth potential. Firstly, the sector is highly fragmented and dominated by smallholders with most farmers owning just under one hectare of farmland. As such, small plantations affect the productivity of the sector. Further, two-thirds of farming households still grow only one crop per year. This is despite the irrigation system in the central region, which allow for all year-round agriculture; most farmers grow monoculture, especially the rice crop, which accounts for 88 percent of the farming households engaging in monoculture farming.

Thailand is eager to transform its agriculture sector through the use of new technology, which presents opportunities in areas such as smart farming to ease industrial operations and increase production yields. Precision agriculture can help increase crop yields in different ways. For instance, precision planting involves planting seeds with a particular growth rate on soil whose properties best fit the genetics of the seed.

Moreover, precision agriculture involves analyzing soil properties to match with the ideal fertilizer. This allows farmers to resume planting after the harvest at quicker rates. Foreign companies can also introduce data processing systems that will help farmers customize their production and harvest plans. These systems can help predict adverse weather patterns and enable farmers to put in place protective measures in advance.

Also See:

- Opportunities for Foreign Investors in Thailand

- Investment Incentives for Foreign Businesses in Thailand

- An Alternative Path to Market Entry in Asia – PEO in China, Vietnam, Singapore, Indonesia, and India

About Us

ASEAN Briefing is produced by Dezan Shira & Associates. The firm assists foreign investors throughout Asia and maintains offices throughout ASEAN, including in Singapore, Hanoi, Ho Chi Minh City, and Da Nang in Vietnam, Munich, and Esen in Germany, Boston, and Salt Lake City in the United States, Milan, Conegliano, and Udine in Italy, in addition to Jakarta, and Batam in Indonesia. We also have partner firms in Malaysia, Bangladesh, the Philippines, and Thailand as well as our practices in China and India. Please contact us at asia@dezshira.com or visit our website at www.dezshira.com.