Opportunities in Malaysia’s Rubber Glove Industry

The onset of COVID-19 has increased the demand for personal protective equipment (PPE). This will continue to rise, and the World Health Organization (WHO) estimated that some 89 million medical masks, along with 76 million examination gloves and 1.6 million medical goggles are needed each month to respond to the pandemic.

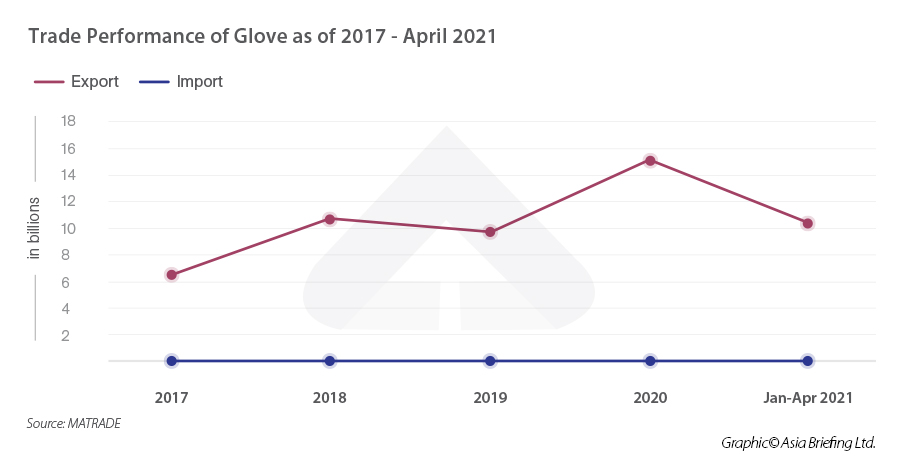

This upsurge in demand for PPE presents many scalable opportunities in Malaysia’s rubber glove industry, especially as the government has introduced new incentives for businesses. The country already supplies 65 percent of the world market for rubber gloves (300 billion pieces) and recording 52.7 billion ringgit (US$12.7 billion) worth of glove exports in 2020. This makes the products a key driver behind Malaysia’s resilient exports during a year in which global demand for the country’s resource-based and traditional manufacturing was adversely affected by the pandemic.

Before the pandemic, the global PPE market was predicted to be valued at US$77 billion by 2027, this has now been revised to reach US$92.86 billion by 2027 with spending on PPE set to be tripled. The global medical glove market itself is expected to reach US$18.5 billion by 2026, growing at a compound annual growth rate (CAGR) of 11.64 percent.

The world’s leading manufacturer of medical gloves, Top Glove (also headquartered in Malaysia) expects an additional 30 percent growth for 2021, after reporting a 417 percent increase in fiscal 2020 post-tax profits (US$459 million).

Expectations in Malaysia’s rubber glove industry remain high

The booming demand for rubber gloves will likely continue due to the pandemic, particularly as countries roll their massive vaccination programs. Beyond the pandemic, the rising need for quality medical services in not only advanced economies but also developing ones will sustain global demand for gloves in the long term.

Many individuals will also remain cautious even after the pandemic and wary of another global health crisis, thus maintaining demand for PPE such as medical gloves. Businesses will also remain cautious, especially in the airline industry, and many staff will continue to wear gloves.Government support

Malaysia’s rubber glove industry enjoys consistent support from the government, as the industry, as well as the rubber sector, are seen as key pillars of the economy and are part of Malaysia’s 12 National Key Economic Areas (NKEAs).

Such support includes providing subsidized gas prices to promote upstream rubber activities. On average, natural gas makes up some 10 to 15 percent of the total operating costs of rubber manufacturers. In addition, the Rubber Industry Smallholders Development Authority — a federal government agency that oversees the smallholder sector — also invests heavily in replanting programs.

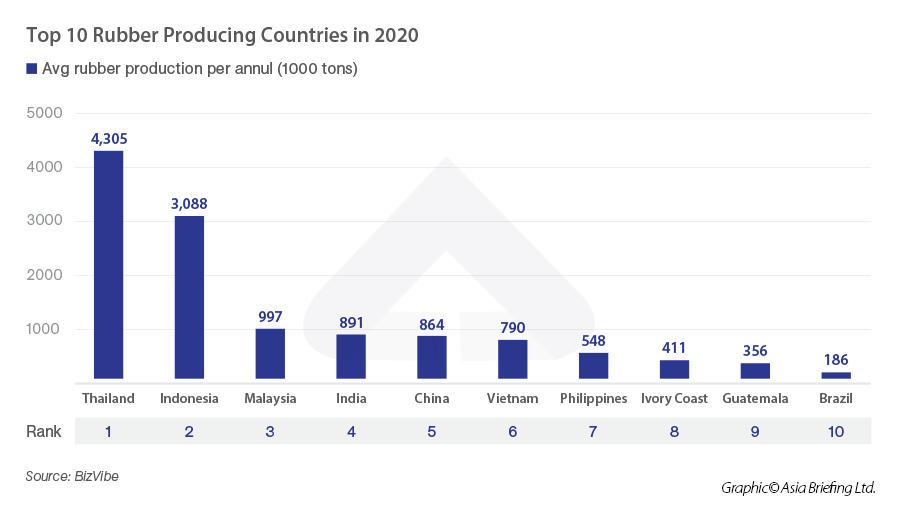

Malaysia is the world’s third-largest producer of rubber, annually producing 0.9 million metric tons, behind Indonesia (3 million tons) and Thailand (4.3 million tons).

The Malaysian Investment Development Authority (MIDA) — the government’s main agency to drive investment into the manufacturing and services sectors in Malaysia —approved 14 projects for medical glove manufacturing, also valued at 3 billion ringgit (US$723 million) and providing over 8,000 jobs. 70 percent of this investment was contributed by domestic investors.

Moreover, MIDA approved 46 manufacturing PPE projects (not including gloves) valued at over 3 billion ringgit (US$723 million). From this, 70 percent, or 2.5 billion ringgit (US$603 million) came from domestic investors with the remaining from foreign investors.

Innovation and moving up the value chain

Innovation in every part of the value chain is why Malaysia’s rubber glove industry is expected to remain competitive. As such, robotics and automation are prevalent throughout the industry, and gloves are now produced at an accelerated rate, while still maintaining international safety standards.

The upstream and midstream segments of Malaysia’s rubber industry dates back to the colonial period, while the downstream segment began developing in the 1980s catalyzed by rising demand for latex gloves following the HIV/AIDS epidemic.

Before automation, it took some 10 workers to produce one million pieces of glove per month but now it reduced to 1.7 as a result of the use of artificial intelligence, big data, and other innovations. Similarly, during the 1980s, glove manufacturers could produce 3,000 gloves per hour, whereas, through modern production lines, over 45,000 pieces can be produced every hour.

Homegrown firms lead-cutting edge innovations such as the development of allergy-free latex gloves as well as even thinner natural gloves. In the midstream segment, the Malaysia Rubber Board (MRB) has taken initiatives to foster public-private research and development partnerships, which has led to technological upgrading and robust quality management lines.Against these backdrops, Malaysian glove makers were able to survive the 1997-1998 Asian financial crisis and have since thrived to become one of the world’s largest suppliers today.

What incentives are available for investors?

The government has issued several new incentives for businesses that can be applied to those looking to enter or are already in the rubber glove-producing industry.

Under the PENJANA stimulus package which was issued in 2020, foreign companies looking to relocate to Malaysia can receive:

- A zero percent tax rate for 10 years for companies in the manufacturing sector with investments in fixed assets between 300 million ringgit (US$70 million) and 500 million ringgit (US$116 million); or

- A zero percent tax rate for 15 years for companies in the manufacturing sector with investments in fixed assets exceeding 500 million ringgit (US$116 million).

Existing companies are eligible for a 100 percent investment tax allowance for three years for an existing company in Malaysia that will relocate its overseas facilities into the country.

Malaysian small and medium-sized enterprises (SME) and mid-tier companies can also apply for the Smart Automation Grant under the PENJANA package. Through this grant, businesses can receive up to 1 million ringgit (US$241,000) to assist their adoption of high-end technology and automation in their operations.

Similarly, the Automation Capital Allowance program provides up to 200 percent tax deduction on the first 4 million ringgit (US$964,000) of expenses incurred within eight years of assessment (2015-2023).

To support digitalization, the government introduced the Industry4WRD Intervention Fund to assist SMEs to leap to Industry 4.0. The fund provides a matching grant of 70:30 of up to 500,000 ringgit (US$120,000) for eligible expenditure.

Challenges remain

Malaysia’s rubber glove industry still faces some hard challenges. Firstly, despite the adoption of automation, the industry is still labor-intensive and businesses are heavily reliant on unskilled foreign workers. With the closure of international borders due to the pandemic, firms have found it difficult to hire workers and citizen workers are not perfect substitutes, with the level of education being the main difference between the two groups.

The majority of Malaysia’s migrant workforce is most educated to the secondary school level, whereas a large portion of its local workforce is tertiary educated.

Further, containment measures triggered by infection hotspots in factories and worker dormitories have led to the repeated suspension of operations, and thus highlights the risks to output. The poor living conditions of these migrant workers have also been in the international spotlight and have raised concerns among stakeholders about the implementation of labor practices in the industry.

The pandemic has also increased the volatility in global rubber prices which could be critical for Malaysian firms. Although the country is one of the world’s largest rubber producers, it is suffering from a shrinking upstream segment. Malaysia has just over 1 million hectares of areas planted with rubber which is considerably smaller than Indonesia (3.6 million hectares) and Thailand (3.7 million hectares).

About Us

ASEAN Briefing is produced by Dezan Shira & Associates. The firm assists foreign investors throughout Asia and maintains offices throughout ASEAN, including in Singapore, Hanoi, Ho Chi Minh City, and Da Nang in Vietnam, Munich, and Esen in Germany, Boston, and Salt Lake City in the United States, Milan, Conegliano, and Udine in Italy, in addition to Jakarta, and Batam in Indonesia. We also have partner firms in Malaysia, Bangladesh, the Philippines, and Thailand as well as our practices in China and India. Please contact us at asia@dezshira.com or visit our website at www.dezshira.com.

- Previous Article E-Commerce License and Permit Fees in Cambodia

- Next Article Stamp Duty in Indonesia: New Law in Effect