Opportunities for Indian Manufacturers in ASEAN

The economic partnership between India and the Association of Southeast Asian Nations (ASEAN) has continued to strengthen since the economic relationship began in 1992 and with the ASEAN-India Free Trade Agreement (AIFTA) coming into effect in 2009.

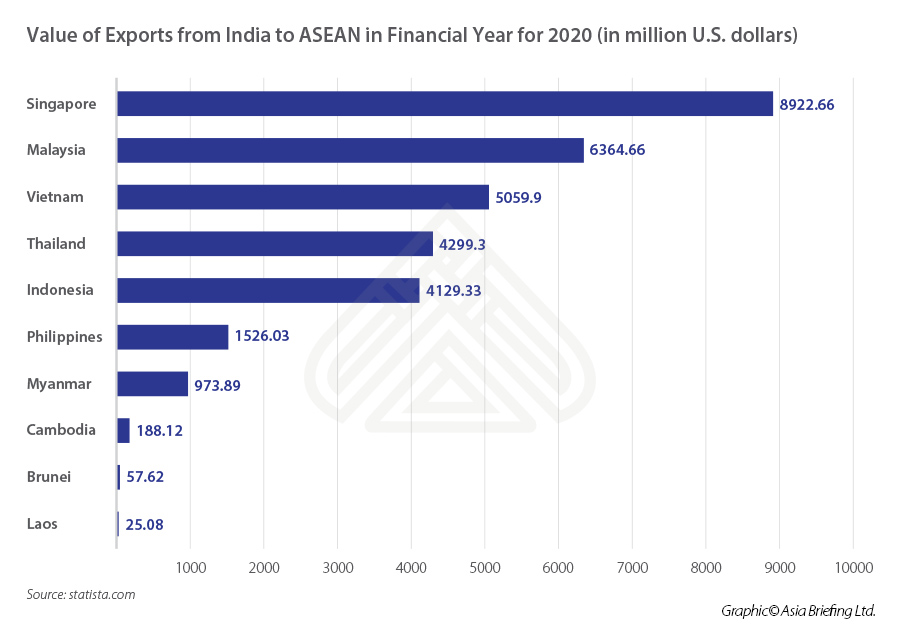

The bloc has presented several opportunities for Indian manufacturers and exporters seeking long-term commitment. Total trade between India and ASEAN was valued at US$86 billion in 2020, a reduction from US$97 billion in 2018-19 due to the pandemic. However, this was an increase from the 2017 total trade value of US$59 billion, indicating an upward trajectory only arrested by the pandemic.

Furthermore, according to India’s Commerce and Industry minister, India-ASEAN trade has the potential to reach US$300 billion by 2025.

ASEAN is already the world’s third most populous economy and is projected to be the fourth-largest single market by 2030, with a GDP of US$7 trillion. Furthermore, domestic consumption is expected to reach US$4 trillion and the population too will rise to 723 million from 648 million currently.Indian exports largely mirror those of ASEAN states, such as rice, electrical equipment, and clothing and accessories. However, there are still sectors where Indian exporters can potentially exploit market needs – wheat exports, the digital economy, and healthcare.

Taking advantage of AIFTA

Since its inception, both regions have made efforts to progressively eliminate trade tariffs on 80 percent of tariff lines. India has excluded 590 tariff lines from the list of tariff elimination and 489 tariff lines from the list of tariff concessions for agriculture, automotive, textiles, petrochemicals, crude and refined palm oil, tea, coffee, and pepper, among others.

ASEAN has also lowered intra-regional tariffs through the Common Effective Preferential Tariff (CEPT) Scheme on exports under the FTA. This means Indian goods and raw material exporters to ASEAN are more competitive.

Many industry bodies in India, however, have complained that AIFTA provides better market access for ASEAN trade into the country, but Indian businesses do not enjoy the same access to such reduced tariffs.

Despite the size and potential of the ASEAN market, India still suffers from a trade deficit, which stood at US$24 billion in 2020. As such, India is keen to renegotiate the terms of AIFTA to level the trade balance.

What are the opportunities for Indian exporters?

Digital economy

COVID-19 has accelerated ASEAN’s adoption of its digital economy, which is expected to have a gross merchandise value of US$300 billion by 2025.

With over 400 million internet users in the region, ASEAN’s digital economy presents a unique opportunity for Indian investors, especially for Indian expertise in the field of information technology (IT). The sector accounted for eight percent of India’s GDP in 2020, with exports expecting to reach US$150 billion by 2021.

Online education, telecommunication, e-commerce, and telemedicine are all scalable opportunities. ASEAN recently saw one of the largest tech mergers between ride-hailing and payments giant Gojek and e-commerce leader Tokopedia, which was valued at US$18 billion.

Such technology-based segments are also expanding in India with its emerging unicorns in the digital payments (Paytm), online retail (Flipkart), online education (Byjus), and raid-hailing segments (Ola).

E-commerce to the driver of digital growth

The pandemic has changed the purchasing behavior of ASEAN consumers, resulting in many turning to e-commerce for their basic needs. This has forced retailers and producers in the region to factor e-commerce into their operations, which was previously seen as an ‘option’ or part of an omni-channel sales strategy rather than a core business initiative.

The industry is expected to reach US$172 billion by 2025 in ASEAN. Some 40 million new users came online in 2020 — compared to 100 million in the previous five years.

Healthcare

Healthcare is fast becoming a priority for ASEAN members, with many slowly committing to a universal healthcare system or national health insurance systems.

Major markets such as Indonesia and the Philippines have succeeded in providing universal healthcare.

Singapore, Thailand, and Malaysia provide the most advanced level of healthcare for their citizens, ranging from advanced neurological procedures to establishing specialized treatment such as heart transplants.India’s healthcare industry, particularly its multi-billion-dollar pharmaceutical industry, can become a reliable supplier of equipment, drugs, and vaccines to these markets.

Furthermore, India’s healthcare sector can capture some of the 11 million global medical consumers travelling to Southeast Asia for treatment. Indonesians alone spent over US$1 billion in medical treatment abroad before the pandemic, mainly in Malaysia and Singapore.

Agriculture

Wheat consumption in ASEAN has been increasing over the decades, despite ASEAN contributing to some 54 percent of global rice exports.

Rising per capita income and a growing middle-class have contributed to the increased consumption of wheat-based products. Moreover, the region’s tropical climate makes it difficult to grow the crop with many members, such as Indonesia, having close to total reliance on imports of wheat for feed and food.

The country is one of the world’s largest importers of wheat, at over 11 million tons annually, which is used to make bread but noodles — Indonesia is the second-largest instant noodle market, after China.

About Us

ASEAN Briefing is produced by Dezan Shira & Associates. The firm assists foreign investors throughout Asia and maintains offices throughout ASEAN, including in Singapore, Hanoi, Ho Chi Minh City, and Da Nang in Vietnam, Munich, and Esen in Germany, Boston, and Salt Lake City in the United States, Milan, Conegliano, and Udine in Italy, in addition to Jakarta, and Batam in Indonesia. We also have partner firms in Malaysia, Bangladesh, the Philippines, and Thailand as well as our practices in China and India. Please contact us at asia@dezshira.com or visit our website at www.dezshira.com.

- Previous Article Import and Export Procedures in Indonesia – Best Practices

- Next Article Cambodia Issues Ninth Round of Stimulus Measures