Indonesia’s Omnibus Law: Individuals Now Allowed to Incorporate Companies

In February 2021, Indonesia issued Government Regulation 8 of 2021 (GR 8/2021), an implementing regulation of the Omnibus Law, which makes amendments to the Company Law of 2007 by introducing the concept of “individually owned companies” as well as leaving the required minimum paid-up capital to the discretion of the founder(s) of the company.

Individually owned companies are a new type of company category in Indonesia that can be incorporated by a single individual.

Investors should note that GR 8/2021 only impacts Indonesian nationals and, as of 2021, foreign investors are required to have paid-up capital of 10 billion rupiah (US$690,000) to incorporate a company in Indonesia. Details can be found here.

In addition, GR 8/2021 sets out the criteria for businesses to get classified as micro or small enterprises, which was not previously regulated. Through this reform, the government hopes to increase the number of officially registered micro and small enterprises who will thus pay tax as well as contribute to the national social security programs. Currently, the majority of Indonesia’s 64 million or so micro, small, and medium enterprises (MSMEs) are in the informal sector and employ more than 70 million informal workers.Minimum authorized capital required

GR 8/2021 stipulates that the amount of paid-up capital is be agreed upon by the founder(s) of the company. However, this does not apply to companies in certain business fields that are obligated to have paid-up capital before starting operations.

Under the 2007 Company Law, companies needed to have paid-up capital of at least 50 million rupiah (US$3,450).

Once the founder(s) of the company has agreed to the amount of authorized capital, they must pay at least 25 percent of the total paid-up capital, and the proof of payment must be electronically submitted to the Ministry of Law and Human Rights (MOLHR) within 60 days from the date of establishment.

The introduction of individually owned companies

GR 8/2021 introduces a new category of companies, namely individually owned companies. Under this category, the company can be incorporated by a single individual, as the founder, who is at least 17 years of age.

Importantly, an individually owned company is only applicable to businesses categorized as micro or small enterprises.

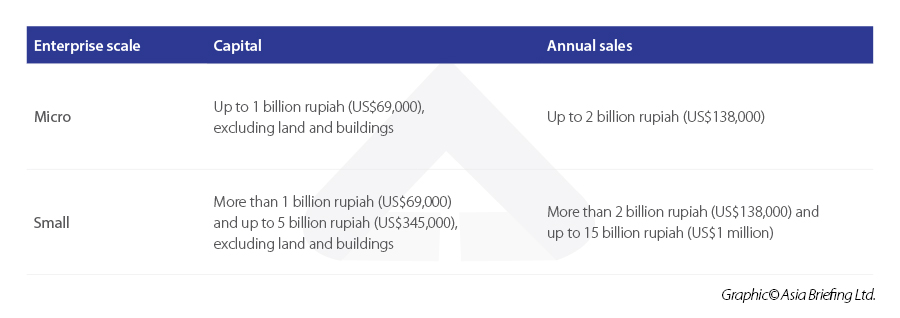

GR 8/2021 states that businesses categorized as micro or small enterprises must fulfill the following capital or annual sales criteria.

Further, the incorporation of an individually owned company does not require a deed of establishment, rather the individual only needs to fill out an establishment statement through the MOLHR website to obtain a registration certificate. The statement must include the following information:

- Name and domicile of the company;

- Purpose and business activities of the company;

- The amount of authorized, issued, and paid-up capital of the company;

- Number of shares of the company;

- Details of the founder of the company; and

- Tax number of the founder of the company.

The individually owned company must change its legal status to a limited liability company if the number of shareholders is more than one person, or the business no longer meets the criteria of a micro or small business.

Another important aspect with regards to an individually owned company, their liability is limited to the company’s capital.

Obligation to file financial statements

Financial statements of individually owned companies must be submitted within six months of the end of their accounting period. Failure to submit financial statements will result in administrative sanctions ranging from a written warning to the suspension of business activities.

Improving the ease of doing business for MSMEs

MSMEs are the backbone of Indonesia’s economy (contributing to 60 percent of GDP) as well as its largest source of employment.

However, a major impediment to these businesses is that they are handicapped in accessing bank loans and other types of financing because they and their workers are unregistered. This makes it difficult for the government to support MSMEs expand and grow, or since the onset of the pandemic, survive. As a result, an estimated 43 percent of Indonesian MSMEs were forced to shut down, and more are expected to close as the government has extended partial lockdown measures in the country.

GR 8/2021 could give individuals the protection and benefits of a limited liability company without needing to fulfill all the administrative requirements. Moreover, these entities can access sources of financing, such as through non-banking institutions. These organizations (such as fintech firms) can provide microloans and are already gaining popularity among the country’s large unbanked and underbanked population.

The microloans are popular because of their convenience as it normally takes just 24 hours for the funds to be disbursed, and the terms and maturity are small and short – with borrowers typically receiving not more than US$100.

About Us

ASEAN Briefing is produced by Dezan Shira & Associates. The firm assists foreign investors throughout Asia and maintains offices throughout ASEAN, including in Singapore, Hanoi, Ho Chi Minh City, and Da Nang in Vietnam, Munich, and Esen in Germany, Boston, and Salt Lake City in the United States, Milan, Conegliano, and Udine in Italy, in addition to Jakarta, and Batam in Indonesia. We also have partner firms in Malaysia, Bangladesh, the Philippines, and Thailand as well as our practices in China and India. Please contact us at asia@dezshira.com or visit our website at www.dezshira.com.