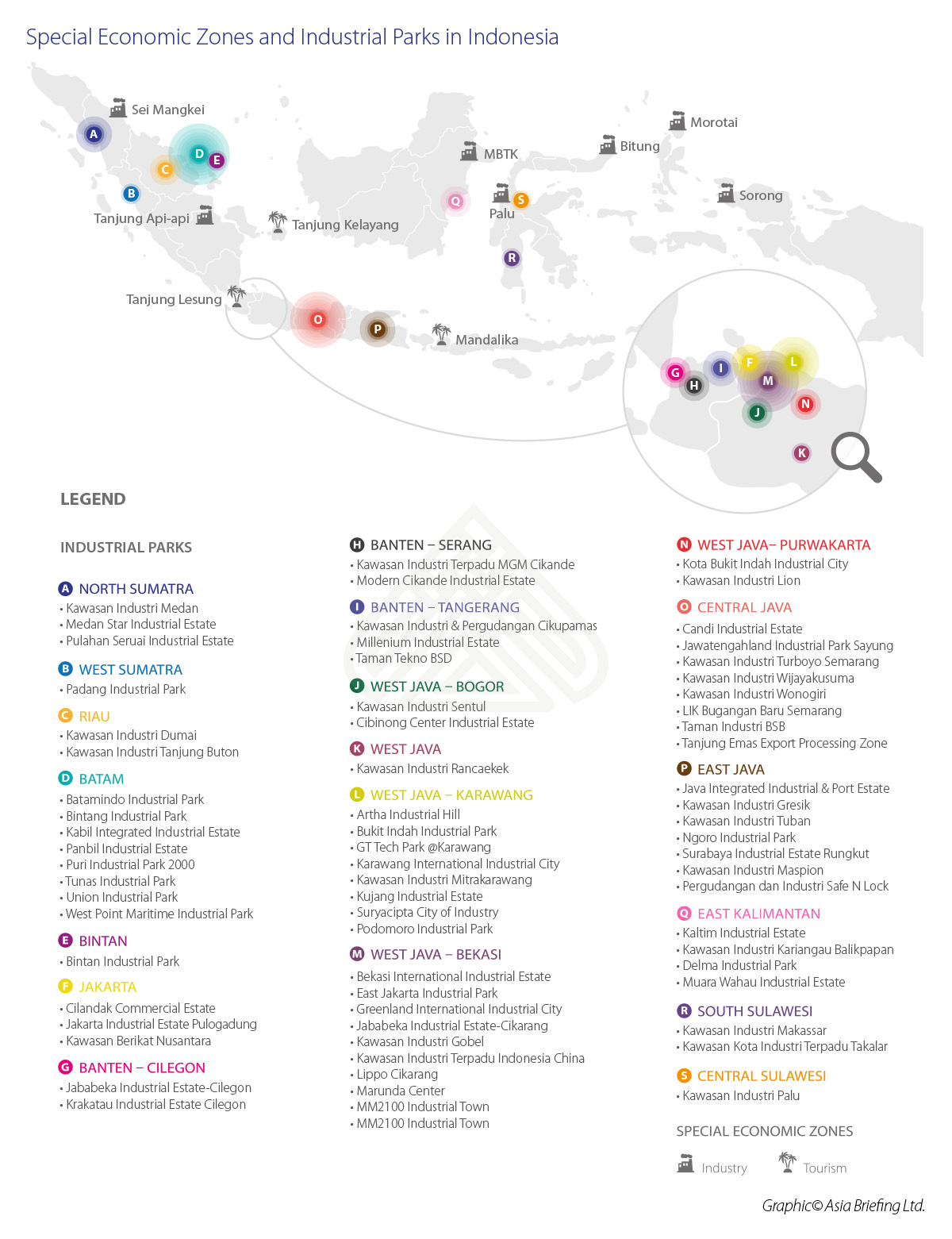

Indonesia’s Growing Special Economic Zones – Opportunities and Challenges

Over the last decade, Indonesia’s economic clusters –special economic zones (SEZs) and industrial estates have grown multi-fold, both in terms of number and breadth. In 2014, there were approximately 74 industrial estates with an area of 36,300 hectares in the country. By 2017, the number of industrial estates expanded to 87 with an area of 59,700 hectares. Similarly, the number of SEZs in the country has increased to 12; out of these, four are currently operational, representing economic activities across various industrial sectors.

Given Indonesia’s locational advantages– rich natural resources and a climate conducive to many forms of agriculture -, these clusters offer growing opportunities for investment in manufacturing, agriculture, marine, infrastructure, and tourism industries. Moreover, Indonesia has large forests areas, deposits of coal, tin, bauxite, copper, nickel, and other minerals. The country also boasts a significant oil and gas sector and is one of the leading suppliers of natural rubber.

To facilitate investment in these zones, the government of Indonesia has instituted a number of incentives targeting investors setting up within SEZs and industrial parks.

Special Economic Zones (Kawasan Ekonomi Khusus or KEKs)

The SEZs in Indonesia are open to foreign investment and offer investors access to preferential regulatory infrastructure and taxation in an attempt to channel investment into specific locations. Some of the industrial SEZs are discussed below.

Industrial SEZs in Indonesia

- SEZ Sei Mangkei

The main industries set up in Sei Mangkei include palm oil and rubber industry. Besides, there are ancillary industries established in the region such as logistic, energy, electronics, and tourism. The main products manufactured here are fatty acid, fatty alcohol, surfactant, biodiesel, and biogas.

- SEZ Tanjung Api-Api

The SEZ is a downstream industrial center of the resource-based sectors such as seed rubber, palm oil, and coal and has a good potential of water supply from the nearby Banyuasin and Telang River. It is strategically located near the Indonesian archipelago Lanes (ALKI 1) and the Strait of Malacca.

- SEZ Maloy Batuta Trans Kalimantan (MBTK)

The MBTK SEZ is located in East Kutai Regency, East Kalimantan province and consists of industrial zones, logistics, and export processing. The region is rich in natural resources such as oil palm, oil, gas, minerals, and coal. The SEZ can serve as the processing center of palm oil and its derivatives, industrial minerals, gas, coal, tourism.

- SEZ Palu

Palu provides a strategic location for the development of natural resources- based industries. These include agriculture and plantations of rubber, cocoa, rattan, seagrass, as well as the mining of nickel, gold, iron ore, and lead.

- SEZ Bitung

Located in Sulawesi Utara District, SEZ Bitung is built on an area of 534 Ha and is strategically located with international access to East Asia and the Pacific. The key industries include fisheries, oil industry, and other logistical support.

- SEZ Morotai

The Morotai Island has a famous World War II airport – Leo Wattimena Airport that has a huge runway capacity. The airport has a potential to serve as supporting infrastructure in the SEZ and increase East Indonesia’s access to the international market. The island is nestled between Asia and Australia and has short flights from Singapore and Taipei.

- SEZ Sorong

Located in Mayamuk District, KEK Sorong is built on an area of 523.7 Ha on the international trade trajectory of the Asia Pacific and Australia.

The SEZ provides several geo-economic advantages, namely potential in the fishery and marine transportation sectors. The location is also very strategic for the development of the logistics industry, agro-industry, mining, and shipyard industry.

Available tax incentives in SEZs

To avail tax facilities, the investing company must be registered by the relevant government authority to be a ‘business entity’ that develops or manages a SEZ; have a new investment with new investment plan; and must be involved in chain of ‘main’ activities – as determined by the National Council for Special Economic Zones, in the SEZs. Some of the available tax facilities include the following.

A. Tax Holiday for Primary Industry

Corporate income tax reduction –

- Of up to 100 percent for 10 to 25 years for investment more than Rp. 1 trillion (US$68.32 million)

- Of up to 100 percent for 5 to 15 years for investment between Rp 500 billion (US$34.16 million)and Rp 1 trillion(US$68.32 million)

- At a rate decided by the Ministry of Finance (MoF) for 5 to 15 years for investment below Rp 500 billion (US$34.16 million)

B. Tax allowance for other industries

- A reduction in net taxable income of up to 30 percent of the amount invested in the form of fixed assets, pro-rated at five percent for six years of commercial production;

- Accelerated depreciation and/or amortization;

- Extension of tax loss carry forward from five years to up to 10 years; and

- A reduction in withholding tax on dividends paid to non-residents to 10 percent, or applicable treaty rate.

C. Value added tax (VAT) and sales tax exemption on luxury goods – 1) imported; 2) delivered among companies in SEZ, and 3) those delivered among companies in other SEZs.

D. Customs exemption is available on

- All goods entering the SEZs; and

- Goods exiting from the SEZs to foreign countries, except leather, woods, cocoa beans, crude palm oil and its derivatives, and minerals.

Goods exiting from the SEZs to the domestic market, however, are subject to customs duty, except those that fulfill the minimum local content requirement of 40 percent.

E. Import duties and excise

- Deferred import duties for imported goods; and

- Exempted excise for imported goods.

Import duty on goods delivered to domestic market is subject to free trade agreement (FTA) tariff rates.

Non-tax incentives

Besides tax incentives, Indonesia’s SEZs offer easy licensing and labor-related incentives to investors that include low wages that keep production costs low, immigration facilities, and labor market flexibility.

Immigration facilities include visa on arrival for 30 days, extendable five times; option to transfer visit visa into temporary stay permit; and option to transfer temporary stay permit into permanent stay permit for individuals working in SEZs and their families.

Furthermore, foreign investors investing in the SEZs are allowed to have the building right on land (Hak Guna Bangunan), which is extendable up to 80 years; own property in the SEZs; and those who own property have the option to apply for the permanent stay permit in Indonesia.

Industrial Parks (Kawasan Industri or KIs)

Industrial parks offer a cost-effective way to increase access to basic infrastructure and ensure that production can be carried out in an efficient and effective manner.

Located throughout the country, these investment options have become more targeted in recent years, often specializing in select industries and providing investors with the resources, utilities, and connections to transport networks required to optimize production chains.Tax Incentives

The applicable tax facilities in industrial parks depend on the classification of the industrial development area (IDA); these are – potential IDA, developing IDA, and advance IDA.

Taxpayers in industrial parks are entitled to the following tax incentives

- VAT exemption on the imports and purchase of machines and equipment used to produce goods;

- Import duty exemption on the imports of machines or materials that are used to produce goods or services;

- Corporate income tax reduction of 10 percent to 100 percent for five to 15 years from the start of commercial production; and

- Income tax facilities similar to inbound investment incentives under the income tax concessions.

Challenges

The slow development of industrial land combined with heightened demand has increased the cost of property in Indonesia’s industrial parks. Furthermore, most industrial zones in Indonesia are still at the primary stage of development and lack adequate infrastructure. While poor road and railway connectivity may increase the transportation costs for manufacturers in some regions, inconsistent power and water supply can restrict factories’ utilization rate – raising the overall cost of manufacturing in the special zones.

Aside from costs, it is essential that investors consider other aspects of the special zones– such as distance from a seaport, quality of infrastructure, availability of labor – carefully, when assessing their investment potential in the country.

Editor’s Note: The article was first published on October 28, 2015 and is updated on August 24, 2018, as per latest developments.

About Us

ASEAN Briefing is produced by Dezan Shira & Associates. The firm assists foreign investors throughout Asia and maintains offices throughout ASEAN, including in Singapore, Hanoi, Ho Chi Minh City and Jakarta. Please contact us at asia@dezshira.com or visit our website at www.dezshira.com.